Using the Google Places

API and Google Trends

Data to Develop High

Frequency Indicators of

Economic Activity

by Paul Austin, Marco Marini, Alberto Sanchez, Chima Simpson-Bell, and

James Tebrake

WP/21/295

IMF Working Papers describe research in progress by the author(s) and are published to elicit

comments and to encourage debate.

The views expressed in IMF Working Papers are those of the author(s) and do not necessarily represent the

views of the IMF, its Executive Board, or IMF management.

2021

DEC

© 2021 International Monetary Fund

WP/21/295

IMF Working Paper

Statistics Department

Using the Google Places API and Google Trends Data to Develop High Frequency

Indicators of Economic Activity

Prepared by Paul Austin, Marco Marini, Alberto Sanchez, Chima Simpson-Bell, and James Tebrake

Authorized for distribution by J. R. Rosales

December 2021

IMF Working Papers describe research in progress by the author(s) and are published to elicit

comments and to encourage debate. The views expressed in IMF Working Papers are those of the

author(s) and do not necessarily represent the views of the IMF, its Executive Board, or IMF management.

ABSTRACT: As the pandemic heightened policymakers’ demand for more frequent and timely indicators to assess

economic activities, traditional data collection and compilation methods to produce official indicators are falling short—

triggering stronger interest in real time data to provide early signals of turning points in economic activity. In this paper, we

examine how data extracted from the Google Places API and Google Trends can be used to develop high frequency

indicators aligned to the statistical concepts, classifications, and definitions used in producing official measures. The

approach is illustrated by use of Google data-derived indicators that predict well the GDP trajectories of selected countries

during the early stage of COVID-19. To this end, we developed a methodological toolkit for national compilers interested in

using Google data to enhance the timeliness and frequency of economic indicators.

JEL Classification Numbers:

C81, E01.

Keywords: Reopening, COVID-19, High-Frequency Data, Business Register.

Author’s E-Mail Address:

3

Contents Page

I. MOTIVATION .......................................................................................................................................................5

II. SO URCE DATA....................................................................................................................................................7

A. Google Places and Google Trends .........................................................................................................7

III. METHODS ........................................................................................................................................................ 14

A. Operating Status Indicators.................................................................................................................. 14

B. Business Activity Indicators ................................................................................................................ 19

IV. USI NG GO OGLE DATA FO R GDP NOWCASTING .......................................................................... 26

V. CONCLUSIONS................................................................................................................................................. 29

REFERENCES......................................................................................................................................................... 47

Box

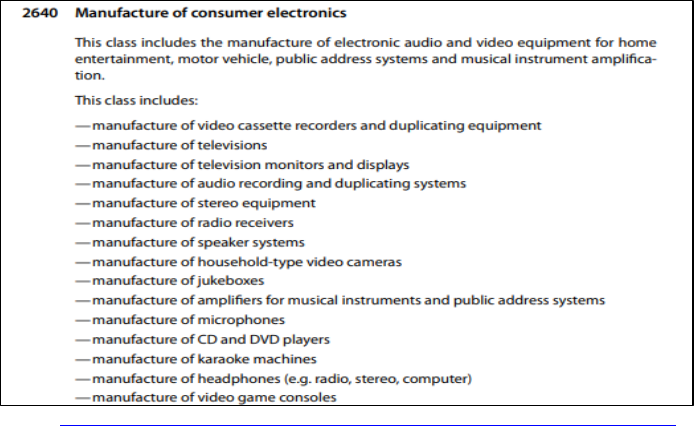

1. Textual Description of the Manufacture of Consumer Electronics Industry .....................22

Figures

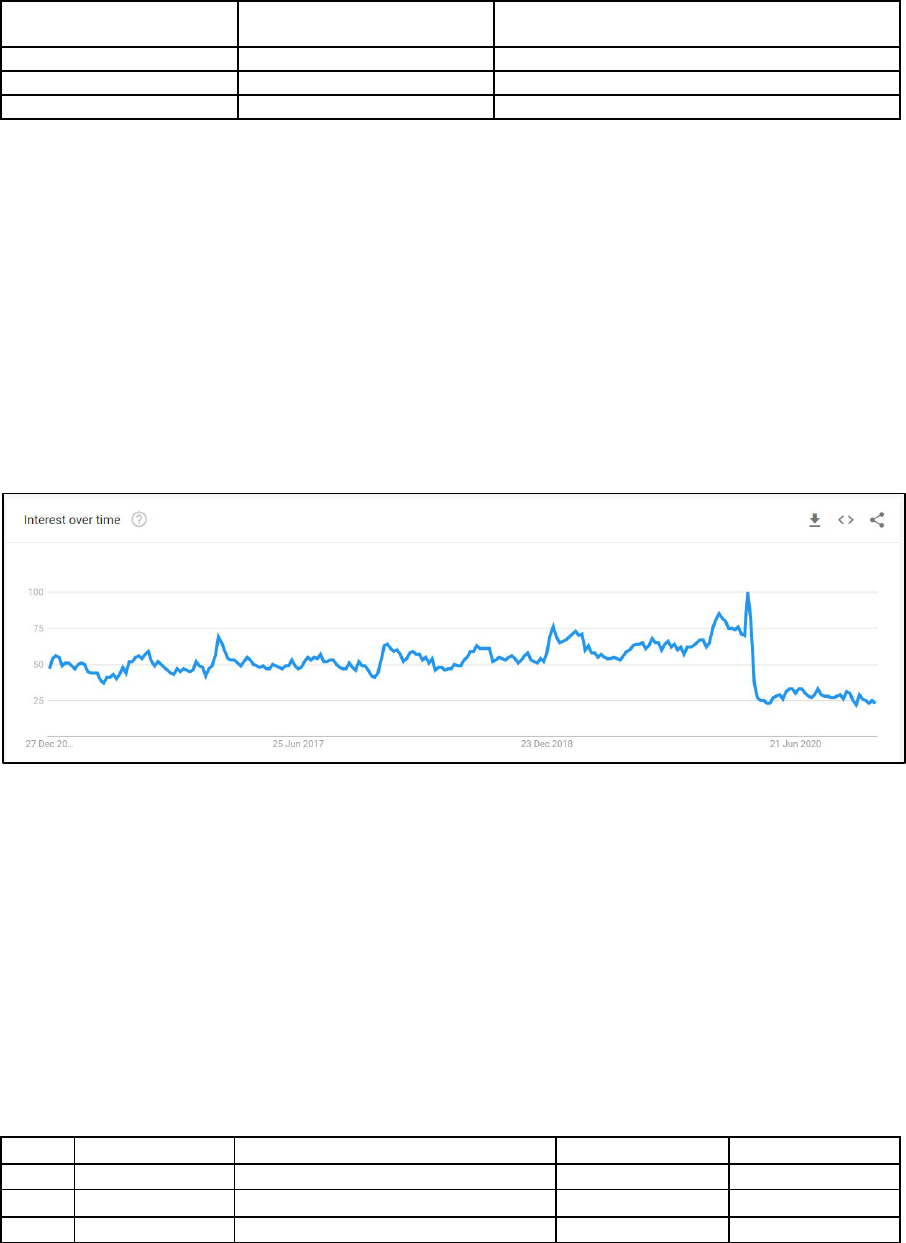

1. Google Trend “Flights” - Canada...................................................................................12

2. Google Trends: Demand for Ford Escape - Canada ........................................................14

3. Operating Indicator (weighted by reviews) for Selected City Centers ..............................16

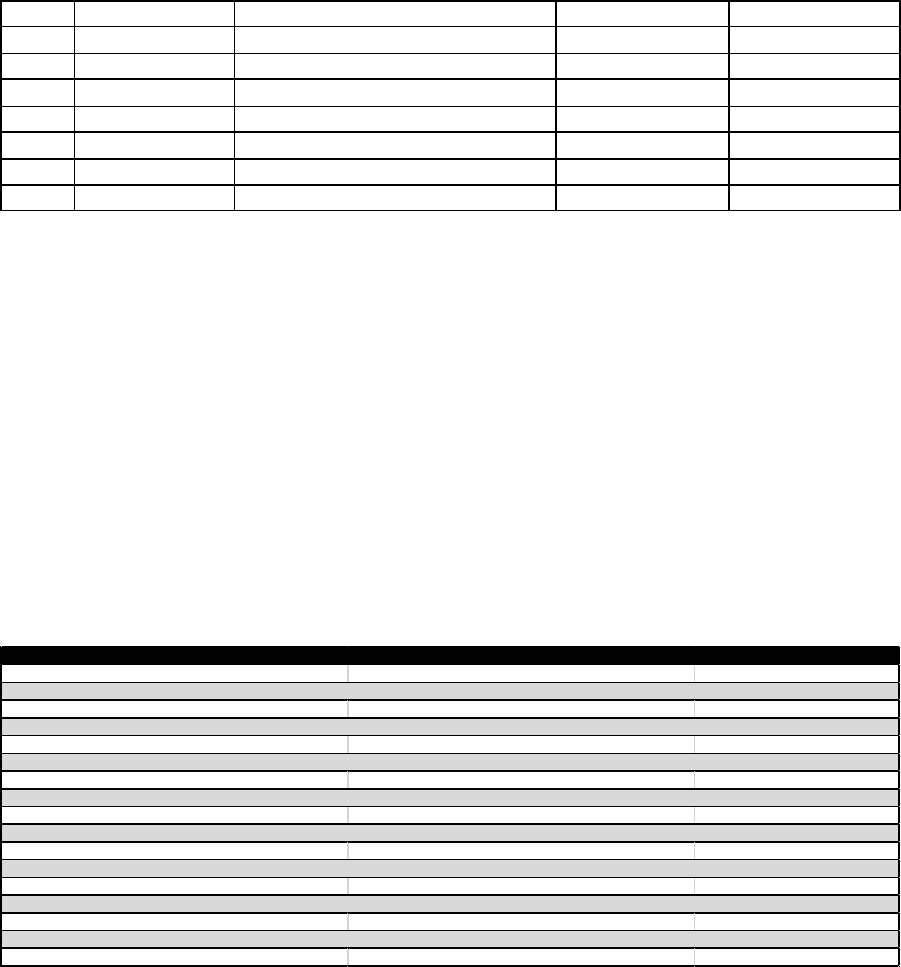

4. Business Re-opening Indicator for Selected City Centers................................................18

5. Review Activity Indicator .............................................................................................21

