Concur Expense: Car

Configuration

Setup Guide

Last Revised: January 12, 2024

Applies to these SAP Concur solutions:

Expense

Professional/Premium edition

Standard edition

Travel

Professional/Premium edition

Standard edition

Invoice

Professional/Premium edition

Standard edition

Request

Professional/Premium edition

Standard edition

Concur Expense: Car Configuration Setup Guide i

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

Table of Contents

Section 1: Permissions ................................................................................................1

Section 2: Overview ....................................................................................................1

Criteria ..................................................................................................................... 2

Examples of Car Configurations .................................................................................... 3

Dependencies ............................................................................................................ 4

Calculations and Amounts ........................................................................................... 4

How Fuel for Mileage is Calculated ........................................................................... 4

Company Car - Variable Rates ................................................................................ 6

Personal Car ......................................................................................................... 6

Calculating Mileage Using Google Maps ......................................................................... 7

Setting Initial Distance ................................................................................................ 7

Journal Entries ........................................................................................................... 8

Default Configurations ................................................................................................ 8

Car Registration Form Configuration Process .................................................................. 8

Section 3: User Experience ..........................................................................................9

Registering Cars ......................................................................................................... 9

Preferred Car ...................................................................................................... 11

Creating Car Expenses .............................................................................................. 12

Calculating Mileage using Google Maps ....................................................................... 13

Approvers ............................................................................................................... 17

User Administrator: Managing Cars on Behalf of an Employee ........................................ 17

Enabling and Restricting Car Configuration for the User Administrator ........................ 18

What the User Administrator Sees ......................................................................... 21

Section 4: Car Configuration Procedures ................................................................... 23

Accessing Car Configurations ..................................................................................... 23

One Rate or No Reimbursement Configuration ............................................................. 25

Variable Rate Configuration (Company or Personal car)................................................. 29

Assigning Different Car Reimbursements Rates Using UnNamed Groups .......................... 35

Example – Assigning to Different Users .................................................................. 35

How It Works...................................................................................................... 36

Modifying Car Configurations ..................................................................................... 37

Deleting Car Configurations ....................................................................................... 38

Section 5: Fuel for Mileage Configuration Procedures ............................................... 39

Overview................................................................................................................. 39

Updating Site Settings .............................................................................................. 39

ii Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

Creating the Fuel for Mileage Expense Type ................................................................. 41

Creating a new Entry Form – Mileage – No Receipt ....................................................... 43

Adding a new simple list (Fuel Type)........................................................................... 47

Copying the Default Entry Form to Create a New Entry Form (Fuel for Mileage) ............... 52

Setting up a New UK Tax Group – Mileage (Placeholder) ............................................... 55

