Brokerage Commission

and Fee Schedule

FEES AND COMPENSATION

Fidelity brokerage accounts are highly flexible, and our cost

structure is flexible as well. Our use of “à la carte” pricing for

many features helps to ensure that you only pay for the

features you use.

About Our Commissions and Fees

The most economical way to place trades is online, meaning

either through Fidelity.com, Fidelity Active Trader Pro®, or Fidelity

Mobile®. The next most economical way is Fidelity Automated

Service Telephone (FAST®). This automated service is available

around the clock and can be accessed from a touch-tone phone.

The fees described in this document apply to the Fidelity

Account®, Non-Prototype Retirement Accounts, Health Savings

Accounts (HSAs), and Fidelity Retirement Accounts (including

Traditional, Roth, Rollover, SEP-IRA, SIMPLE IRAs, and Fidelity

Retirement Plans (Keogh and SE 401(k)), and inherited IRAs and

inherited Keogh accounts). Note that for Stock Plan Services

Accounts, a different fee schedule located on NetBenefits.com

may apply for Exercise-and-Sell Fees for Stock Option Plans and

Sale of Company Stock. This Fidelity Brokerage Commission and

Fee Schedule applies to all other transactions. The fees described

in this document may change from time to time without notice.

Before placing a trade, consider Fidelity’s most recent Brokerage

Commission and Fee Schedule, available at Fidelity.com or

through a Fidelity representative.

STOCKS/ETFs

Online $0.00 per trade

FAST® $12.95 per trade

Rep-Assisted $32.95 per trade

The remuneration that Fidelity receives and keeps as described in this

section applies to transactions and activities involving securities including,

but not limited to, domestic (U.S.) equities traded on national exchanges,

short sales, exchange-traded funds (ETFs), and U.S.-traded foreign securi-

ties (ADRs, or American Depository Receipts, and ORDs, or Ordinaries).

1

For details on foreign stock trading, see the Foreign Stocks section. Large

block orders requiring special handling, restricted stock orders, and certain

directed orders may carry additional fees, which will be disclosed at the

time of the transaction.

In addition to the per trade charges identified above, Fidelity’s remuneration

also includes a fee that is charged on all sell orders (“Additional Assessment”).

The Additional Assessment, which typically ranges from $0.01 to $0.03

per $1,000 of principal, is charged by Fidelity. Fidelity uses the Additional

Assessment to pay certain charges imposed on Fidelity by national securities

associations, clearing agencies, national securities exchanges, and other

self-regulatory organizations (collectively, “SROs”). The SROs in turn pay the

SEC using the money they collect from Fidelity and other broker-dealers.

The Additional Assessment that Fidelity charges you is designed to offset

the charges imposed on Fidelity by the SROs, which in turn are intended to

cover the costs incurred by the government, including the SEC, for supervising

and regulating the securities markets and securities professionals. You

acknowledge, understand, and agree that Fidelity determines the amount

of the Additional Assessment in its sole and exclusive discretion, and that

the Additional Assessment may differ from or exceed the charges imposed

on Fidelity by the SROs. These differences are caused by various factors,

including, among other things, the rounding methodology used by Fidelity, the

use of allocation accounts, transactions or settlement movements for which

a fee by the SROs may not be assessed, and differences between the dates

of changes to rates charged by the SROs. You understand, acknowledge, and

agree that Fidelity has made no representation that the Additional Assessment

charged to you will equal the fees assessed against Fidelity by the SROs in

connection with your transactions. The Additional Assessment is in addition

to the commissions we charge (i.e., the per trade charges identified above),

and is included on your trade confirmation as a part of the Activity Assessment

Fee. For the exact amount of the Additional Assessment charged on a

particular transaction, please contact a Fidelity representative.

Fidelity Brokerage Services LLC (“FBS”) and/or NFS receives remuneration,

compensation, or other consideration (such as financial credits or reciprocal

business) for directing orders in certain securities to particular broker-dealers

or market centers for execution. The payer, source, and nature of any

compensation received in connection with your particular transaction will vary

based on the venue that a trade has been routed to for execution and will

be disclosed upon written request to FBS. Please refer to Fidelity’s customer

agreement for additional information about order flow practices and to Fidelity’s

commitment to execution quality

(http://personal.fidelity.com/products/trading/

Fidelity_Services/Service_Commitment.shtml)

for additional information about order

routing. Also review FBS’s annual disclosure on payment for order flow policies

and order routing policies.

FBS has entered into a long-term, exclusive and significant arrangement with the

advisor to the iShares Funds that includes but is not limited to FBS’s promotion

of iShares funds, as well as in some cases purchase of certain iShares funds at

a reduced commission rate (“Marketing Program”). FBS receives compensation

from the fund’s advisor or its affiliates in connection with the Marketing Program.

FBS is entitled to receive additional payments during or after termination of

the Marketing Program based upon a number of criteria, including the overall

success of the Marketing Program. The Marketing Program creates significant

incentives for FBS to encourage customers to buy iShares funds. Additional

information about the sources, amounts, and terms of compensation is

described in the ETF’s prospectus and related documents.

Certain ETF sponsors pay an asset-based fee in support of their ETFs on Fidelity’s

platform that supports services including related shareholder support services, the

provision of calculation and analytical tools, as well as general investment research

and education materials regarding ETFs. Fidelity does not receive payment from

these ETF sponsors to promote any particular ETF to its customers, and these

ETF shares are not marginable for 30 days after purchase. Customers purchasing

shares in a limited number of ETFs that are not supported by their providers will be

subject to a $100 service fee.