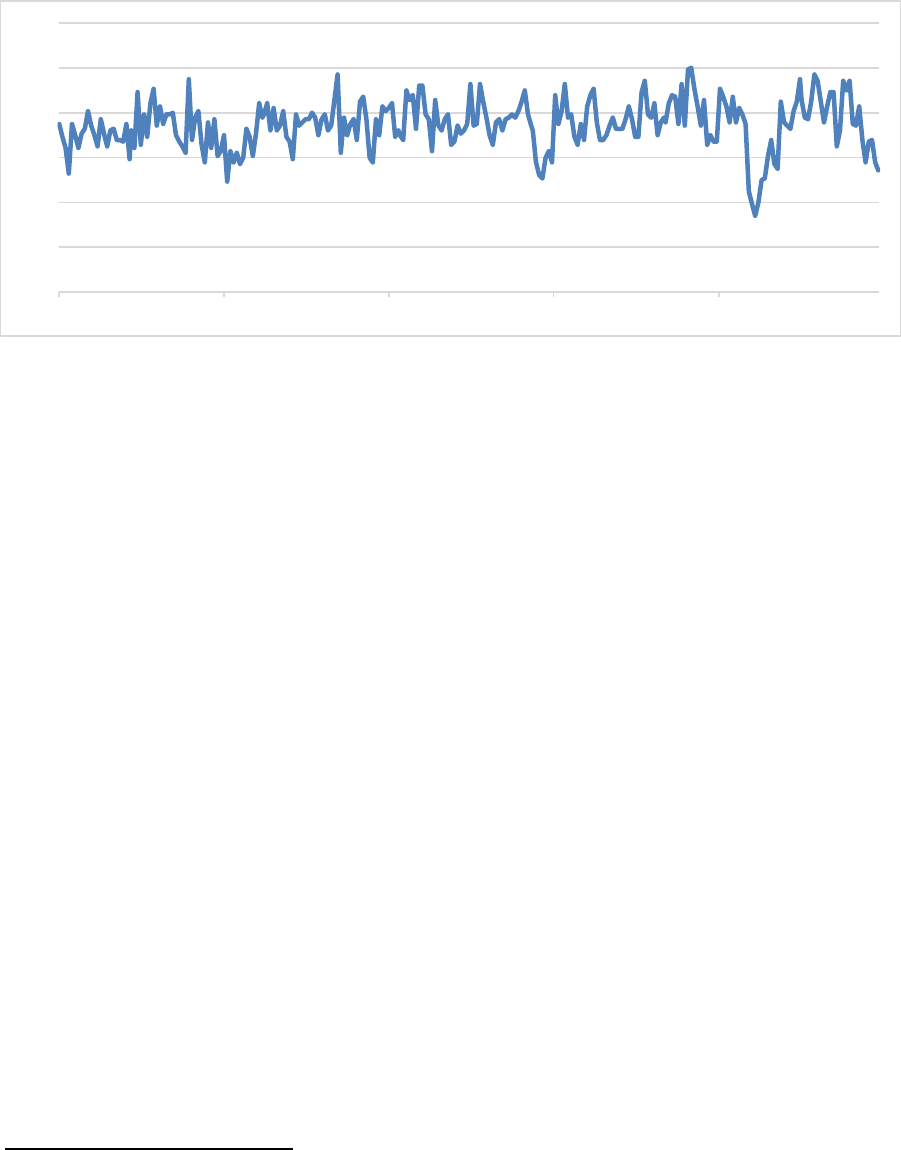

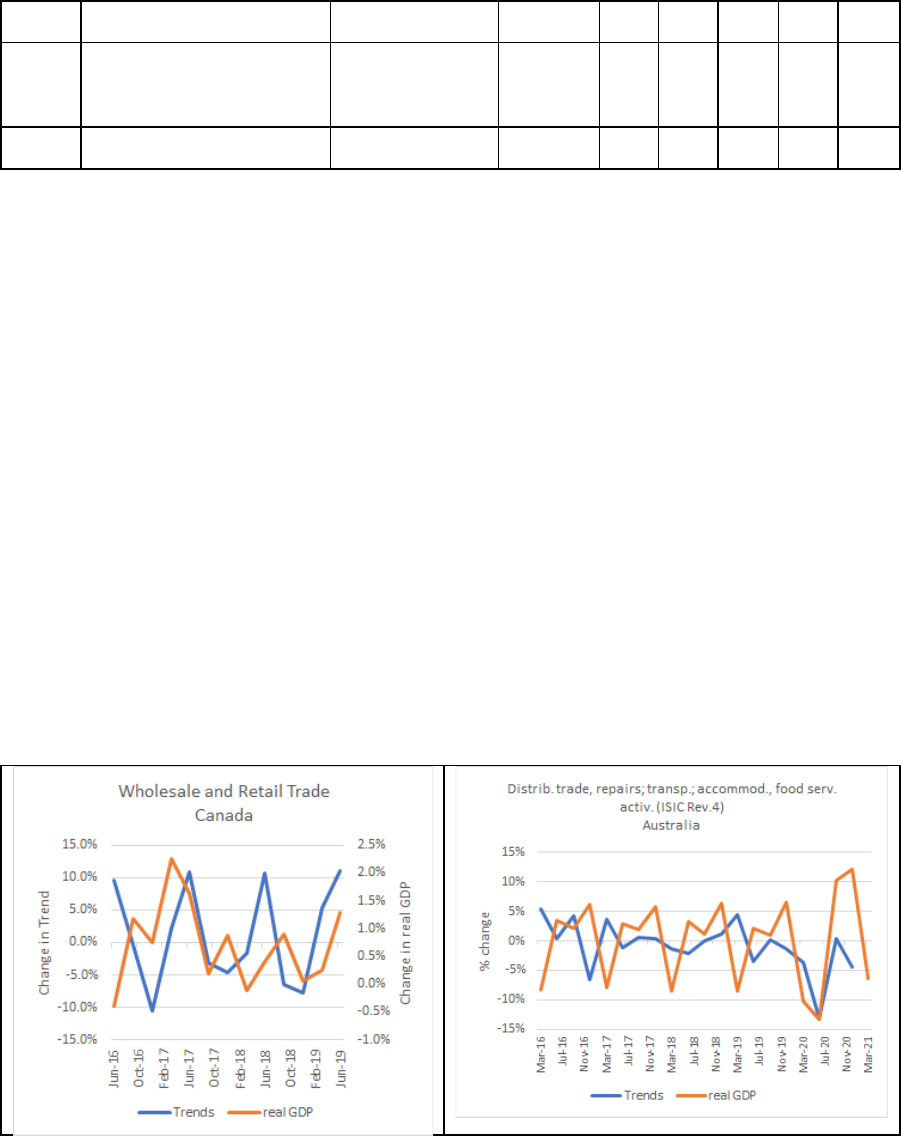

6. Change in Google Trends Compared to Change in Real Quarterly GDP ..........................25

7. Transportation and Storage: Comparison between Official Data (GDP-H), Google Trends

(TRE-H), and Reopening Indicator (REOP) for Selected Countries ....................................27

8. Transportation and Storage: Nowcasts for 2020-Q2 and 2020-Q3 ...................................29

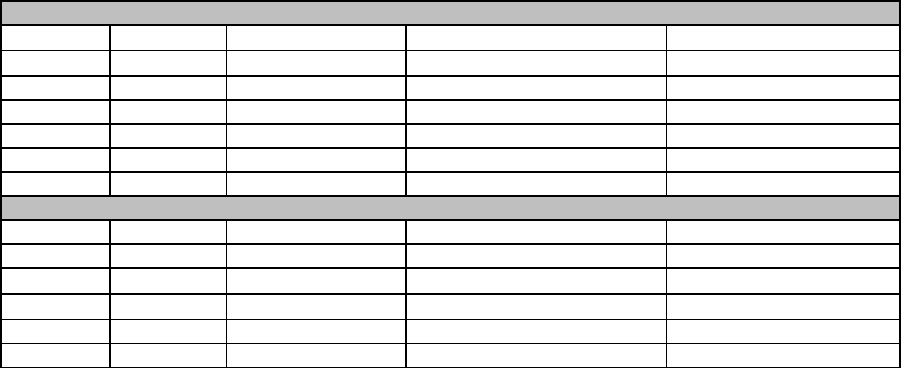

Tables

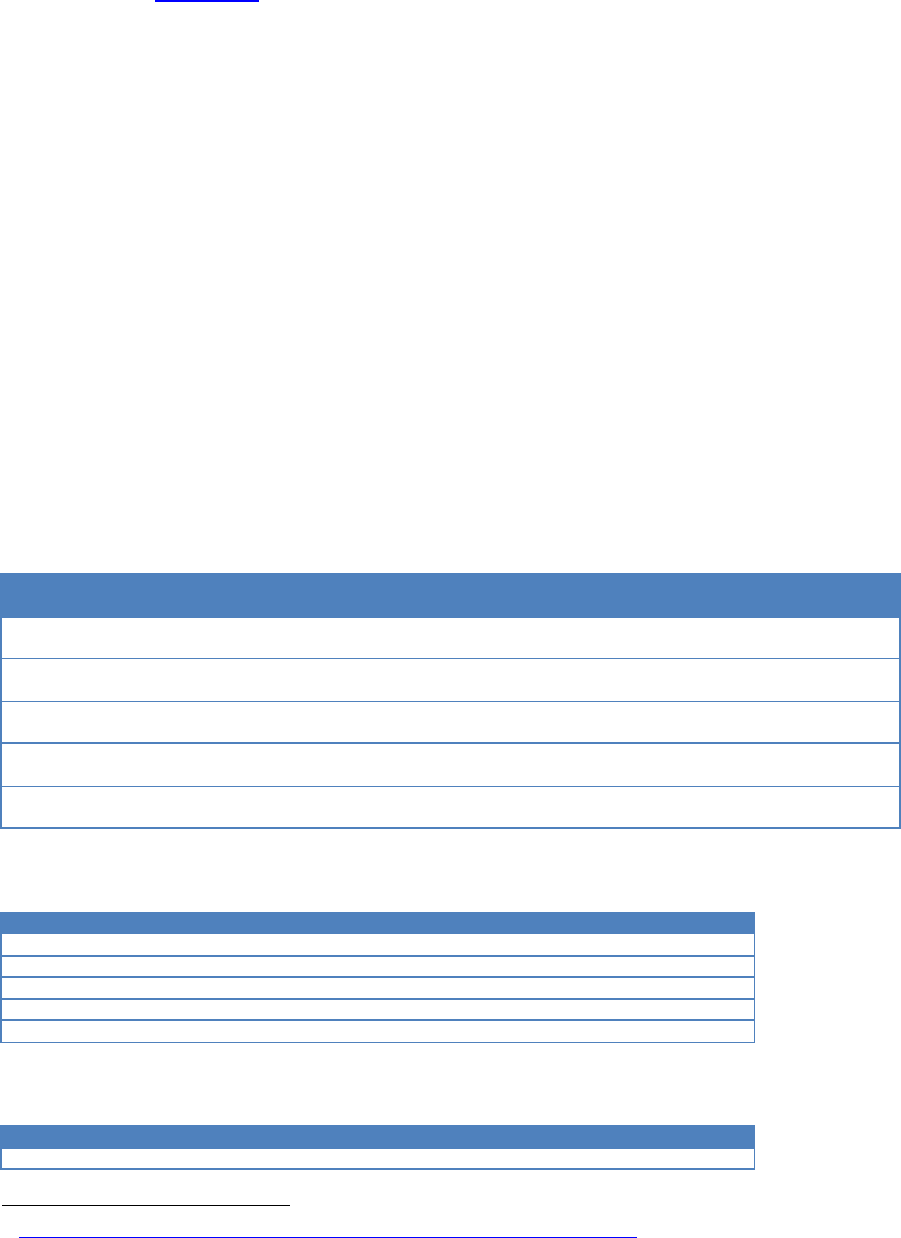

1. Fields of Information that can be Extracted for Each Place using Google Places API.........9

2. Statistical Concept: Units ..............................................................................................10

3. Statistical Concept: Operating Status .............................................................................11

4. Statistical Concept: Territory .........................................................................................11

5. Statistical Concept: Size ................................................................................................12