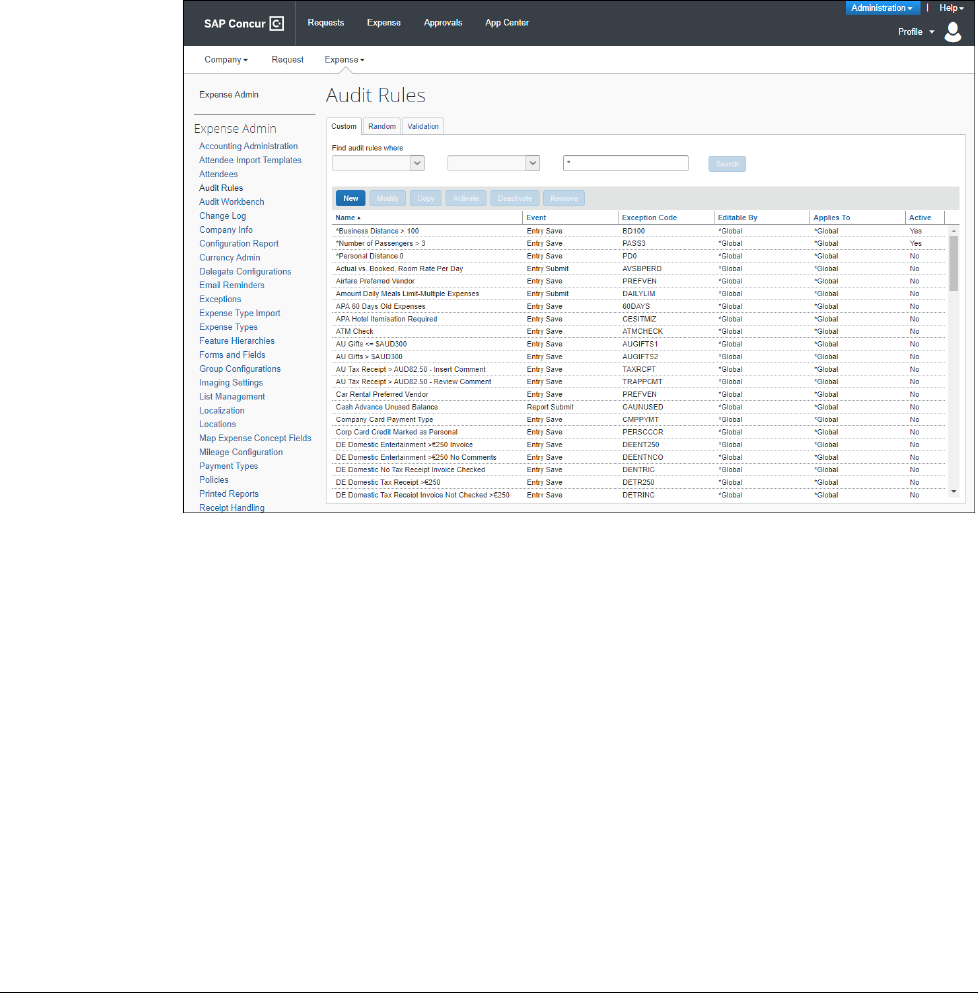

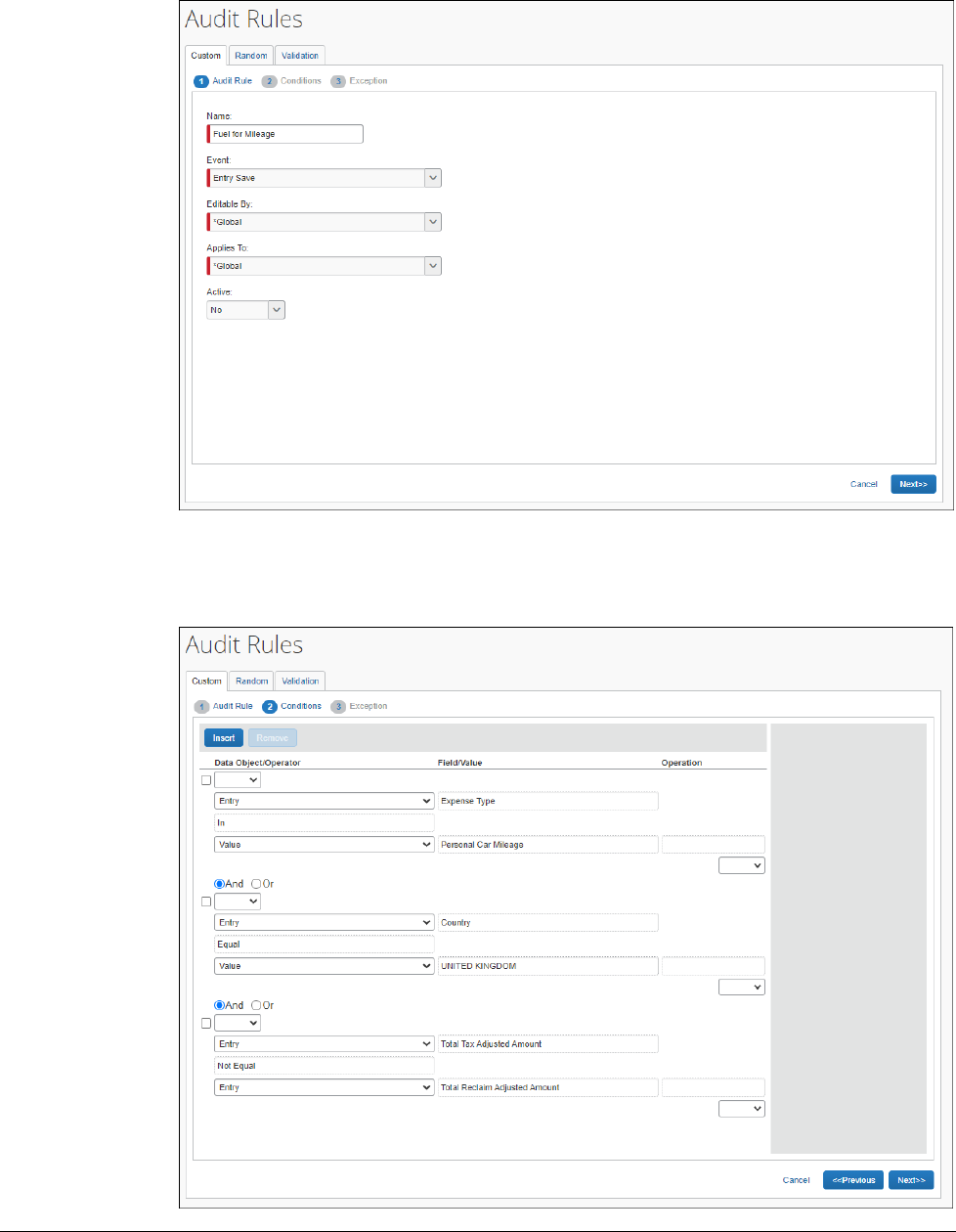

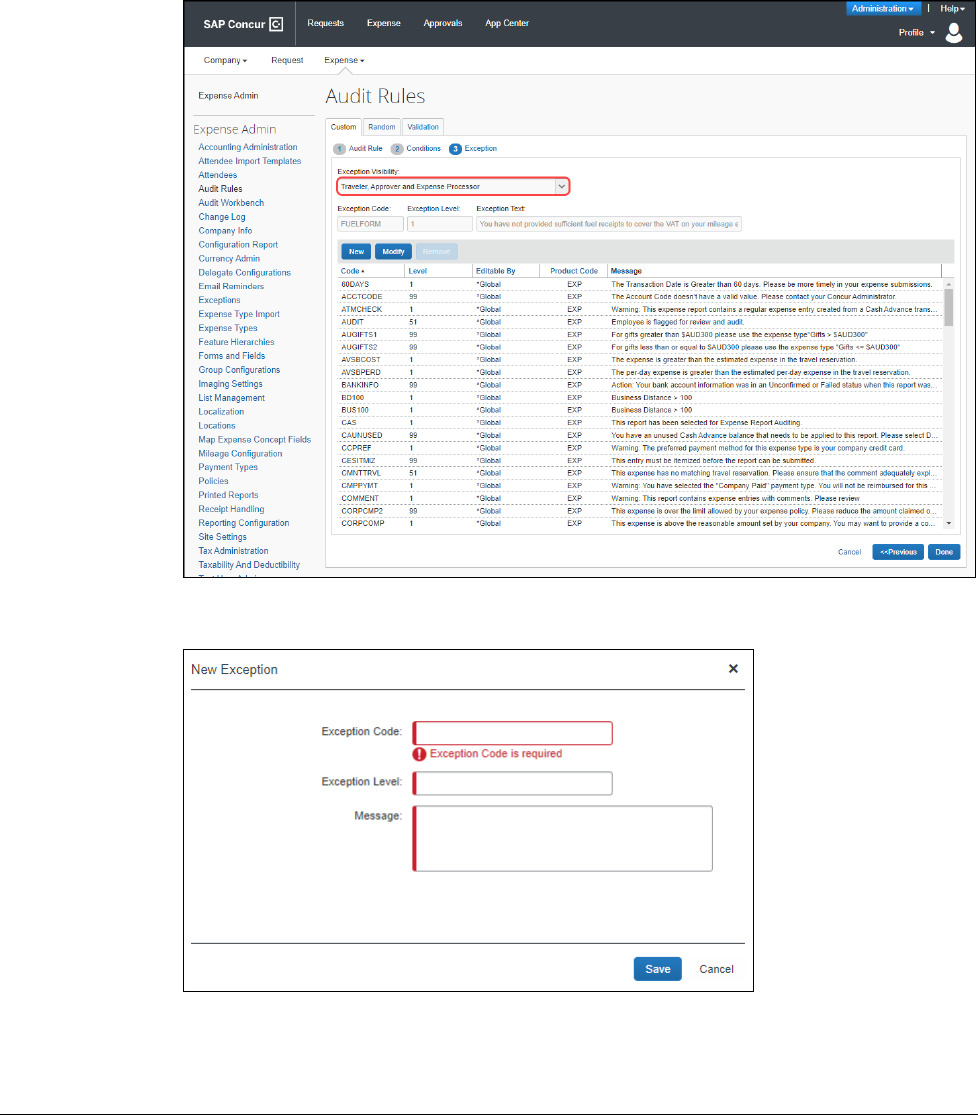

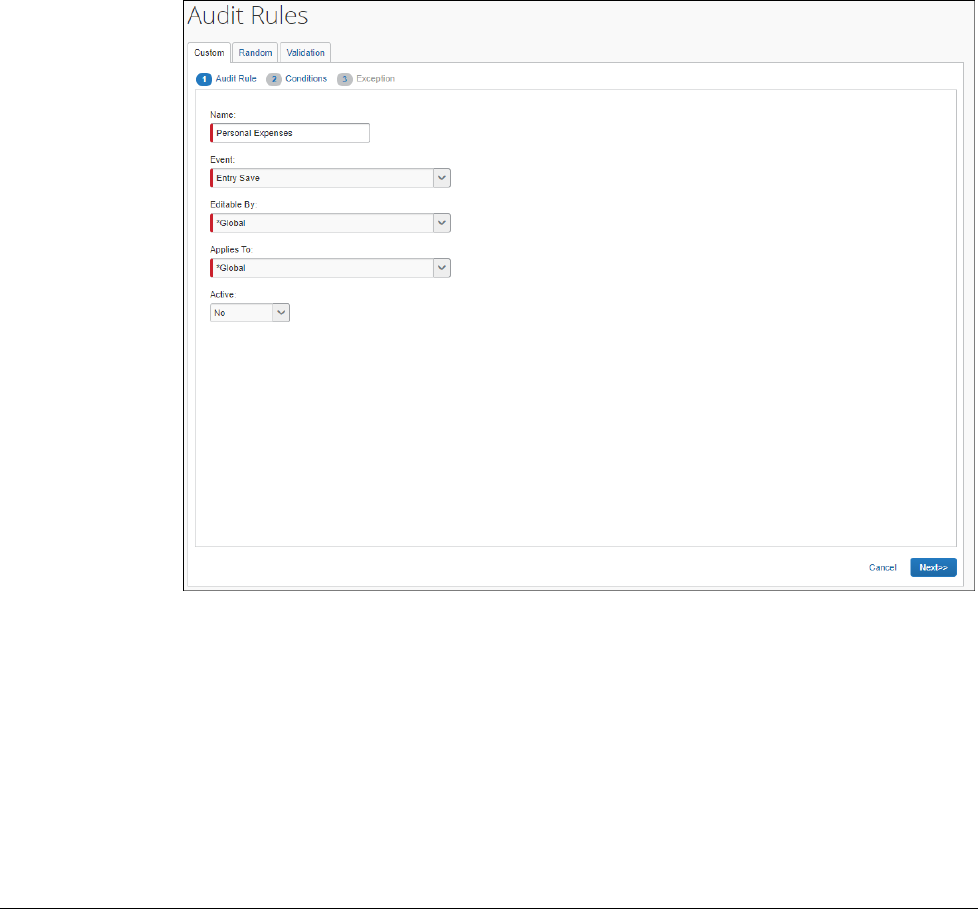

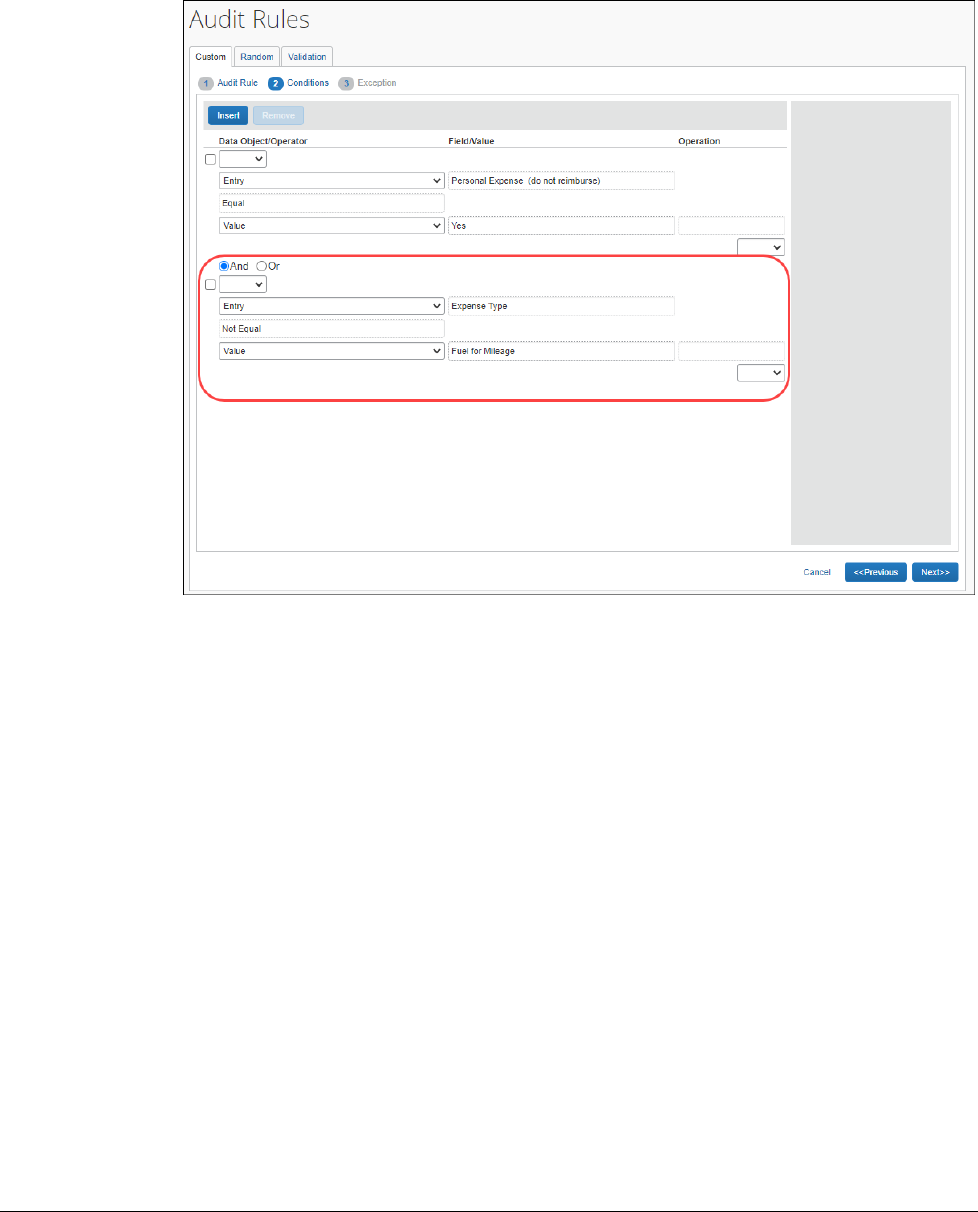

Adding and Updating Audit Rules for Mileage ............................................................... 61

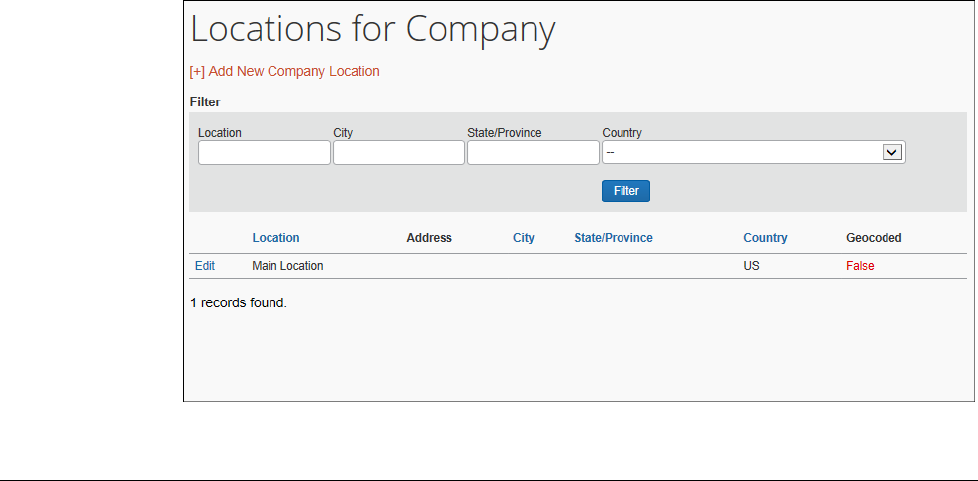

Section 6: Company Locations ................................................................................... 65

Overview................................................................................................................. 65

Geocoding ............................................................................................................... 66