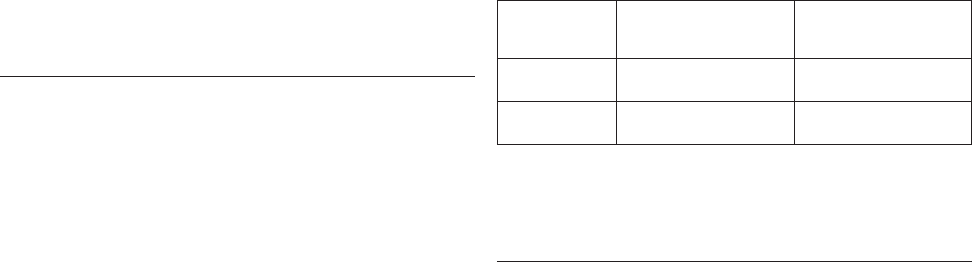

NEW ISSUE

Fidelity makes certain new issue products available without a

separate transaction fee. Fidelity may receive compensation for

participating in the offering as a selling group member or underwriter.

The compensation Fidelity receives from issuers when acting as both

underwriter and selling group member is reflected in the “Range of

Fees from Underwriting” column. When Fidelity acts as underwriter

but securities are sold through other selling group members, Fidelity

receives the underwriting fees less the selling group fees.

Securities Range of Fees

from Participation

in Selling Group

Range of Fees

from Underwriting

IPOs • 3% to 4.2% of the

investment amount

• 5% to 7% of the

investment amount

Follow-Ons • 1.8% to 2.4% of the

investment amount

• 3% to 4% of the

investment amount

Please refer to the applicable pricing supplement or other

offering document for the exact percentage sales concession or

underwriting discount.

OPTIONS

Online $0.00 per trade + 65¢ per contract

FAST®

$12.95 per trade + 65¢ per contract

Rep-Assisted

$32.95 per trade + 65¢ per contract

Buy-to-close orders placed online for options priced 0¢ to 65¢ are

commission-free and are not subject to per contract option fees. For

trades placed on other channels, you will not be charged a per contract

fee when the contract price is 65¢ or less. Regular option rates (as shown

above) apply when the contract price exceeds 65¢.

Maximum charge: 5% of principal (subject to a minimum charge of $12.95 for

FAST trades and $32.95 for Rep-Assisted trades).

Exercises and assignments are commission-free and are not charged a per

contract fee.

In addition to the per trade/contract fees described above, Fidelity’s

remuneration also includes fees it charges you (“Options Fee”) that are

designed to offset the Options Regulatory Fee (“ORF”) that the Options

Clearing Corporation (“OCC”) charges Fidelity through various options

exchanges. The ORF applies to any transaction to buy or sell options contracts

and represents the cumulative charges imposed by all the participating options

exchanges. The ORF has ranged from $0.02 to $0.04 per contract but is subject

to change at any time. You acknowledge, understand, and agree that Fidelity

determines the amount of the Options Fee charged to you and its other

customers in its sole and exclusive discretion, and that the Options Fee amount

collected from you by Fidelity may differ from or exceed the ORF that Fidelity

pays to OCC. These differences are caused by various factors, including,

among other things, the rounding methodology used by Fidelity, the use of

allocation accounts, transactions for which a fee may not be assessed, and

differences between the dates of changes to the ORF rate. You understand,

acknowledge, and agree that Fidelity has made no representation that the

fees assessed to you will equal the fees assessed against Fidelity by the OCC

in connection with your transactions. This Options Fee is in addition to your

commission and is included on your trade confirmation as a part of the Activity

Assessment Fee. For the exact amount of the Options Fee charged to you on a

particular transaction, please contact a Fidelity representative.

1

A Financial Transaction Tax of 0.30% of principal per trade on purchases of French securities, 0.10% of principal per trade on purchases of Italian securities, and

0.20% of principal per trade on Spanish securities may be assessed.

Multi-Leg Option orders placed online are charged a per contract Options

Fee for the total number of contracts executed in the trade. Multi-Leg

Option orders placed through other channels are charged a commission

and the 65¢ per contract fee.

An “Additional Assessment” is also charged on any order to sell options

contracts. Please refer to the discussion of the “Additional Assessment” in

the Stocks/ETFs section of this document for additional information.

BONDS AND CDs

New Issues, Primary Purchases (all other fixed-income securities

except U.S. Treasury)

Fidelity makes certain new issue products available without a separate

transaction fee. Fidelity may receive compensation from issuers

for participating in the offering as a selling group member and/or

underwriter. The compensation Fidelity receives from issuers when acting

as both underwriter and selling group member is reflected in the “Range

of Fees from Underwriting” column. When Fidelity acts as underwriter but

securities are sold through other selling group members, Fidelity receives

the underwriting fees less the selling group fees.