6. Construction of Google Trends Index: Example .............................................................12

7. Search Topics Related to Consumer Electronics for Australia .........................................13

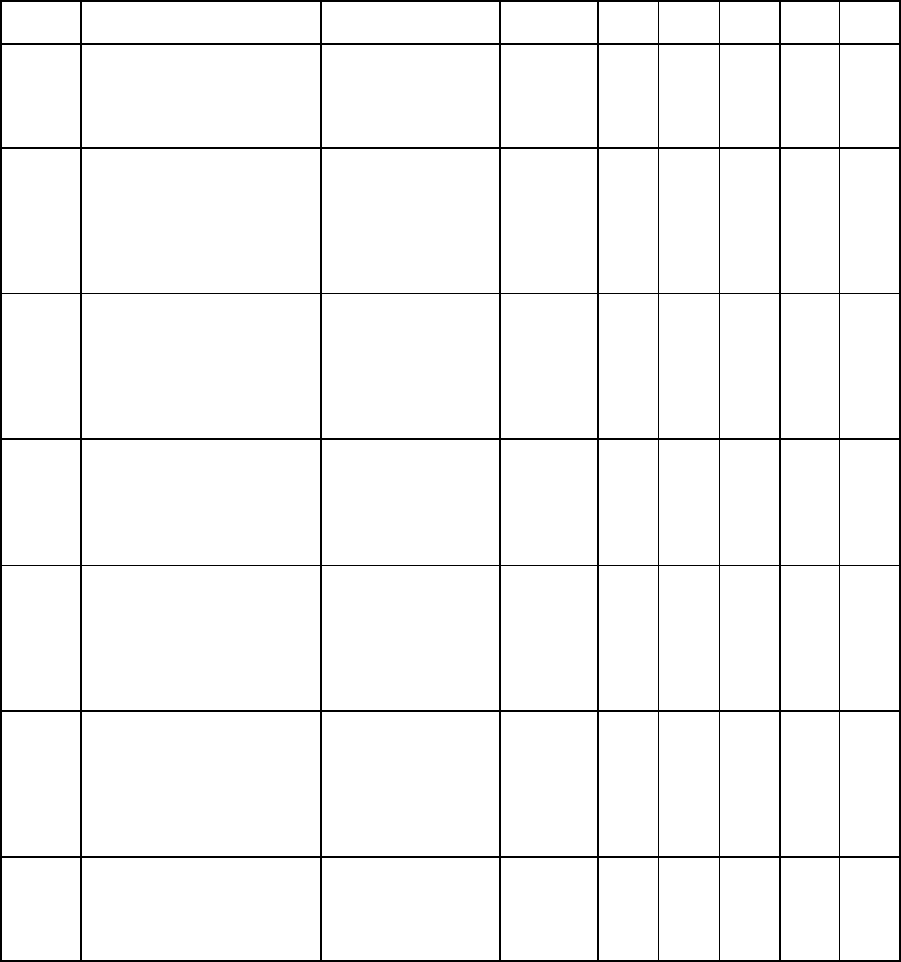

8. Construction of Operational Indicator-Example..............................................................15

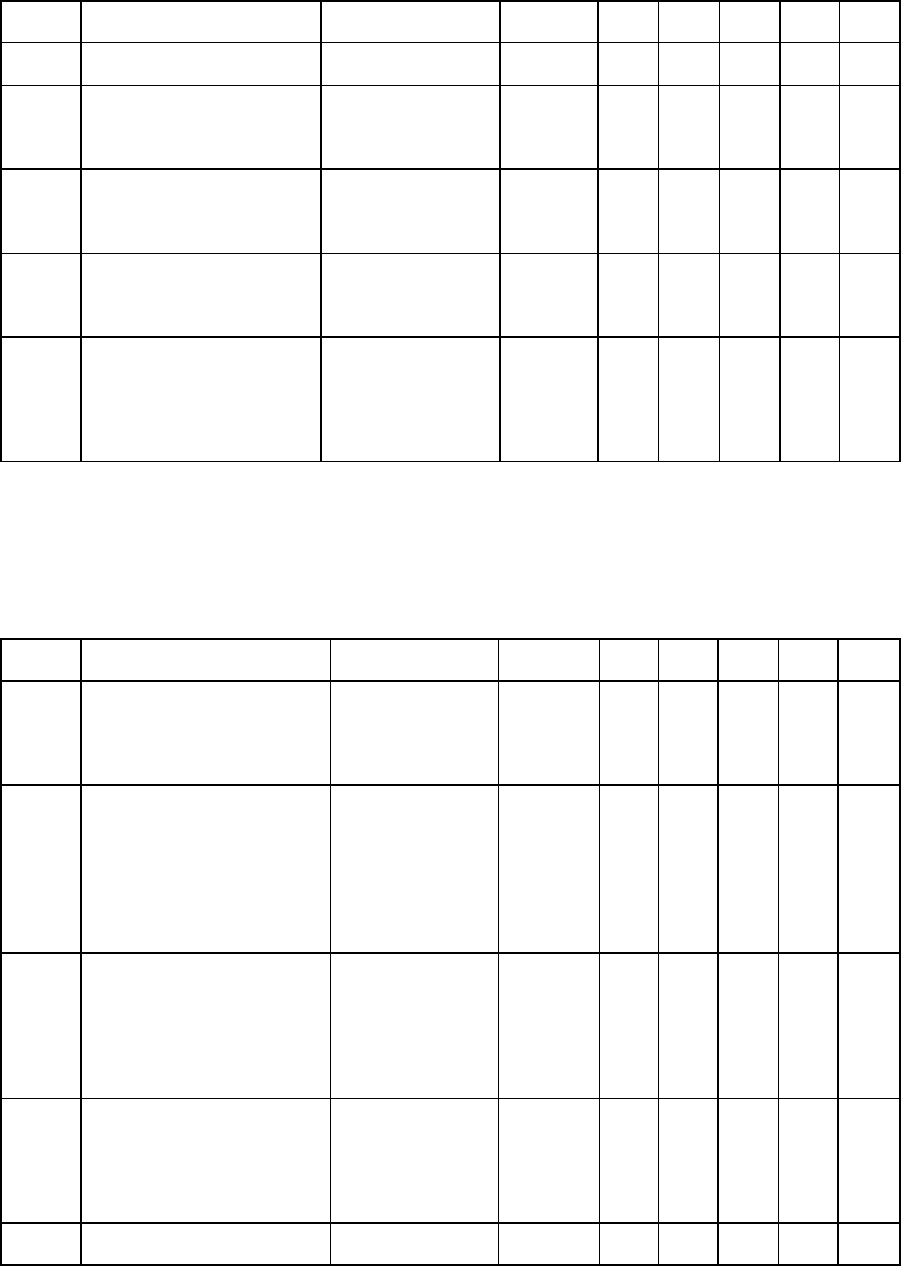

9. Reopening Indicator ......................................................................................................17

10. Indicator of Business Activity Using Reviews ..............................................................19

11. Stock / Change in Reviews – Paris City Center Beauty Salons ......................................20

12. Monthly Google Trends SVIs at ISIC 4-digit level for Accommodation and Food Service

Activities (I) for Australia .................................................................................................23

13. Monthly Google Trends SVIs at ISIC Section Level for Accommodation and Food

Service Activities (I) for Australia .....................................................................................24

14. Transportation and Storage: Regression Results ...........................................................28

4

Annexes

I. Technical Aspects of Google Trends and Google Places API ..........................................31

II. Data and Methods with the Imfgoogle R Package ..........................................................41

5

I. MOTIVATION

To say the needs of users of economic statistics have changed since the start of the pandemic

would be an understatement. Things are simply not what they were. We have gone from a

world of short-term predictability to one where policymakers need to take a daily pulse of

economic activity and adjust course often. Data consumers have become accustomed to

seeing daily charts of health-related data. Case counts, moving averages and trends, cycles,

peaks, and troughs are now a common part of our vocabulary and daily conversations. Users

of economic data are now starting to demand a similar service from economic statisticians.

Tasked with identifying the path out of the pandemic—represented by letter shapes whether

that be V, W, U, K (choose your letter of choice)—data users and policy makers require

more frequent, timely and granular economic statistics.

The need to modernize is clear. Traditional economic data collection and processing methods

to produce indicators of economic activity do not meet the timeliness and frequency demands

of policymakers during a pandemic (or any other crisis for that matter). Even among those

countries with the most advanced statistical systems it often takes at least 45 to 60 days

following the reference period to get a reading on what is happening. As we have seen with

the pandemic, those 45 to 60 days can mean the difference between staying in business or

losing your business. Just over two-thirds of the 190 IMF member countries produce

quarterly estimates of gross domestic product (GDP). The rest produce annual measures of

GDP and most are released 9 to 12 months following the reference period. This means that in

many countries, statisticians will not have a final tally of the effect of the start of the

pandemic until sometime in late 2021 and those estimates will say very little about the path

of the economy since its onset.

Improving the timeliness and frequency of economic statistics while maintaining their quality

is a longstanding challenge in the realm of economic measurement. Economic statisticians

often refer to this as the timeliness versus quality tradeoff in which policy makers are told

they need to accept lower quality data if they want improved timeliness. When constrained

by traditional data sources and approaches used to compile economic indicators, this is

certainly the case. Economic statisticians need to examine new data sources and develop new

methods to provide users with the type of ‘statistical tickers’ they are becoming accustomed

to. As has been widely acknowledged, “big data” and the vast amount of data collected by an

increasing number of digital platforms can offer part of the solution. Statisticians need to

quickly figure out how to bridge the gap between “big data” and official measures of

economic activity. The challenges facing many statistical organizations are:(1) acquiring the

source data; (2) processing these data; and (3) integrating these data with high quality official

measures of economic activity to improve their timeliness and frequency. Data available

from the Google Places and Google Trends Platforms may provide part of the answer.

6

Interest in the use of real time, non-traditional data sources

1

to measure economic activities is

not new. Elvidge et al. (1997) identified a correlation between illuminated areas, electric

power consumption, and GDP at the country level. Since then, the rapid growth of new

sources of big data—enabled by internet-based technologies—has expanded the toolkit for

tapping real-time information at a more scalable and granular level. Within the last decade,

scanner data on purchases, credit card transaction records, and prices of various goods and

services scraped from the websites of online sellers have been increasingly mainstreamed in

the compilation programs of statistical agencies in advanced and emerging economies.

Abraham et. al (2019) documents the progress made toward the goal—and the challenges to

be overcome to realize the full potential—of using big data in the production of statistics.

Exploiting online platforms for tracking economic developments gained traction as the data

observations harvested became longer, more accessible, and stable. The use of Google-

sourced data to forecast private consumption was explored by Schmidt and Vosen (2011);

and was followed by academic research in similar directions by Choi and Varian (2012) on

predicting economic activity, and by Luca (2016) on the impact of Yelp-based consumer

reviews on the restaurant industry, among others. Jun, Yoo and Choi (2016) traces the ten

years of research using Google Trends since the company made this source of data available

in 2006. Noting that the availability of timely data is a long standing challenge for

policymaking and analysis for low-income developing countries, Narita and Yin (2018)

explored the use of Google Trends data to narrow such information gaps. Many organizations

have since developed timely leading indicators using Google data (Google Trends, Google

Mobility data, Google APIs) that track well official measures of economic activity. More

recently, the OECD Weekly Tracker of GDP growth (2020) attempts to fill the gap in real-

time high-frequency indicators of activity with a large country coverage.

These research strands and experimental estimates have shaped our understanding of current

(now-time) economic trends. Building on this work, over the last year, the IMF Statistics

Department (STA) has been working with Google data to determine how data extracted from

the Google Places and Google Trends platforms can be processed for use by data compilers

in developing higher frequency and timely measures of economic activity that can be used to

increase the timeliness and frequency of official measures.

This paper is organized as follows. Section II describes Google Places API and Google

Trends and how they can be accessed by national statistical organizations. Section III

explains how country compilers and researchers can process these data and develop high

frequency indicators that align with the concepts, classifications, definitions, and methods

used to produce official measures of economic activity. Section IV shows an application of

these indicators to nowcast quarterly GDP of selected countries during the onset of the

COVID-19 pandemic. Section V offers some concluding remarks and next steps from this

1

Non-traditional data are characterized by high volume, velocity, and variety, often generated by social media,

web-based activities, machine sensors, or financial, administrative or business operations (BIS, 2021).

7

work. Finally, the technical annex describes the characteristics of the Google data used in this

research and the R package developed by the authors to reproduce the results.

2

II. SOURCE DATA

A. Google Places and Google Trends

Over the last five to ten years there has been a large push within the economic statistical

community to take advantage of a growing (exponentially) set of “big data” to produce

official statistics. This new source of information has the potential to address a lot of the

unmet needs of users of economic statistics – specifically as it pertains to their demand for

more timely data, published with a higher frequency and with more granularity. While these

data hold promise to significantly increase the timeliness, frequency, and granularity of

official statistics there are often significant challenges that need to be addressed before they

can be leveraged in the production of official statistics. These challenges are related to access

/ terms of use, coverage, and concepts.

The first, and generally most time-consuming challenge, is securing access to the data.

Before a statistical organization can consider using a particular data source in the production

of official statistics it needs to ensure it will have regular access to the data over the medium

term. It also needs some assurance that the composition of the data (coverage, variables,

frequency) will be stable during that period. Finally, it needs to ensure that its proposed use

aligns with the terms of use as outlined by the data owner and that these terms of use will be

stable over the medium term.

The second challenge that statistical organizations often face is coverage. Often big data can

be very timely and granular but may only cover part of the population of interest. For

example, a statistical organization may obtain scanner data from major retailers. If a

significant share of purchases occurs at local markets, the scanner data, while useful, only

provides partial coverage. In other cases, statistical organizations may require long-time

series to establish relationships with existing official estimates. Often big data can have broad

coverage, be timely and available on a daily frequency, but the data may only be available for

the previous two to three years, limiting their usefulness (at least in the short term).

The third challenge that statistical organizations face is the potential conceptual

misalignment between the big data source and the target statistic being produced. Statistical

frameworks outline and provide definitions for concepts such as revenue, income,

expenditure, exports, production, value added, etc. Statistical organizations are tasked with

developing statistics that provide a numerical representation of these concepts. To do this

statistical organizations often design collection instruments in which they tailor the questions

2

The results presented in this work and the accompanying datasets are available through an R package

developed by the authors. The ‘imfgoogle’ package is available upon request. Please refer to Annex II for more

deta ils.

8

to align with the concept they are trying to measure. In the case of big data, statistical

organizations have no control over the “question.” It is therefore often the case that the

concepts that underpin “big data” do not align with the concepts that the economic

statistician is attempting to measure. In these cases, the economic statistician will need to

make assumptions, build models, or make “second best measures” to align the big data with

the concept being estimated.

The data that can be acquired from the Google Places and Google Trends platforms exhibit

very few of these shortcomings. As shown below, data obtained from the Google Places and

Google Trends platforms address the economic statisticians’ needs with respect to access,

coverage and conceptual alignment with official statistics.

Google Places and Google Trends - Access

Data from the Google Places platform can be obtained using the Google Places API. The

Google Places API

3

is a service offered by Google that allows users to obtain information

about “Places” via an HTTP request. The requests return a JSON or XML file that is easily

integrated into a database. Uses of this information must comply with the Places API Policies

and Google Maps Platform Terms of Service. The terms of use support research purposes

and permit the results of research to be shared. There are limitations with respect to the

volume of data that can be extracted, and fees may apply depending on the volume of the

request and use of the information. From the perspective of compilers of official statistics,

the existence of the API addresses one of the key hurdles that are often associated with the

use of Big Data – access. The Google Places API provides seamless and stable access to over

20 fields of information for each Place on the Google Maps Platform. In addition, the Google

Places API has policies which help reduce the risk of using these data in the compilation of

official statistics. For example, the Google Places API has a depreciation policy which they

provide users with at least one year’s notice if they intend to change or discontinue a field.

This provides ample lead time for statistical organizations to adjust processes and methods.

One challenge facing statistical organizations is the cost of access. For data to be useful,

statistical organizations require a significant amount of data. Given the scope of their data

needs, they are required to pay. During COVID-19, this limitation is being addressed by

Google. Google has launched an

initiative to support nonprofit organizations with COVID-19

response efforts to access its data, free of charge, provided the applications have a public

good element. Since production of official statistics generally fall within the public good

category, there is opportunity for statistical organizations to negotiate access free of charge.

Google Trends is a public website (trends.google.com) managed and maintained by Google

that facilitates analysis of Google search queries. There is no charge to use the website or

extract information from the website. The information can be downloaded into CSV files, the

charts can be captured as images, shared, or directly embedded into webpages. The terms of

3

https://developers.google.com/places/web-service/overview.

9

use are governed by Google’s Terms of Use and Privacy Policy. While Google does not

provide an API to access the Google Trends data several publicly available web-scraping

scripts have been developed that facilitate the extraction of data. From the perspective of

statistical organizations, the data are highly accessible and the use of these data in the

compilation of official statistics falls within the Terms of Use and Privacy Policy outlined by

Google. The methodology Google uses to produce the trends data are documented and

available on the Google Trends website.

Google Places and Google Trends - Coverage

Both Google Places and Google Trends have wide (near census) coverage. It is safe to

assume that in the countries where Google operates the Google Places platform contains a

near census of Places - everything from businesses, to places of interest, to government

offices. This is important since it implies that the estimates produced using these data will be

very representative of the population of interest. In addition, given that the Google Places

platform contains a near census of Places, scientific samples of this population can be drawn,

and the characteristics and activities of the sample can be inferred on the population.

Similarly, the Google Trends data contains broad country and topical coverage. In fact, given

the widescale use of the Google search engine, trends can be calculated for individual

businesses and products. From a coverage perspective, the data that can be obtained from the

Google Places and Google Trends platforms have enough coverage to be used by most

countries across most economic activities. Clearly, coverage is wide for countries where

Google is used as the primary Internet search engine and there is no restriction to its use.