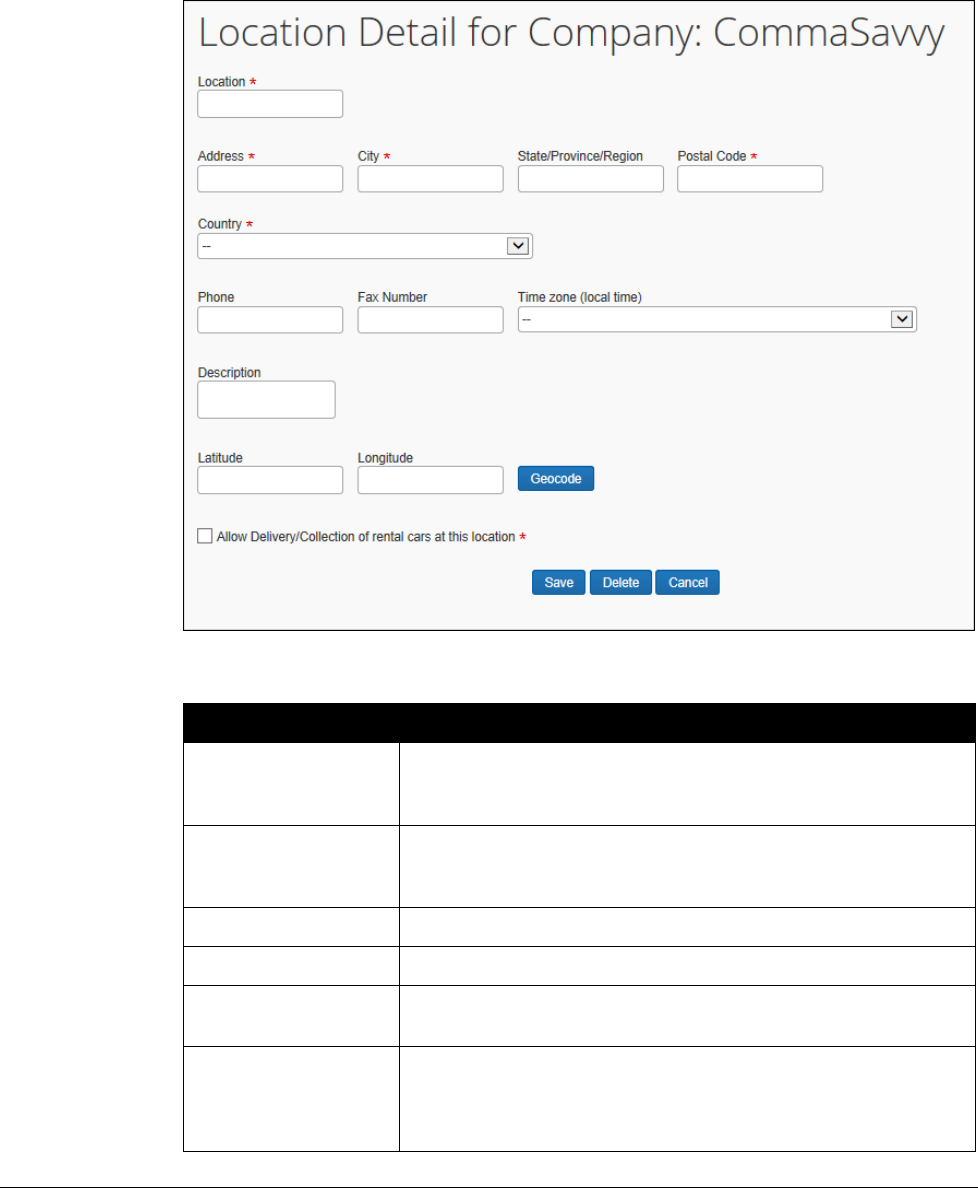

Creating a New Company Location ............................................................................. 66

Editing a Company Location ....................................................................................... 68

Deleting a Company Location ..................................................................................... 68

Concur Expense: Car Configuration Setup Guide iii

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

Revision History

Date

Notes / Comments / Changes

January 8, 2024

Added information about recovering VAT rates in the UK.

August 31, 2022

Removed What the User Sees – Existing UI instructions

January 21, 2022

Updated the copyright year; no other changes; cover date not updated

July 21, 2021

Added a new Fuel for Mileage Configuration Procedures section, which

details the Fuel for Mileage feature and the necessary processes required to

configure Site Settings; additions also include how to create a new expense

type (Fuel for Mileage), entry (Mileage – No Receipt), and a simple list (Fuel

Type); set up a new UK tax group; and add and update Audit Rules.

January 27, 2021

Added information to the Registering Cars section of Section 5: What the

User Sees – NextGen UI that explains how a user must have at least one

registered vehicle.

Added information about the Expense Type list availability for a user with a

registered vehicle in the Creating Car Expenses section of Section 5: What

the User Sees – NextGen UI.

January 6, 2021

Updated the copyright; no other changes; cover date not updated

July 1, 2020

Added information about the existing UI and NextGen UI; made modifications

throughout; cover revision date updated

April 9, 2020

Renamed the Authorization Request check box to Request on the guide’s

title page; cover date not updated

January 2, 2020

Updated the copyright; no other changes; cover date not updated

January 4, 2019

Updated the copyright; no other changes; cover date not updated

April 16, 2018

Added a note to the Creating Car Expenses section, stating that the

payment type always defaults to Cash for mileage expenses.

April 4, 2018

Changed the check boxes on the front cover; no other changes; cover date

not updated

January 4, 2018

Updated the copyright; no other changes; cover date not updated

December 14, 2016

Changed copyright; no other content changes.

October 27, 2016

Updated the Initial Distance field note and removed the Concurforce check

box from the cover.

May 13, 2016

Updated instances of he/she to they.

May 15, 2015

Updated the screen shots to the enhanced UI; no other content changes

January 22, 2015

Added a note that deleting a configuration results in the automatic deletion

of the associated personal cars in Profile

September 24, 2014

Added information about two user interfaces; no other content changes.

April 15, 2014

Changed copyright and cover; no other content changes

February 7, 2014

A passenger rate can now be added to the Company Car type using variable

rates just as it is supported for the Personal Car type

iv Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

Date

Notes / Comments / Changes

November 22, 2013

Added information about using a hierarchical list to assign different mileage

rate reimbursement configurations to different users – this bypasses the

traditional reconfiguration of users under the Group Configurations tool

January 13, 2013

Reimbursement rates are no longer locked, allowing the client to choose

their own reimbursement rate (for example, lower amount of

reimbursement rate or HMRC for reclaim value).

December 28, 2012

Made rebranding and/or copyright changes; no content changes

October 19, 2012

Added information on:

• Update to Google Maps version 3 with this release

• Employee admin role can now view and (optionally) edit and register a

new car on behalf of a user

August 17, 2012

Administrator can force the use of Google Map calculation instead of

manually-mapped route calculation

February 2012

Changed copyright; no content change

December 17, 2011

Availability of Accumulate Mileage By option when configuring for the

variable rate personal or company car

March 18, 2011

Updated Car Configuration to the current user interface

December 31, 2010

Updated the copyright and made rebranding changes; no content changes.

December 2010 (SU62)

Clarify that the country and currency selected for Single and Variable car

configuration reimbursement rates must match the default country and

currency of the employee for whom the car is being configured.

April 2010 (SU54)

Added information on Google Maps integration and Company Locations

February 2010 (SU52)

Added information on car registration form for current user interface

Section 1: Permissions

Concur Expense: Car Configuration Setup Guide 1

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

Car Configuration

NOTE: Multiple SAP Concur product versions and UI themes are available, so this

content might contain images or procedures that do not precisely match your

implementation. For example, when SAP Fiori UI themes are implemented, home

page navigation is consolidated under the SAP Concur Home menu.

Section 1: Permissions

A company administrator may or may not have the correct permissions to use this

feature. The administrator may have limited permissions, for example, they can

affect only certain groups and/or use only certain options (view but not create or

edit).

If a company administrator needs to use this feature and does not have the proper

permissions, they should contact the company's SAP Concur administrator.

Also, the administrator should be aware that some of the tasks described in this

guide can be completed only by SAP. In this case, the client must initiate a service

request with support.

Section 2: Overview

In some organizations, employees use a company car or personal car for business

purposes and are reimbursed for maintenance or mileage as defined by the company

policy.

Expense types such as maintenance and fuel are set up and configured like any other

expense type; however, car mileage is an expense type that has some special

configurations and helper panes associated with it. Submitting a mileage expense

type is a way for the employee to pay for expenses such as maintenance and fuel for

a car used for business purposes. This guide discusses the car mileage configurations

that are supported in Concur Expense.

Concur Expense supports two types of car mileage configurations:

• Company Car: When tracking company car mileage, the employee tracks

distance traveled and is reimbursed for miles traveled multiplied by the rate

per mile. Company car mileage can also be tracked by storing a running total

of distance traveled per car, and then restarting the running total yearly by

entering zero rates and distances. In this case, the employee is reimbursed

for actual expenses. There are two types of company car mileage

reimbursements:

Variable Rates: A rate is defined for every mile traveled. This

configuration supports a single rate and variable rates by rate bands, such

as .20 USD per mile for every mile traveled, or .20 USD per mile when

fewer than 4000 miles are traveled, and .25 USD per mile when 4001

Section 2: Overview

2 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

miles or greater is traveled. The rate is based on specific criteria such as

distance, petrol, diesel, engine size, and so on.

Distance/No Reimbursement: Car expenses are reimbursed at the

actual amount. Expenses may include items such as fuel, maintenance,

and insurance. There is no distance per mile reimbursement.

• Personal Car: A personal car configuration is created when employees use

their own car for business purposes and are reimbursed for items such as

maintenance, gas, and mileage as defined by the company, or are given a flat

rate per mile traveled to cover car expenses. There are two types of personal

car mileage reimbursements:

One Rate: Mileage is reimbursed at a flat rate, such as .20 USD per mile.

Variable Rate: Mileage is reimbursed based on specific criteria, such as

.20 USD per mile when fewer than 4000 miles are traveled, and .25 USD

per mile when 4001 miles or greater is traveled. Rates are based on

distance and other criteria such as petrol, diesel, or engine size.

Both types of mileage configurations are set up and maintained on the Car

Configuration page of Expense Admin.

Concur Expense supports multiple car registration forms to present to users in

Profile, and to user administrators managing cars in User Administration on behalf of

their users. These forms can be used when employees in different countries have

different car mileage reporting requirements. The forms can include additional fields

such as engine size, CO2 emission rate, and dates of circulation. The car registration

forms are set up and maintained on the Forms and Fields page in Expense Admin.

Criteria

Companies reimburse their employees by using various criteria that are associated

with rates, such as .20 USD per mile for engine sizes below 1000cc and .18 USD per

mile for engine size of 1001cc-2000cc. Examples of criteria include:

• Engine size

• Diesel or petrol

• Emissions

• Vehicle type or vehicle value

The criteria used to establish reimbursement rates vary by country and company,

and are dependent on applicable tax laws.

Section 2: Overview

Concur Expense: Car Configuration Setup Guide 3

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

Examples of Car Configurations

A company may choose to create several car configurations to address various

company policies:

• Track odometer readings for all company cars and fully reimburse employees

for car expenses such as fuel and maintenance. To do this, the company

creates a Distance/No Reimbursement car configuration type. This

configuration ensures that the Company Car helper pane appears when the

Company Car Mileage expense type is selected. The helper pane provides a

field for employees to enter odometer start and odometer end readings. The

Distance/No Reimbursement configuration type uses a distance rate

reimbursement of zero.

• Track mileage under 4000 miles, between 4001 and 8000 miles, and over

8001 miles applying a different rate for each category. The company uses the

Company Car Variable Rates configuration type to capture this information.

• Have an employee pay the company in order for the employee to use a

company car. In this case, the company can apply a negative personal rate to

a company car configuration. If the employee enters a mileage expense with

only personal miles, then the amount would be a negative expense, meaning

the employee owes the company money.

