Paying to Match: Decentralized Markets with

Information Frictions

*

Marina Agranov

†

Ahrash Dianat

‡

Larry Samuelson

§

Leeat Yariv

¶

January 24, 2023

Abstract

We experimentally study decentralized one-to-one matching markets with transfers. We vary the informa-

tion available to participants, complete or incomplete, and the surplus structure, supermodular or submod-

ular. Several insights emerge. First, while markets often culminate in efficient matchings, stability is more

elusive, reflecting the difficulty of arranging attendant transfers. Second, incomplete information and sub-

modularity present hurdles to efficiency and especially stability; their combination drastically diminishes

stability’s likelihood. Third, matchings form “from the top down” in complete-information supermodular

markets, but exhibit many more and less-obviously ordered offers otherwise. Last, participants’ market

positions matter far more than their dynamic bargaining styles for outcomes.

Keywords: Matching Markets, Transfers, Incomplete Information, Experiments.

JEL: C78, C92, D02, D47.

*

We thank Jeongbin Kim and Pellumb Reshidi for superb research assistance. We gratefully acknowledge financial

support from the International Foundation for Research in Experimental Economics and from the NSF, through grant

SES 1629613.

†

Division of the Humanities and Social Sciences, California Institute of Technology, Email: [email protected]

‡

Department of Economics, University of Essex, Email: [email protected]

§

Department of Economics, Yale University, Email: [email protected]

¶

Department of Economics, Princeton University, Email: [email protected]

1 Introduction

1.1 Overview

A large and successful literature studies matching markets with complete information. It as-

sumes individuals know not only their own preferences over possible allocations, but also all

others’ preferences. This assumption is often made for tractability and is reasonable for some

applications. In large school choice systems, for example, historical data on admission patterns

might be persistent and therefore predictable. Nevertheless, there are numerous applications in

which incomplete information regarding others’ preferences, at times even one’s own, might be

present. Newly-minted doctors seeking a residency in a specific specialty may not be privy to

the idiosyncratic preferences of both their peers and the hospitals they interview with. Similarly,

fresh academic Ph.D.’s may not be fully informed of other applicants’ preferences or of universi-

ties’ particular research and teaching needs. Outside the labor market, potential adoptive parents

are unlikely to know the preferences over child characteristics of other potential adoptive parents

seeking children, or of the birth mothers relinquishing them. In marriage markets, an entire con-

sulting industry builds on the premise that individuals frequently misread others’ preferences,

even after lengthy interactions. While incomplete information is prevalent across these applica-

tions, there is a paucity of empirical data to elucidate its impacts.

We report results from an array of lab experiments in which participants match through de-

centralized interactions, as in the examples above. Our treatments vary the surplus structure and

the initial information available to market participants about others’ preferences. We illustrate

the substantial effect limited information has on outcomes and the regularities it produces.

Since many markets operate through transfers—labor markets often entail targeted wages,

housing markets generate exchanges via prices, etc.—we consider decentralized matching mar-

kets allowing for transfers. While common wisdom suggests that transfers assist in equilibrating

economic systems, they also allow for various bargaining frictions to emerge when negotiations

are unconstrained. Differences in bargaining styles, failures to follow up with appropriate offers,

and the like could, in principle, affect the generated match surpluses and their split between par-

ties. Furthermore, in practice, implementing the “right” transfers might be challenging: agents

often interact with a small set of potential partners and have limited information on what others

1

should reasonably expect to receive. The challenge of finding the “right” transfers is compounded

by agents’ incomplete information about others’ preferences. Our design allows us to discern how

transfers evolve and get determined.

Experimental Design. While our study speaks to many applications, field data are difficult to

gather. Rarely do we know market participants’ true preferences, their detailed interactions, or

the information available to them. The lab setting allows us to control for different market features

and observe how individuals respond.

We consider two-sided one-to-one markets in which agents can make match offers to one an-

other. Agents in the market are characterized by their “types,” which can stand for education level

or expertise in labor markets, age in child-adoption processes, or pizzazz in the marriage setting.

All agents prefer to be matched with higher-type agents: they generate a greater match surplus.

Going back to Becker (1973), the matching literature has often assumed match surpluses

exhibit either supermodularity or submodularity; see Chade, Eeckhout, and Smith (2017) and

Chiappori (2017) for literature surveys. We accordingly consider two surplus structures: super-

modular and submodular. In supermodular markets, higher types experience a greater marginal

increase in generated surplus from matching with higher types. Consequently, the utilitarian

efficient matching is positively assortative. In submodular markets, the reverse holds: it is the

lower-type agents who experience the greatest marginal benefit from increasing their partner’s

quality. In such markets, utilitarian efficiency implies negatively assortative matchings.

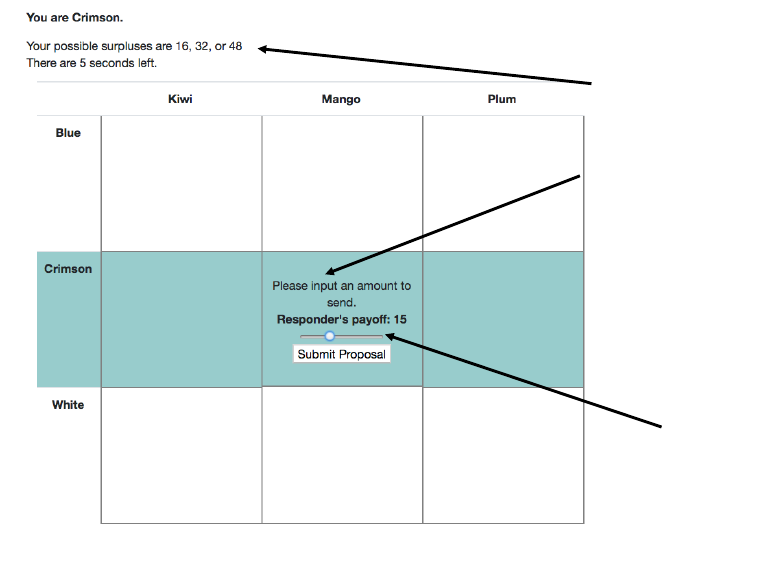

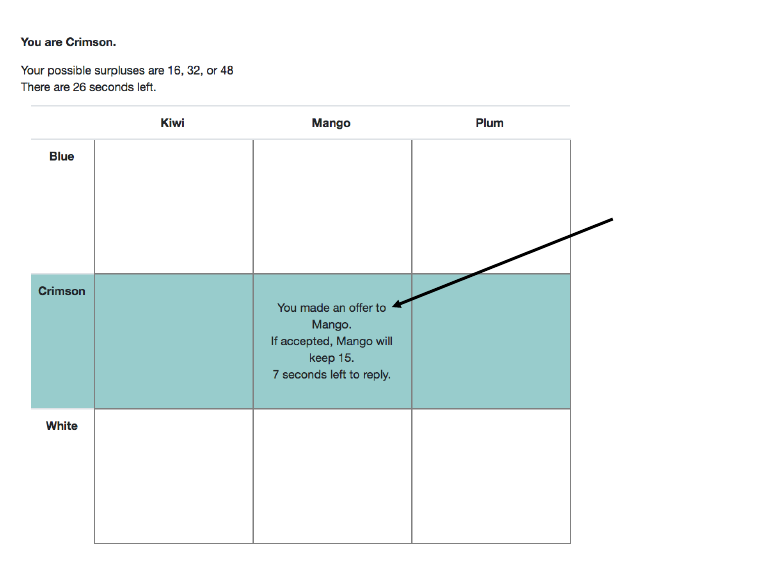

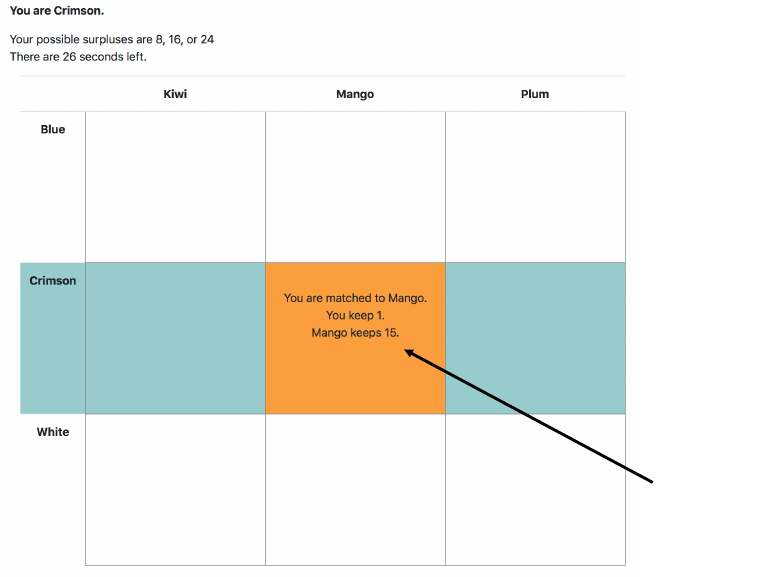

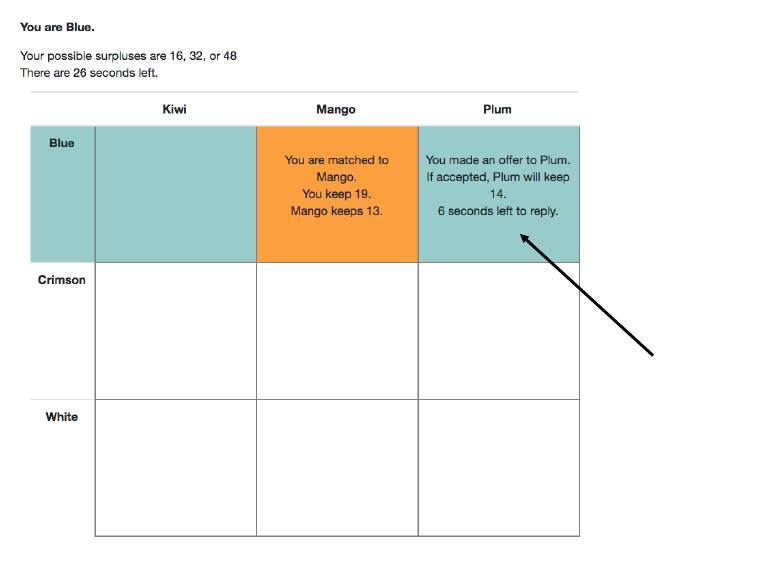

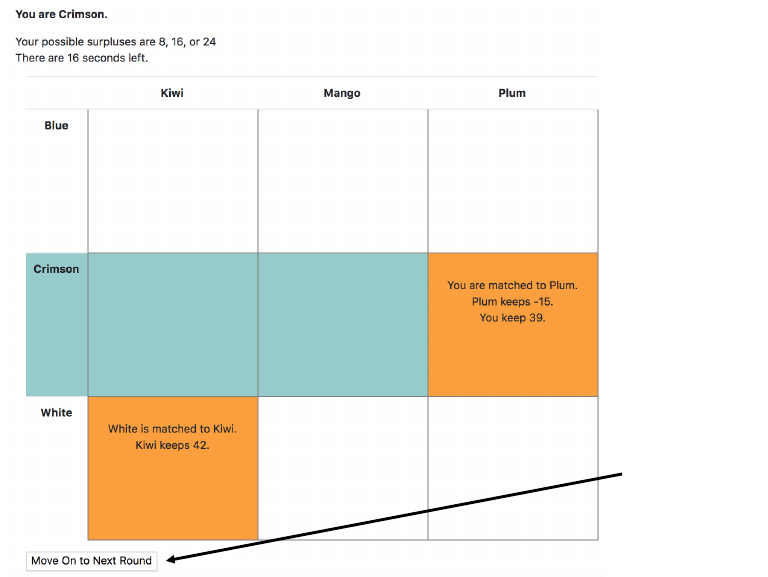

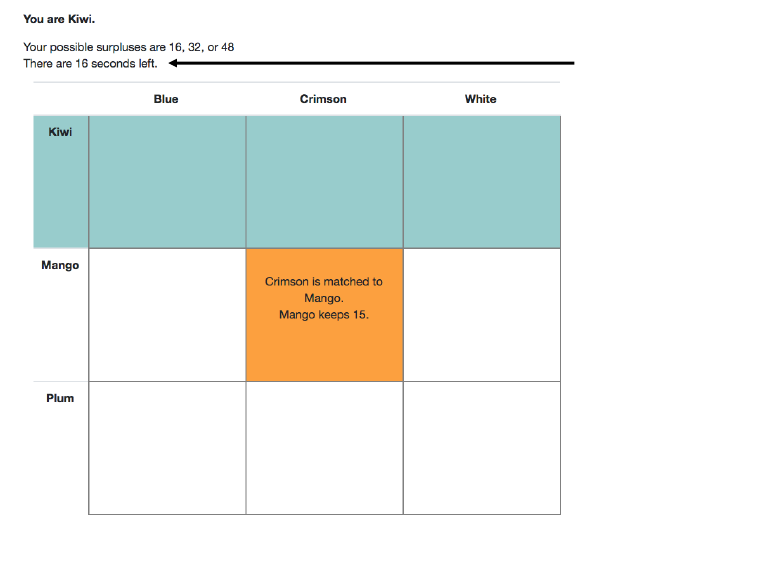

In our experimental markets, interactions are decentralized: individuals can make offers to

one another in an unscripted fashion, with the sole restriction that only one offer can be made or

accepted at any time. An offer indicates a split of the match surplus. Accepted offers generate ten-

tative matches—they can be broken by making a different offer that gets accepted, or by accepting

an alternative offer. A market terminates after 30 seconds of inactivity. We use this matching pro-

tocol for three reasons. First, it echoes the narrative underlying the cooperative underpinnings of

stable matchings with complete information: any coalition can be formed throughout a market’s

duration. Second, it provides participants ample opportunities to learn about others’ match qual-

ities, which is important for some of our analysis. Last, it captures features of many real-world

matching settings, where pairs negotiate with a variety of partners before settling on a permanent

match. For example, employees can negotiate with one firm and switch to negotiations with an-

2

other, home buyers inspecting a property can decide to forgo that property and inspect others,

and individuals seeking a life partner often date multiple individuals sequentially.