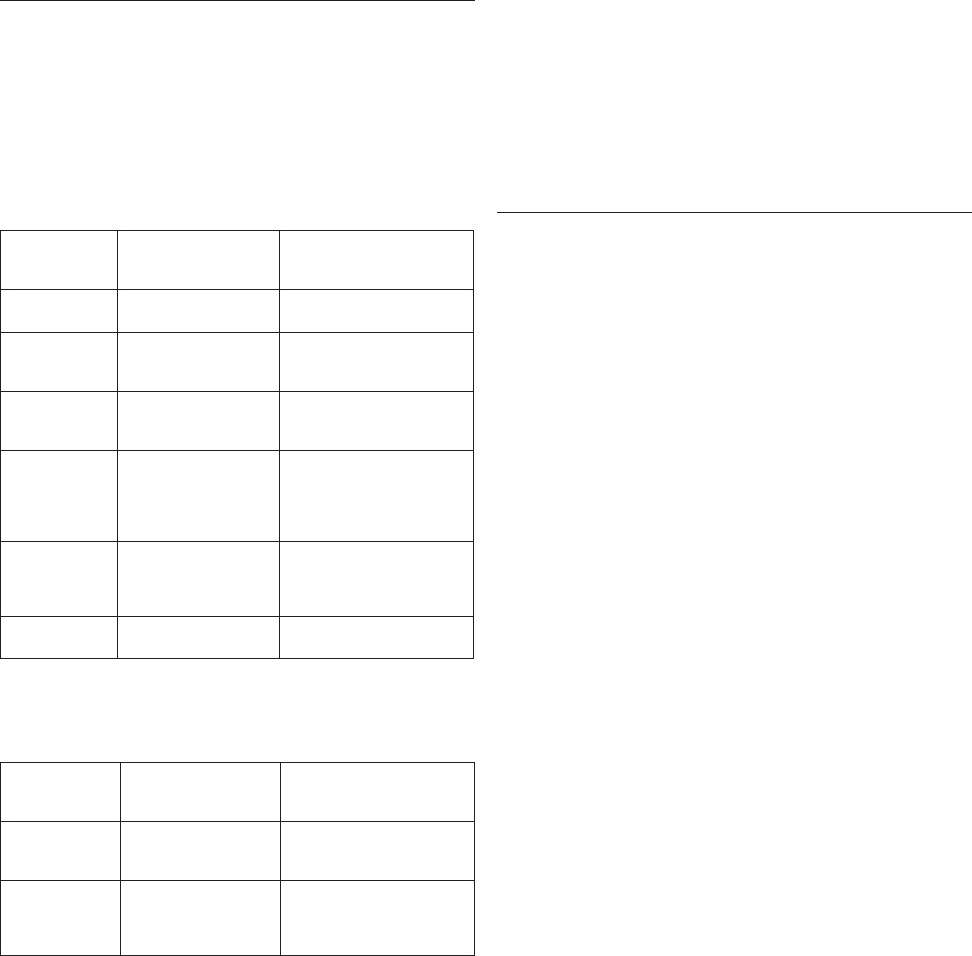

BONDS

Securities Range of Fees from

Participation in

Selling Group

Range of Fees

from Underwriting

Agency/GSE N/A • 0.05% to 1.00% of the

investment amount

Corporate

Notes

• 0.01% to 2.5% of

the investment

amount

• 0.01% to 3.0% of the

investment amount

Corporate

Bond

• 0.01% to 2.5%

of the investment

amount

• 0.05% to 3.0%

of the investment

amount

Municipal

Bonds and

Taxable

Municipal

Bonds

• 0.1% to 2% of

the investment

amount

• 0.1% to 2.5% of the

investment amount

Structured

Products

(Registered

Notes)

• 0.05% to 5.0% of

the investment

amount

N/A

Fixed-Rate

Capital

• 2% of the invest-

ment amount

• 3% of the investment

amount

Please refer to the applicable pricing supplement or other

offering document for the exact percentage sales concession or

underwriting discount.

CDs

Securities Range of Fees

from Participation

in Selling Group

Range of Fees

from Underwriting

CDs — CDIPs

(Inflation

Protected)

• 0.1% to 2% of

the investment

amount

• 0.1% to 2.5% of the

investment amount

Structured

Products

(Market-linked

CDs)

• 0.05% to 5% of

the investment

amount

N/A

U.S. Treasury, including TIPS — Auction Purchases

Online No charge

Rep-Assisted $19.95 per trade

SECONDARY MARKET TRANSACTIONS

Mark-ups for all secondary bond (fixed-income) trades are listed below.

U.S. Treasury, including TIPS

Online No charge

*Rep-Assisted $19.95

All Other Bonds

Online $1.00 per bond

Rep-Assisted $1.00 per bond*

*Rep-Assisted $19.95 minimum

Please note that a $250 maximum applies to all trades and is reduced to

a $50 maximum for bonds maturing in one year or less.

Bond orders cannot be placed through FAST®.

The offering broker, which may be our affiliate National Financial Services

(“NFS”), may separately mark up or mark down the price of the security and

may realize a trading profit or loss on the transaction. If NFS is not the offer-

ing broker, Fidelity compensation is limited to the prices above.

Foreign Fixed-Income Trading

When purchasing a foreign currency–denominated fixed-income security for

settlement in USD, the following additional charges will apply:

<$1M 0.30% of principal

$1M–$5M 0.20% of principal

>$5M negotiated rate

Commercial Paper

Generally, our affiliate NFS will receive compensation in the form of a

mark-up or mark-down when facilitating transactions in commercial paper.

MUTUAL FUNDS

This section only describes fees associated with your account. Fees

charged by a fund itself (for example, expense ratios, redemption fees

[if any], exchange fees [if any], sales charges [for certain load funds]) are in

the fund’s prospectus. Read it carefully before you invest.

Fidelity Funds

All Methods No transaction fee

FundsNetwork Funds

Through FundsNetwork®, your account provides access to over 10,000

mutual funds. At the time you purchase shares of funds, those shares will

be assigned either a transaction fee (TF), a no transaction fee (NTF) or a

load status. When you subsequently sell those shares, any applicable fees

will be assessed based on the status assigned to the shares at the time

of purchase.