• Have all employees in France see a different car registration form so that they

will enter data required by the French government. The company can create a

form with the necessary fields:

CO2 emission

First date of circulation

First date of circulation with the current registration

Horsepower

Energy

Car type (custom field)

Engine Size

Registration Date

Company first date of circulation

End date of circulation

Then the company can create a car configuration for users in France and

select this form.

Section 2: Overview

4 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

Dependencies

Car mileage expense types are dependent on:

• Expense Types defined within Expense Admin: A car mileage expense

type, either Personal or Company, must exist in the system for the mileage

field(s) to appear on the page. Personal Car Mileage and Company Car

Mileage expense types are provided as part of the system and are set to

Active in the default policy. Once a car configuration is created for a group

and country, then the employees who are assigned to the group and country

can select company car and/or personal car expense types from the Expense

helper pane. However, if the expense type has been deleted from the system,

then the expense type will not appear in the expense types list regardless of

whether a car configuration was created.

For more information about configuring expense types, refer to the

Concur Expense: Expense Types Setup Guide.

• Policies within Expense Admin: If a car configuration is created for a

group, the group must be assigned to a policy that has the mileage expense

types active in order for the expense type to appear on the page.

For information about setting expense types to Active, refer to the

Concur Expense: Policies Setup Guide.

Calculations and Amounts

The reimbursement amount calculated by Concur Expense is an estimated amount.

Mileage expense entries in other reports not yet approved or submitted may affect

the current report that contains a mileage expense. The reimbursement amount may

change once the report is submitted.

How Fuel for Mileage is Calculated

The Fuel for Mileage functionality is used to track and reclaim taxes paid for total

miles driven as well as the fuel that was used to travel the distance. The Value-

Added Tax (VAT) reclaim (expense) feature lets the Expense user record on a single

expense report the VAT paid on the fuel used during the mileage journey.

You can check the reimbursement rates applied to your company in Administration

> Expense Settings > Mileage > Personal/Company Car Rates and select the

appropriate country and mileage group. The reimbursement rate is defined by the

engine size and fuel type:

• Petrol: LPG 1400cc or less / LPG 1401cc to 2000cc / LPG Over 2000cc

• Diesel: 1600cc or less / 1601cc to 2000cc / Over 2000cc

Section 2: Overview

Concur Expense: Car Configuration Setup Guide 5

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

UNITED KINGDOM: CALCULATING MILEAGE FOR RECOVERY OF VAT

The UK-based administrator supporting a company and/or users working under UK

regulations must activate the Fuel for Mileage Placeholder configuration by updating

the UK Expense policy, the UK Tax Configuration, and the VAT Receipt Required

Check audit rule to exclude Personal Car Mileage values from the report. Then, the

administrator must make available the Fuel for Mileage expense type for reclaiming

fuel and mileage taxes if not already in use.

NOTE: The user must enter Fuel for Mileage expenses even if the company does not

reimburse the expense, as this is mandatory justification for the VAT

reclaimed for the mileage entries per the UK's HMRC.

Please note the following before configuring for the company car:

• The transaction date for the Fuel for Mileage entry cannot be:

More than 45 days prior to the date of the mileage journey

- OR -

After the date(s) of the mileage journey

• The Receipt Status field in the Fuel for Mileage entry must be set to Tax

Receipt

• The fuel type must match the engine type of the vehicle being used (diesel or

petrol)

• The country of purchase in the Fuel for Mileage entry must be the same as

the user’s country of residence

The Fuel for Mileage expense type must be assigned to the Standard tax group, while

the Personal and Company Car mileage expense types are assigned to the Mileage

tax groupFormula to calculate UKVAT Amount

UKVAT = VAT - Potential VAT = ( Distance * AFR ) - ( Distance * AFR / 1.2 )

EXAMPLE:

Given:

• PETROL 1401cc to 2000cc

• Distance 178 Miles

• Company AFR: 45 pence = 0.45 GBP / Mile

• UK Gov AFR: 14 pence = 0,14 GBP/Mile

You may use one of two options to calculate your UK VAT Amount:

1. Using the UK GOV AFR = £0.14 per Mile Distance 178 M

UKVAT = VAT - Potential VAT

UKVAT = ( D * AFR ) - ( D*AFR / 1.2)

Section 2: Overview

6 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

£4.15 = (178*0,14) - [(178*0,14)/1.2]

£4.15 = 24.92 - (24.92/1.2) = 24.92 - 20.76

2. Using your Company Mileage Rate / Client AFR = 0.45 GBP per Mile Distance

178 M (note this calculation does not correspond with HMRC guidance)

UKVAT = VAT - Potential VAT

UKVAT = ( D * AFR ) - ( D*AFR / 1.2 )

£13.35 = (178*0,45) - [(178*0,45)/1.2]

£13.35 = 80.1 -(80.1/1.2) = 80.1 - 66.75

You can change manually the amount shown in the UK VAT Amount in GBP field

but remember per the HMRC guidance the correct AFR is £4.15 and not £13.35

Company Car - Variable Rates

Note the following:

• If there was no distance limit, then the Amount field is calculated as:

Rate * Business Distance + Personal Rate * Personal Distance.

- PLUS -

Business Miles * No. of Passengers * Additional Passenger Rate

• If there is a distance limit or limits, then the Amount field is calculated as:

Rate Under Limit * Business Distance under limit + Rate Over Limit *

Business Distance over limit + Personal Rate * Personal Distance

- PLUS -

Business Miles * No. of Passengers * Additional Passenger Rate

NOTE: Calculating Distance under limit is only an estimate until the report is

submitted, and then the Amount of Company Car entries may be updated.

Personal Car

Note the following:

• If there was no distance limit (one fixed rate), then the Amount field is

calculated as:

(Rate + (Rate Per Passenger * Number of Passengers)) * Distance

• If there is a distance limit or limits, then the Amount field is calculated as:

(Rate Under Limit + (Rate Per Passenger * Number of Passengers)) *

Distance under limit + (Rate Over Limit + (Rate Per Passenger * Number of

Passengers)) * Distance over limit

Section 2: Overview

Concur Expense: Car Configuration Setup Guide 7

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

NOTE: Calculating Distance under limit will only be an estimate until the report is

submitted, and then the Amount of Personal Car entries may be updated.

Calculating Mileage Using Google Maps

Concur Expense has integrated with Google Maps to allow users to enter mileage

expenses using the Google Maps interface. Note the following about this feature:

• The user can optionally select start and end points, and waypoints in

between, for each mileage expense

- OR -

The administrator can enforce use of Google Maps route calculator for

defining start, end and waypoints

• The locations entered by the user are stored and can be accessed again using

a Most Recently Used list.

• Users can modify the distance on the Mileage expense entry.

• Company locations can be entered and listed for the user to choose from.

Refer to the Company Locations section of this guide for more

information.

• The commute distance for the user can be subtracted from the mileage

expense. Commute distance is calculated using the user’s home address value

and the company location value.

• Audit rules can identify when the mileage has been edited to exceed the

calculated amount, and whether the commute distance has been deducted.

Refer to the Concur Expense: Audit Rules Setup Guide for more

information.

• The Google Maps integration feature can be activated per car configuration.

Refer to the Modifying Car Configurations section of this guide for

more information.

• The Commute Deduction feature can be activated for car configurations that

have Google Maps integration activated.

Refer to the Modifying Car Configurations section of this guide for

more information.

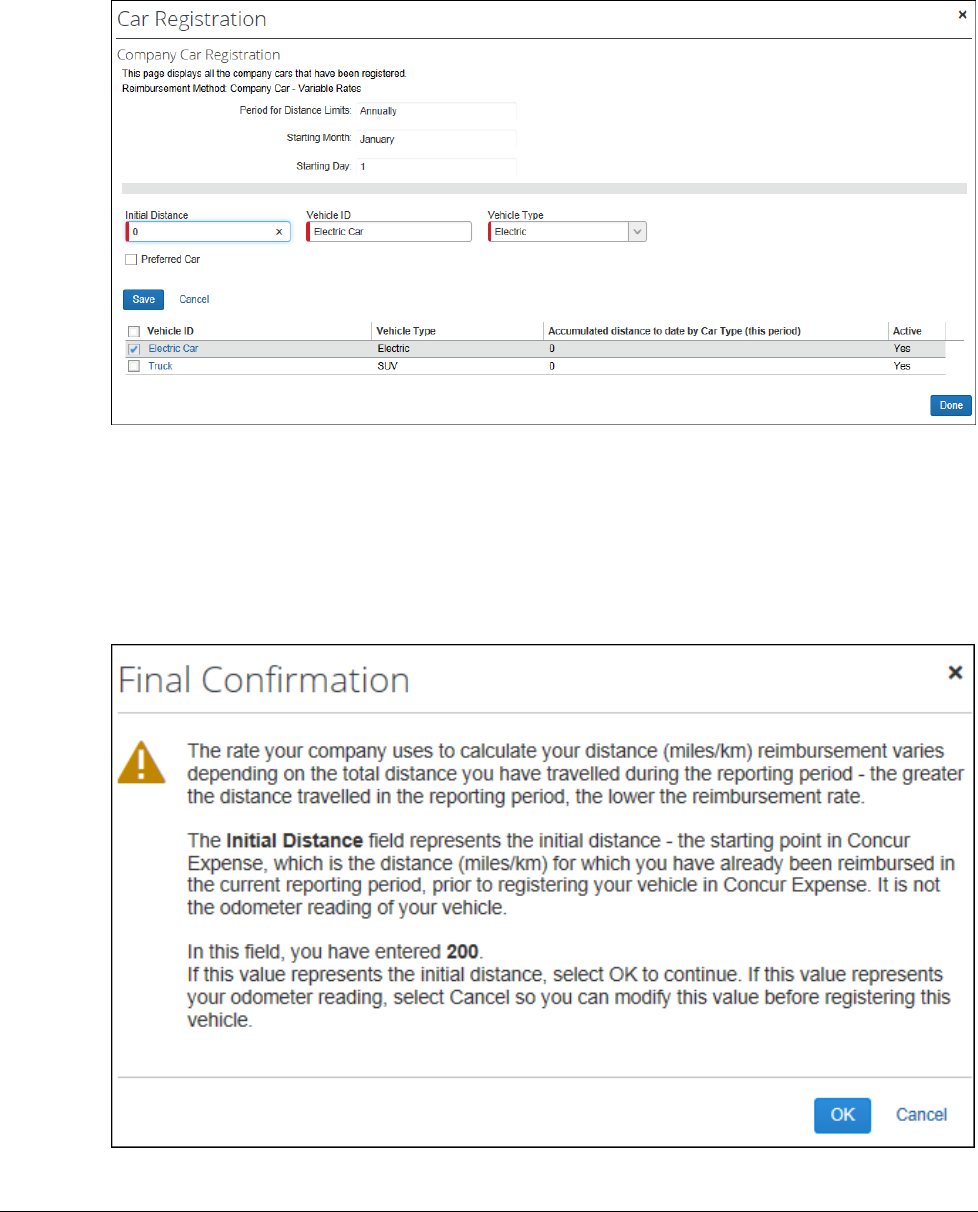

Setting Initial Distance

The Initial Distance field represents the odometer reading for the employee's car

that is the accumulated distance within the reporting period, or the point when the

employee begins using Concur Expense, depending on the car and rate type, variable

or fixed. Capturing this information ensures that the correct rate is applied to the

employee's car expense, when rates are based on miles or kilometers.