1

In our complete-information treatments, participants know the surplus generated by each pair

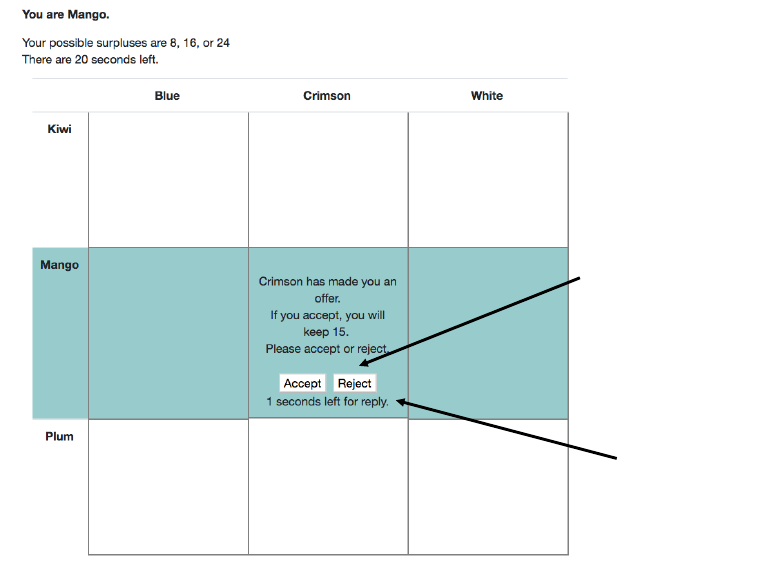

of participants in the market. In our incomplete-information treatments, participants enter the

market knowing the profile of match surpluses they can generate. That is, they know their own

type. They do not, however, know the types of other participants. In particular, at the start of the

market, they do not know who will help them generate which surplus. Learning occurs through

market interactions. Whenever an offer is accepted, both partners learn the match surplus they

jointly generate and the resulting payoffs they receive.

2

The full market observes the creation of

matches, as well as the surplus that recipients of accepted offers receive, but not the total surplus

such matches generate.

Empirical Regularities. Several insights emerge from our analysis. As we describe in our liter-

ature review below, prior experimental work supports the impression that, at least without trans-

fers, decentralized interaction yields stable outcomes. Our results show that matching markets

with transfers often produce utilitarian efficient matchings, but stable outcomes are less com-

mon.

3

Thus, there is a sense in which the common wisdom on the benefits of transfers holds

water in our data, albeit at the cost of stability. This effect is particularly salient when the surplus

is submodular. Specifically, with complete information, 94% of our supermodular markets cul-

minate in efficient, positively assortative outcomes and 78% of market results are stable. When

preferences are submodular, only 73% of our markets yield efficient, negatively assortative out-

comes and a mere 14% of ultimate outcomes are stable.

When information is incomplete, the theoretical literature offers little guidance as to the dy-

namics and outcomes one might expect; see our review of the literature. In particular, there is

little work inspecting the information revealed through the operations of a market that starts

1

While markets’ termination depends on all market participants ceasing activity, any particular pair can stop search-

ing for alternatives sooner by maintaining their pairing till the market ends.

2

Offers still entail the specification of a transfer. Absent information on match surpluses, certain offers can lead

to negative payoffs. We allow participants to cancel such offers ex-post. We do not see participants “gaming” the

experiments through this option.

3

Utilitarian efficient matchings maximize the sum of match surpluses. Stability with transfers corresponds to a

matching and a profile of transfers such that no pair of agents can find a transfer that, if implemented, would make

their match desirable relative to what they already receive. It is well known that stable matchings are utilitarian

efficient (e.g. Roth and Sotomayor, 1990).

3

with incomplete information. In simple incomplete-information markets such as ours, where par-

ticipants enter with considerable information and every accepted or rejected offer yields more

information, interactions could plausibly lead to complete information. Therefore, throughout

much of our analysis, we use complete-information stability as a benchmark, returning to this

issue in Section 5.1.

In our data, incomplete information and submodularity constitute substantial obstacles to

both efficiency and stability. Indeed, with incomplete information, in markets with a supermod-

ular surplus structure, 84% of outcomes are efficient, while 54% are stable. With submodular

surpluses, 39% of outcomes are efficient, and a mere 3% are stable. In other words, the combina-

tion of incomplete information with submodularity nearly eliminates the likelihood of achieving

stable outcomes. This observation opens the door for richer theories of matching with incom-

plete information: ones that allow for some market learning, but still yield outcomes that are not

complete-information stable.

The analysis of offer dynamics provides a lens into how market outcomes are generated. When

information is complete, markets governed by supermodular surpluses “match from the top,”

in the sense that high-type agents (who generate the greatest surplus) match first, followed by

medium-type agents, and finally low-type agents.

4

In contrast, the sequenceing of matches is

more haphazard in submodular markets. Many more offers are made throughout those market

operations. Early matches that “stick” are often between high-type agents, and generate a barrier

to achieving market-wide efficiency. Medium-type agents follow suit, while low-type agents tend

to match late, regardless of their partner’s type.

When information is incomplete, regardless of the underlying surplus structure, initial matches

are often transient and broken later in the market’s operations as participants learn. This leads to

far more market activity. Matches between incongruent types, low and high, occur earlier. Inter-

estingly, the enhanced market activity we observe implies that, by the end of our markets’ oper-

ations, most participants learn with whom they can generate which surplus, consistent with our

focus on complete-information stability. However, even matches formed later in our incomplete-

information markets do not echo the patterns seen in their complete-information counterparts.

Why do outcomes not mimic those in our complete-information markets? We show that our data

4

This sequence resembles the Marshallian path studied by Plott, Roy, and Tong (2013).

4

are consistent with simple satisficing heuristics of participants. Based on their type, participants

aim at a certain payoff and actively search for partners only below their satisficing threshold. This

observation echoes evidence documented in individual decision-making; see Caplin, Dean, and

Martin (2011). In our setting, satisficing emerges through dynamic market interactions.

A large literature, scientific and popular, suggests the importance of bargaining strategies

in determining outcomes—for reviews, see Bertrand (2011) and Shell (2006). One may wonder

whether our participants’ individual tendencies help explain their obtained payoffs. We indeed

see large variation in individuals’ bargaining styles, in terms of offer volume, number of matches

created throughout a market, how demanding offers are, and the timing of interactions. Nonethe-

less, none of these has any substantial explanatory power for outcomes. Ultimately, market fea-

tures and one’s position in the market—namely, the type—appear to explain the lion’s share of the

payoffs participants receive. This result may be comforting to some: while individual characteris-

tics and access to opportunities for self-improvement may greatly affect one’s consequences, they

do so only insofar as they alter one’s position, or “quality,” in the market. Once in the market,

outcomes appear resilient to individual variations that go beyond participants’ contributions to

the surpluses they can generate.

Implications. Taken together, our results carry several important implications for market de-

sign. First, when transfers are available, stability through decentralized interaction is not guaran-

teed and depends crucially on the underlying preferences in the market. In particular, centralized

clearinghouses may be especially beneficial when preferences are submodular. Second, incom-

plete information presents a substantial hurdle for achieving stability. Interventions directed at

alleviating information frictions may therefore prove useful. Such interventions could entail al-

lowing for more communication between participants, introducing public releases of information

about market attributes, etc. Alternatively, centralization of the matching process may be par-

ticularly important when participants are not perfectly informed. The existing literature rarely

considers clearinghouses with imperfectly-informed participants, and the consideration of those

may be necessary. Last, educating participants to achieve their maximal potential “quality” as

they enter a matching market may be of far greater importance than educating participants on

how to negotiate their interactions once in the market.

5

1.2 Related Literature

A large theoretical literature considers matching markets with complete information, with or

without transfers; see Roth and Sotomayor (1990). Incomplete information poses many challenges

to the analysis of matching markets. Even the basic stability notion is difficult to translate when

agents are not fully informed of everyone’s preferences. Pairs that would block a matching with

complete information—pairs of agents that prefer one another over their allocated match—may

not form if agents cannot discern who would prefer a match with them. Furthermore, any at-

tempt to form a blocking pair allows other participants to partially infer the preferences of agents

involved, possibly others’ when those are correlated.

Starting from Liu, Mailath, Postlewaite, and Samuelson (2014), several recent papers suggest

stability notions for incomplete information markets, mostly restricting attention to incomplete

information only on one market side. Bikhchandani (2017) considers matching markets without

transfers. Liu et al. (2014), and relatedly Alston (2020) and Liu (2022), consider matching with

transfers as we do. At the heart of the stability notions in these papers is the requirement that any

agent’s “deviation” from a matching, with its attendant transfers, ultimately leaves her (weakly)

worse off. The stability notions in these papers are defined with respect to a given matching and

a fixed specification of the uncertainty agents have about others’ types. They do not consider the

possibility that the match formation process may reveal information, rendering the specification

of uncertainty endogenous and possibly leading to effectively complete information.

Stability notions are interesting due to the presumption that, in frictionless decentralized mar-

kets, agents would ultimately converge to a stable outcome. Nonetheless, only a few papers explic-

itly model the decentralized process that generates such stable outcomes. Roth and Vate (1990)

offer non-strategic dynamics that yield stable outcomes, whereby at each stage, a random block-

ing pair is implemented. Complete information is implicitly assumed, as all blocking pairs are

considered at every step. Ferdowsian, Niederle, and Yariv (2022) consider a decentralized mar-

ket game in which firms and workers interact in a dynamic fashion. They illustrate the hurdles

incomplete information or time frictions generate in establishing stability as a property of equi-

librium outcomes. Chen and Hu (2020) focus on incomplete-information settings and construct

an adaptive learning process leading to stable outcomes as they define them.

Hakimov and Kübler (2021) present a general overview of the experimental matching liter-

6

ature. Several papers in that literature share features with our design.

5

Concurrent work by

He, Wu, and Zhang (2022) considers decentralized matching with complete information, allow-

ing for transfers between participants. He et al. (2022)’s design resembles that of our complete-

information treatment, although their experimental markets have a pre-specified time of opera-

tion.

6

In line with our results, they observe far more stable outcomes in assortative than in anti-

assortative markets. In contrast with our results, they observe a substantial fraction of unmatched

individuals, potentially due to the limited-market horizon. Outside the matching context, Agra-

nov and Elliott (2021) identify the important impacts of transfers on bargaining outcomes.