Fidelity Brokerage Services LLC, or its affiliates, may receive compensa-

tion in connection with the purchase and/or the ongoing maintenance of

positions in certain mutual funds in your account. FBS may also receive

compensation for such things as systems development necessary to

establish a fund on its systems, a fund’s attendance at events for FBS’s

clients and/or representatives, and opportunities for the fund to pro-

mote its products and services. This compensation may take the form

of sales loads and 12b-1 fees described in the prospectus; marketing,

engagement, and analytics program participation fees; maintenance fees;

start-up fees; and platform support paid by the fund, its investment advi-

sor, or an affiliate.

FundsNetwork No Transaction Fee Funds.

All Methods No transaction fee* Most NTF Funds will have no load.

Certain NTF Funds will be available load waived.

Short-term Trading Fees

Fidelity charges a short-term trading fee each time you sell or exchange

shares of a FundsNetwork NTF fund held less than 60 days. This fee does

not apply to Fidelity funds, money market funds, FundsNetwork Transaction

Fee funds, FundsNetwork load funds, funds redeemed through the Personal

Withdrawal Service, or shares purchased through dividend reinvestment. In

addition, Fidelity reserves the right to exempt other funds from this fee, such

as funds designed to achieve their stated objective on a short-term basis.

The fee will be based on the following fee schedule:

Online $49.95 flat fee

Fidelity Automated Service Telephone (FAST®): 0.5625% of principal

(25% off representative-assisted rates), maximum $187.50, minimum $75

Rep-Assisted: 0.75% of principal, maximum $250, minimum $100

Keep in mind that the short-term trading fee charged by Fidelity on

FundsNetwork NTF funds is different and separate from a short-term

redemption fee assessed by the fund itself. Not all funds have short-term

redemption fees, so please review the fund’s prospectus to learn more

about a potential short-term redemption fee charged by a particular fund.

*Fidelity reserves the right to change the funds available without transac-

tion fees and reinstate the fees on any funds.

FundsNetwork Transaction-Fee Funds

Purchases:

Online: $49.95 or $100 per purchase. To identify any applicable

transaction fees associated with the purchase of a given fund, please

refer to the “Fees and Distributions” tab on the individual fund page on

Fidelity.com.

FAST®: 0.5625% of principal per purchase; minimum $75,

maximum $187.50

Rep-Assisted: 0.75% of principal per purchase; minimum $100,

maximum $250

These fees may be waived for certain types of periodic investment

accounts.

Redemptions:

Fidelity does not charge a transaction fee on any redemption of shares

of a transaction-fee fund that were purchased with no load. A fund’s own

redemption fees may apply.

You can buy shares in a transaction-fee fund from its principal underwriter

or distributor without a Fidelity transaction fee.

FundsNetwork Load Funds

A fund’s sales charges may apply. Fidelity does not charge a transaction

fee on a load fund. A fund’s own redemption fees may apply.

FOREIGN STOCKS

Fidelity offers three different opportunities to trade foreign stocks. You can

utilize “International Trading,” “Dollarized International Trading,” or Fidelity’s

“Foreign Ordinary Share Trading” services. Depending on the service,

different commissions, taxes, and fees may apply as more fully described

below. You may also call a Fidelity representative for further details. The

International Trading team at Fidelity is available Monday through Friday,

from 5 a.m.–7 p.m. ET.