Section 2: Overview

8 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

NOTE: If an incorrect Initial Distance figure is entered, the Employee administrator

may have rights to correct the figure, but the Initial Distance figure can only

be modified if there are no expenses created for the car yet. Once an expense

is created for the car, the initial distance cannot be modified.

This data is intended to capture the mileage of the newly configured car at a

point within a company's reporting period cycle. This is different from the current

overall mileage of the car. For example, if a new employee has already put 800 miles

on their car in the current reporting cycle and been reimbursed for that mileage

outside of Expense, Concur Expense needs the mileage (800 miles) so that

additional mileage is correctly calculated. In this case, if the employee adds another

201 miles to the car, 200 miles can then be calculated at the Up to 1000 miles" rate

while the single mile left over can now be correctly calculated at the correct rate for

"Over 1,000 miles". If this scenario is not applicable, the employee should just set

the initial distance as 0.

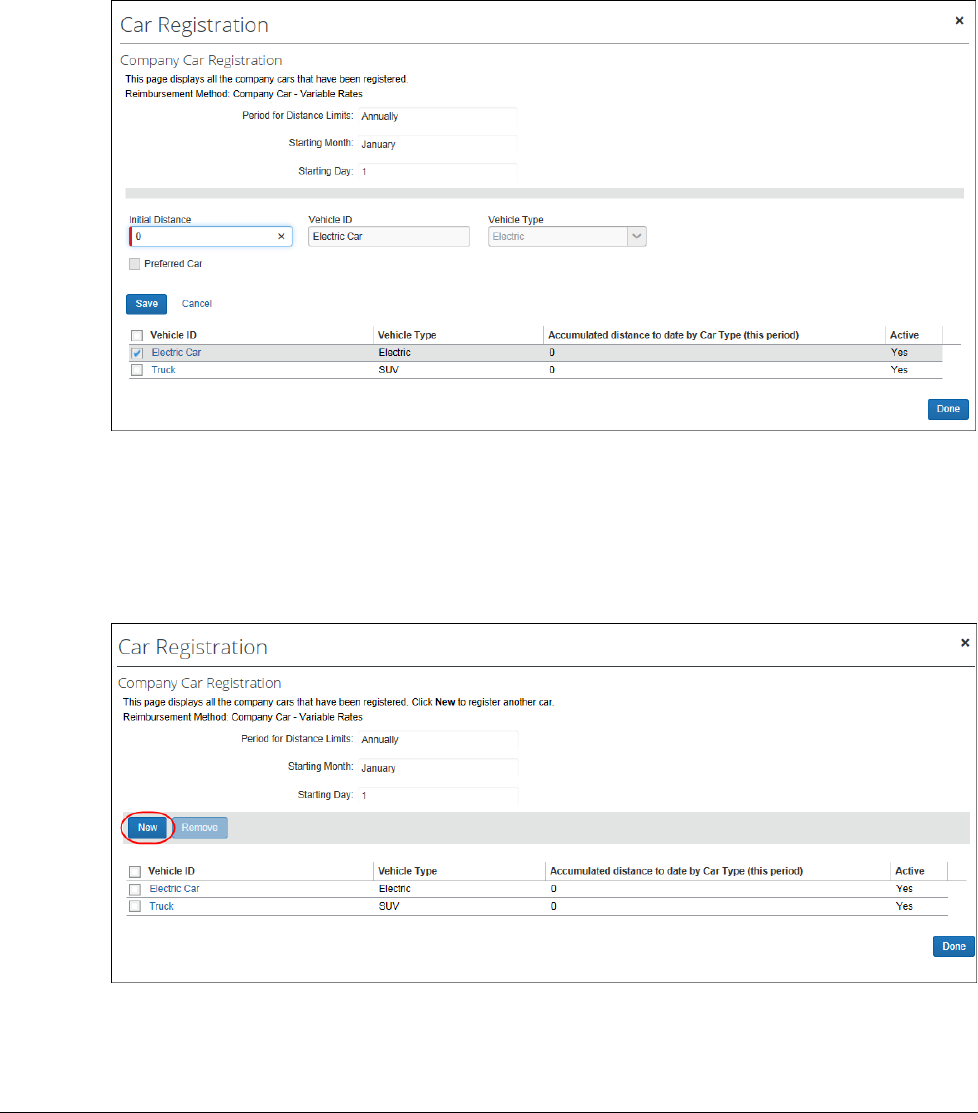

An Initial Distance field may appear for first-time registration of a personal or

company car when the employee clicks the New button on the Company Car

Registration page in Profile.

NOTE: The Initial Distance field is not intended for the car's current odometer

reading. It is the accumulated distance within the reporting period that

has been reimbursed using other means. This number is the distance to date

for the reporting period.

Journal Entries

Journal Entries are created for Company Car Mileage entries. In cases where both

business miles and personal miles have been accrued, two journal entries are

created. Journal Entries are also created for Personal Car Mileage entries.

Default Configurations

Several car configurations may be included with your system by default. The

configurations are provided as guidelines. You may use them as defined, or edit

them to meet the specific needs of your organization.

Car Registration Form Configuration Process

Administrators can create custom forms for use when users register cars. The

custom forms allow clients to gather additional data about the cars, and are most

often used to meet European regulatory requirements. The forms are created then

selected for each car configuration.

The configuration process is:

3. In List Management:

Section 3: User Experience

Concur Expense: Car Configuration Setup Guide 9

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

If you will be using the Energy list field, you must create the associated

list.

Refer to the Shared: List Management Setup Guide for more

information.

4. In Forms and Fields:

Create the desired forms to use for car registration.

Add the desired fields to the forms.

Refer to the Concur Expense: Forms and Fields Setup Guide for more

information.

5. In Car Configuration:

Create or update the car configuration, selecting the desired car

registration form.

Section 3: User Experience

Once a car configuration is set up within the Expense Admin, the employee is

affected in two ways:

• Generally, the user must register their car in Profile before the user can

create a car expense.

Exception: The employee does not need to register a car in Profile if the

configuration they use is the Personal Car One Rate configuration type. This is

because the reimbursement rate is the same for all cars – it is not dependent

on specific criteria such as engine size or vehicle type.

• When an employee creates a mileage expense, they are presented with the

appropriate fields to ensure the correct information is gathered.

Registering Cars

The employee registers their car by using the Personal Car or Company Car link in

Profile. Their user administrator uses the User Administration page to register a car

on behalf of the employee they are administrating for.

• The Personal Car link only appears if the Personal Car Configuration is set

up with a variable rate for the group and country to which the employee is

assigned. The Personal Car link does not appear if the Personal Car One

Rate configuration type has been created.

• The Company Car link appears if there is a Company Car Configuration set

up for the group and country to which the employee belongs regardless of the

type of company car configuration specified.

Section 3: User Experience

10 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

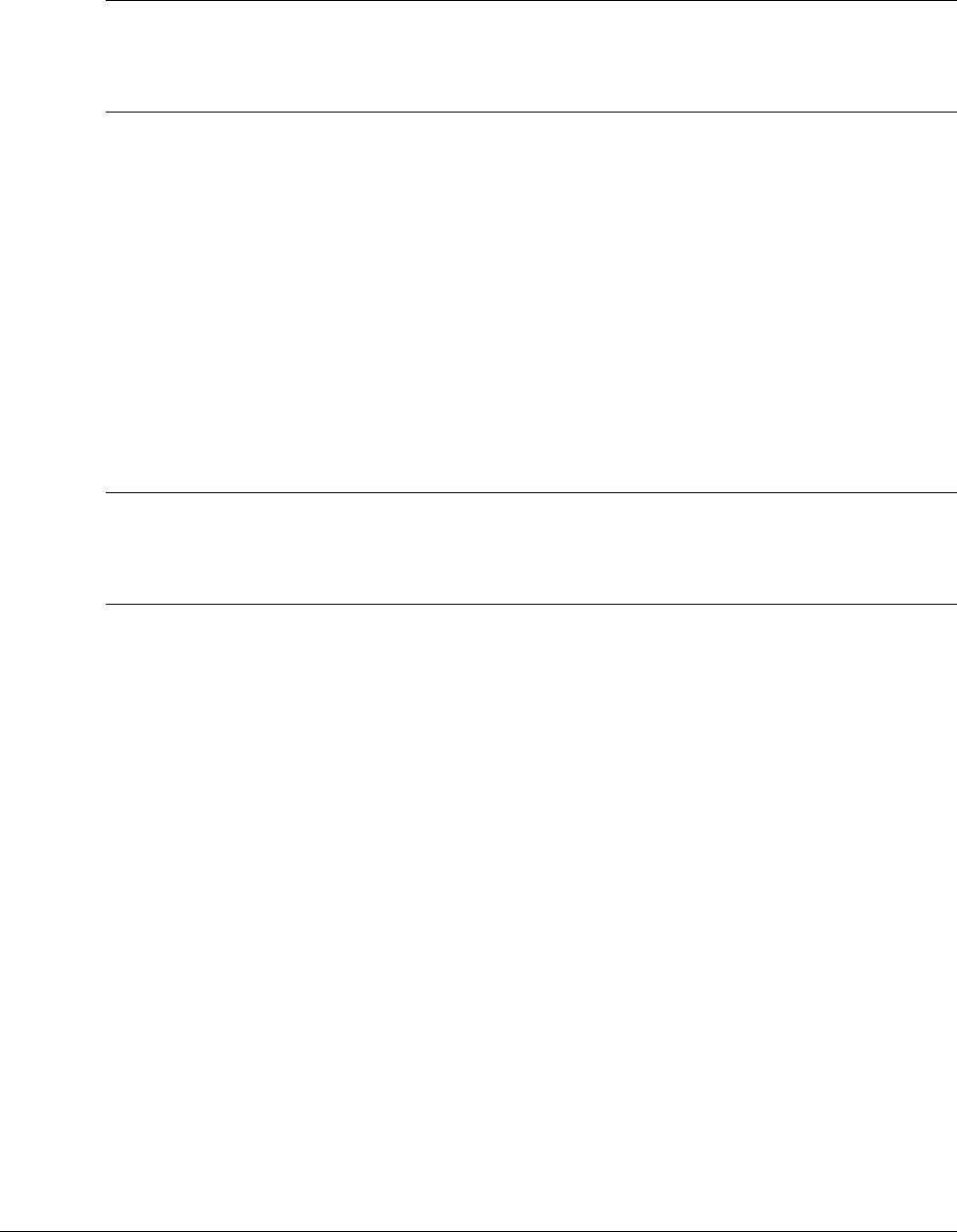

When selected, the user is presented with the car registration form. The fields

displayed are configured for each car configuration:

NOTE: Users must have at least one registered vehicle associated with their profile to

access the Expense List. This requirement also affects what a NextGen UI

user sees in the NextGen User Interface (UI) in the Expense Type list. For

more information, refer to the NextGen Expense – Expense Type List section.