Nalbantian and Schotter (1995) report on experiments emulating the market for professional

baseball players in the free-agent years. They analyze several allocation procedures with trans-

fers, including a decentralized procedure in which agents are informed of their own bargaining

outcomes, but not of others’. Pais, Pintér, and Veszteg (2020) study decentralized markets with

multiple stable matchings. There are no transfers and markets operate over a fixed duration. In

some treatments, participants are privately informed of their preferences. Incomplete informa-

tion in their setting does not affect the stability or the efficiency of the final outcome. However,

similar to what we observe, it boosts market activity. Niederle and Roth (2009) study unrav-

eling by considering an incomplete-information setting in which one side of the market makes

proposals to the other side over three experimental periods and information is exogenously and

incrementally released. They illustrate the impact of proposal structure on matching outcomes

and efficiency. Incomplete information has also been considered in centralized markets, mostly

focusing on school-choice mechanisms and, therefore, absent transfers. See, for example, Chen

and Sönmez (2006), Pais and Pintér (2008), and work that followed.

7

2 Experimental Protocol

In our experiments, participants engage in a sequence of decentralized markets varying in two

dimensions: the surplus structure, which is either supermodular or submodular, and the infor-

mation available. In some matching markets, participants are fully informed of everyone’s pref-

5

There are also several papers studying decentralized matching with complete information and no transfers, see

Echenique and Yariv (2013) and references therein.

6

In their design, participants whose match is broken in the last 15 seconds can make offers within 15 seconds.

7

There is also recent empirical work that highlights the consequences of incomplete information in school choice,

see Kapor, Neilson, and Zimmerman (2020).

7

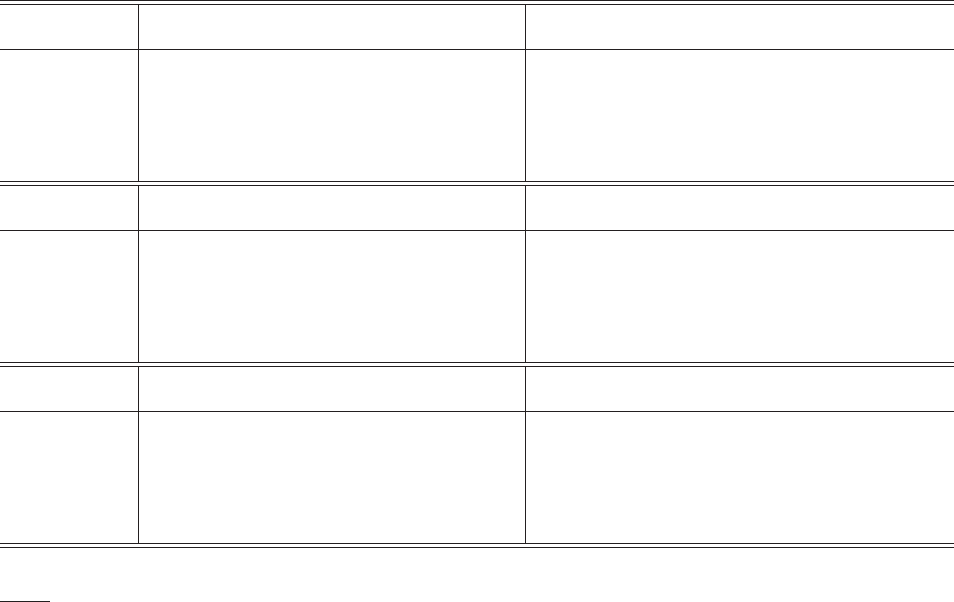

Table 1: Match Surpluses (Efficient Allocation in Bold)

Kiwi Mango Plum

Blue 8 16 24

Crimson 16 32 48

White 24 48 72

(a) Supermodular

Kiwi Mango Plum

Blue 8 32 56

Crimson 32 48 64

White 56 64 72

(b) Submodular

erences, in others they receive only partial information. We describe each of these dimensions in

turn. Sample experimental instructions are presented in Online Appendix C.

Our two-sided one-to-one matching markets are comprised of six participants, three on each

side. Each participant has a role: a color or a food. These roles capture the market sides and can

be metaphors for firms and workers in labor markets, men and women in the marriage market,

etc. There are three payoff-relevant types for each role. Specifically, the three color types are Blue,

Crimson, and White. The three food types are Kiwi, Mango, and Plum. A matching specifies

which colors and foods are unmatched, as well as a mapping between the remaining colors and

foods that is one-to-one: if a color type, say Blue, is assigned to a food type, say Kiwi, then the

reverse holds as well: Kiwi is assigned to Blue.

8

Table 1 depicts the match surpluses governing preferences in our markets. Panel (a) corre-

sponds to our supermodular surpluses, while panel (b) captures our submodular surpluses. In

each, the entry corresponding to each color and food pair is the match surplus generated by that

pair. Unmatched agents receive a payoff of 0.

We consider two information structures. In our complete-information treatments, partici-

pants are fully informed of surpluses generated by all pairs in the market. In particular, they

can readily rank their potential partners in terms of the surpluses they would jointly generate. In

our incomplete-information treatments, participants know their own type: at the market’s outset,

they are informed of the three possible surpluses they can generate with the three potential part-

ners on the other side of the market. However, they do not know which partner generates which

surplus, nor which of the remaining two types have been assigned to which other agent on their

side of the market. Formally, we permute the type labels in markets and inform participants only

of their own type. The structure of payoffs is transparent, as well as the randomization procedure.

The general structure of each session is as follows. The governing match surpluses, either su-

8

In our experimental results, the incidence of unmatched participants is only 0.5% across all sessions.

8

permodular or submodular, as well as the information structure, are fixed throughout the session.

Participants engage in one practice round, followed by 10 real rounds, each corresponding to a

new market (of the same sort in terms of both preferences and information), with a freshly drawn

random set of participants within the session. Participants maintain their role, a color or a food,

throughout the session. However, in each round, they are randomly assigned one of the three

types corresponding to their role.

In our complete-information treatments, each participant observes the full surplus matrix

throughout every round.

9

In our incomplete-information treatments, each participant only ob-

serves her own possible match surpluses at the start of each round.

10

As we soon explain, inter-

actions in the market can reveal some information on who generates which surplus.

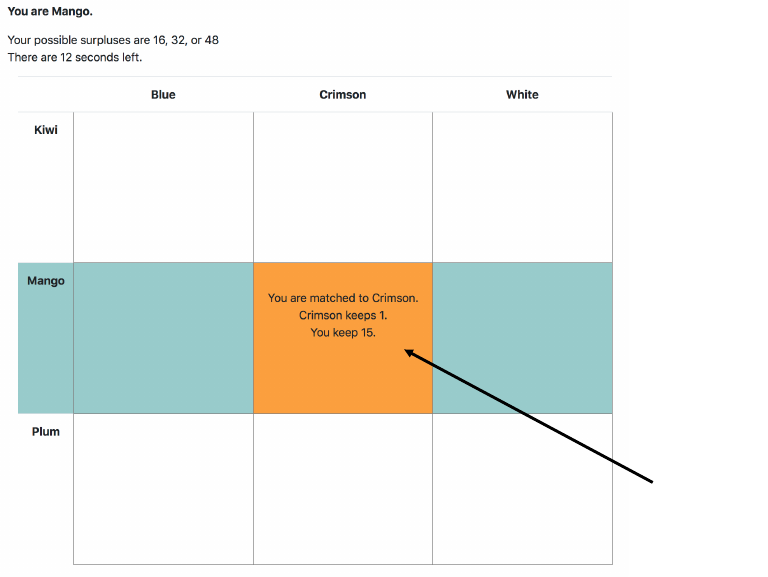

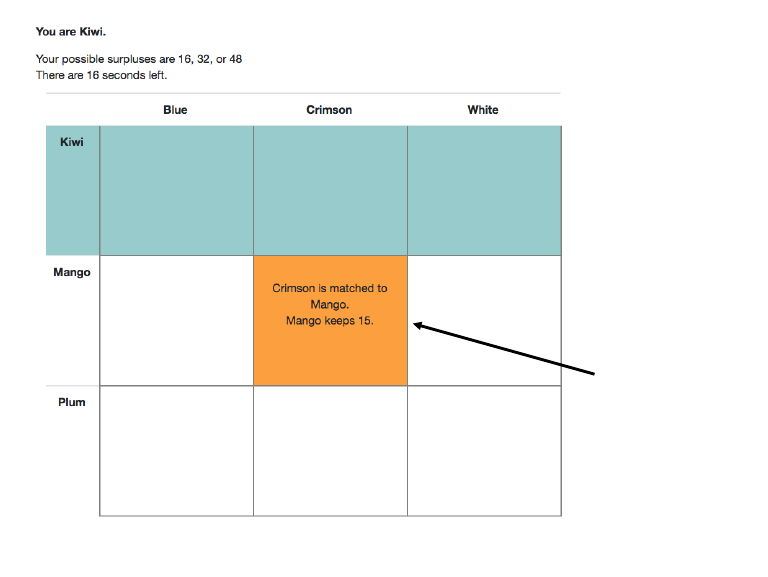

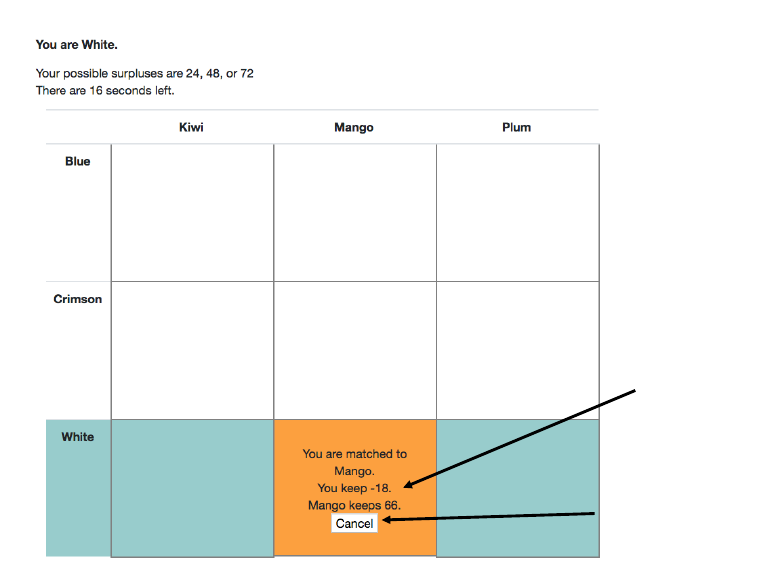

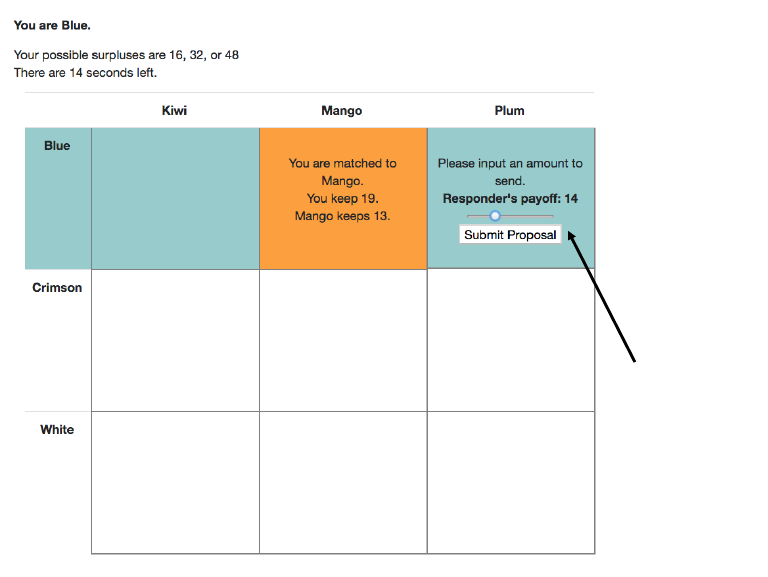

We now describe the rules of the matching protocol. In each round, participants start off un-

matched. Each participant is free to make at most one match proposal to any individual of the

opposite role at any given time. In the complete-information treatments, a match proposal speci-

fies how the match surplus will be split among the two individuals—i.e., the proposer’s payoff and

the responder’s payoff, summing up to the match surplus. In the incomplete-information treat-

ments, a match proposal only specifies the responder’s payoff, with the attendant proposer payoff

revealed if the responder accepts. Thus, the proposer bears the payoff risk under incomplete infor-

mation. This design choice was made to echo many applications in which the proposing side has

limited information on the returns to her proposal. For instance, firms offering employment often

cannot assess workers’ abilities. Nonetheless, we limited the scope of risk by allowing proposers

to immediately retract an offer if it turned out to generate a strict loss. For example, suppose Blue

and Kiwi generate a match surplus of 8. If Blue offers Kiwi a payoff of 16, and Kiwi accepts, then

Blue earns a payoff of -8. Since Blue earns a negative payoff, we would allow her to unilaterally

cancel the match.