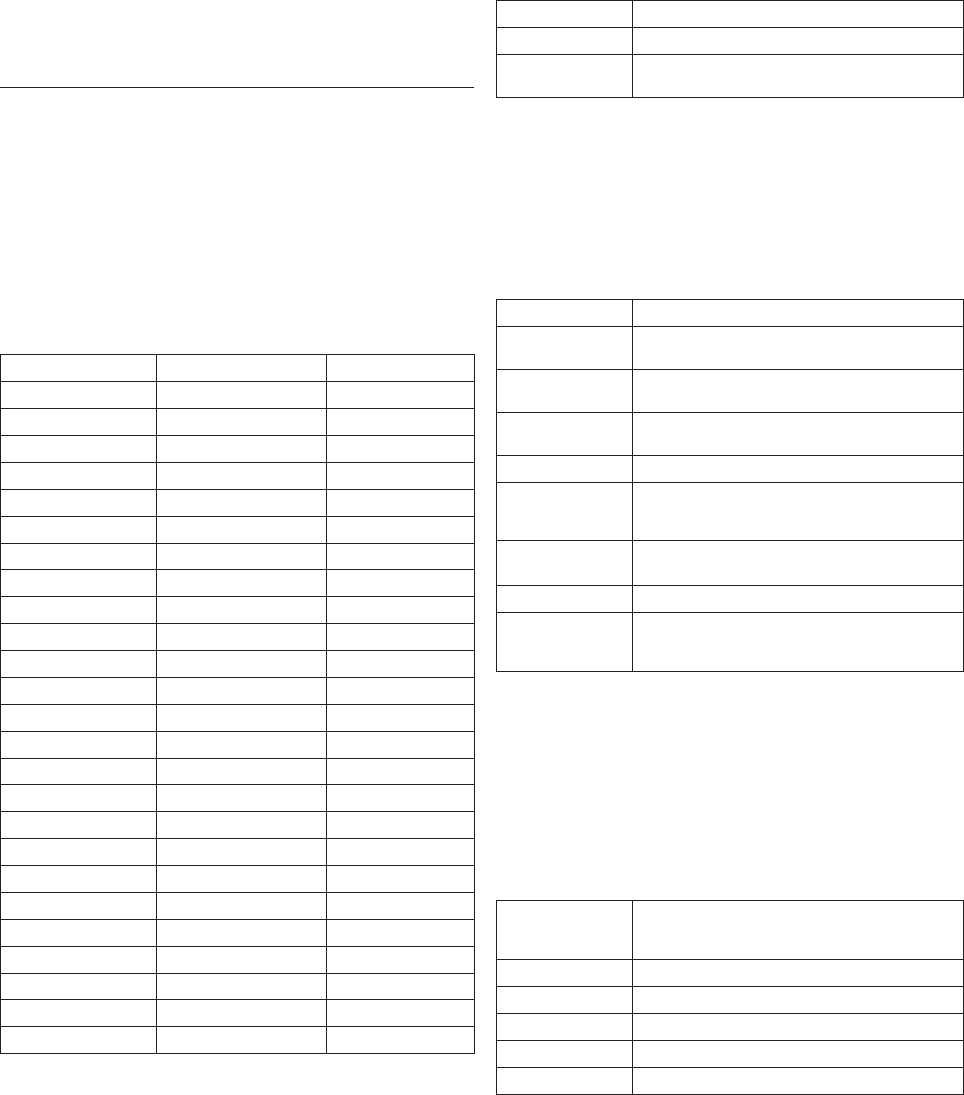

International Trading

International Trading allows customers to trade stocks from 25 countries and

exchange between 16 currencies. These trades are placed using a root sym-

bol, followed by a colon (:) and the two-letter country code for the market the

customer wants to trade in. The commission charged by Fidelity is dependent

on the market in which the order is placed and whether the trade is placed

online or with the assistance of a representative as noted in the table below.

Country Online* Rep Assisted*

Australia $32 AUD $70 AUD

Austria 19 EUR(€) 50 EUR(€)

Belgium 19 EUR(€) 50 EUR(€)

Canada $19 CAD $70 CAD

Denmark 160 DKK 420 DKK

Finland 19 EUR(€) 50 EUR(€)

France 19 EUR(€) 50 EUR(€)

Hong Kong $250 HKD $600 HKD

Germany 19 EUR(€) 50 EUR(€)

Greece 19 EUR(€) 50 EUR(€)

Ireland 19 EUR(€) 50 EUR(€)

Italy 19 EUR(€) 50 EUR(€)

Japan 3,000 JPY(¥) 8,000 JPY(¥)

Mexico 360 MXN 960 MXN

Netherlands 19 EUR(€) 50 EUR(€)

New Zealand $35 NZD $90 NZD

Norway 160 NOK 400 NOK

Poland 90 PLN 235 PLN

Portugal 19 EUR(€) 50 EUR(€)

Singapore $35 SGD $90 SGD

South Africa 225 ZAR 600 ZAR

Spain 19 EUR(€) 50 EUR(€)

Sweden 180 SEK 480 SEK

Switzerland 25 CHF 65 CHF

United Kingdom 9 GBP(£) 30 GBP(£)

*Per trade

Note that retirement account registrations are ineligible for this service. Please

also note that if a security trading on an exchange in one of the markets

noted above is only listed for trading in a currency other than that country’s

local market’s currency, then the commission that will be charged will be

based on the currency the security is trading in instead of the identity of the

local market.

Dollarized International Trading

Dollarized International Trading allows customers to execute stocks on foreign

exchanges in retirement and non-internationally enabled accounts using

a five-character symbol ending in “F” for settlement in U.S. Dollars. Trade

Amounts are calculated and posted in U.S. Dollars by incorporating a foreign

currency exchange. This service is only available through the International

Trading team at Fidelity and orders will execute during the respective coun-

tries’ regular market hours. At a minimum, all the same countries listed above

for the International Trading offering are available, but please inquire with

your Fidelity representative if you have a question about the availability of any

additional countries.

Country Rep Assisted Only*

Canada Rep Assisted Commission

All Others Rep Assisted Commission + $50 non-DTC

(Depository Trust Company) Fee

*Per trade

Country-Specific Taxes and Fees

Additional country-specific taxes and fees may be charged as detailed in the

table below for International Trading and Dollarized International Trading.

The list of countries, currencies, taxes, and fees provided below is subject to

change without notice. There may also be further fees, taxes, or other charges

assessed by intermediaries when conducting transactions in foreign securities

beyond those described here, which could change at any time based on the

country or exchange directive. Details regarding these charges are available

from a Fidelity representative.

Country Tax (Per Trade)

France* Financial Transaction Tax (FTT) .30% of

principal on purchases

Italy* Financial Transaction Tax (FTT) .10% of

principal on purchases

Spain* Financial Transaction Tax (FTT) .20% of principal

on purchases

Ireland Stamp Tax 1.00% of principal on purchases

Hong Kong Transaction Levy 0.0027% of principal

Trading fee 0.005% of principal

Stamp Duty 0.10% of principal

South Africa Securities Transfer Tax .25% of principal

on purchases

Singapore Clearing fee of 0.04% of principal

United Kingdom PTM Levy 1 GBP where principal amount is

> £10,000 Stamp Duty 0.50% of principal

on purchases

*Certain securities based on market capitalization

Please also note that if a security trading on an exchange in one of the

markets noted above is only listed for trading in a currency other than that

country’s local market’s currency, then the fees that will be charged will be

based on the currency the security is trading in instead of the identity of the

local market.

Foreign Currency Exchange

In addition to the commissions, taxes, fees, and other charges for International

Trading and Dollarized International Trading, a currency exchange fee (in the

form of a markup or markdown on the exchange rate) will be charged based

on the size of the currency conversion, pursuant to the following schedule:

Total Foreign

Exchange

Amount

Cost

<$100K 1.0% of principal

$100K–<$250K 0.75% of principal

$250K–<$500K 0.50% of principal

$500K–<$1M 0.30% of principal

$1M+ 0–0.20% of principal

Note: The Foreign Currency Exchange Fees above are applied to orders filled

in the local country markets listed above. Rates may vary for additional curren-

cies in available countries not listed in this schedule. Details are available from

a Fidelity representative.