To register a car in Profile, the employee completes or chooses:

• Car criteria such as engine size, car type, and emission value depending on

the car configuration criteria and form that are selected.

• Distance traveled during the current period if mileage expenses were incurred

and reimbursed before registering the car. Initial Distance is applicable only

the first time Concur Expense is used and the employee has incurred

reimbursable mileage expenses for the current period.

• Any additional fields configured for the form.

Section 3: User Experience

Concur Expense: Car Configuration Setup Guide 11

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

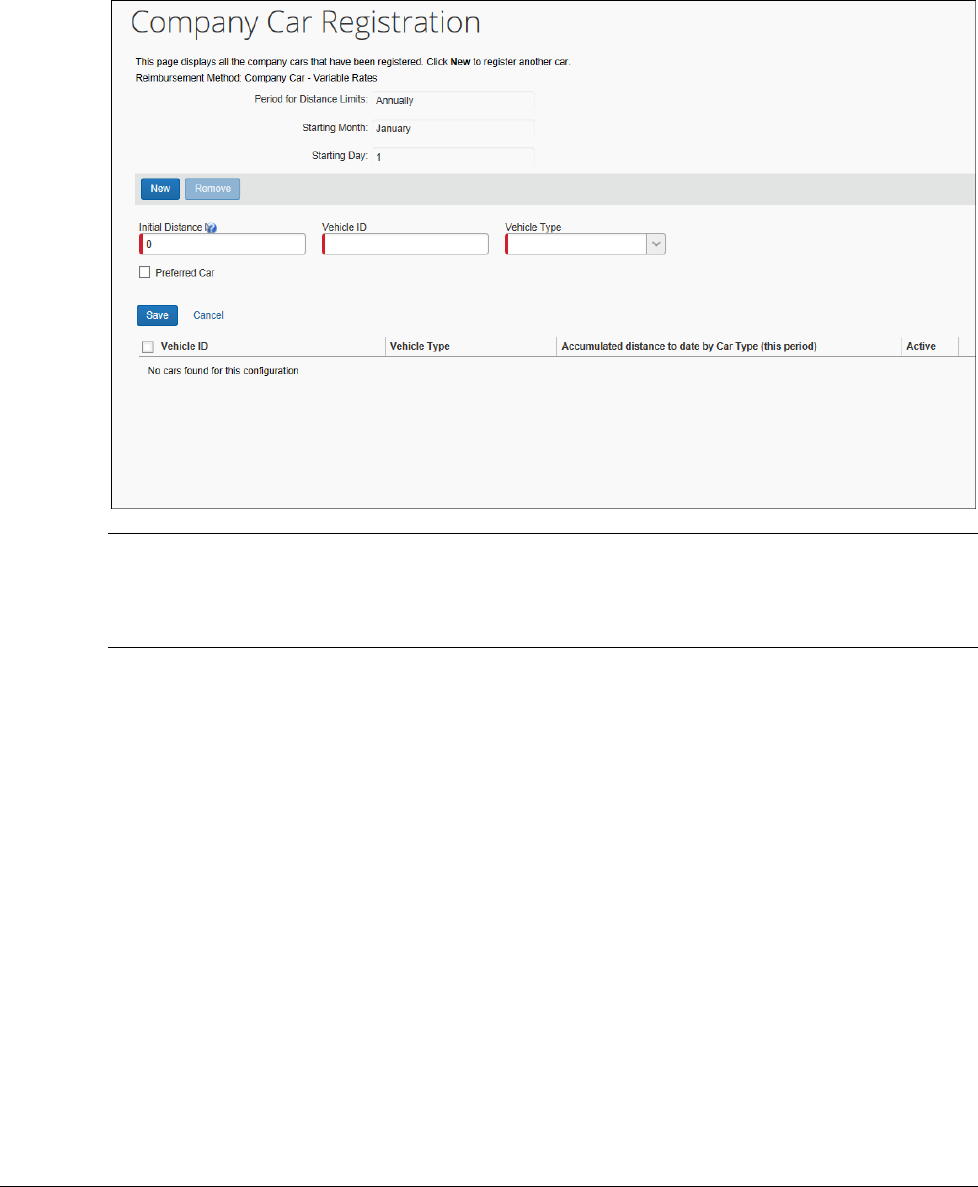

Preferred Car

The user can select one personal and one company car as their Preferred Car, using

the check box on the car registration form.

This car will be the default vehicle selected when the user creates a Mileage expense

entry.

Section 3: User Experience

12 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

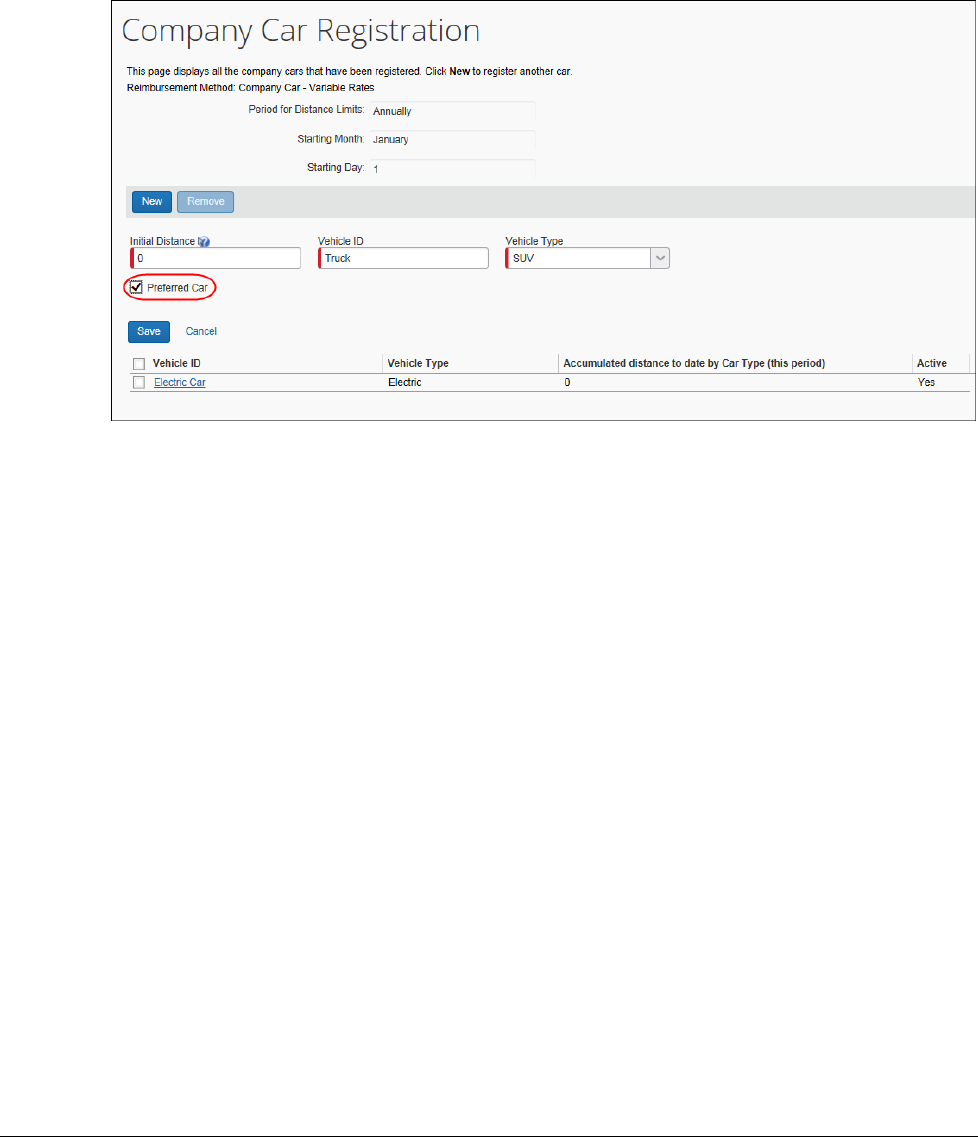

Creating Car Expenses

When the user creates a car expense, the appropriate fields are displayed (based on

the configuration) to ensure that the user enters the correct information. For

example, the From Location and To Location fields and Mileage.

NOTE: The reimbursement amount is only an estimate. Mileage expense entries in

other reports not yet approved or submitted may affect the current report

that contains a mileage expense. The reimbursement amount may change

once the report is submitted.

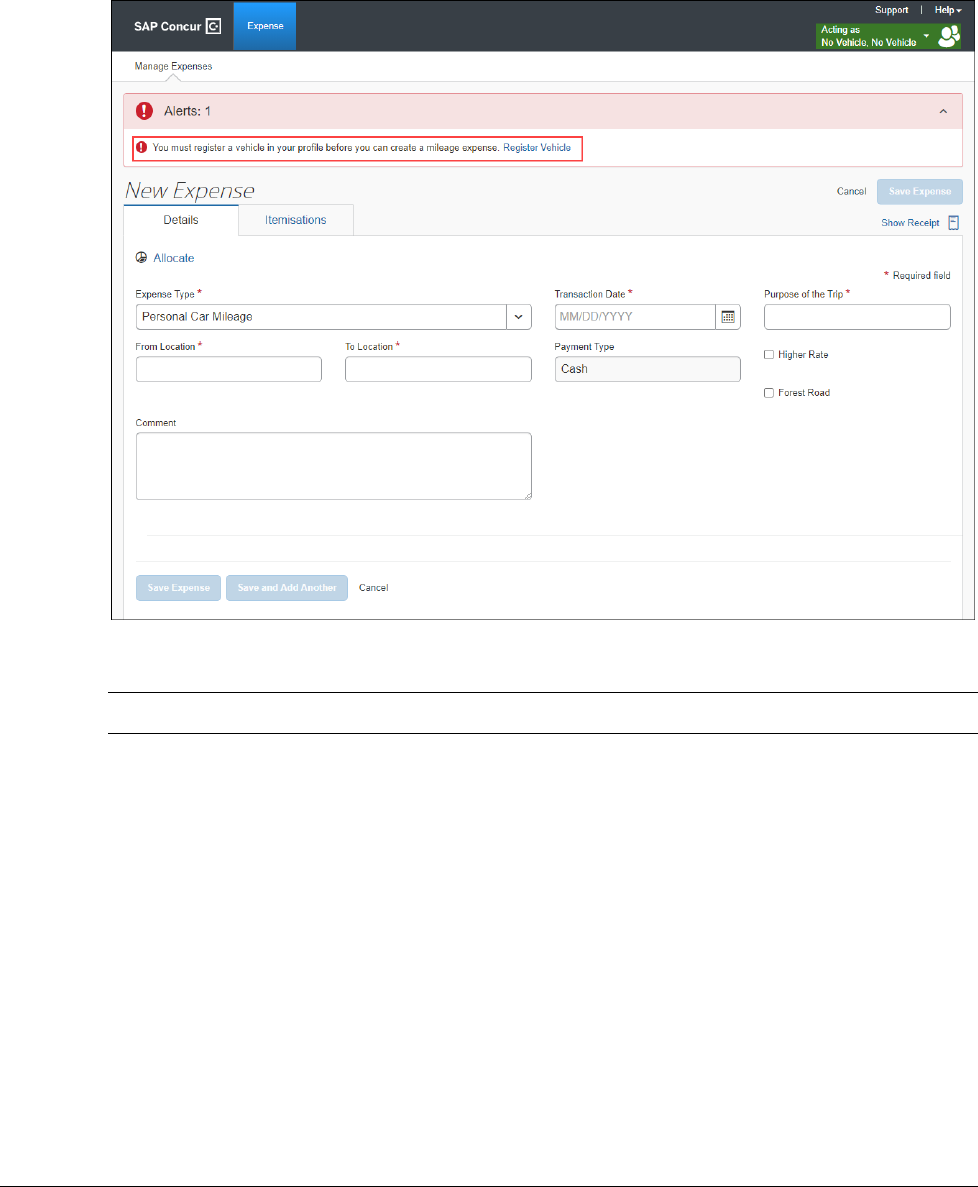

If a user has at least one registered vehicle associated with their profile, they will see

mileage expense types in the Expense Type list when creating a new expense.