Google Places – Conceptual Alignment

The Google Places API allows users to extract information about Places from the Google

Maps Platform. In total, users can extract 23 fields of information for each Place as identified

in Table 1.

Table 1. Fields of Information that can be Extracted for Each Place using

Google Places API

Basic Fields

4

Address Component

Address

Business Status

Formatted Address

Viewport

Location

Icon

Name

Photo

Place ID

Plus Code

Typ e

4

https://developers.google.com/places/web-service/place-data-fields.

10

URL

UTC Of f set

Vicinity

Contact Fields

Phone Number

International Phone Number

Opening Hours

Website

Atmosphere Fields

Price Level

Rating

Reviews

User Ratings Total

The usefulness of these data in the production of economic indicators is determined, in part,

by how well these fields align with the target concepts outlined in international statistical

standards such as the System of National Accounts, Balance of Payments Statistics and

International Standard of Industrial Classification (ISIC).

The statistical unit is one of the most important concepts underpinning the production of

official statistics. It represents “the entity about which information is sought”

5

and ultimately

for which statistics are produced. The Google Places statistical unit is the Places ID. The

Google Places platform defines a Place as a “business, landmark, park, and intersection.” It

reflects an entity with a physical presence, where activity takes place which has a specific

and identifiable location. In the field of economic statistics, there are two types of statistical

units – households and legal entities. Legal units are generally classified into sectors or

industries (activities). When classified to activities a statistical hierarchy is adopted. This

statistical hierarchy moves from an enterprise, to an establishment, to a kind of activity unit /

local unit.

6

In the statistical domain a local unit is defined as “an enterprise or a part of an

enterprise (for example, a workshop, factory, warehouse, office, mine or depot) which

engages in productive activity at or from one location.”

7

The Google Places concept of a

Place aligns well with the statistical concept of a local unit. Given Google also identifies the

“place type,” the combination of the Google Places location information with the Google

Places “place type” approaches the statistical concept of an establishment. The conceptual

alignment between the Google Places Place and the statistical concept of a local unit or

establishment can therefore be regarded as “High.”

Table 2. Statistical Concept: Units

Target Statistical

Concept

Google Field

Subjective degree of alignment with

statistical concepts.

Local Unit

Places ID

High

5

https://unstats.un.org/unsd/classifications/Econ/Download/In%20Text/ISIC_Rev_4_publication_English.pdf (p.15).

6

https://unstats.un.org/unsd/classifications/Econ/Download/In%20Text/ISIC_Rev_4_publication_English.pdf.

7

https://unstats.un.org/unsd/classifications/Econ/Download/In%20Text/ISIC_Rev_4_publication_English.pdf (p.17).

11

Establishment

Places ID / Places Ty p e

High

The business status indicator available on the Google Places Platform also aligns well with

the statistical concept of the operating status of a business. The Google Places business status

indicator identifies whether a business is “operational,” “temporarily closed” or

“permanently closed.” This status indicator aligns with the economic statistical concepts of

“births” and “deaths,” “entries” and “exits” or “capacity” that are employed by most

statistical organizations. In addition to being conceptually well aligned the business status

information available from the Google Places Platform is available in real-time and indicates

when a business is temporarily closed - something that is generally not available from

statistical registers.

Table 3. Statistical Concept: Operating Status

Target Statistical

Concept

Google Field

Subjective degree of alignment

with statistical concepts.

Business Status

Business Status Indicator

High

Most economic statistics are presented at some level of geographic detail, whether the data

are presented for a country as a whole or for a specific region(s). Economic statisticians often

employ the concept of a territory. A territory is generally reflective of a country’s geographic

boundaries with a few exceptions such as the land area associated with embassies or

consulates. Given the Google Places Platform provides access to the longitude, latitude and

address associated with each Place the Google Places data can easily be reconciled to the

statistical concept of a territory.

Table 4. Statistical Concept: Territory

Target Statistical

Concept

Google Field

Subjective degree of alignment with

statistical concepts.

Territory

Longitude / Latitude

High

Territory

Address

High

In addition to concepts such as territory and activity most economic statisticians require

information about an entity’s size. In most cases countries rely on business surveys or

administrative sources (such as taxation records) to obtain information about the size (e.g.,

revenue, number of employees) of an entity. While the Google Places Platform does not

contain information related to the revenue or employment of a Place, it does collect and store

what Google refers to as “Atmosphere Data Fields.” These fields include the number of

reviews associated with a given entity, its price level as well as the rating (scaled 1-5)

provided by reviewers. It is fair to assume that larger / more popular / successful places will

have more reviews. It is also fair to assume (but to a lesser degree) that a place with twice as

many reviews as another place is roughly twice its size (or at least twice as popular). Using

these assumptions, the number of reviews could therefore be used to proxy the size of a

Place. Information about the size of an entity will assist with statistical methods such as

sampling, weighting, and aggregation.

12

Table 5. Statistical Concept: Size

Target Statistical

Concept

Google Field

Subjective degree of alignment with

statistical concepts.

Size

Reviews

Medium

Size

Rating

Low

Size

Price Level

Low

Google Trends – conceptual alignment

Google Trends are a measure of interest in a topic relative to all other topics over time. A

topic can be anything from a person or event to a business or specific product. To the extent

that the topics relate to a business, industry, or product the trend could be indicative, at least

to some extent, of economic activity. For example, consider Figure 1 which shows the

Google Trend for the term “Flights” for Canada. The “interest” in flights in Canada declined

significantly towards the end of the first quarter of 2020 due to the COVID-19 travel

restrictions imposed by the Canadian Government. This is indicative of the decline in

economic activity that occurred in the Canadian Air Transportation Industry during this

period.

Figure 1. Google Trend “Flights” - Canada

Source: Google Trends – July 2020.

To illustrate how a “Google Trend” is calculated consider the following example. Assume

there are 10,000 searches in week 1 in a region and that 1,000 are related to restaurants. The

level of interest in restaurants is therefore 1,000/10,000=.1. Assume that each week we

measure the level of interest in restaurants (e.g., week 2=.08, week 3=.09) as illustrated in

Table 6. The weekly level of interest in restaurants is indexed to the week with the highest

level of interest (week 4 in our example). Using search activity as a proxy for demand for

restaurant services the trend would be interpreted as an indication that demand for restaurant

services was increasing in the first four weeks, stable over the next three weeks and declining

in the final weeks. This provides valuable information about turning points in activity.

Table 6. Construction of Google Trends Index: Example

Week

Total Searches

“Restaurant” Searches

Search Intensity

Trends Index

1

10000

1000

.1

83

2

10000

800

.08

67

3

10000

900

.09

75

13

Week

Total Searches

“Restaurant” Searches

Search Intensity

Trends Index

4

10000

1200

.12

100

5

15000

1200

.8

67

6

12500

1000

.8

67

7

10000

800

.8

67

8

10000

700

.7

58

9

10000

600

.6

50

10

10000

500

.5

42

The amount of information available via this platform is extensive. The platform provides

users with near worldwide geographic coverage and could be considered universal coverage

of social, economic, and environmental topics. This detail is an advantage and a

disadvantage. Given the almost infinite number of topics, the key challenge is selecting those

topics that are most indicative of a given economic activity. Therefore, it is necessary to

either group topics together into meaningful categories or select a sample of topics that

correspond to the activity of interest. With respect to the former, Google has developed an

algorithm to aggregate search topics into 1000+ “trend” categories. Google identifies the

most popular search topics related to category and aggregates the data by category. This

aggregation can be done by region and for different periods of time. For example, the

category “Consumer Electronics” for Australia is an aggregation of search topics in Table 7.

Table 7. Search Topics Related to Consumer Electronics for Australia

Source: Google Trends – July 2020.

In addition to obtaining trends by category it is also possible to extract trends for specific

businesses/products. For larger firms there are enough searches made that allow trends to be

calculated. For example, trends are available for Sandals Resorts, Cineplex Entertainment,

The Home Depot, Ikea Furniture Company, Holiday Inn Hotels, Oh Henry! Chocolate bar,

Ford Escape (see Figure 2), and Xbox Console in various countries. Assuming at company /

product level, there is a relationship between searches and business activity, having this

detail improves the potential of using Google Trends as an indicator of economic activity.

Radar

Apple Ultra-high-definition television

Bureau of Meteorology Television Kmart Pharmacy

The Good Guys Canon Kmart

Xbox Canon Rain

Xbox One JB Hi-Fi

Meaning

Camera Apple Weather radar

Headphones

Battery charger Soundbar

Australia Sony Bunnings Warehouse

Xbox Price

Fitbit

PlayStation 4 Fortnite Smart TV

Loudspeaker PlayStation 4 Pro JBL

Television set Microsoft Xbox One X Watch

Garmin Ltd.

Nintendo Switch Nintendo

Samsung Electronics New South Wales Education Standards Authority Netflix

Samsung AirPods Garmin Forerunner 235

Samsung Group Oppo reddit

4K resolution Reddit

Related Topics

14

Figure 2. Google Trends: Demand for Ford Escape - Canada

Both the Google Places and Google Trends platform are a rich data source that align well

with the type of data sources used to compile official statistics. Data acquired from the

Google Maps platform closely aligns with the type of data used by national statistical

organizations in the production of business status and dynamic type statistics. These data

may be of use in helping better understand the business population and some of the entry and

exit dynamics at a very granular geographic level of detail. The Google Trends data, when

properly filtered, could highlight sudden turning points, and be used to improve the

timeliness and frequency of official measures. The next section of this paper outlines how the

Google Places and Google Trends data described above can be processed and transformed

into a set of economic indicators consistent with the classifications and concepts of official

measures.

III.

METHODS

A. Operating Status Indicators

The Google Places API permits users to extract the operating status of each place identified

on the Google Places platform. Places are given the status of “Open,” “Temporarily Closed”

or “Permanently Closed.” This information can be used to produce several useful business

dynamic indicators. If we assume that the Google Places Platform has a near census coverage

of all Places operating in a region and that the number of reviews is a good indication of the

relative size of one Place to another – we can use this information to measure the operating

status of Places in each geographic area.

8

Since there is a strong relationship between the

business’ operating status and its revenue and employment, these indicators could be useful

8

This a ssum ption is pa rticularly valid for consumer-facing establishments, such as stores and restaurants. For

businesses that do not sell directly to consumers, the number of reviews may not be a good indication of their

size. Statistics agencies can use existing business register or business survey data to a djust the rela tive weights

from reviews in a composite high-frequency indicator.

0

20

40

60

80

100

120

1/10/2016 1/10/2017 1/10/2018 1/10/2019 1/10/20 20

15

in providing an early signal of trends in the labor market or trends in aggregate economic

activity for the region.

Operational Indicator

The Google Places business status field can be used to construct an operational indicator. The

operational index represents the share of Places in each geographic region that are

operational at a given point in time weighted by the number of reviews. Weighting by

reviews is intended to capture the impact of the size of the business, in which businesses with

more reviews will have a larger impact on the movement in the indicator. To illustrate,

consider the following example (Table 8) in which the status of a sample of Places with

Place Type = “restaurants” f or a specific geographic region are tracked over a five-week

period. Since the Google Places API does not permit users to extract a census of all Places in

each geographic region, each week’s extraction is treated as a random and representative

sample of places for the region. Assume that these places are restaurants operating in the

same geographic area. In week 1, we note that Place A has 1000 reviews, Place B has 500

reviews, Place C has 500 reviews, Place D has 100 reviews, Place E has 400 reviews, and it

is temporarily closed.

The initial operational status of the business population of restaurants for this region is 84,

which simply represents the share of reviews of Places in operation. To understand the

dynamics of the indicator, the above example is extended such that:

• In week 2, establishment F is temporarily closed

• In week 3, establishment F re-opens

• In week 4, all establishments remain operational

• In week 5, establishment C permanently closes

Each week a business operational indicator can be calculated, as shown below.