Foreign Ordinary Share Trading

Foreign Ordinary Share Trading allows customers to trade shares in foreign

corporations on the over-the-counter (OTC) market using a five-character

symbol ending in “F.” Trades in foreign ordinary shares can be placed online

through the domestic equity order ticket or through a Fidelity representative.

In either case, the domestic commission schedule for stocks/ETFs will apply. A

$50 fee will also be charged on each transaction in any foreign ordinary stock

that is not Depository Trust Company eligible. Retirement and non-retirement

accounts are eligible for this service.

Country-Specific Taxes and Fees

Additional country-specific taxes and fees may be charged as detailed in the

table below for Foreign Ordinary Share Trading. The list of countries, taxes,

and fees provided below is subject to change without notice. There may also

be further fees, taxes, or other charges assessed by intermediaries when

conducting transactions in foreign securities beyond those described here,

which could change at any time based on the country. Details regarding these

charges are available from a Fidelity representative.

Country Tax (Per Trade)

France* Financial Transaction Tax (FTT) .30% of

principal on purchases

Italy* Financial Transaction Tax (FTT) .10% of

principal on purchases

Spain* Financial Transaction Tax (FTT) .20% of principal

on purchases

*Certain securities based on market capitalization

Note: The taxes and fees, if any, will be disclosed individually on the trade

confirmation.

OTHER INVESTMENTS

Unit Investment Trusts (UITs) $35 minimum per redemption; no fee

to purchase. Fidelity makes certain new issue products available without a

separate transaction fee. Fidelity receives compensation for participating

in the offering as a selling group member. Fees from participating in the

selling group range from 1% to 4% of the public offering price. Fidelity

may also receive compensation for reaching certain sales levels, which

range from 0.001% – 0.0025% of the monthly volume sold.

Precious Metals

% Charged on % Charged on

Buy Gross Amount Gross Amount Sell Gross Amount Gross Amount

$0–$9,999 2.90% $0–$49,999 2.00%

$10,000–$49,999 2.50% $50,000–$249,999 1.00%

$50,000–$99,999 1.98% $250,000+* 0.75%

$100,000+* 0.99%

*delivery charges and applicable taxes if you take delivery

Fidelity charges a quarterly storage fee of 0.125% of the total value or

$3.75, whichever is greater. Storage fees are pre-billed based on the

value of the precious metals in the marketplace at the time of billing.

For more information on these other investments and the cost of a specific

transaction, contact Fidelity at 800-544-6666. Minimum fee per precious

metals transaction: $44. Minimum precious metals purchase: $2,500 ($1,000

for IRAs). Precious metals may not be purchased in a Fidelity Retirement Plan

(Keogh), and are restricted to certain types of investments in a Fidelity IRA.

OTHER FEES AND COMPENSATION

All Accounts

Foreign Currency Wires up to 3% of principal; charged when

converting USD to wire funds in a foreign currency

Foreign Dividends / Reorganizations 1% of principal; charged when

a dividend is paid or a reorganization event occurs on a foreign asset held

in an account in USD

Nonretirement Accounts

Debit Card and ATM Fees There is no annual fee for the Fidelity®

Debit Card or the Fidelity HSA® debit card. You may be charged separate

fees by other institutions, such as the owner of the ATM. Note: You cannot

use the Fidelity HSA® debit card at an ATM.

For Fidelity Account® owners coded Premium, Private Client Group,

Wealth Management, or with household annual trading activity of 120

or more stock, bond, or options trades, your account will automatically

be reimbursed for all ATM fees charged by other institutions while using

the Fidelity® Debit Card at any ATM displaying the Visa®, Plus® or Star®

logos. The reimbursement will be credited to the account the same day

the ATM fee is debited. In rare instances, ATM owners may not itemize

fees, which may cause disruption of individual automatic rebates. Should

this occur, please contact Fidelity. Please note there may be a foreign

transaction fee of 1% included in the amount charged to your account.

Fidelity debit cards are issued by PNC Bank, N.A., and the debit card

programs are administered by BNY Mellon Investment Servicing Trust

Company. These entities are not aliated with each other or with Fidelity.

Visa is a registered trademark of Visa International Service Association,

and is used by PNC Bank pursuant to a license from Visa U.S.A. Inc.

Transfer and Ship Certificates $100 per certificate; applies only to

customers who have certificate shares reregistered and shipped; waived

for households that meet certain asset and trade minimums at Fidelity

2

HSAs

Annual fees For Fidelity HSAs that are opened through, or serviced by,

an intermediary, or in connection with your workplace benefits, Fidelity

may deduct:

• an administrative fee of up to $12 per quarter ($48 annually) from

your Fidelity HSA, unless it is paid by your employer (may be waived

for households that were established before a certain date and meet

certain asset minimums at Fidelity).

Fee and Trading Policies

Commissions will be charged per order. For commission purposes,

orders executed over multiple days will be treated as separate

orders. Unless noted otherwise, all fees and commissions are

debited from your core account.

Fee Waiver Eligibility

To determine your eligibility for fee waivers, we group the assets

and trading activity of all of the eligible accounts shown on your

periodic account statement.

Eligible accounts generally include those maintained with

Fidelity Service Company, Inc., or FBS [such as 401(k), 403(b),

or 457 plan assets] or held in Fidelity Investments Life Insurance

Company accounts, Fidelity Portfolio Advisory Service® or Fidelity®

Personalized Portfolios accounts. Assets maintained by Fidelity

Personal Trust Company, FSB, are generally not included. We may

include other assets at our discretion.