11

This design choice was made both for practical reasons, in order to limit the

liability participants face, and also to mimic applications in which catastrophic relationships can

be severed promptly. For instance, a worker who does not have their presumed credentials can be

9

To prevent participants from reacting to cosmetic features of the surplus matrix, we shuffled the rows and columns

of the surplus matrix between rounds. In particular, specific colors and foods correspond to different match-surplus

profiles in each round. As a result, the efficient matchings do not always coincide with the diagonal (in the positively

assortative case) or anti-diagonal (in the negatively assortative case) of the surplus matrix.

10

For example, Blue in panel (a) of Table 1 would know that her possible match surpluses are 8, 16, and 24. However,

she would not know which surplus corresponds to which match.

11

In our data, 88% of negative offers were canceled by the proposers immediately. Other cases were associated with

immediate new offers by the proposers. Either way, we never see negative payoffs for any participant at any round.

9

fired quickly by the firm that hired them in many labor-market settings. Whenever an offer that

gives a positive payoff for both parties is accepted, the match can be dissolved only upon one of

its participants making or receiving an alternative offer that is accepted.

A match generating a loss certainly conveys some information to the proposer. In general,

whenever a match proposal is made and accepted, both the proposer and the responder observe

their realized payoffs. Other participants observe the formation of the match and the responder’s

payoff. This is the main channel through which learning occurs under incomplete information.

In terms of market activity, participants are free to accept or reject match proposals they re-

ceive from other individuals. Any match proposal that is not accepted or rejected within 10 sec-

onds automatically disappears and is effectively interpreted as a rejection. An acceptance forms a

match. Participants who are currently matched can still make and receive new match proposals,

with their current match persisting until such a new match proposal is accepted, at which point

(only) the current match is dissolved. A round ends after 30 seconds of inactivity. In incomplete-

information treatments, in order to allow participants to avoid excessive waiting, we introduced a

“move on to next round” button. Whenever at least 5 participants pressed the button, the market

for that group and round terminated.

12

A participant’s payoff in their current match at the end

of a round is their final payoff for that round. If a participant is unmatched at the end of a round,

their final payoff is 0 for that round.

At the end of each session, participants also complete two risk-elicitation tasks and two al-

truism tasks. We use a version of the Gneezy and Potters (1997) investment task to measure

risk preferences and a dictator game to measure altruism.

13

All payoffs in the experiment are

expressed in tokens. For the main part of the experiment, 10 tokens correspond to $1. For the

elicitation tasks, one token corresponds to $0.01. Participants’ total earnings in the experiment

include a $10 show-up payment, the sum of their final payoffs across the 10 rounds, and their

payoffs from the auxiliary elicitation tasks.

12

We were particularly concerned about the sensitivity of our incomplete-information treatments to specific indi-

viduals prolonging rounds after long waits. Whenever 5 of the 6 group members are ready to halt market activity,

we suspected the choice of the sixth individual to delay the end time would not affect outcomes. As will be seen, our

incomplete-information treatments indeed took much longer in terms of both time and market activity.

13

Specifically, in each of the two risk-elicitation tasks, participants were provided with 200 tokens that they had to

allocate between a safe project, returning token for token, and a risky project. In the first task, each token invested in

the risky project returned 2.5 tokens with 50% probability, and 0 otherwise. In the second task, each token invested

returned 3 tokens with 40% probability, and 0 otherwise. Altruism was elicited using two dictator-game elicitations,

one with an endowment of 100 tokens and another with an endowment of 200 tokens.

10

The experimental sessions were run at the Experimental and Behavioral Economics Laboratory

(EBEL) at UC Santa Barbara between July 2018 and October 2018. Each treatment, characterized

by a combination of underlying preferences and information structure, was run in 4 sessions, each

consisting of 12 participants. This generated 16 sessions overall and a total of 192 participants.

Each session lasted approximately 90 minutes, and paid an average of $24.75, in addition to a $10

show-up fee. The experiment was programmed and conducted with the oTree software (Chen,

Schonger, and Wickens, 2016).

3 Theoretical Preliminaries

In both our supermodular and submoduar markets, types can be ordered. In Table 1, White

generates higher surplus than Crimson, who generates higher surplus than Blue, for any food.

Similarly, Plum generates higher surplus than Mango, who generates a higher surplus than Kiwi,

for any color. Since labels of different types are shuffled across rounds, and the two sides of

our markets are fully symmetric, we refer to the types generating the highest surplus as high

types, those generating the intermediate surplus as medium types, and those generating the lowest

surplus as low types.

Formally, let C be the set of colors and F the set of foods, with generic elements f and c.

Let π : C × F → R identify the surplus associated with each pair of agents. A matching (with no

unmatched agents) is a bijection m : C ∪ F → C ∪ F, where m(C) ⊆ F, m(F) ⊆ C, satisfying the

restriction that if m(c) = f , then m(f ) = c for all c ∈ C and f ∈ F. An outcome is a matching m and

a pair of transfer schemes τ

C

: C → R and τ

F

: F → R.

Under complete information, an outcome (m,τ

C

,τ

F

) is stable if it satisfies

τ

C

(c), τ

F

(f ) ≥ 0 ∀(c, f ) ∈ C × F

τ

C

(c) + τ

F

(m(c)) = π(c,m(c)) ∀c ∈ C

τ

C

(c) + τ

F

(f ) ≥ π(c, f ) ∀(c,f ) ∈ C × F.

The first condition is an individual rationality requirement guaranteeing that no agent prefers to

be unmatched. The second condition is a feasibility condition guaranteeing that transfers in a

matched pair do not exceed the generated surplus. The third condition is a no-blocking condition

11

that guarantees there is no pair of agents who can increase their transfers by matching with one

another and appropriately dividing the attendant surplus. We say that a matching m is stable if it

is consistent with some stable outcome.

While all our treatments allow participants to make transfers to one another, it is useful to

first contemplate a no-transfer benchmark, in which surpluses are divided at some fixed ratios

between the two sides of the market.

14

In this case, there is a unique stable matching in both the

supermodular and submodular markets: the positive assortative matching (PAM) that matches

individuals of the same type. In the markets depicted in Table 1, the unique stable matching

would match the highest types, White and Plum, then the medium types, Crimson and Mango,

and finally the low types, Blue and Kiwi.

When transfers are available, stable outcomes induce matchings that maximize the sum of

surpluses: the utilitarian efficient matchings, hereafter referred to as simply efficient. For the

two markets we consider, there may be many transfer profiles that sustain stable outcomes, see

Appendix B for a formal characterization, but the matching itself is unique. In our supermod-

ular markets, the matching maximizing utilitarian efficiency is the positive assortative matching

(PAM). Furthermore, PAM together with transfers that split each surplus equally constitute a sta-

ble outcome. In our submodular markets, the matching maximizing utilitarian efficiency is the

negative assortative matching (NAM). Importantly, there is no stable outcome in which each sur-

plus is split equally. Instead, in the matches between low and high agents (Blue with Plum and

White with Kiwi), the high agents (White and Plum) must receive more than half the surplus.

The existing theoretical literature offers less definitive guidance as to the behavior and out-

comes one might expect under incomplete information. We adopt a permissive analog of complete-

information stability, deeming an outcome as unstable if there is a pair of agents with the property

that (i) one of the agents can propose matching under terms that will make both agents better off,

and (ii) the proposing agent knows there is no chance the proposal could make her worse off.

To make this precise, for each color c, let the set E

c

⊂ R

3

, with generic element (π(c,·)), con-

tain vectors specifying the surpluses that c can generate with each food f . Let E

f

be similarly

defined for each food f . We say that the set E

c

(or E

f

) is consistent with color c’s (or food f ’s)

experience if it excludes those values that the experience has revealed to be impossible. Then

14

That is, we can restrict τ(c) = απ(c,m(c)) and τ(f ) = (1 − α)π(m(f ),f ) for all c and f , where α ∈ (0,1).

12

(m,τ

C

,τ

F

,(E

c

)

c∈C

,(E

f

)

f ∈F

) is incomplete-information stable if the sets (E

c

)

c∈C

,(E

f

)

f ∈F

are consis-

tent and

τ

C

(c), τ

F

(f ) ≥ 0 ∀(c, f ) ∈ C × F

τ

C

(c) + τ

F

(m(c)) = π(c,m(c)) ∀c ∈ C

τ

C

(c) + τ

F

(f ) ≥ min

(

˜

π(c,·))∈E

c

˜

π(c,f ) ∀c ∈ C

τ

C

(c) + τ

F

(f ) ≥ min

(

˜

π(·,f ))∈E

f

˜

π(c,f ) ∀f ∈ F.

The first two conditions are the individual rationality and feasibility conditions. The latter two

conditions are the no-blocking conditions, stated separately for colors and foods. For example, the

colors’ no-blocking condition asks each color c to identify the minimum surplus generated with

each food f , given what c has learned. The condition guarantees that no split of that (pessimistic)

surplus can leave both c and f better off. The last condition is the analog for foods.

If at least one of the participants in each possible match knows the surplus that would be gen-

erated by the match, then this notion of incomplete-information stability reduces to complete-

information stability. This sufficient condition will be met in our case if at least 5 market par-

ticipants know the surplus they can generate with each opponent. Our results (Table 5 below)

show that the average number of participants who learn from their direct experience—i.e., from

matches in which they have at least temporarily participated—the surpluses they can generate

with each opponent exceeds 5. The matching process provides yet more information. We accord-

ingly take complete-information stability as our benchmark throughout.

Despite the abundance of information participants accumulate through market interactions,

we show that our incomplete-information markets do not routinely produce stable outcomes. In

latter parts of the paper, we consider two explanations. First, market participants may make

use of even less information than that which they have gained through their direct experience.

Second, incomplete information may introduce glitches into the matching process beyond the lack

of information—some offers a potential proposer knows impose no risk of a reduced payoff and

benefit both parties involved, may not be made. In particular, participants may pursue decision

criteria different from payoff maximization. Our analysis indicates the room for a richer theory of

matching with incomplete information.

13

4 Aggregate Outcomes

We start by describing the aggregate outcomes in our experimental markets. We use all 10 rounds

played in each session and omit the practice round.

4.1 Efficiency and Stability

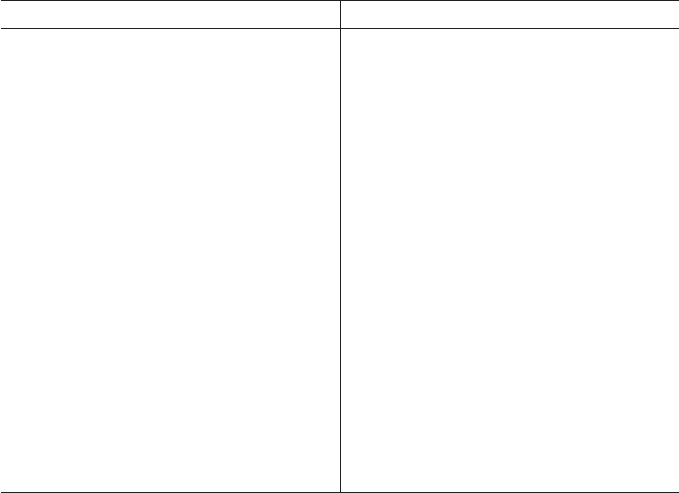

Table 2 depicts the fraction of efficient outcomes, those corresponding to a matching that maxi-

mizes the sum of match surpluses, i.e. the fraction of PAM for supermodular markets and NAM

for submodular markets. The table also depicts the fraction of stable outcomes, consisting of both

an efficient matching and a stable transfer profile. For the latter, we also display the fraction of

outcomes that are “almost stable” in that the matching is efficient, and no pair can generate more

than a small additional amount, 2 or 5 tokens, by blocking the observed outcome.