Table 8. Construction of Operational Indicator-Example

Week 1 – Initial Status: Places A, B, C, and D operational

Business

Reviews

Share of Reviews

Business Status

Operational Indicator

A

1000

40

Operational

B

500

20

Operational

C

500

20

Operational

D

100

4

Operational

E

400

16

Temporarily Closed

2500

100

84

Week 2 – Place F is temporarily closed

Business

Reviews

Share of Reviews

Business Status

Operational Indicator

F

1000

37

Temporarily Closed

G

700

26

Operational

H

500

19

Operational

I

100

4

Operational

J

400

14

Operational

16

2700

100

63

Week 3 – All places are operational

Business

Reviews

Share of Reviews

Business Status

Operational Indicator

F

1000

33

Operational

K

700

24

Operational

L

500

17

Operational

M

400

13

Operational

J

400

13

Operational

3000

100

100

Week 4 – all Places are operational

Business

Reviews

Share of Reviews

Business Status

Operational Indicator

A

1100

30

Operational

B

900

25

Operational

C

600

17

Operational

M

500

14

Operational

L

500

14

Operational

3600

100

100

Week 5 – Place L permanently closes

Business

Reviews

Share of Reviews

Business Status

Weighted Population

A

1200

31

Operational

K

900

24

Operational

L

600

15

Closed Permanently

P

600

15

Operational

Q

600

15

Operational

3900

100

75

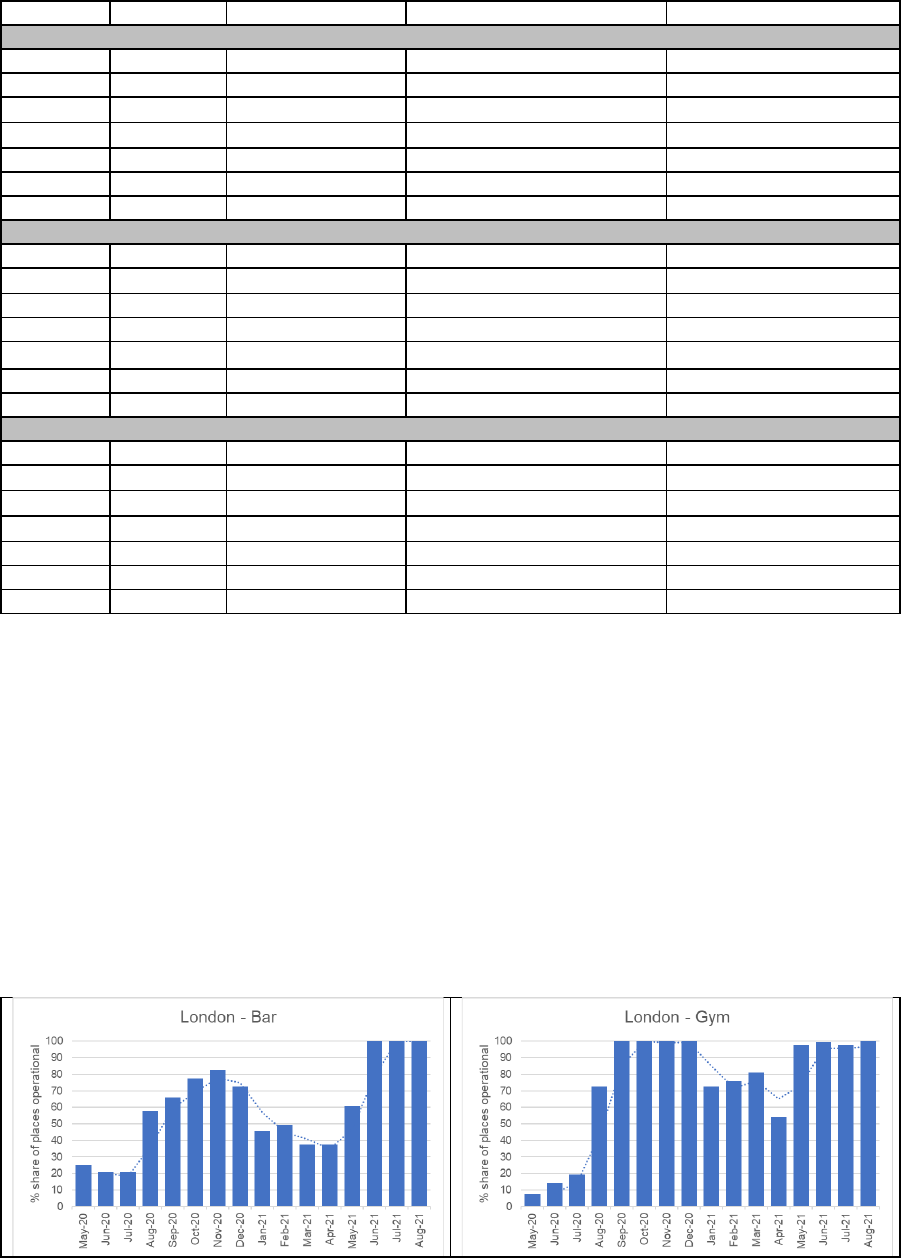

The above methodology was used to construct an operational indicator for several major city

centers for the period April 24, 2020 (the baseline) to August 10, 2021. The results indicate

that weighting by reviews has a significant impact on the index – introducing greater

variability. There is variation by city center and the operational status aligns well with the

timing of the various waves of the COVID-19 pandemic experienced by each of the city

centers. The variation by type of place is also consistent with the scope of the lockdown in

city centers where essential businesses remained open and non-essential business were

temporarily closed or altered their operations (e.g., curb-side pickup, limited capacity, limited

hours of operation). The following series of charts in Figure 3 compares bars with gyms for a

select set of city centers.

Figure 3. Operating Indicator (weighted by reviews) for Selected City Centers

17

Figure 3. Operating Indicator (weighted by reviews) for Selected City Centers

(continued)

Source: Goo gle Places API – Data Extracted between April 24, 2020 and August 10, 2021.

Business Re-opening Indicator

A second business status indicator that was constructed was a re-opening indicator. This

indicator is used to track the path and pace at which businesses that are temporarily closed in

a region re-open. This type of indicator was of particular interest during the COVID-19

pandemic where businesses were forced to shut down due to government regulations. This

indicator starts with the selection of a baseline cohort of places. In this case the cohort

consists of those firms that are temporarily closed. Each week (or selected time interval) the

status of each of these Places is examined to see if they have opened of if they remain

temporarily closed. The indicator reflects the share of businesses that were temporarily

closed in the baseline period that are now open. To illustrate consider the case of five firms

that were temporarily closed at the at time Baseline (Period B). Table 9 shows their status

(1=open, 2=temporality closed) in each of the following five time periods. The indicator is

calculated as the number of open firms divided by the total number of firms that were

temporarily closed in the baseline period.

Table 9. Reopening Indicator

Place

Period B

Period 1

Period 2

Period 3

Period 4

Period 5

A

2

2

2

2

2

2

B

2

2

2

2

2

1

C

2

2

1

2

1

1

D

2

2

1

1

1

1

E

2

1

1

1

1

1

Indicator

100

20

60

40

60

80

18

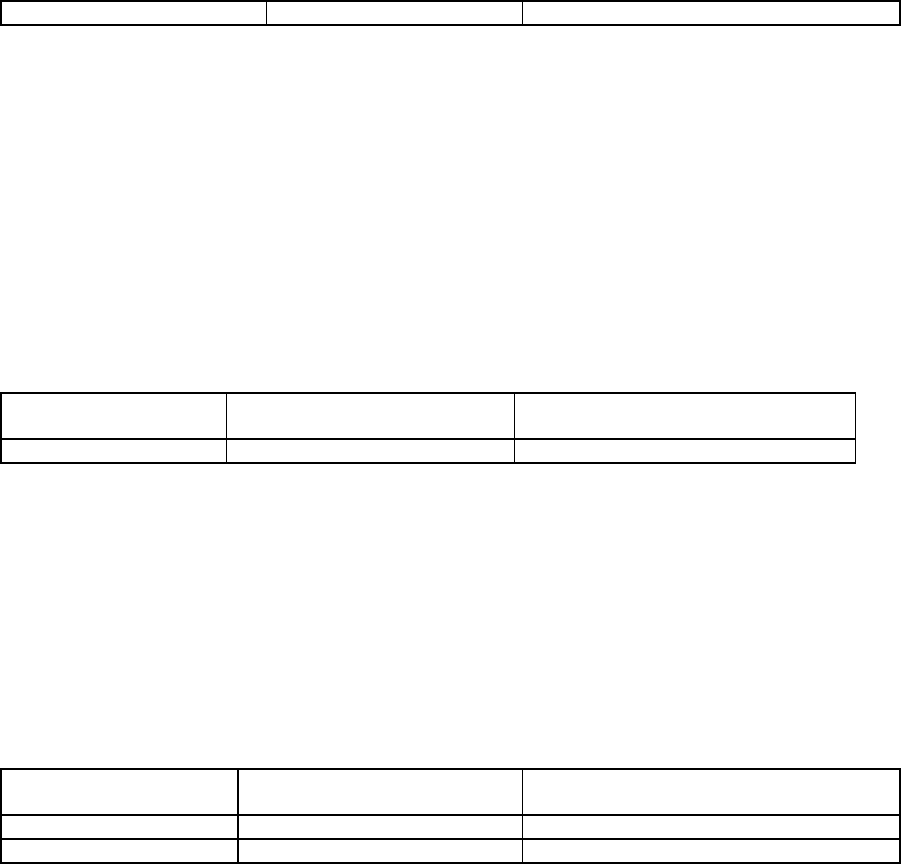

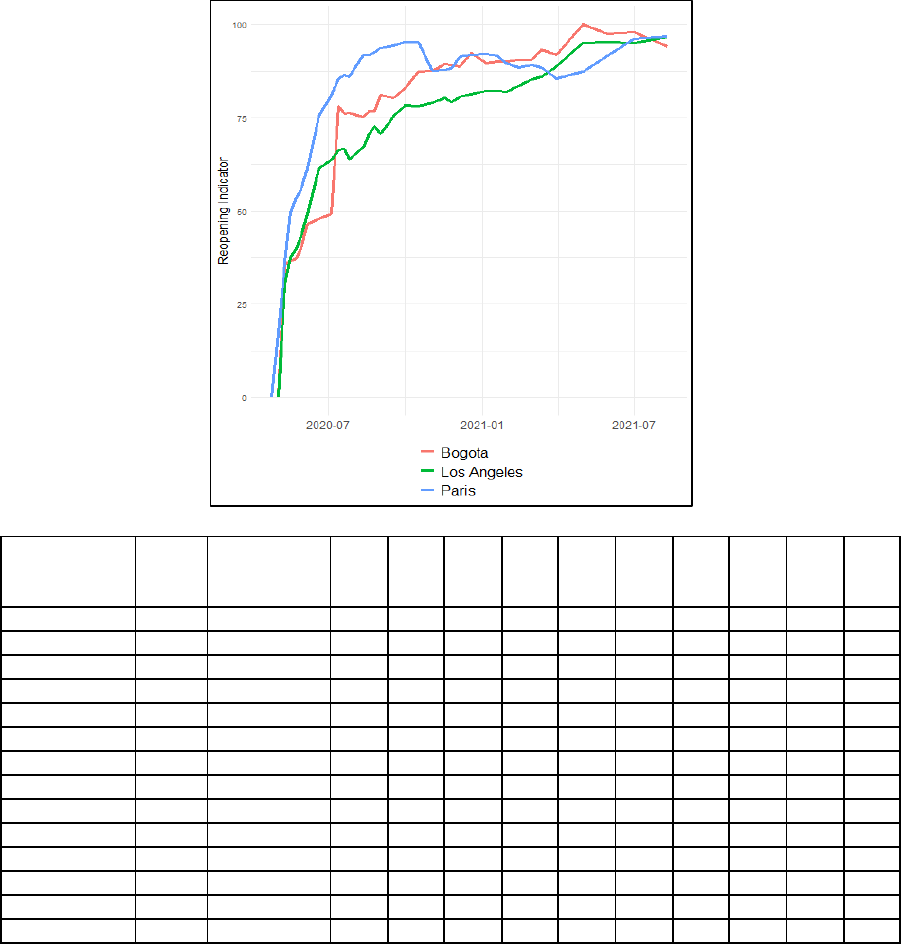

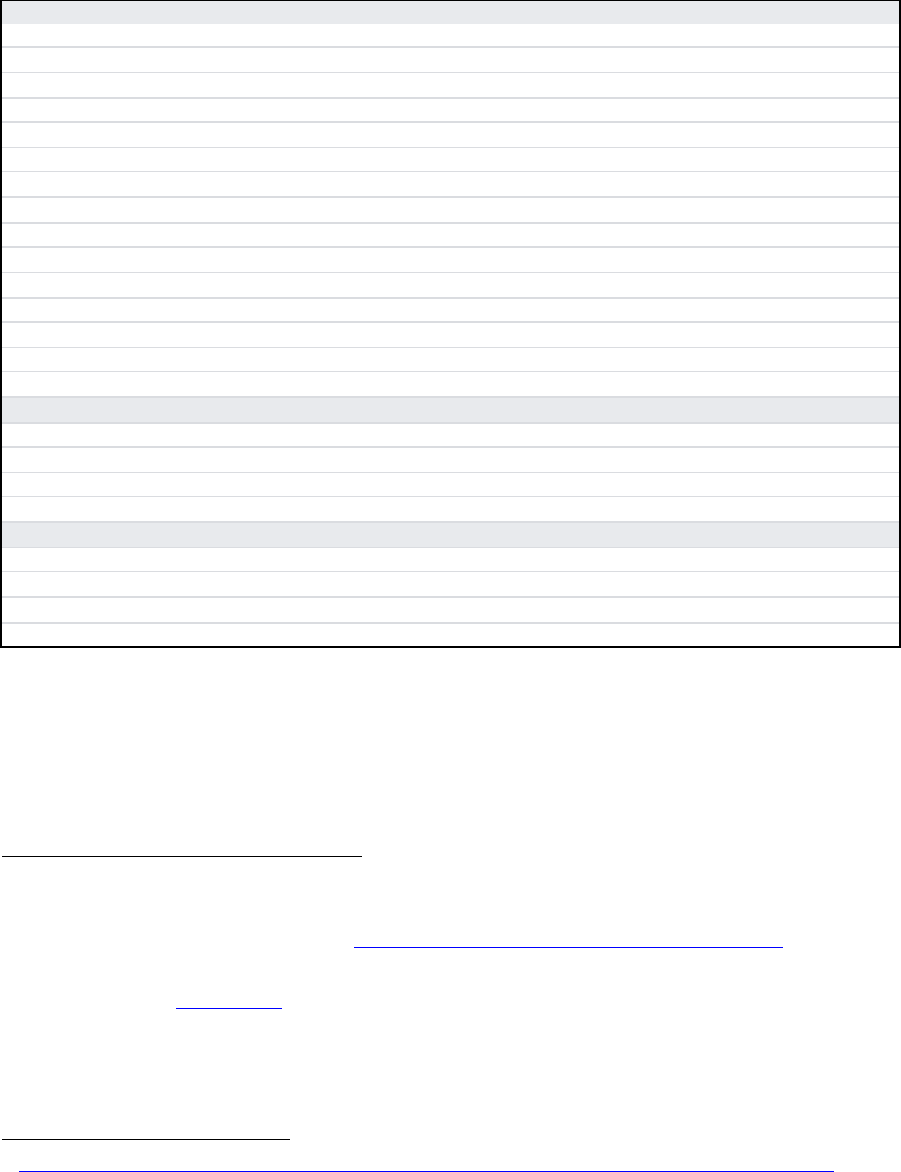

The above methodology was used to construct a business re-opening indicator for several

major city centers for April 24, 2020 (the baseline, where 0 percent of sampled businesses

had re-opened. Note below how some cities have a different baseline) to August 10, 2021.