We will review your account periodically to confirm that your

household is receiving the best fee waivers it qualifies for, and

may change your fee waiver eligibility at any time based on

these reviews. We update fee waiver eligibility across household

accounts promptly after a daily review of trading activity, and

monthly after a review of household assets. All trading activity is

measured on a rolling 12-month basis.

If you believe there are eligible accounts within your household

that are not being counted in our fee waiver eligibility process —

for example, accounts held by immediate family members who

reside with you — you may authorize Fidelity to consolidate these

accounts into an aggregated relationship household and review

them for eligibility. Any resulting fee waivers would extend both

to you and to all immediate family members residing with you.

Most customers receive only a single customer reporting statement

from Fidelity and do not need to take any action. However, for

more information, go to Fidelity.com/goto/commissions or call us at

800-544-6666.

2

Households with $1 million or more in assets or $25,000 or more in assets + 120 trades a year. For details, see Fee Waiver Eligibility section above.

Limits on Feature Eligibility

Retirement accounts and Fidelity BrokerageLink® accounts cannot

trade foreign securities or sell short, are not eligible for margin

loans, and may be subject to other rules and policies. Please see

the literature for these accounts for details.

Prospectuses and Fact Sheets

Free prospectuses are available for UITs, Fidelity funds, and Fidelity

FundsNetwork® funds. Fact sheets are availab le for certificates of

deposit. To obtain any of these documents, and for other informa-

tion on any fund offered through Fidelity, including charges and

expenses, call 800-544-6666 or visit Fidelity.com.

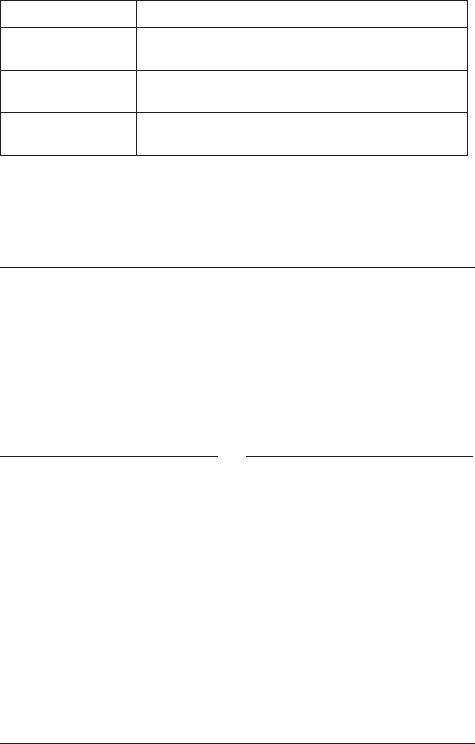

Margin Fees

Understanding how margin charges are calculated is essential

for any investor considering or using margin. The information

below, provided in conformity with federal securities regulations,

is designed to help you understand the terms, conditions, and

methods associated with our margin interest charges.

For all margin borrowing — regardless of what you use it for — we

charge interest at an annual rate that is based on two factors: our

base rate, and your average debit balance. We set our base rate

with reference to commercially recognized interest rates, industry

conditions regarding margin credit, and general credit conditions.

The following table shows the premiums and discounts we apply

to our base rate depending on the average debit balance:

Interest Charged

Interest Charged

Average Debit Balance Above/Below Base Rate

$0–$24,999.99 +1.250%

$25,000–$49,999.99 +0.750%

$50,000–$99,999.99 –0.200%

$100,000–$249,999.99 –0.250%

$250,000–$499,999.99 –0.500%

$500,000–$999,999.99 –2.825%

$1,000,000+ –3.075%

In determining your debit balance and interest rate, we combine

the margin balances in all your accounts except short accounts

and income accounts. We then compute interest for each account

based on the rate resulting from averaging the daily debit balances

during the interest period. Interest is charged from the date we

extend you credit.

In the event that we have to take action in your account to meet

a margin call, you will be charged the Rep-Assisted rate for such

transactions.

Your rate of interest will change without notice based on changes

in the base rate and in your average debit balance. When your

interest rate is increased for any other reason, we will give you at

least 30 days’ written notice. If the base rate is stated as a range,

we may apply the high end of the range.

For any month where your monthly margin charges are $1 or more,

your monthly statement will show both the dollar amount and the

rate of your interest charges. If your interest rate changed during the

month, separate charges will be shown for each rate. Each interest

cycle begins the first business day following the 20th of each month.

Other Charges

You may be assessed separate interest charges, at the base rate

plus two percentage points, in connection with any of the following:

• Payments of the proceeds of a security sale in advance of the

regular settlement date (such prepayments must be approved

in advance)

• When the market price of a “when-issued” security falls below

your contract price by more than the amount of your cash deposit

• When payments for securities purchased are received after the

settlement date

How Interest Is Computed

Interest on debit balances is computed by multiplying the average

daily debit balance of the account by the applicable interest rate

in effect and dividing by 360, times the number of days a daily

debit balance was maintained during the interest period.

Marking to Market

The credit balance in the short account will be decreased or

increased in accordance with the corresponding market values

of all short positions. Corresponding debits or credits will be posted

to the margin account. These entries in the margin account will, of

course, affect the balance on which interest is computed. Credits in

your short account, other than marking to market, will not be used

to offset your margin account balance for interest computation.