Table 2: Final Outcomes (allocations)

Complete Information Incomplete Information

Supermodular Submodular Supermodular Submodular

mean (se) mean (se) mean (se) mean (se)

Efficiency 0.94 (0.04) 0.73 (0.07) 0.84 (0.04) 0.39 (0.10)

Matching

PAM 0.94 (0.04) 0.01 (0.01) 0.84 (0.04) 0.08 (0.06)

NAM 0.00 (0.00) 0.73 (0.07) 0.00 (0.00) 0.39 (0.10)

Stability

exact 0.78 (0.10) 0.14 (0.09) 0.54 (0.07) 0.03 (0.03)

- 2 tokens 0.89 (0.06) 0.33 (0.11) 0.68 (0.06) 0.06 (0.05)

- 5 tokens 0.93 (0.05) 0.58 (0.12) 0.78 (0.06) 0.19 (0.11)

Notes: Robust standard errors (reported in parentheses) are obtained by clustering at the session level to account for

interdependencies of observations that come from the same session. An efficient outcome is one that maximizes the sum

of match surpluses. PAM indicates positive-assortative matching, while NAM indicates negative-assortative matching.

An allocation is stable (or stable −x tokens) if the matching is utilitarian efficient and no pair can generate any gain (of

more than x tokens) by blocking the observed outcome.

Table 2 suggests several insights. First, a substantial fraction of all of our markets culminates

in efficient matchings. For the most part, matchings are positively assortative when PAM is effi-

cient and negatively assortative when NAM is efficient.

Second, incomplete information poses an important obstacle for efficiency, particularly for

submodular markets. For supermodular markets, moving from complete to incomplete infor-

14

mation generates a reduction of 10 percentage points in the fraction of efficient matchings. In

contrast, for our submodular markets, the fraction of efficient matchings almost halves, dropping

by 34 percentage points.

Third, there are fewer stable than efficient outcomes. Much of the instability we observe is due

to unstable transfer profiles, as captured by the difference between the fraction of outcomes that

entail an efficient matching and those that are stable. For example, with complete information, 6%

of supermodular markets do not culminate in an efficient matching, while 16% of supermodular

markets yield an efficient matching but with unstable transfers. This wedge is even more pro-

nounced for submodular markets. With complete information, 27% of markets do not culminate

in efficient matchings, while 59% produce an efficient matching with unstable transfers.

Fourth, the surplus structure has important impacts on whether emergent outcomes are sta-

ble. Submodular markets generate significantly and substantially fewer stable outcomes than do

supermodular markets, especially under incomplete information, with differences that are more

pronounced than the comparisons of efficient outcomes. With complete information, 78% of su-

permodular markets culminate in a stable outcome, while for submodular markets, the corre-

sponding figure is 14%. This is the case even when allowing for minimal “mistakes” in terms of

the transfer profile. With incomplete information, the fraction of stable outcomes in supermod-

ular markets falls to 54%, while the fraction of stable outcomes in submodular markets nearly

vanishes, standing at 3%.

These comparisons are mirrored by the pattern of blocking pairs. For supermodular markets,

unstable outcomes are associated with an average of 1.56 blocking pairs with complete informa-

tion and an average of 1.65 blocking pairs with incomplete information. The corresponding fig-

ures for our submodular markets are 1.67 and 2.86. In particular, with incomplete information,

submodular preferences yield significantly more blocking pairs than supermodular preferences

(at the 1% significance level). The patterns are more pronounced when considering efficient, but

unstable, outcomes. In those, we see an average of one blocking pair with complete information

and an average of 1.25 blocking pairs with incomplete information when surpluses are super-

modular. The figures for our submodular markets are 1.32 and 1.93, both significantly higher (at

the 1% significance levels). A similar pattern emerges when considering the average surplus gen-

erated by blocking pairs of unstable outcomes, with incomplete information and submodularity

15

leading to greater average surplus available across blocking pairs.

15

These results suggest that,

even with fairly unrestricted and decentralized interactions, market participants facing incom-

plete information are not gleaning enough information to attain complete-information stability.

4.2 Payoffs

Table 3 provides aggregate statistics of participants’ payoffs and transfers. The top panel of the

table depicts the average payoffs by type. Theoretically, all stable outcomes of our supermodular

markets entail higher types gaining greater payoffs. In our submodular markets, however, a uni-

form distribution over stable outcomes would yield only 50% of stable transfer profiles exhibiting

this monotonic pattern (see our Appendix B for details on the constraints stability with transfers

imposes). Interestingly, when considering average payments, in all of our treatments we see high

types garnering significantly greater payoffs than medium types, who end up with significantly

greater payoffs than low types. Nonetheless, when we consider these comparisons market by mar-

ket, we see some differences, echoing our theoretical predictions. When information is complete,

all of our supermodular markets, but only 83% of our submodular markets, end up with higher

types gaining greater payoffs. When information is incomplete, 93% of our supermodular markets

and 61% of our submodular markets generate greater payoffs for higher types.

Equal splits are common in experimental work (e.g. Andreoni and Bernheim, 2009). While

equal splits are consistent with stability for supermodular markets, that is not the case for sub-

modular markets. In fact, were participants simply following an egalitarian norm and always

proposing an equal split of match surpluses, we would expect to observe PAM outcomes in all

our markets, as described in Section 3. Table 2 suggests that egalitarian norms cannot be medi-

ating all of our results. Indeed, in our submodular markets, we see PAM outcomes quite rarely.

In fact, while the transfers required for stable outcomes seem elusive, particularly in submodular

markets, the overall efficiency in those markets is far greater than under PAM. While PAM would

generate a total surplus of 128 tokens, the top panel of Table 3 indicates an average total surplus

of 157.5 tokens under complete information and an average total surplus of 150.5 tokens under

incomplete information. In other words, transfers do allow for greater efficiency, even in cases in

15

In supermodular markets that culminated in an unstable outcome, the average surplus available to blocking pairs

was 7.06 tokens with complete information and 7.19 tokens with incomplete information. For submodular markets,

the corresponding figures were 5.33 and 7.90 tokens. In particular, the greatest number of blocking pairs and available

surplus per blocking pair were observed for submodular markets with incomplete information.

16

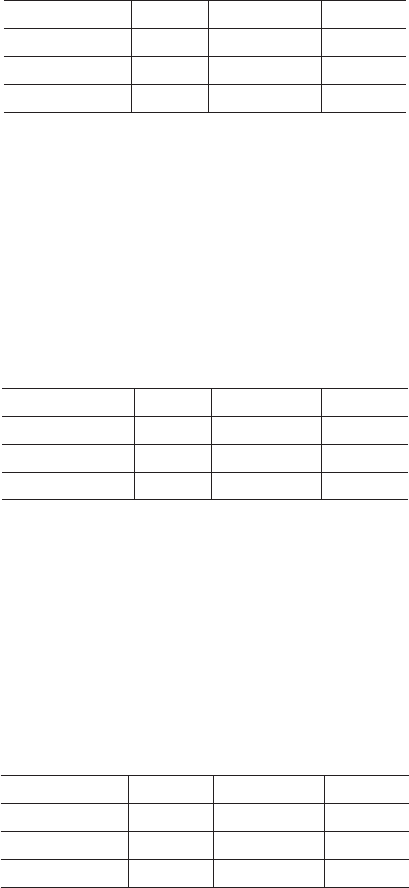

Table 3: Players’ Final Payoffs

Complete Information Incomplete Information

Supermodular Submodular Supermodular Submodular

mean (se) mean (se) mean (se) mean (se)

Payoffs by Type

Low Type 4.11 (0.06) 16.07 (0.37) 4.41 (0.15) 14.72 (0.60)

Medium Type 15.83 (0.12) 23.81 (0.25) 15.60 (0.51) 24.19 (0.14)

High Type 35.86 (0.10) 38.87 (0.45) 35.29 (0.27) 36.33 (0.54)

Equal Splits

All allocations 0.79 (0.04) 0.32 (0.01) 0.67 (0.06) 0.39 (0.06)

First two deals 0.64 (0.03) 0.60 (0.03) 0.15 (0.01) 0.23 (0.02)

Efficient allocations 0.81 (0.03) 0.31 (0.01) 0.69 (0.05) 0.29 (0.02)

Stable allocations 0.87 (0.02) 0.30 (0.01) 0.80 (0.06) 0.33 (0.21)

Notes: Average payoffs by players’ types are reported in the first three rows. Robust standard errors are clustered at

the session level and reported in the parentheses. Equal splits correspond to ratios of payoffs between two matched

players falling between 45% and 55%. For the first two deals in the incomplete-information markets, we focus on deals

in which the proposer receives non-negative payoffs.

which stability appears the most challenging to achieve.

The bottom panel of Table 3 displays explicitly the frequency of (roughly) 50 − 50 splits of

the match surplus in the final outcomes observed across markets. In order to allow for some

margin of error, we consider offers that range from 45% to 55% of the surplus. Since there are

many opportunities for participants to learn their match surpluses with others through markets’

operations—see Section 5.2 below—we consider the possibility of equal splits for incomplete-

information markets as well. Such roughly equal splits are prevalent, albeit not universal, in our

supermodular markets: hovering around 80% with complete information and around 70% with

incomplete information. They are far less common in our submodular markets, comprising fewer

than 40% of the outcomes regardless of the information available.