The results are consistent with what is generally understood regarding the way different

governments implemented and lifted lockdown restrictions over the course of the pandemic.

Some governments imposed longer lockdowns in the hope that all businesses would be able

to move quickly to 100 percent operations after the lockdown. Other governments decided to

impose short lockdowns and leave the business to decide if it was economically beneficial to

open. Figure 4 illustrates the different path to re-opening taken in selected city centers.

Figure 4. Business Re-opening Indicator for Selected City Centers

city

sam

ple

size

baseline

24-

Apr

-20

24-

May

-20

26-

Jul-

20

26-

Aug

-20

3-

Nov

-20

30-

Jan

-21

31-

Mar

-21

1-

May

-21

1-

Jul-

21

10-

Aug

-21

Atlanta

503

2-May-20

59

82.9

96

97

96.8

97.6

98.6

98.8

99

Bogota

339

2-May-20

37.2

76.4

76.7

87.6

90

92

100

97.9

94.1

Casablanca

209

17-May-20

9.1

32.5

40.7

47.4

54.5

60.3

93.8

65.1

67.9

Istanbul

566

24-Apr-20

0

41.7

64.7

78.3

83.6

83.9

88.5

94.9

88.7

91.5

Lagos

180

24-Apr-20

0

25

38.3

38.9

53.9

58.3

62.8

98.3

76.7

76.1

London

842

24-Apr-20

0

53.4

84.8

93.1

97.1

80.8

79

89.7

97.9

98.5

Los Angeles

1,001

2-May-20

40

64

72.8

79.1

82

88.8

95

95

96.6

Madrid

1,437

24-Apr-20

0

44.6

75.9

87.3

92.3

92.9

94.7

98.3

95.8

95.9

Manila

2,750

24-Apr-20

0

41

70.1

79.6

84.6

88.1

89.8

96.6

92.1

92.8

Milan

936

24-May-20

0

59.1

77.1

84

81.9

86.3

95.8

92

90.5

Mumbai

2,939

24-Apr-20

0

45.6

66

72.8

85.7

92.8

94.2

97.2

93.4

93.9

New York

1,278

24-Apr-20

0

47.4

75.7

84.7

92.4

92.3

94.3

96.9

97.2

97

Paris

1,645

24-Apr-20

0

53.5

86

92.5

87.7

89.7

85.6

87.4

96.2

96.9

Rome

1,343

17-May-20

25.4

64.6

82.7

88.2

88.3

89.4

97.2

93.8

94.6

19

Sao Paulo

526

24-Apr-20

0

35.6

64.4

66.5

79.7

84.6

81.2

93

89.7

89.4

Sydney

359

2-May-20

47.4

84.7

86.9

91.6

94.4

95.8

97.2

76

74.9

Tel Aviv-

Yaf o

1,045

17-May-20

16.2

62.3

70.8

76.3

77.1

85.4

98.7

94.6

87.4

Tokyo

416

24-Apr-20

0

51.2

95

94.7

96.6

96.4

96.4

88

97.6

97.8

Toronto

978

24-Apr-20

0

42.1

90.8

93.4

94.7

84.6

89.9

87.1

88.9

95.9

Source: Google Places API – Data extracted fro m April 2020 to August 2021.

B. Business Activity Indicators

While the above indicators are intended to capture the evolution of the operation status of the

Places population, they do not fully capture the economic activity of the Places. To do this,

we require some indication of activity. As noted earlier, Google Trends capture the interest in

a topic relative to all other topics at a given point in time. If we assume that there is a

relationship between changes in interest in a topic(s) and changes in business activity the

Google Trends could be used as a proxy for business activity (at least in the short term).

Similarly, the Google Places API permits users to extract reviews from the Google Places

platform. These reviews are generally posted following some form of engagement with the

Place. If we assume that reviews reflect engagement, then this information can also be used

as a proxy for business activity. In the world of official statistics, business activities are

aggregated and classified in a systematic way. Most countries use the ISIC Rev. 4 (or some

variant of it) to classify business activities. It therefore seems appropriate that if we want to

use the Google Trends and Google Reviews data to proxy business activity we first need to

aggregate and classify these indicators by the ISIC Rev. 4.

Google Reviews as an Indicator of Business Activity

The Google Places API permits users to extract the number of reviews posted for a given

Place. In addition to the review the API also allows users to extract the average rating

provided for a Place. Ratings range from 1 (poor) to 5 (excellent). It is assumed higher

change in ratings are correlated with higher economic activity. For this indicator, the rating

was used to adjust the number of reviews such that a Place with 100 poorly rated reviews

would have a lower weight than a Place with 100 highly rated reviews. Since the maximum

score for a review is 5 the “adjusted” number of reviews was calculated as (average rate / 5)

*(number of reviews). To illustrate consider the following Places, each with 100 reviews and

various average ratings:

Table 10. Indicator of Business Activity Using Reviews

Place

Reviews

Rating

Weighted Rating

Adjusted Reviews

A

100

1

.2

20

B

100

3

.6

60

C

100

5

1

100

The review information available from the Google Places API represents the accumulated

number of reviews at a point in time. In this sense they should be treated as a “stock” type

variable. Since we are interested in measuring the change in activity from one period to

20

another, the variable of interest is not the stock of reviews but the change in the stock of

reviews from one period to the next. In addition to focusing on the change in reviews we also

need to consider that the Places selected for a given period represent a sample of Places for

the given geographic region. Ideally, we would like to track the change in reviews for the

same set of Places over time to reduce any potential sampling errors in the estimate. To

address this issue a month-to-month matched sample approach is taken. The match sample

approach involves identifying an overlapping set of Places in two consecutive periods and

calculating the stock of reviews for each period for this set of Places.

9

The stock of reviews

for each period is then linked together to form a continuous time-series using the baseline

stock of reviews as the initial level. To illustrate, five samples of Beauty Salon Places in

Paris were selected for the months April, May, June, July, and August 2020. The linked

stock of reviews and the change in reviews is presented in table 11.

Table 11. Stock / Change in Reviews – Paris City Center Beauty Salons

Matched Sample

Apr-20

May-20

Jun-20

Jul-20

Aug-20

April-May

1,289

1,306

May-June

1,694

1,744

June-July

1,772

1,821

July-August

1,664

1,727

Linked Stock of Reviews

1,289

1,306

1,344

1,381

1,433

Change in Reviews

17

38

37

52

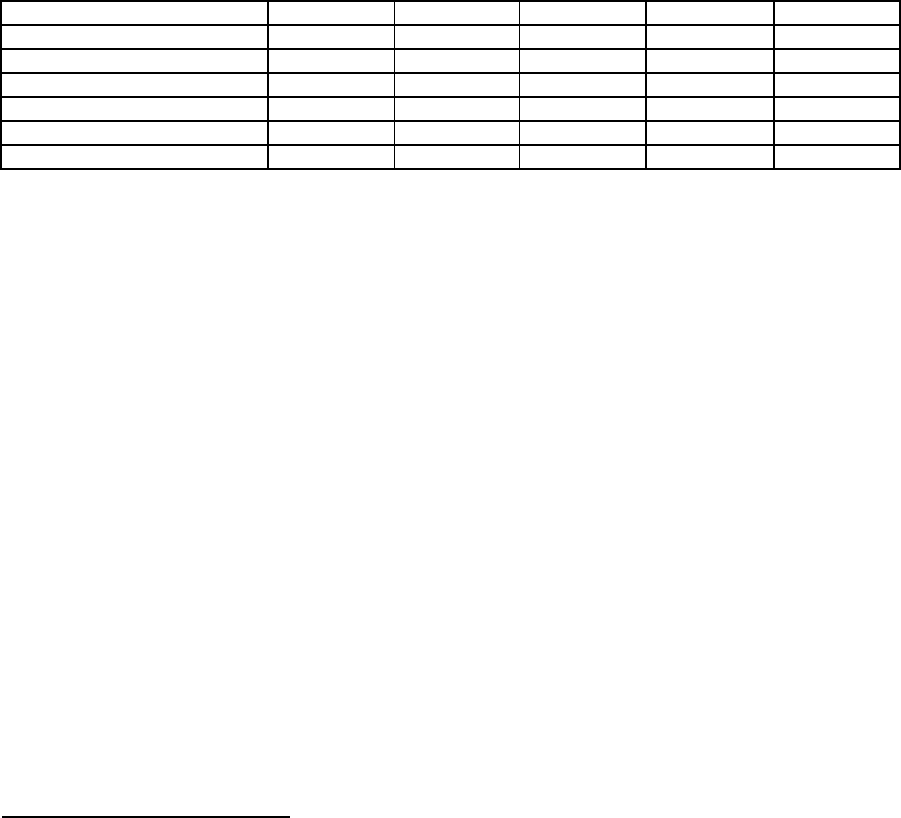

This methodology was applied to the monthly sample of Places collected in this project since

April 2020. The results align with the trends in activity over the last year in which activity

slowed during periods of lockdown or partial lockdown. The results also indicate that the

slowdown was the most pronounced during the first wave of COVID-19 and less pronounced

during subsequent waves – even though the subsequent waves were more pronounced in

terms of cases and severity of illness. The following series of charts in Figure 5 shows the

review activity for restaurants in Toronto, London, Manila, Johannesburg, Nairobi, Seoul,

and Sydney (the dotted lines in the figure are three-month moving averages).

9

The reason the same set of Places are not used for each month is because the sample size would deteriorate and reduce the

robustness of the estimate.

21

Figure 5. Review Activity Indicator

Source: Goo gle Places API – Data extracted from April 2020 to June 2021.

Google Trends as an indicator of activity

While there appears to be some conceptual and statistical relationship between reviews and

economic activity there are limitations associated with using reviews. First, up to this point, it

is not possible to construct a long time series of reviews due to unavailability of historical

Places data. Second, processes and extraction routines need to be set up at regular intervals as

not to introduce any bias into the estimates. Finally, the data are essentially self-reported, and

a key assumption is that the average reviews per visitor is constant over time. Given these

limitations and assumptions, additional activity indicators are required. As noted in Section

II, Google also provides access to information related to Google searches via the Google

22

Trends website. The challenge with using Google Trends data is how to best aggregate the

almost infinite detail into meaningful information that can reveal current economic trends.

Google’s aggregation of trends into categories provides a first step in developing meaningful

aggregate indicators. While this is a good first step it is not entirely apparent how these

category trends are related to the more commonplace economic indicators most analysts and

policy makers use to monitor current economic trends. In the world of economic statistics,

business activities are aggregated and classified in a systematic way. Most countries use the

ISIC Rev. 4 (or some variant of it) to classify business activities. It therefore seems

appropriate that if we want to aggregate Google Trends to monitor current economic trends,

we should aggregate them using the ISIC Rev 4. Classifying Google Trends according to this

classification will facilitate the use of this information to improve the frequency and

timeliness of economic indicators.

One approach that can be used to link the Google Trends categories to the ISIC classification

is a textual matching process. This approach “links” the textual information underscoring a

specific Google category / topic with the textual information associated with a specific ISIC

class. There is a rich set of textual detail that underpins the Google Trends data by category.

This includes the textual description of the category along with the textual description of the

individual topics associated with the category. As noted earlier the category “Consumer

Electronics” is comprised of topics such as “Sony,” “Fortnite,” “PlayStation,” “Xbox,”

“Apple,” “Canon” etc. The first approach that was used to produce ISIC-based Google

Trends indicators was to construct a vector of Google Trend category and topic terms and

match these terms with the text used to describe the activities of establishments associated

with an ISIC Rev. 4 class (see Box 1, which provides the textual description of the ISIC class

2640 - manufacture of consumer electronics industry).

Box 1. Textual Description of the Manufacture of Consumer

Electronics Industry

Source: International Standard Industrial Classification System of All Economic Activities Rev. 4.

23

The method chosen was the natural language processing (NLP) library word2vec that scores

the Google Trends category / topic description against the ISIC industry class description (at

the 4-digit level). Any Google Trends category that matched to an ISIC industry within a

given threshold is retained (See technical annex for details). The Google Trends by category

are then aggregated using a simple average to the ISIC class. This aggregation is illustrated in

Tables 12 and 13 below.

Table 12. Monthly Google Trends SVIs at ISIC 4-digit level for Accommodation

and Food Service Activities (I) for Australia

At ISIC 4-digit level we take the average Google Trends SVIs of all matched categories.