459374.66.0 FA-FEES-0224

1.828131.164

FundsNetwork

®

FBS and/or NFS has contracted with certain mutual funds, their

investment advisors, or their affiliates and certain ETF investment

advisors to receive other compensation in connection with the purchase

and/or the ongoing maintenance of positions in certain mutual fund

shares and ETFs in your brokerage account. This additional annual

compensation may be paid with respect to the mutual fund by the

mutual fund, its investment advisor, or one of its affiliates and with

respect to the ETF by its investment advisor or its affiliates.

• FundsNetwork No Transaction Fee (NTF) Funds and ETFs

– For funds participating in the NTF program and certain ETFs,

Fidelity receives compensation that typically ranges from 5 to 65

basis points based on the average daily balance. As of 12/31/2023,

88% of the mutual funds currently in the NTF program are in the

35–40 basis point range. For NTF funds with a 12b-1 fee, the fund

family may use the 12b-1 fee as part of its NTF payment.

• FundsNetwork Transaction Fee (TF) Funds

– For funds participating in the TF program, Fidelity receives

compensation based on: (1) per-position fees that typically range

from $3 to $25 per brokerage account or (2) asset-based fees that

typically range from 2 to 20 basis points based on average daily

assets. As of 12/31/2023, 86% of the mutual funds participating

in the TF program had per-position fees in the $12–$19 per-

position fee range or asset-based fees in the 8–12 basis point

range. TF compensation is in addition to any 12b-1 fees as

described in the fund’sprospectus.

• Fidelity receives fees from certain unaffiliated product providers to

compensate Fidelity for maintaining the infrastructure required to

accommodate unaffiliated product providers’ investments products

in one or more of Fidelity’s distribution channels, including retail,

workplace and intermediary channels. These fees vary by providers,

but in each case the fee is a fixed amount that is less than .07% of

the product provider’s assets in the Fidelity distribution channel(s) for

which it applies. In addition, certain unaffiliated product providers

may pay Fidelity initial start-up fees, product add, maintenance,

access to certain distribution channels, and provider minimum

monthly fees as well as a flat, uniform, annual fee related to an

exclusive marketing, engagement, and analytic program.

• Fidelity may receive a payment from American Fund Distributors

(AFD) for among other things, to compensate Fidelity for providing

them access to financial intermediaries and investors in certain

Fidelity channels, a platform to support the provision of investment

guidance and service to such financial intermediaries and investors,

when applicable, and to promote operational efficiencies. As

described in American Fund prospectuses, AFD has discretion as

to the amount of the payment, if any; the criteria to determine any

payment includes sales, assets, and cash flows as well as qualitative

factors. It is anticipated that the payment would not exceed .08%

annually of American Fund assets in all retail, workplace and

intermediary channels maintained by Fidelity, subject to certain

exclusions.

• Fidelity may receive an annual product fee of up to $2,000 if

aggregate assets held in that product across all retail, workplace

and intermediary channels maintained by Fidelity are less than $1.5

million.

• If you would like more information on any of the mutual funds in the

FundsNetwork program, please call Fidelity at 800-544-5373.

Use of funds held overnight

FBS is the introducing broker-dealer for Fidelity brokerage accounts

(“Accounts”). Its affiliate, NFS, provides clearing and other related

services on Accounts. As compensation for services provided with

respect to Accounts, NFS receives use of: amounts from the sale

of securities prior to settlement; amounts that are deposited in the

Accounts before investment; and disbursement amounts made

by check prior to the check being cleared by the bank on which it

was drawn. Any of the above amounts will first be netted against

outstanding Account obligations. The use of such amounts may

generate earnings (or “float”) for NFS or instead may be used by NFS

to offset its other operational obligations. Information concerning the

time frames during which NFS may have use of such amounts and

rates at which float earnings are expected to accrue is provided as

follows:

(1) Receipts. The deposit of amounts that settle from the sale of

securities or that are deposited into an Account (by wire, check,

ACH [Automated Clearing House] or other means) will generally be

purchased into the Account’s core sweep vehicle by close of business

on the business day that NFS receives such funds. NFS gets the use

of such amounts from the time it receives funds until the core sweep

vehicle purchase settles on the next business day. Note that amounts

disbursed from an Account (other than as referenced in Section 2

below) or purchases made in an Account will result in a corresponding

“cost” to NFS. This occurs because NFS provides funding for these

disbursements or purchases one day prior to the receipt of funds

from the Account’s core sweep vehicle. These “costs” may reduce or

eliminate any benefit that NFS derived from the receipts described

previously.

(2) Disbursements. NFS gets the use of amounts disbursed by check

from Accounts from the date the check is issued by NFS until the check

is presented and paid.

(3) Float Earnings. To the extent that such amounts generate float

earnings, such earnings will generally be realized by NFS at rates

approximating the Effective Federal Funds Rate.

Fidelity Defined Contribution Retirement Plan Accounts (including

Profit Sharing, Money Purchase, and Self-Employed 401(k) plans)

for Customers who Reside Outside the United States

If you reside outside the United States in any country other than

Canada (as described in the Residing Outside of the United States

section of the Fidelity Brokerage Retirement Customer Account

Agreement [“Agreement”]), deposits to your Fidelity retirement

account will be held in the Intraday Free Credit Balance as more

fully described in the Agreement. Any interest paid as a result of the

Intraday Free Credit Balance will be labeled “Credit Interest” in the

Activity section of your account statement. To the extent such amounts

generate earnings, such earnings will be realized by NFS at rates

approximating the Effective Federal Funds Rate. NFS’s compensation

is the amount of earnings reduced by any interest paid to Accounts.

596805.18.0 1.933210.117

Addendum to

Brokerage Commission and Fee Schedule