16

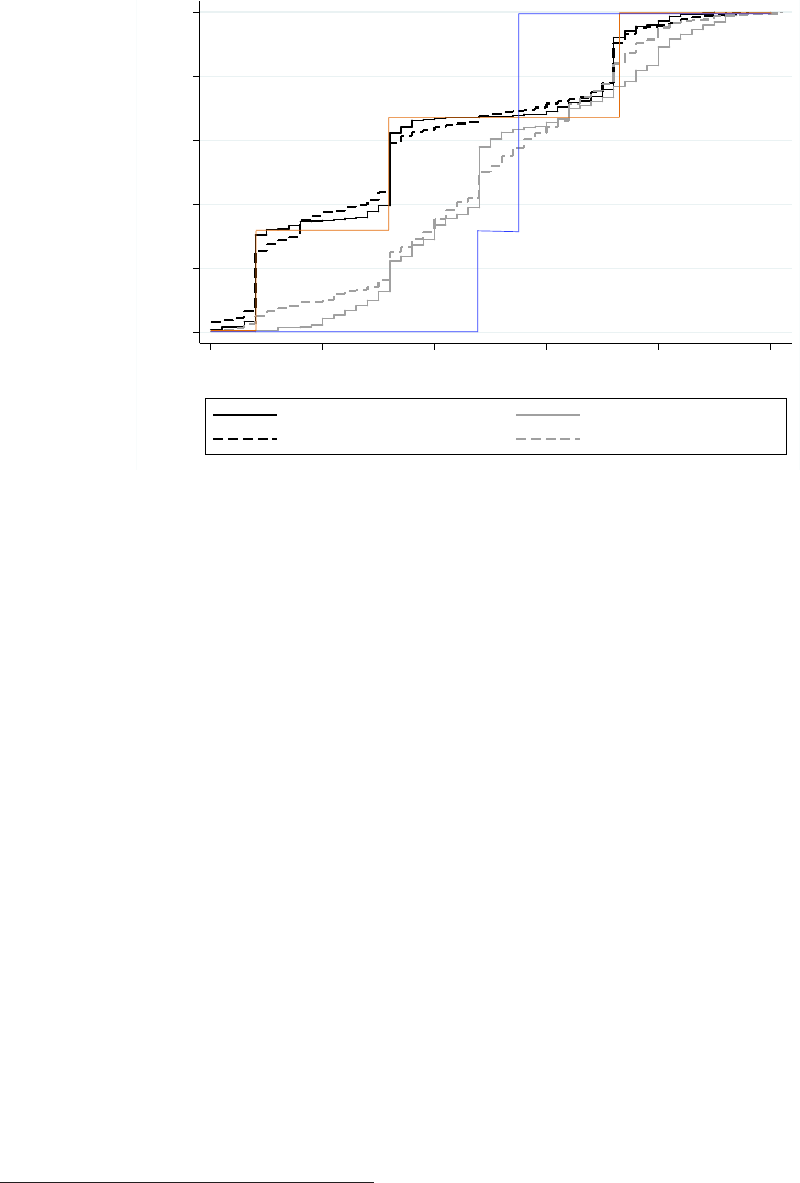

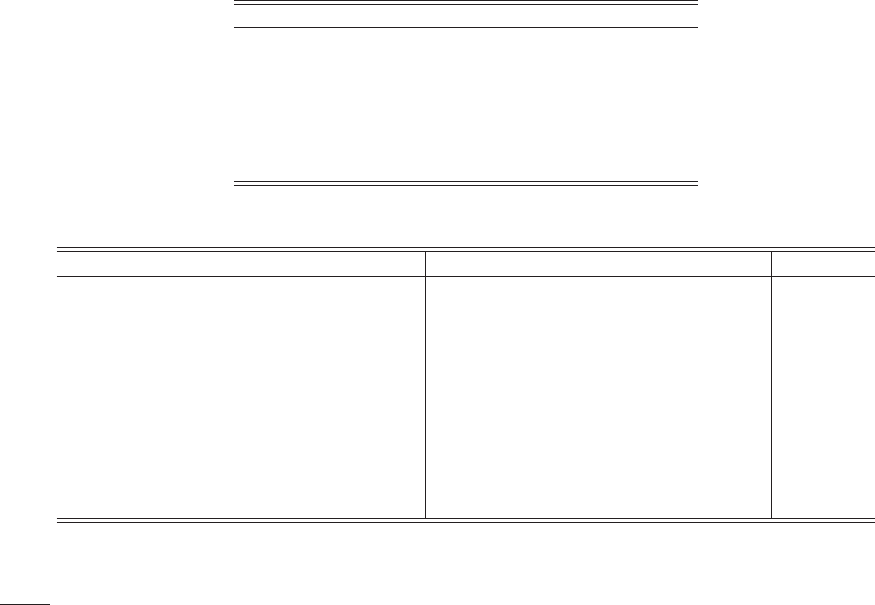

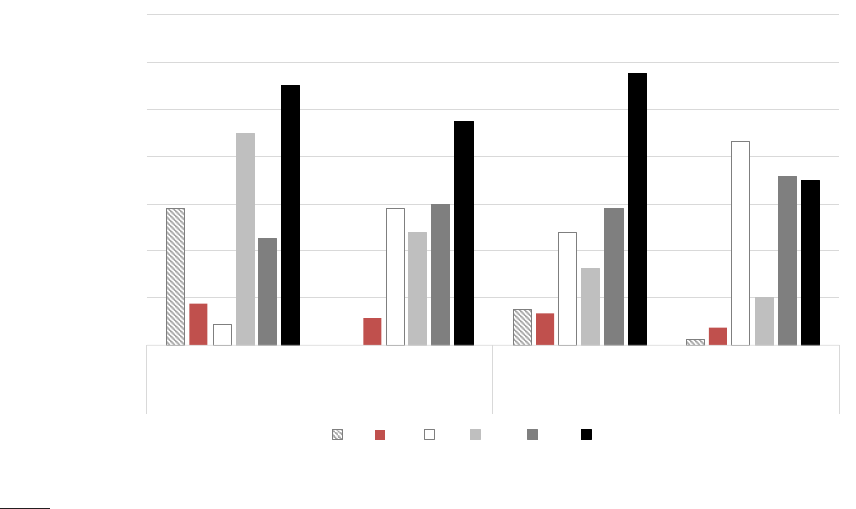

Figure 1 describes the cumulative distribution functions corresponding to payoffs across our

treatments. While complete-information treatments generally yield more pronounced “jumps”

the underlying preferences have a clear impact. With supermodular preferences, many of the

payoffs take one of three values. Indeed, when superimposing the distribution of payoffs that

would be generated by equally splitting the surplus between agents in the efficient matching (the

16

Interestingly, when looking at initial accepted offers in our markets, we see far more equal shares of match sur-

pluses for matches between congruent types in our submodular markets. In the first two accepted offers, equal sharing

occurs in over 89% of deals between participants of the same type. Nonetheless, even in these additional deals, partic-

ipants of different types do not split the surpluses equally. In particular, low types matching with high types get only

20% of the surplus. We provide more details on behavior at the start of our markets’ operations in Appendix A.

17

Figure 1: Cumulative Distributions of Players’ Payoffs

0

.2

.4

.6

.8

1

Cumulative Probability

0 10 20 30 40 50

Players' Payoffs

Complete Supermodular Complete Submodular

Incomplete Supermodular Incomplete Submodular

orange solid line, corresponding to equal masses receiving payoffs of 4, 16, and 36), we see sub-

stantial overlap. Submodular preferences, however, yield a nearly uniform distribution of payoffs,

particularly when information is incomplete. With complete information, we do see a large frac-

tion of individuals receiving a payoff of 24, an observation we soon elaborate on. Furthermore, the

payoff distributions corresponding to submodular preferences first order stochastically dominate

those corresponding to supermodular preferences. This, again, suggests that participants are not

simply implementing the efficient matching and splitting the surplus in those markets. Indeed,

the resulting distribution (depicted in the blue solid line, corresponding to one third of the popu-

lation receiving a payoff of 24 and two thirds receiving a payoff of 28) would second order, but not

first order, stochastically dominate the corresponding distribution for our supermodular markets.

Figure 1 presents payoff distributions aggregated across all market participants. At first blush,

it indicates similarity in overall payoff distributions between complete- and incomplete-information

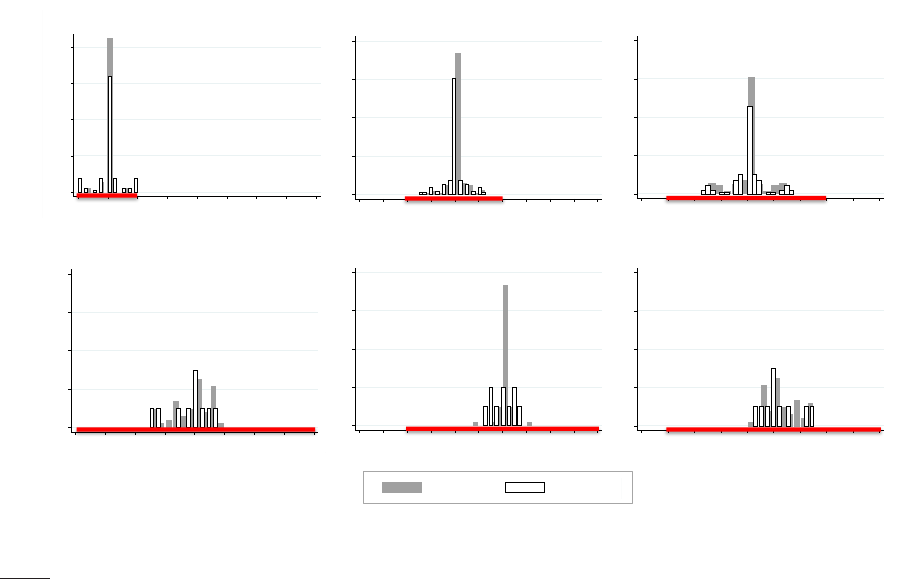

markets of the same surplus variety. Figure 2 presents the distribution of payoffs by types of

agents in markets that culminated in “nearly stable” outcomes, ones in which the matching is effi-

cient and there is a stable allocation of the surpluses such that each participant’s payoff is at most

2 tokens away from what they would receive in that allocation.

17

The figure depicts how observed

17

Allowing for a small margin of error ensures that the samples we discuss are of sufficient size.

18

Figure 2: Distribution of Payoffs by Types in Stable (-$2) Allocations

0 .2 .4 .6 .8

Fraction

0 4 8 12 16 20 24 28 32

Submodular: Low Types

0 .2 .4 .6 .8

Fraction

0 4 8 12 16 20 24 28 32

Supermodular: Low Types

0 .2 .4 .6 .8

Fraction

0 4 8 12 16 20 24 28 32 36 40

Supermodular: Medium Types

0 .2 .4 .6 .8

Fraction

0 4 8 12 16 20 24 28 32 36 40

Submodular: Medium Types

0 .2 .4 .6 .8

Fraction

20 24 28 32 36 40 44 48 52 56

Supermodular: High Types

0 .2 .4 .6 .8

Fraction

20 24 28 32 36 40 44 48 52 56

Submodular: High Types

PayoffsHighStableT2Sub 5/31/20, 11:38 AM

0 .2 .4 .6 .8

Fraction

20 24 28 32 36 40 44 48 52 56

Complete Incomplete

Submodular: High Types

Notes: The red line on the horizontal axis of each graph depicts the range of payoffs corresponding to stable outcomes

predicted by theory.

payoffs relate to the range of payoffs corresponding to stable outcomes, captured by the red solid

line in each panel (see Appendix B for computational details). In line with our discussion above,

the distribution of payoffs for all agents and across our markets exhibits a spike at the midpoint

of stable allocations. However, the figure conveys several additional messages. Considering our

complete-information treatments, payoffs corresponding to the midpoint of the interval of stable

transfers are far more prevalent in our supermodular markets. In fact, in our submodular mar-

kets, while over 70% of the medium-type agents receive the mid-point of their stable payoffs, low-

and high-type agents have far more disperse payoff distributions. With incomplete information,

payoffs are noticeably more diffuse, particularly when preferences are submodular. In fact, for

submodular preferences, for all types, no allocation carries more than 30% of our data.

4.3 Market Activity

Table 4 summarizes the aggregate features of activity in our markets. As can be seen, market

activity took, on average, between 3 and 5 minutes. Our incomplete-information markets corre-

19

Table 4: Market Characteristics

Complete Information Incomplete Information

Supermodular Submodular Supermodular Submodular

mean (se) mean (se) mean (se) mean (se)

Market duration (in sec) 158.6 (14.0) 171.5 (16.1) 191.6 (16.5) 292.9 (10.6)

Nb of offers extended

overall per market 24.8 (1.5) 24.1 (3.0) 42.4 (4.3) 45.9 (5.3)

by Low type 9.6 (1.4) 10.7 (2.0) 19.9 (1.5) 21.0 (2.7)

by Medium type 8.0 (0.8) 8.4 (0.7) 14.2 (2.0) 15.8 (2.2)

by High type 7.2 (0.8) 5.2 (0.3) 8.3 (0.9) 9.1 (1.4)

Nb of offers accepted

overall per market 5.6 (0.3) 8.8 (1.3) 15.9 (1.0) 17.3 (1.1)

by Low type 1.7 (0.04) 2.1 (0.26) 5.9 (0.36) 5.7 (0.38)

by Medium type 2.1 (0.16) 3.1 (0.48) 5.9 (0.48) 5.7 (0.35)

by High type 1.8 (0.12) 3.5 (0.55) 4.2 (0.43) 6.0 (0.37)

Notes: Robust standard errors are clustered at the session level and reported in parentheses.

spond to significantly longer durations and a greater volume of offers made and accepted. Our

submodular markets correspond to somewhat longer times to reach an outcome. However, the

volume of offers made or accepted does not seem to hinge on the underlying preference structure.

At the aggregate level, there are no great differences across agent types in terms of overall offers

made or accepted. One exception corresponds to the low-type agents, who make significantly

more offers than the high-type agents, particularly when information is incomplete.

4.4 Summary of Aggregate Outcomes

Overall, participants often establish efficient matchings. Stability is more elusive, indicating that

it is easier to settle on an efficient matching than to arrange the attendant transfers. Incomplete

information and submodular surplus structures present hurdles to efficiency and especially sta-

bility, with the combination of incomplete information and submodularity reducing stability to a

tiny percentage of outcomes. Incomplete information appears to introduce “complexity” in that

markets with incomplete information take longer to converge and involve substantially more par-

ticipant interactions to reach an outcome.