ISIC 4-

digit

ISIC description

Trends category

description

Trends

category

Jan-

21

Feb-

21

Mar-

21

Apr-

21

May

-21

5610

Accommodation and food

service activities; Food and

beverage service activities;

Restaurants and mobile

food service activities

Food & Drink: 71;

Restaurants: 276;

Fast Food: 918

918 90.0 82.0 85.0 91.0 87.0

5610

Accommodation and food

service activities; Food and

beverage service activities;

Restaurants and mobile

food service activities

Business &

Industrial: 12;

Hospitality

Industry: 955; Food

Service: 957;

Grocery & Food

Retailers: 121

121 70.0 66.0 61.0 73.0 68.0

5610

Accommodation and food

service activities; Food and

beverage service activities;

Restaurants and mobile

food service activities

Business &

Industrial: 12;

Hospitality

Industry: 955; Food

Service: 957;

Restaurant Supply:

816

816* - - - - -

5610

Accommodation and

food service activities;

Food and beverage

service activities;

Restaurants and mobile

food service activities

Total 5610

Average

SVIs

80.0 74.0 73.0 82.0 77.5

5629

Accommodation and food

service activities; Food and

beverage service activities;

Event catering and other

food service activities;

Other food service

activities

Food & Drink: 71;

Restaurants: 276;

Fast Food: 918

918 90.0 82.0 85.0 91.0 87.0

5629

Accommodation and food

service activities; Food and

beverage service activities;

Event catering and other

food service activities;

Other food service

activities

Food & Drink: 71 71 83.0 78.0 74.0 86.0 84.0

5629

Accommodation and

food service activities;

Food and beverage

service activities; Event

catering and other food

Total 5629

Average

SVIs

86.5 80.0 79.5 88.5 85.5

24

ISIC 4-

digit

ISIC description

Trends category

description

Trends

category

Jan-

21

Feb-

21

Mar-

21

Apr-

21

May

-21

service activities; Other

food service activities

5630

Accommodation and food

service activities; Food and

beverage service activities;

Beverage servin g activities

Food & Drink: 71;

Non-Alcoholic

Beverages: 560;

Coffee & Tea: 916

916 92.0 83.0 82.0 93.0 97.0

5630

Accommodation and food

service activities; Food and

beverage service activities;

Beverage servin g activities

Food & Drink: 71;

Non-Alcoholic

Beverages: 560

560 96.0 89.0 83.0 91.0 94.0

5630

Accommodation and food

service activities; Food and

beverage service activities;

Beverage servin g activities

Food & Drink: 71 71 83.0 78.0 74.0 86.0 84.0

5630

Accommodation and

food service activities;

Food and beverage

service activities;

Beverage serving

activities

Total 5630

Average

SVIs

90.3 83.3 79.7 90.0 91.7

* This category did not return data for Australia for this instance. Included for completeness.

Source: Author’s estimates.

Table 13. Monthly Google Trends SVIs at ISIC Section Level for

Accommodation and Food Service Activities (I) for Australia

At ISIC section level we take the average Google Trends SVIs of all matched categories to ISIC 4-

digit removing duplicate categories to keep a simple average.

ISIC 4-

digit

ISIC description

Trend’s category

description

Trend’s

category

Jan-

21

Feb-

21

Mar-

21

Apr-

21

May-

21

5610

Accommodation and food

service activities; Food and

beverage service activities;

Restaurants and mobile

food service activities

Food & Drink: 71;

Restaurants: 276;

Fast Food: 918

918 90.0 82.0 85.0 91.0 87.0

5610

Accommodation and food

service activities; Food and

beverage service activities;

Restaurants and mobile

food service activities

Business &

Industrial: 12;

Hospitality

Industry: 955;

Food Service:

957; Grocery &

Food Retailers:

121

121 70.0 66.0 61.0 73.0 68.0

5610

Accommodation and food

service activities; Food and

beverage service activities;

Restaurants and mobile

food service activities

Business &

Industrial: 12;

Hospitality

Industry: 955;

Food Service:

957; Restaurant

Supply: 816

816 - - - - -

5629

Accommodation and food

service activities; Food and

beverage service activities;

Even t catering and other

food service activities; Other

food service activities

Food & Drink: 71 71 83.0 78.0 74.0 86.0 84.0

5630

Accommodation and food

service activities; Food and

Food & Drink: 71;

Non-Alcoholic

916 92.0 83.0 82.0 93.0 97.0

25

beverage service activities;

Beverage serving activities

Beverages: 560;

Coffee & Tea: 916

5630

Accommodation and food

service activities; Food and

beverage service activities;

Beverage serving activities

Food & Drink: 71;

Non-Alcoholic

Beverages: 560

560 96.0 89.0 83.0 91.0 94.0

Total

Accommodation and food

service activities

Total

Average

SVIs

86.2 79.6 77 86.8 86

Source: Author’s estimates.

The benefit of the Google Trends data is that users have access to a long and high frequency

time series. These data are particularly useful in helping understand turning points and are

intended to be combined with and benchmarked to official measures to improve their

timeliness and frequency. Therefore, the emphasis of the series will generally be on the

current period. While the emphasis is on the current period a long time series is required to

establish relationships and models with existing official measures of economic activity. Since

there are many factors that can influence search intensity a 5-year moving intervals is used

and the weekly trends are smoothed using a five-week moving average. To derive the

monthly and quarterly series the weekly series was averaged for the month or quarter.

Finally, often the series exhibit lag effects and therefore for certain series – such as travel

type series where vacation interest precedes the trip some consideration should be given to

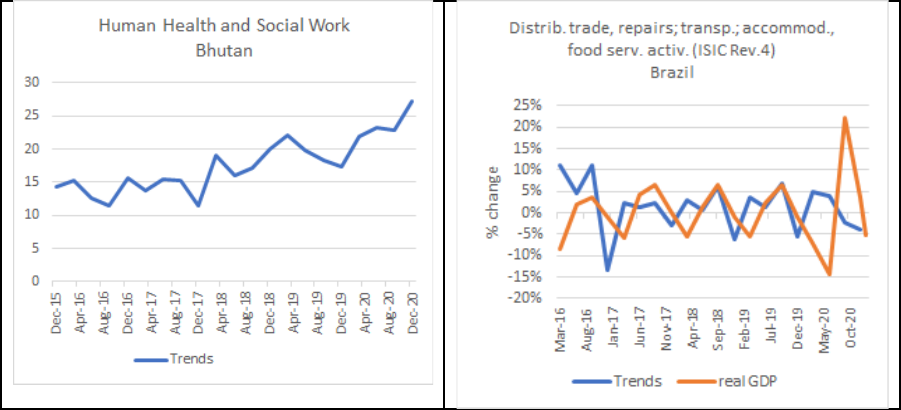

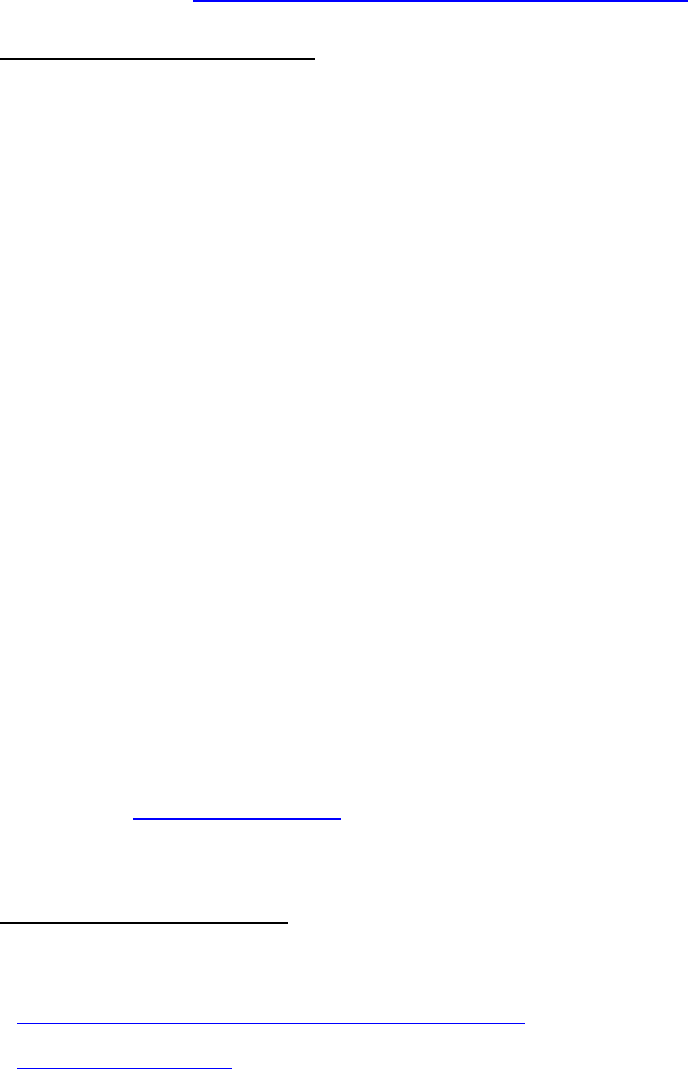

lagging the series. This needs to be done on a case-by-case basis. Figure 6 compares the

Google Trends by ISIC index with real GDP for selected industries for a sample of countries.

In many cases the trends exhibit similar patterns and are very good at predicting the turning

points.

Figure 6. Change in Google Trends Compared to Change in Real Quarterly

GDP (in percentages)

26

Figure 6. Change in Google Trends Compared to Change in Real Quarterly

GDP (in percentages) (continued)

*Note – Bhutan does not release quarterly estimates of GDP.

IV. U

SING GOOGLE DATA FOR GDP NOWCASTING

In this application, we show the predictive ability of our indicators in nowcasting quarterly

GDP for selected industries for a group of countries during the pandemic. Our objective is to

determine if our business activity indicator, operating status indicator, reopening indicator,

and Google Trends by ISIC correlate well with official GDP numbers and can be used to

improve the timeliness and frequency of GDP preliminary estimates through simple

regression techniques. Specifically, we want to show that the strength of these indicators is to

closely track the fall and subsequent rebound of economic activities that were particularly hit

by the effects of the pandemic in the second and third quarter of 2020.

First, we selected a sample of six countries with availability of quarterly GDP data by

economic activity. The selected countries are Australia, Brazil, Canada, France, the

Philippines, and South Africa. The sample is sufficiently heterogenous with respect to

income level, economic structure, and geographic locations. We consider all economic

activities at the one-digit level of the ISIC available from the official statistics agency (e.g.,

19 sections in the ISIC rev. 4). Although longer times series were available for some of these

countries, for this exercise we only considered data from 2015-Q4 to 2020-Q3 to match the

five-year span available for our Trends series by ISIC. All data were used in seasonally

adjusted form. It should be noted that we picked a sample of countries where quarterly GDP

already existed, so that we could test the accuracy of nowcasting at the quarterly level using

the indicators developed in this research. Nevertheless, our indicators can also be used to

produce quarterly estimates of the GDP in those countries where only annual GDP is

available, for example by using annual-to-quarterly benchmarking techniques.

27

We performed a correlation analysis at the 1-digit ISIC level between our Google Trends

series and quarterly Gross Value Added (GVA) by economic activity in the last five years.

Positive (contemporaneous) correlations were found for many ISIC sections in the service

industry for most countries, most notably Transportation and Storage (H), Accommodation

and Food Services activities (I), Professional, Scientific, and Technical activities (M), Arts,

Entertainment and Recreation (R). With few exceptions, correlation for industrial activities

and the primary sector was substantially lower.

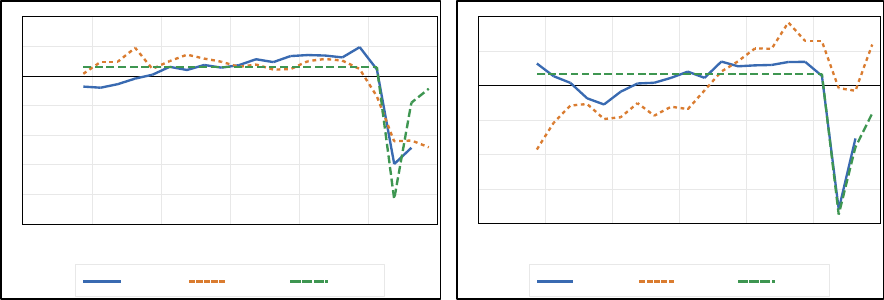

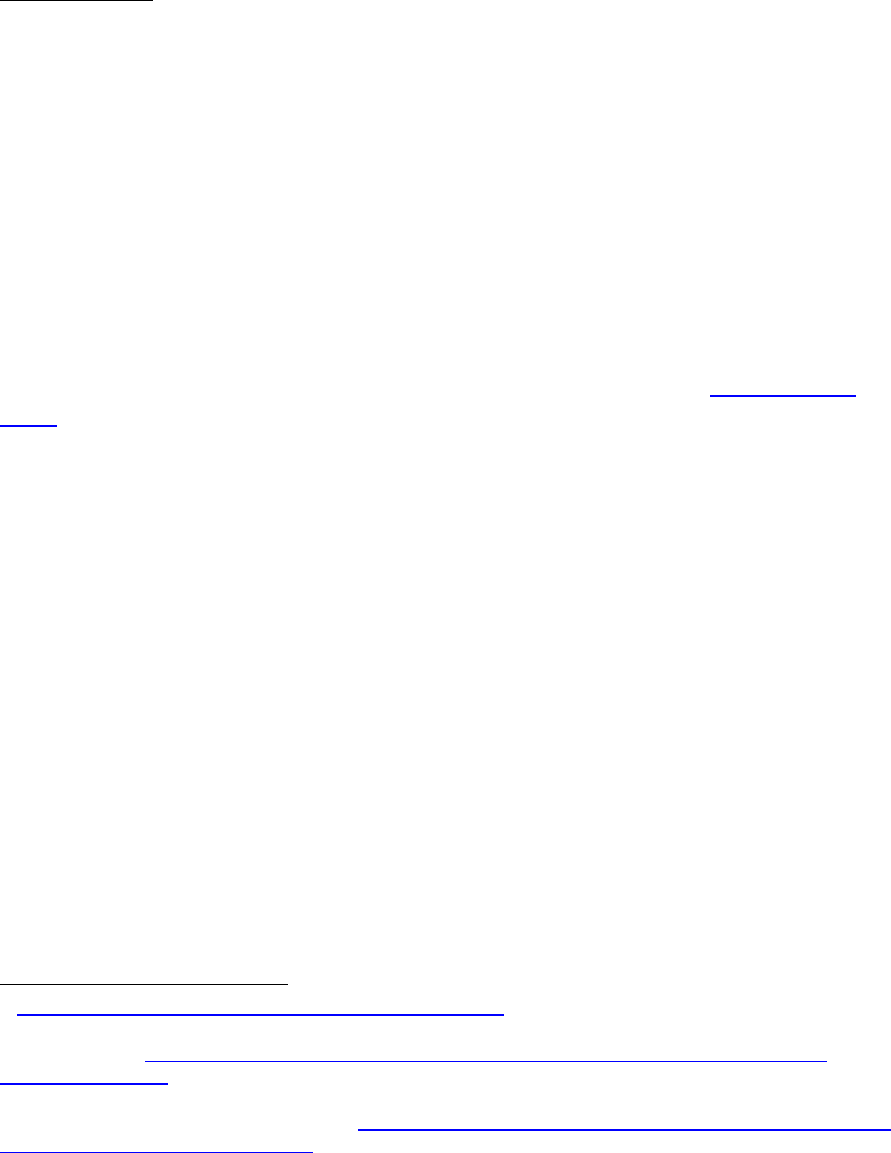

Correlation for the “Transportation and Storage” activity was strikingly consistent across