20

5 Market Dynamics

5.1 Match Evolution

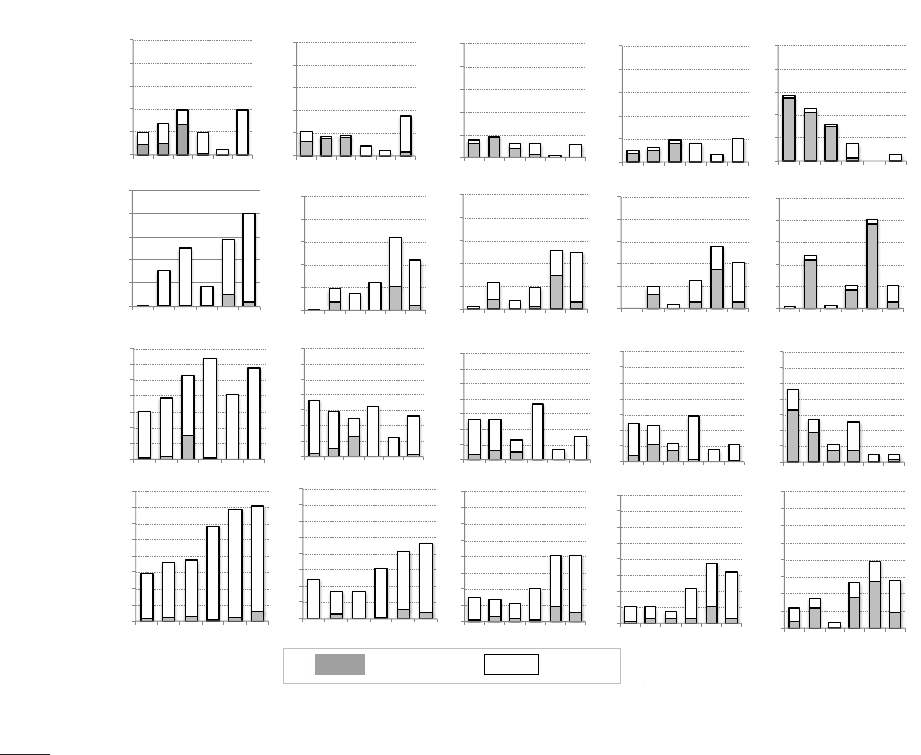

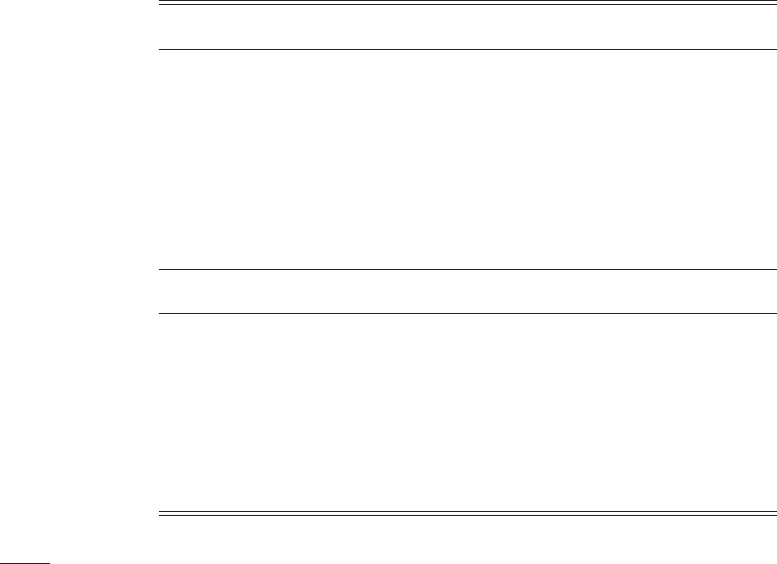

Figure 3: Transient and Permanent Matches, by Quintiles

Complete

Supermodular

Quintile 1 Quintile 2

Quintile 3 Quintile 4 Quintile 5

PayoffsHighStableT2Sub 5/31/20, 11:38 AM

0 .2 .4 .6 .8

Fraction

20 24 28 32 36 40 44 48 52 56

Complete Incomplete

Submodular: High Types

TransientPermanent

Complete

Submodular

Incomplete

Supermodular

Incomplete

Submodular

0

0. 2

0. 4

0. 6

0. 8

1

LL MM HH LM LH MH

0

0. 2

0. 4

0. 6

0. 8

1

LL MM HH LM LH MH

0

0. 2

0. 4

0. 6

0. 8

1

LL MM HH LM LH MH

0

0. 2

0. 4

0. 6

0. 8

1

LL MM HH LM LH MH

0

0. 2

0. 4

0. 6

0. 8

1

LL MM HH LM LH MH

0

0. 2

0. 4

0. 6

0. 8

1

LL MM HH LM LH MH

0

0. 2

0. 4

0. 6

0. 8

1

LL MM HH LM LH MH

0

0. 2

0. 4

0. 6

0. 8

1

LL MM HH LM LH MH

0

0. 2

0. 4

0. 6

0. 8

1

LL MM HH LM LH MH

0

0. 2

0. 4

0. 6

0. 8

1

LL MM HH LM LH MH

0

0. 2

0. 4

0. 6

0. 8

1

1. 2

1. 4

LL MM HH LM LH MH

0

0. 2

0. 4

0. 6

0. 8

1

1. 2

1. 4

LL MM HH LM LH MH

0

0. 2

0. 4

0. 6

0. 8

1

1. 2

1. 4

LL MM HH LM LH MH

0

0. 2

0. 4

0. 6

0. 8

1

1. 2

1. 4

LL MM HH LM LH MH

0

0. 2

0. 4

0. 6

0. 8

1

1. 2

1. 4

LL MM HH LM LH MH

0

0. 2

0. 4

0. 6

0. 8

1

1. 2

1. 4

1. 6

LL MM HH LM LH MH

0

0. 2

0. 4

0. 6

0. 8

1

1. 2

1. 4

1. 6

LL MM HH LM LH MH

0

0. 2

0. 4

0. 6

0. 8

1

1. 2

1. 4

1. 6

LL MM HH LM LH MH

0

0. 2

0. 4

0. 6

0. 8

1

1. 2

1. 4

1. 6

LL MM HH LM LH MH

0

0. 2

0. 4

0. 6

0. 8

1

1. 2

1. 4

1. 6

LL MM HH LM LH MH

Notes: Quintiles are defined relative to the total time the average market takes to reach a final outcome, where average

market duration is calculated as the mean time difference between the last and first activity in that market. The white

parts of the bars indicate the transient matches, i.e. those that are broken later on. Grey bars depict the final matches

that remain intact until the market’s termination.

We start by considering the progression of matches over the course of a market’s operation. In

order to depict our markets’ evolution, we inspect quintiles of activity in each market’s operation.

Namely, for each round in our sessions, we consider the time between the first and last moments

of activity. We split that time span into five quintiles, thereby effectively normalizing the length

of activity in each of our experimental markets.

21

Figure 3 reports the mean number of transient and permanent matches formed at each quin-

tile of market duration across treatments, for each combination of matched types—LL denotes

two low-type agents, LM denotes one low- and one medium-type agent, and so on. Several obser-

vations emerge. First, there are substantial differences in match dynamics across supermodular

and submodular markets. The complete-information treatments are particularly telling. With

supermodular preferences, both transient and permanent matches are first formed between the

high-type agents. They are followed by medium-type agents, and last by low-type agents. In

contrast, with submodular preferences, extremal types form matches first: we see the most early

transient matches between medium- and high-type agents and the most early permanent matches

between low- and high-type agents. These are followed by matches between congruent medium-

type agents. The early permanent matches between low- and high-type agents occur at substan-

tially lower rates than the corresponding congruent and permanent early matches in our super-

modular markets, particularly when accounting for the fact that each market contains two incon-

gruent low- and high-type pairs. Last, we see a substantial fraction of matches between low- and

medium-type agents at later market phases. These late matches are not part of stable outcomes.

The second observation from Figure 3 is that incomplete-information treatments are associ-

ated with far more offers, in every quintile and particularly early on. Some of these offers act to re-

veal information about the types of agents on the other side of the market—indeed, early-quintile

offers are frequently transient. This presumably explains why some features of the complete-

information markets remain. Specifically, we see more transient and permanent early matches

involving high-type agents. In contrast, the lower-type agents take more time to find partners.

18

5.2 Learning through Market Operations

As incomplete-information markets evolve, participants have opportunities to learn others’ types.

Indeed, whenever an offer is accepted, individuals learn the resulting payoffs and can thus identify

the type of individual on the other side of the market. Table 5 documents this type of learning

throughout quintiles of our sessions. In both supermodular and submodular markets, by the

18

Repeat offers occur frequently, even in later parts of markets’ operations. Consider the average fraction of repeat

offers in the second half of each round. In complete-information supermodular markets, these range from 0.27 for

low-type agents to 0.34 for medium-type agents to 0.13 for high-type agents. In incomplete-information supermodular

markets, these range from 0.34 for low-type agents to 0.29 for medium-type agents to 0.25 for high-type agents. Our

submodular markets yield nearly identical frequencies of repeat offers.

22

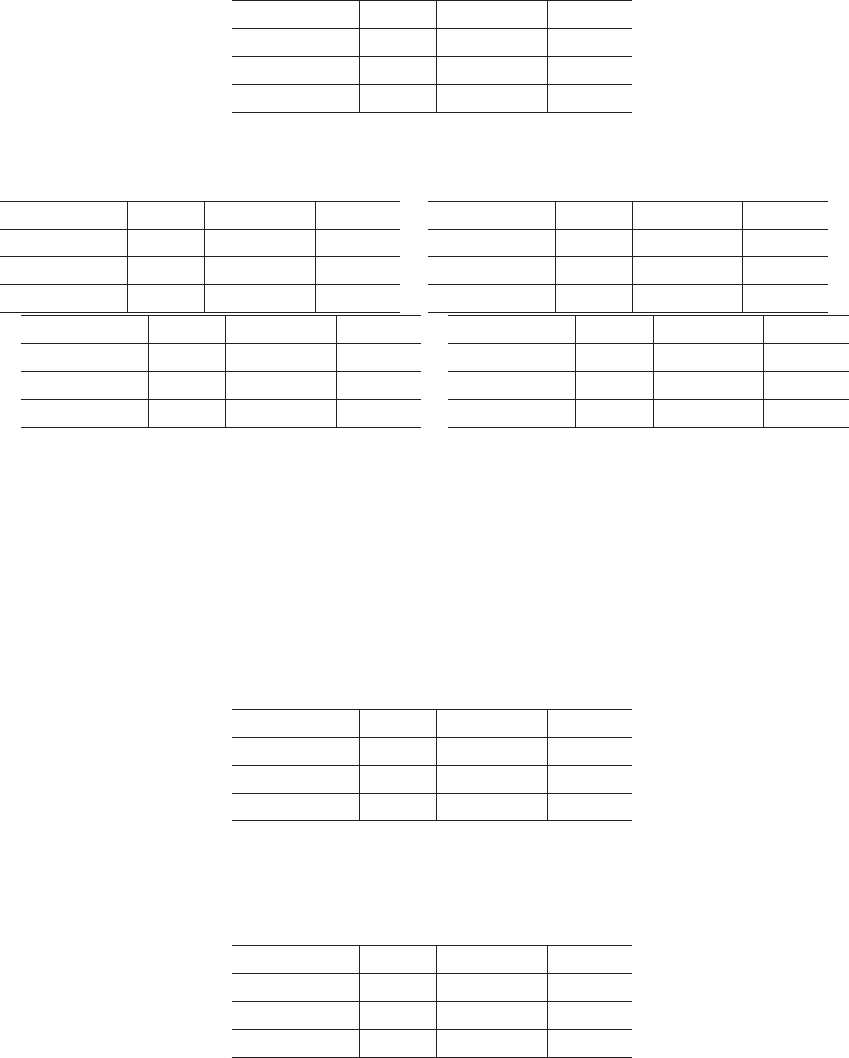

Table 5: Discovering Partners in Incomplete Information Markets

Quintile 1 Quintile 2 Quintile 3 Quintile 4 Quintile 5

Supermodular

all players know partners (frac of markets) 0.14 0.38 0.51 0.56 0.60

av # of players who know their partners 3.38 4.84 5.18 5.29 5.41

Submodular

all players know partners (frac of markets) 0.21 0.41 0.63 0.65 0.80

av # of players who know their partners 3.44 4.75 5.35 5.40 5.66

Notes: For each type of market, supermodular or submodular, we report the fraction of markets in which all players

discover their partners’ surpluses in the corresponding quintile (the first row) and the average number of players (out

of six) who discover their partners’ surpluses in each quintile (the second row).

third quintile, all participants are fully informed about the surpluses they can generate with all

those on the other side of the market in over 50% of markets, with an average of over 5 out of 6

participants being informed. By the termination of each market, these numbers are even higher.

19

The experimental protocol also ensures that whenever a match is formed, everyone learns the

payoff of the participant accepting the corresponding offer.

Having 5 out of 6 participants informed is sufficient for our stability notion to coincide with

complete-information stability, see Section 3. The dearth of stable outcomes in our incomplete-

information treatments is thus puzzling. The following subsection suggests explanations.

5.3 Patterns of Market Interactions

Matching theory provides limited guidance on the equilibrating dynamics one might expect in

decentralized markets with transfers. We now discuss how certain beliefs might be consistent with

a modified version of stability explaining our markets’ outcomes. We also illustrate behaviors in

our data consistent with participants following a satisficing heuristic, reducing substantially their

efforts once hitting a (type-dependent) payoff target.

5.3.1 Stability with Pessimistic Beliefs

Suppose that instead of using all the information participants learn from their market interac-

tions, they assemble only the minimal information consistent with the observed final matching.

19

Learning in submodular markets appears slightly faster than in our supermodular markets. However, this differ-

ence is significant only in the last quintile. Indeed, regression analysis clustering errors at the session level suggests a

corresponding p-value of p = 0.026 when looking at the last quintile, whereas p > 0.10 for earlier quintiles.

23

Suppose, further, that participants form pessimistic expectations (from the point of view of block-

ing), recognizing the possible match surpluses in the market. Namely, when observing a match

in which the receiver realizes a payoff of x, they assume the matched partner receives the max-

imal feasible payoff of 72 − x. Then, in those incomplete-information outcomes that fail to be

complete-information stable, there is an average of only 0.59 blocking pairs in the supermodular

markets and 1.04 blocking pairs in the submodular markets. These numbers are considerably

smaller than those reported above for our complete-information markets (1.56 and 1.67, respec-

tively). This indicates that there are beliefs consistent with the information revealed under which

participants come as close to stable outcomes as they do under complete information. In prac-

tice, we might expect participants to be less pessimistic and to glean yet more information from

the matching process (though perhaps not as much as do the hyper-rational agents in theoret-

ical treatments of incomplete-information stability such as Liu et al., 2014). We conclude that

the matching process in incomplete-information markets does not convey enough information to

bring the agents to complete-information stability. We leave as an important topic for future work

the more refined investigation of whether the resulting behavior reflects stability on the part of

timid, under-inferring agents, or failures of less timid and more clever agents to achieve stability.

While pessimistic beliefs provide an effective way to organize the market outcomes we observe,

they do not, on their own, explain the dynamics markets follow.

20

In what follows, we illustrate a

simple heuristic consistent with the market activity we observe.

5.3.2 Satisficing Patterns

We now consider a satisficing heuristic, whereby participants target a particular payoff, possibly

dependent on their market type. Caplin et al. (2011) document the use and prevalence of sat-

isficing heuristics in individual choices. Our design allows for satisficing behavior to emerge in

a market setting, where the satisficing threshold depends on global market features. Satisficing

would suggest that participants make offers before hitting their target payoff, and cease making

offers once that target is achieved.

For each market, we compute the number of offers made by players of each type—low, medium,

20

For instance, pessimistic beliefs at the start of each market’s activity could correspond to each participant sus-

pecting the minimal match surplus available to them. However, initial offers in our incomplete-information markets

significantly exceed half that surplus for each of the three types. Furthermore, initial offers do not reflect a persistent

fraction other than 50% of that “pessimistic” surplus.

24

or high—conditional on their current payoff, excluding unmatched individuals. We then group

offers in bins corresponding to participants’ current payoff. We normalize the number of offers

by the volume of offers made by the corresponding type across all rounds. Table 6 presents the

resulting fraction of offers by each type in each of our treatments, conditioning on the current pay

bin. Horizontal lines in the table correspond to a satisficing rule, allowing for a 20% mistake rate.

That is, payoffs exceeding those the line represents yield fewer than 20% of offers. As can be seen,

similar qualitative conclusions result from using lower mistake thresholds.

21

Table 6: Frequency of Offers Made Conditional on the Current Pay

Supermodular

Low Type Medium Type High Type

Current Pay Complete Incomplete Complete Incomplete Complete Incomplete

1 to 4 0.87 0.64 0.03 0.08 0.00 0.04

5 to 8 0.13 0.28 0.29 0.25 0.00 0.05

9 to 12 0.00 0.05 0.28 0.23 0.03 0.16

13 to 16 0.00 0.01 0.35 0.33 0.06 0.09

17 to 24 0.00 0.01 0.04 0.09 0.39 0.30

25 to 32 0.00 0.00 0.01 0.01 0.33 0.23

33 to 40 0.00 0.00 0.00 0.00 0.18 0.12

41 and above 0.00 0.00 0.00 0.01 0.00 0.01

Submodular

Low Type Medium Type High Type

Current Pay Complete Incomplete Complete Incomplete Complete Incomplete

1 to 4 0.33 0.26 0.00 0.06 0.00 0.00

5 to 8 0.17 0.24 0.00 0.12 0.00 0.00

9 to 12 0.13 0.11 0.03 0.10 0.00 0.01

13 to 16 0.27 0.24 0.27 0.17 0.01 0.01

17 to 24 0.11 0.11 0.60 0.37 0.05 0.18

25 to 32 0.00 0.04 0.11 0.17 0.37 0.53

33 to 40 0.00 0.00 0.00 0.01 0.51 0.23

41 and above 0.00 0.00 0.00 0.00 0.05 0.04

Notes: Fractions represent the frequency of offers of a particular type in a particular market conditional on current-

payoff bin. The horizontal line corresponds to the satisficing thresholds with a 20% mistake threshold: payoffs beyond

the threshold lead to fewer than 20% of offers.

Estimated satisficing thresholds are remarkably consistent across complete- and incomplete-

information markets across types, with only one exception corresponding to low types in super-

modular markets. This consistency is reassuring and suggests that market positions are among the

strongest forces shaping our participants’ behavior. The next section explores this idea further.

21

Similar levels are derived when considering the first and second half of each market’s operations separately. In

addition, we do not see substantial differences across early and later rounds. Offer rates documented in Table 6 nat-

urally reflect a combination of how active people are conditional on their current pay and how frequently they find

themselves with that pay.

25

Table 7: Impact of Number of Offers on Final Payoffs

Low Medium High

Complete

Supermodular 0.19 (0.09) 0.16 (0.08) 0.14 (0.09)

Submodular 0.21 (0.07) 0.18 (0.06) 0.11 (0.11)

Incomplete

Supermodular 0.25 (0.10) 0.17 (0.08) 0.10 (0.05)

Submodular 0.22 (0.08) 0.17 (0.09) 0.11 (0.07)

(a) Fraction of Offers by Type

β

low

β

med

β

high

β

low

= β

med

β

low

= β

high

β

med

= β

high

R

2

(n)

Complete -0.17 -1.77 13.33 0.35 0.12 0.11 0.94 (480)

Supermodular (0.61) (1.74) (6.60)

Complete 1.05 1.18 -2.05 0.98 0.69 0.39 0.84 (480)

Submodular (4.70) (2.53) (5.04)

Incomplete -1.44 -10.64

∗

-5.72 0.04 0.45 0.44 0.93 (480)

Supermodular (1.05) (3.76) (5.37)

Incomplete -17.72 -14.30

∗

-9.96 0.79 0.41 0.63 0.74 (480)

Submodular (11.11) (4.81) (4.43)

(b) Payoff Regressions

Notes: Panel (a) reports the average number of offers made by each participant type as a fraction of all offers made

in that specific market, with standard deviations in parentheses. Rows add up to 50%, modulo rounding. Panel (b)

reports the estimated coefficients from linear regressions in which the dependent variable is the participants’ payoff

and the independent variables include the constant, the dummies for medium and high types (leaving the low types

as the base group), the round and the round squared, two measures of altruism per participant, two measures of risk

attitudes per participant, and the fractions of offers extended by low, medium, and high types. The first three columns

in panel (b) report the estimated coefficients, and robust standard errors in parentheses, on the fraction of offers made

by low, medium, and high types, respectively. Standard errors are clustered at the session level. The next three columns

report p-value tests of coefficients based on these regressions. The final column reports the number of observations and

the R-squared.

5.3.3 Bargaining Styles

We now turn to the various bargaining styles participants used and how they affect outcomes in

our markets. The main message is that, while individuals vary widely in how they approach our

markets, in terms of the number of offers they make, their insistence on higher shares, etc., their

payoffs are not strongly affected by these differing interaction styles. By and large, payoffs are

determined by the governing match surpluses: supermodular or submodular, and the position

one takes in the market in terms of types.

26

We focus our discussion on one aspect of behavior: the number of offers made in a market. In

the Appendix, we include analogous analyses relating to other aspects: number of matches made

throughout the market, the share of surpluses demanded in offers, and which quintile the first

and last matches were created. The messages from these are qualitatively identical.

Panel (a) of Table 7 illustrates, for each of our treatments, the fraction of offers made by type,

as well as their standard deviation.

22

There is substantial variation in the number of offers partic-

ipants make, reflected in the relatively large standard deviations. While there are some notable

differences across types, with lower types generally making more offers than higher types, differ-

ences across information or preference treatments are insignificant.

Panel (b) of Table 7 illustrates the impacts of the number of offers on payoffs. In the reported

regressions, we explain the final payoff of a participant by their position, market characteristics,

and the number of offers they make, allowing for fixed-effects by participant and clustering errors

at the session level. The association is insignificant in all but one case, pertaining to medium types

in the incomplete-information supermodular markets, where we observe a moderately positive

association between fraction of offers made and final payoff.

A similar picture emerges when considering variations at the individual level. We consider

participants who are “high earners,” receiving a final payoff that is above the average payoff for

the role they take in at least 7 of the 10 rounds played. Analogously, we consider “low earners”

as those receiving a final payoff below the average for their role in at least 7 of the 10 rounds.

“Medium earners” are all those that remain. The distribution of the various types of earners is

similar to that which would be generated by random choice, with somewhat more “high earn-

ers.”

23

We see minute differences between the three categories of earners in terms of fraction

of offers made, when controlling for market features, position in the market, session round, and

overall number of offers made in the market (see the Appendix for detailed regression results).

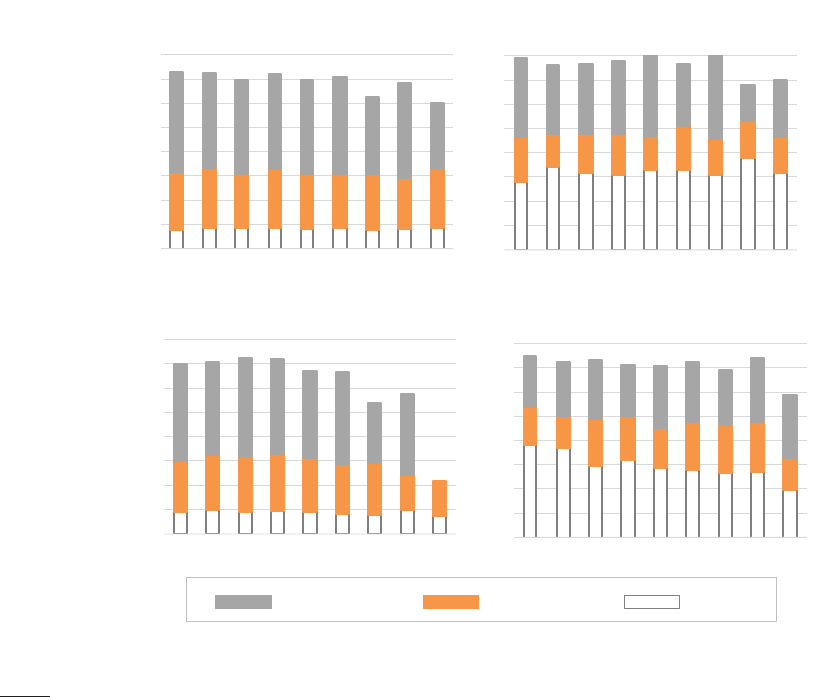

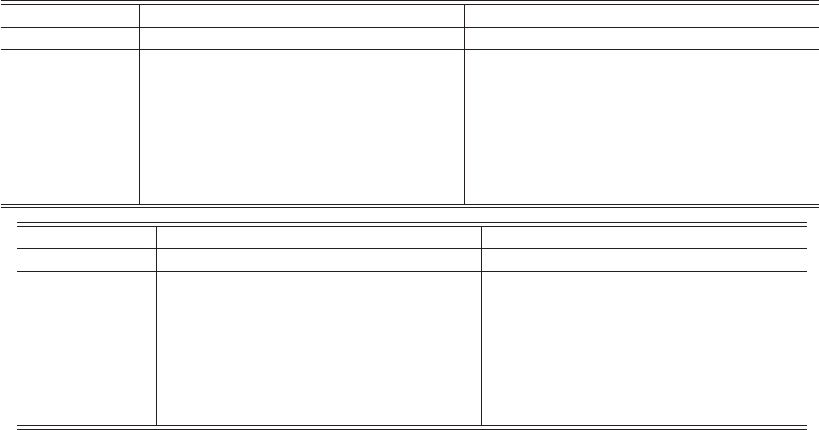

Figure 4 summarizes this discussion. For each of our treatments, and each market position,

or type, we classify participants according to the fraction of offers they made, divided into 9

categories. We see a substantial number of observations in each of these categories, particularly

22

Since there are 6 participants in each market, if all made offers at equal volumes, we would expect each to make

16.66% of the offers observed.

23