countries, which prompted us to focus our nowcasting exercise on this sector. Figure 7 shows

the official GDP data for section H and the respective Google Trends series for the six

countries in our sample. We also include in the charts the reopening indicator for the last

three quarters of 2020. We found that real Transportation and Storage gross value added

showed high and consistent correlation with the respective Google Trends series for all

countries. Google search categories matched to Transportation were, among others,

“Aviation,” “Freight and Trucking,” “Rail Transport,” “Maritime Transport” and “Public

Storage” We believe that the number of hits of search terms in these categories (e.g., “get an

air ticket to New York”) can track closely the movements of activities related to travel that

were severely hit during the pandemic, such as air, maritime, and railroad transportation and

supporting activities.

Figure 7. Transportation and Storage: Comparison between Official Data

(GDP-H), Google Trends (TRE-H), and Reopening Indicator (REOP) for

Selected Countries

Period: 2015-Q4-2020-Q4. Seasonal adjusted and normalized data.

Australia

Brazil

-5

-4

-3

-2

-1

0

1

2

2015 2016 2017 2018 2019 2020

GDP-H

TRE-H

REOP

-4

-3

-2

-1

0

1

2

2015 2016 2017 2018 2019 2020

GDP-H

TRE-H

REOP

28

Figure 7. Transportation and Storage: Comparison between Official Data

(GDP-H), Google Trends (TRE-H), and Reopening Indicator (REOP) for

Selected Countries (continued)

Canada

France

The Philippines

South Africa

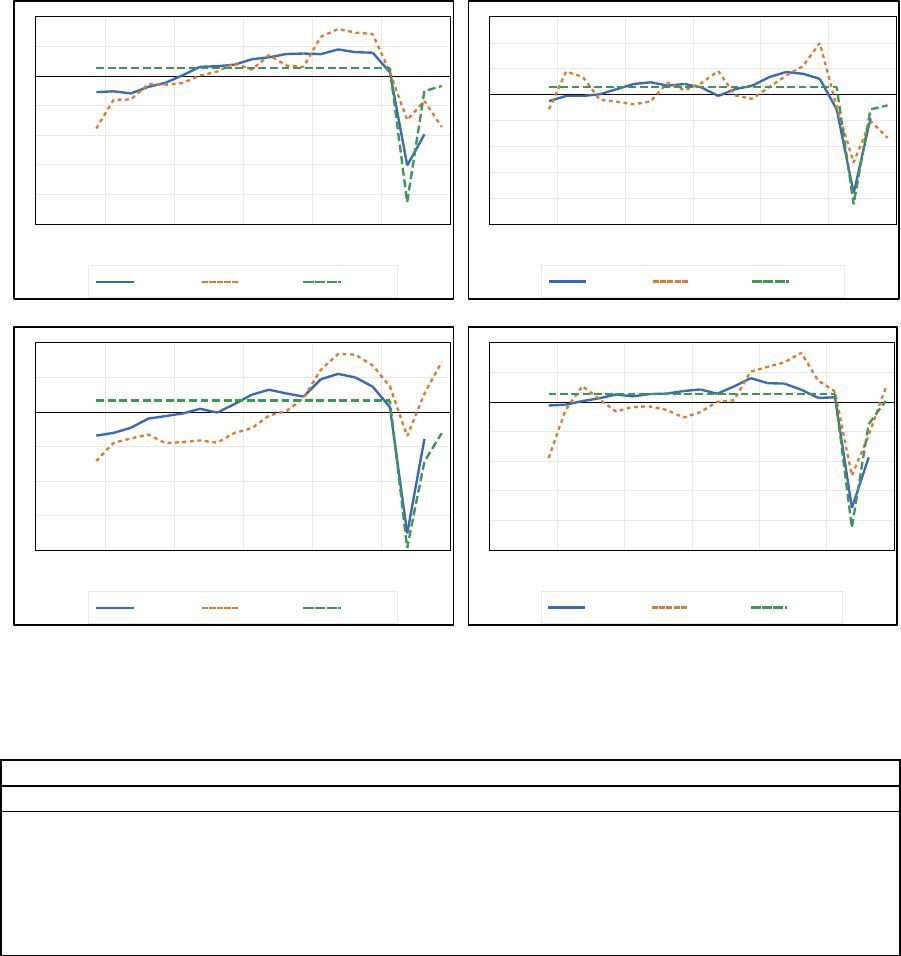

Table 14. Transportation and Storage: Regression Results

Period: 2015-Q4-2020-Q3.

Regression model in logs, no lags, plus constant. Seasonally adjusted data.

Likewise, our regression results show that both indicators are good predictors of

Transportation and Storage activity. Table 14 shows that the model fitting is very good f o r all

countries, with an R

2

above 80 percent. All models are estimated in logs with a constant

value. Coefficients for both indicators are positive and statistically significant. It is important

to note that the reopening indicator (REOP) is a dummy variable available only for three

quarters (2020-Q2, 2020-Q3, and 2020-Q4.) As shown in Figure 1, the fall and subsequent

-5

-4

-3

-2

-1

0

1

2

2015 2016 2017 2018 2019 2020

G

DP-H

TRE-H

REOP

-5

-4

-3

-2

-1

0

1

2

3

2015 2016 2017 2018 2019 2020

G

DP-H

TRE-H

REOP

-4

-3

-2

-1

0

1

2

2015 2016 2017 2018 2019 2020

GD

P-H

TRE-H

REOP

-5

-4

-3

-2

-1

0

1

2

2015 2016 2017 2018 2019 2020

GDP-H

TRE-H

REOP

Model for GDP-H

TRE-H

REOP

R

2

Coeff.

t-stat

Coeff.

t-stat

Australia

0.83

0.43

3.22**

0.19

2.43**

Brazil

0.91

0.10

2.21**

0.30

13.20**

Canada

0.88

0.89

5.57**

0.38

6.44**

France

0.92

0.25

2.15**

0.48

7.28**

Philippines

0.95

0.45

6.40**

1.28

15.96**

South Africa

0.92

0.25

2.47**

0.34

8.90**

29

rebound of the reopening indicators almost perfectly match the effects of the pandemic noted

in the official data.

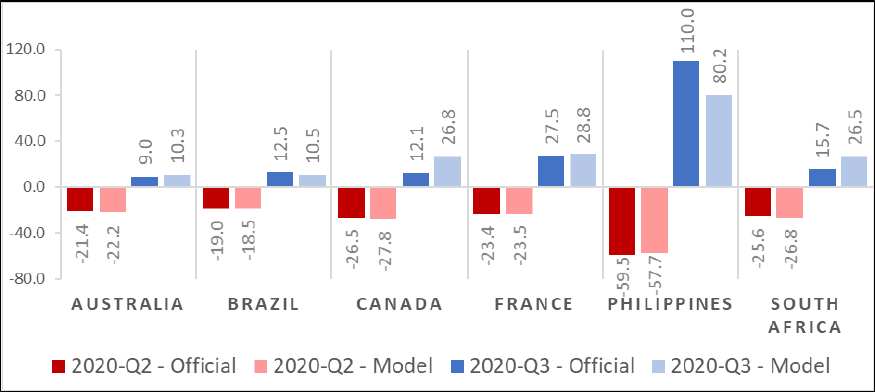

Finally, we used the regression models to produce nowcasts of the second and third quarter

of 2020. Figure 8 compares the official estimates produced by the national statistics agencies

with our model estimates. The large drop in 2020-Q2 is accurately captured by our

predictions, and those for 2020-Q3 adequately anticipate the subsequent recovery. The

advantage of our nowcasts is that they could have been produced a few days after the end of

each quarter, given that the Google data from Trends and Places API are available in real-

time.

Figure 8. Transportation and Storage: Nowcasts for 2020-Q2 and 2020-Q3

Data expressed in quarter-to-quarter rate of change, seasonally adjusted

V. C

ONCLUSIONS

The pandemic highlighted the need to use nontraditional data to prepare more timely and

detailed economic indicators. With the onset of the pandemic, consumption and production

patterns changed dramatically. Consumers rapidly changed their preferences and behaviors,

shifting from traditional brick-and-mortar stores to online shopping. As governments swiftly

passed lockdown measures amid an unprecedented health crisis worldwide, businesses were

forced to close or moved to remote working, when possible. As these dramatic events

unfolded, real-time data on people’s mobility and business-related activities made available

by the private sector played a key public policy function for decision makers and the citizens.

In this work, we developed high-frequency indicators based on Google data to measure the

various business dynamics and activity since the start of the pandemic. First, we used Google

Places API to build indicators of “business status” for several major cities for the period

April 2020 to the current period. Second, we transformed Google Trends data into “business

activity” indicators that match the classifications used in the national accounts and other

30

official business statistics. Through a simple regression experiment, we showed that the two

indicators could predict very well the fall and subsequent recovery in the GDP of selected

countries during the early stage of COVID-19.

Beyond assessing the impact of COVID-19, our purpose was to expand the methodological

toolkit for national statistics agencies and central banks interested in increasing timeliness

and frequency of economic indicators using Google data. The key advantage of Google data

is that they are easily accessible in all countries. Google Trends series can be accessed at no

cost from a publicly available website

maintained by Google. Places API can be used to

retrieve data on the operational status of businesses (and other information) for a small fee,

relative to the cost of collecting the same data through surveys or interviews (when possible).

Countries with significant lags in the production of quarterly national accounts may test these

indicators to release early estimates of quarterly GDP. Countries producing only annual GDP

data may find these indicators useful to produce sub-annual estimates on an experimental

basis for selected sectors of the economy. Quality of these indicators should be tested and

validated with official high-frequency indicators, such as industrial production indexes,

retails sales, and value-added-tax indicators.

We encourage countries to develop experimental high frequency indicators of economic

activity based on our methodology. The technical annex and the R package provided with

this paper can be used to reproduce the step-by-step procedure for building the same

indicators for any country. These indicators will need to be assessed to determine their ability

to nowcast national accounts data and other official indicators available with a long delay. If

these indicators show accurate and robust results vis-à-vis traditional data, countries should

consider publishing experimental products to provide faster signals on the status of the

economy to their users. Investing resources to develop innovative statistical products based

on nontraditional sources will make these countries better equipped and prepared to tackle

the next period of economic turbulence.

31

Annex I. Technical Aspects of Google Trends and Google Places API

This Annex outlines the data collection and processing methods IMF staff (the authors) used

to transform and process the data acquired from the Google Trends Platform and Google

Maps Platform (using the Google Places API).

Google Maps Platform (Google Places API)

Google Places API, part of the Google Maps Platform

, provides developers access to a set of

APIs and SDKs that allows them to embed Google Maps into mobile apps and web pages, or

to retrieve data from Google Maps. The Places API is a service that returns information about

“Places” using HTTP requests. Places are defined within this API as establishments,

geographic locations, or prominent points of interest.

Data collection

For this study, IMF Staff selected a sample of 24 cities (initially, only 13: Bogota, Istanbul,

Lagos, London, Madrid, Manila, Mumbai, New York, Paris, Sao Paulo, Sydney, Tokyo,

Toronto) that were the most affected by the COVID-19 lockdowns

10

representing the world’s

major geographical areas. The authors drew an initial sample of n (<= 60) establishments for

each Places Type

11

by distance from the center of the city.

12

For most “Places Types” the

number of sample units was less than 60 (n < 60 - there will be fewer than 60 “amusement

parks” in any given city). Some businesses have multiple types assigned to them by Google,

(e.g.: a Place can be classified as both “restaurant” and “food delivery”) so the final sample

size n for certain types could be > 60 but was limited to 60 for operational reasons.

For each city, for each type, IMF staff queried the Google Places API 3 times (60 max

responses concatenating 20 max responses per individual query) using search term = type

and latitudes and longitudes of the city center as illustrated below:

sstring = gsub("_"," ",t),

lat = y,

lon = x,

type = t,