NOTE: If a NextGen Expense user does not have a registered vehicle associated with

their profile, mileage expense types will not display when creating an

expense.

Section 3: User Experience

Concur Expense: Car Configuration Setup Guide 13

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

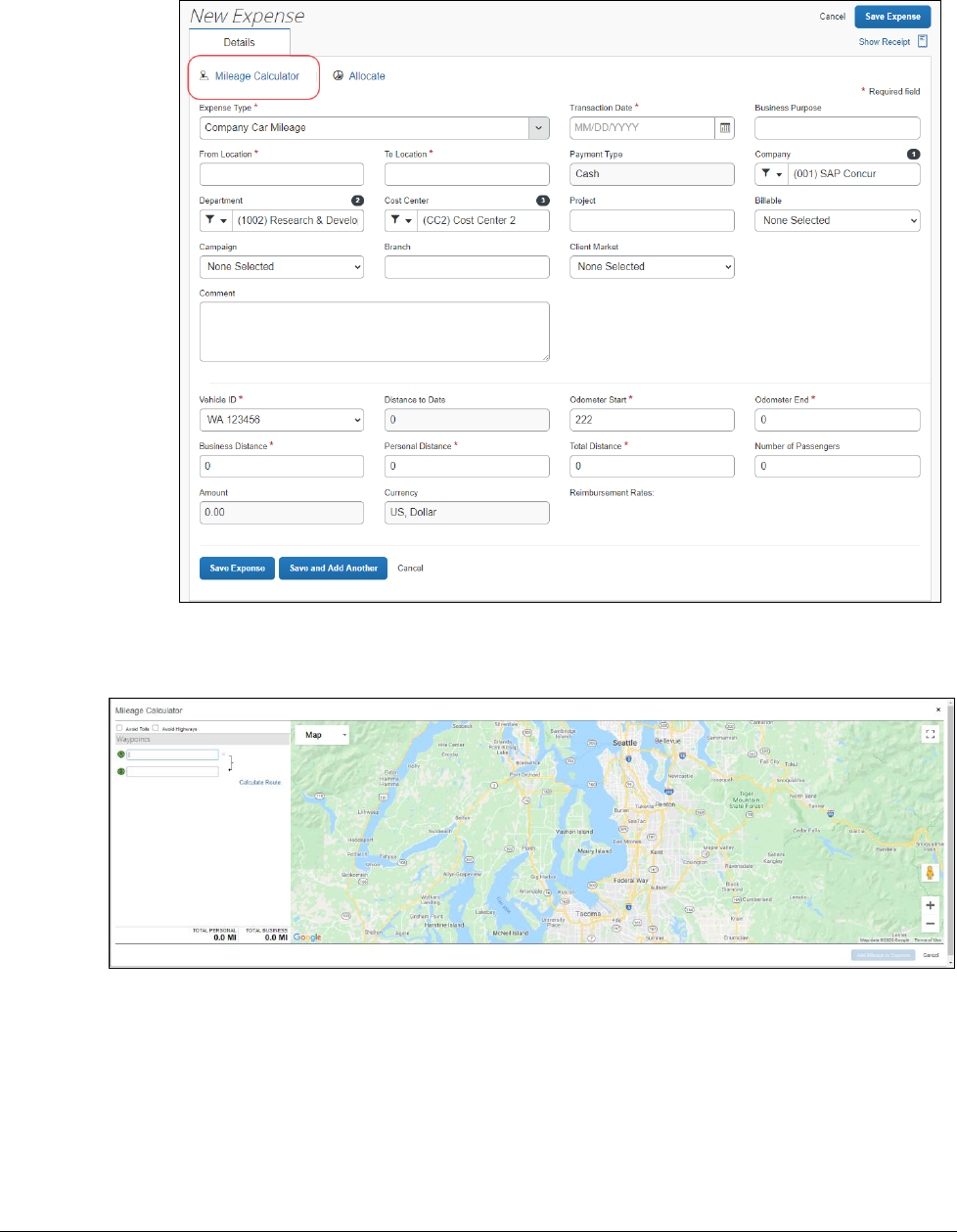

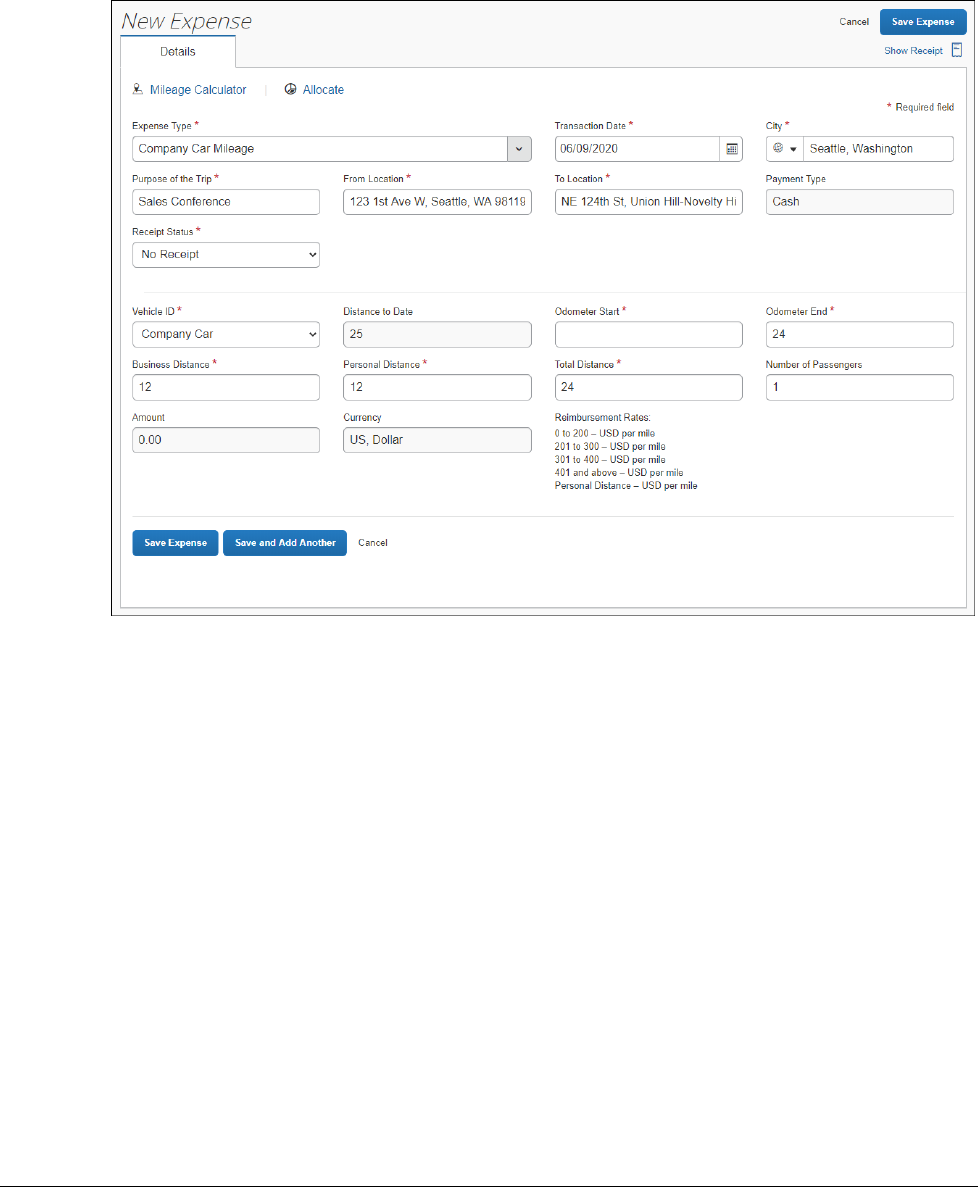

This end-user screen sample shows what the New Expense page looks like when

the user profile has a registered vehicle:

NOTE: The payment type always defaults to Cash for mileage expenses.

Calculating Mileage using Google Maps

Administrators can set Car configurations to use Google Maps for mileage calculation.

When this feature is enabled, one of two actions occur when entering car mileage:

• The Mileage Calculator link option is available and can be used to populate

the From Location and To Location fields

• The Mileage Calculator window appears automatically, and the user is

restricted from using the From Location and To Location fields, forcing

mileage entries calculated using the calculator

Section 3: User Experience

14 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

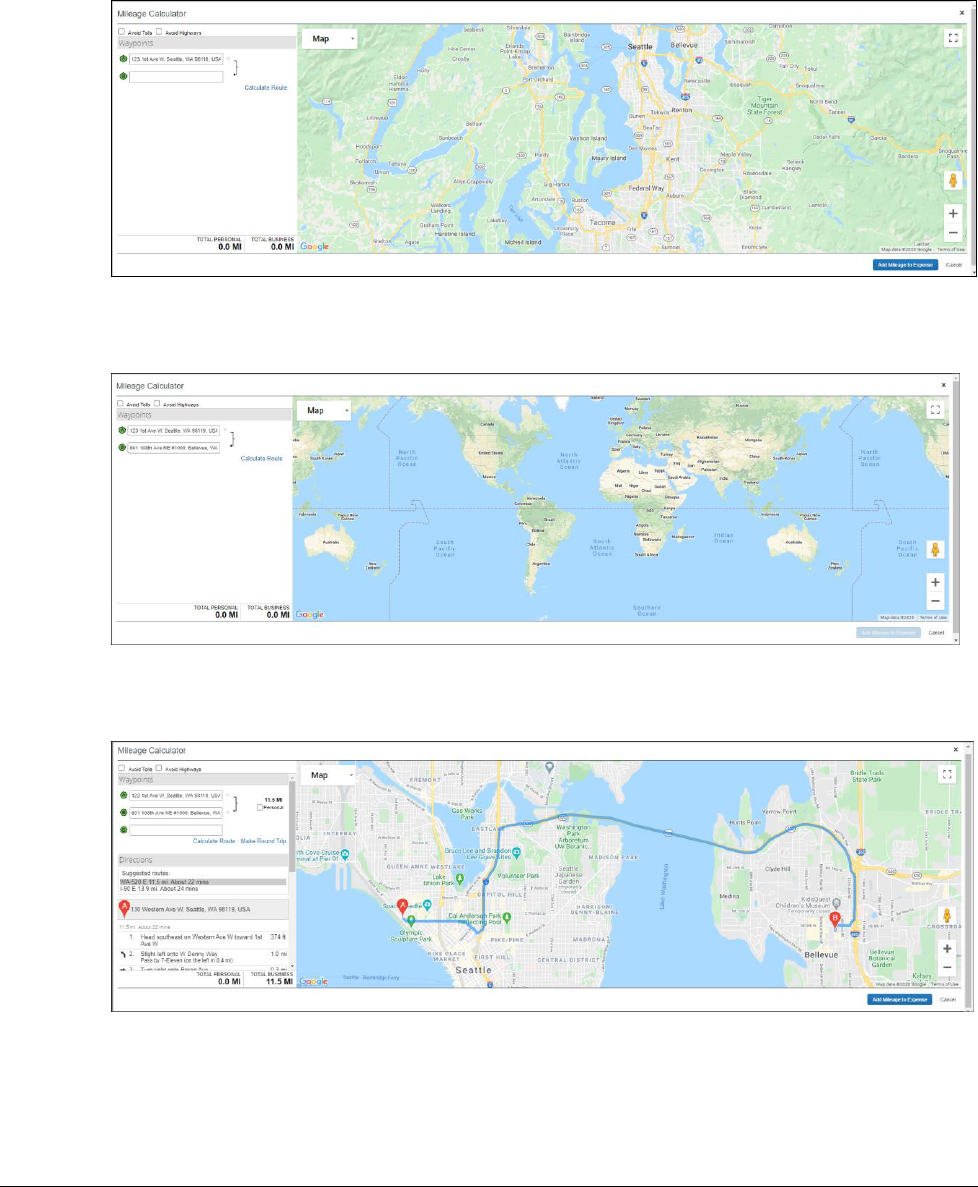

When they click the button, a window with a Google Maps interface appears, allowing

them to enter the start and end points for their trip:

Section 3: User Experience

Concur Expense: Car Configuration Setup Guide 15

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

If the user has a Home Address configured, the first waypoint will default to that

address:

When the user starts entering text, the configured Company Locations and Most

recently used addresses appear:

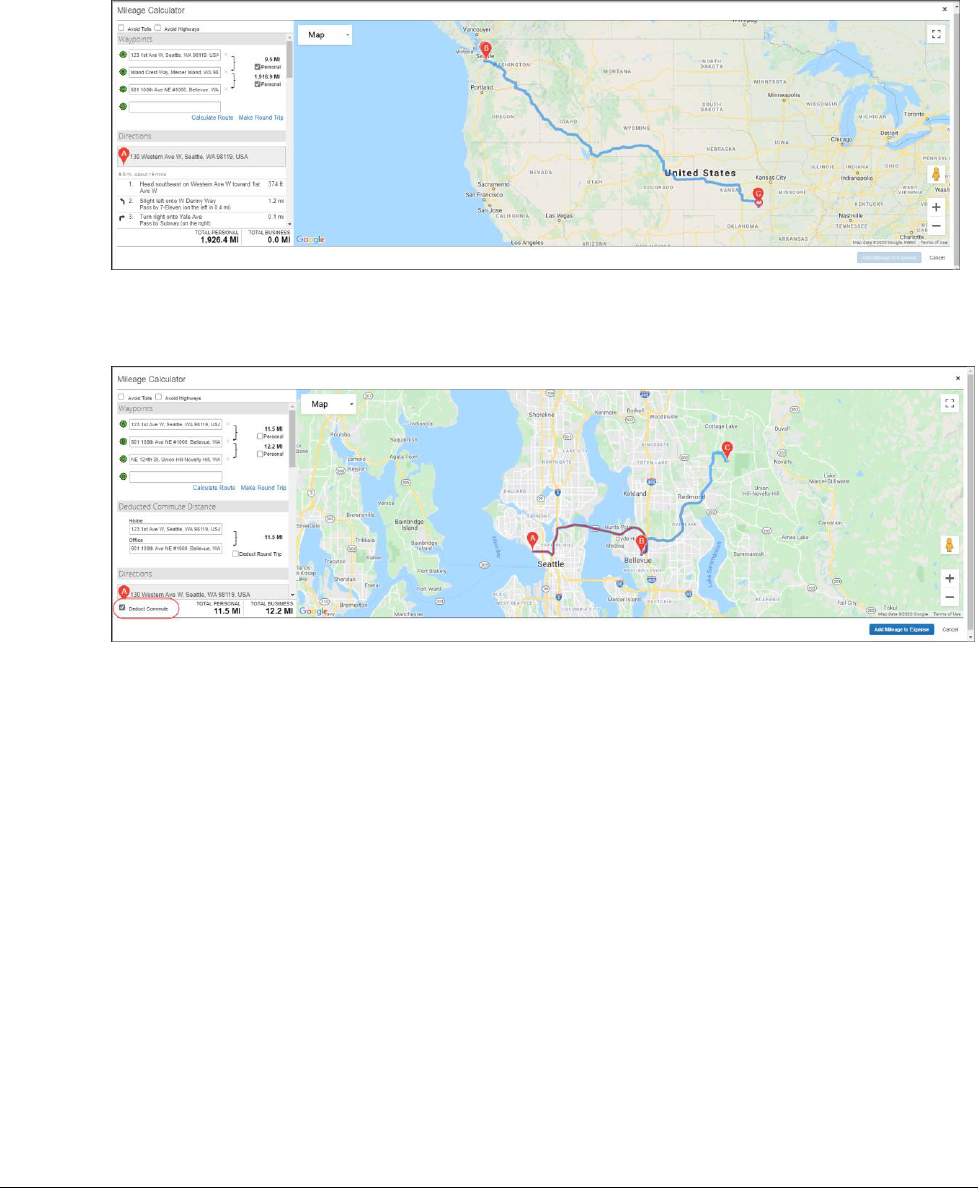

Once the user has entered two waypoints, the mileage is calculated at the bottom of

the screen:

Section 3: User Experience

16 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

The user can mark individual waypoints as Personal. Their mileage is deducted from

the reimbursable amount:

If the car configuration is set to allow deduction, the user can click Deduct

Commute to subtract their commute from the mileage:

Section 3: User Experience

Concur Expense: Car Configuration Setup Guide 17

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

When finished, the user clicks Add Mileage to Expense and the values are

transferred to the expense entry:

Approvers

An approver cannot partially reject a personal car mileage expense, nor can they

change the amount of the expense or any information that was provided by the

employee by using the mileage helper. Depending on the configuration, the approver

may be able to change the Type of Trip and Receipt Status fields, if available and

if appropriate.

User Administrator: Managing Cars on Behalf of an Employee

The user administrator can view, and optionally edit and/or register a car on behalf

of the employee they are administrating. This is done using the Personal Car and/or

Company Car links made available to the user administrator through the User

Administration page. The user administrator selects a user to manage and uses

these links to open the identical car configuration page the user sees through their

Profile access to car configuration.

Section 3: User Experience

18 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

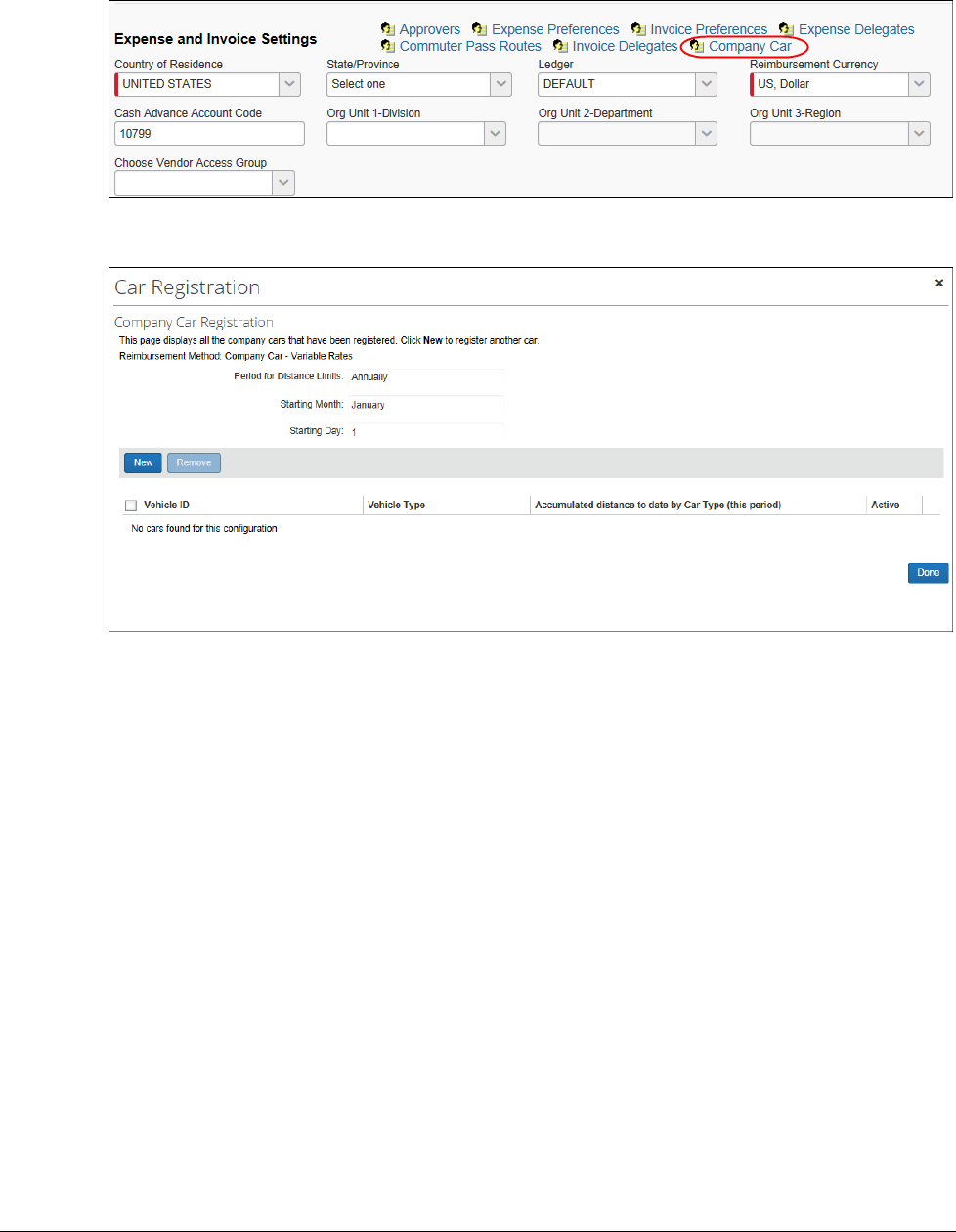

When they click the link, the Car Registration page appears.

The user administrator has permissions to view the car configuration, but may be

restricted from editing an existing car, or registering a new car for the user. For

example, the figure above shows the New button which is available to the

administrator based on selection of the Allow user administrator to add car setting

available during the initial car configuration setup.

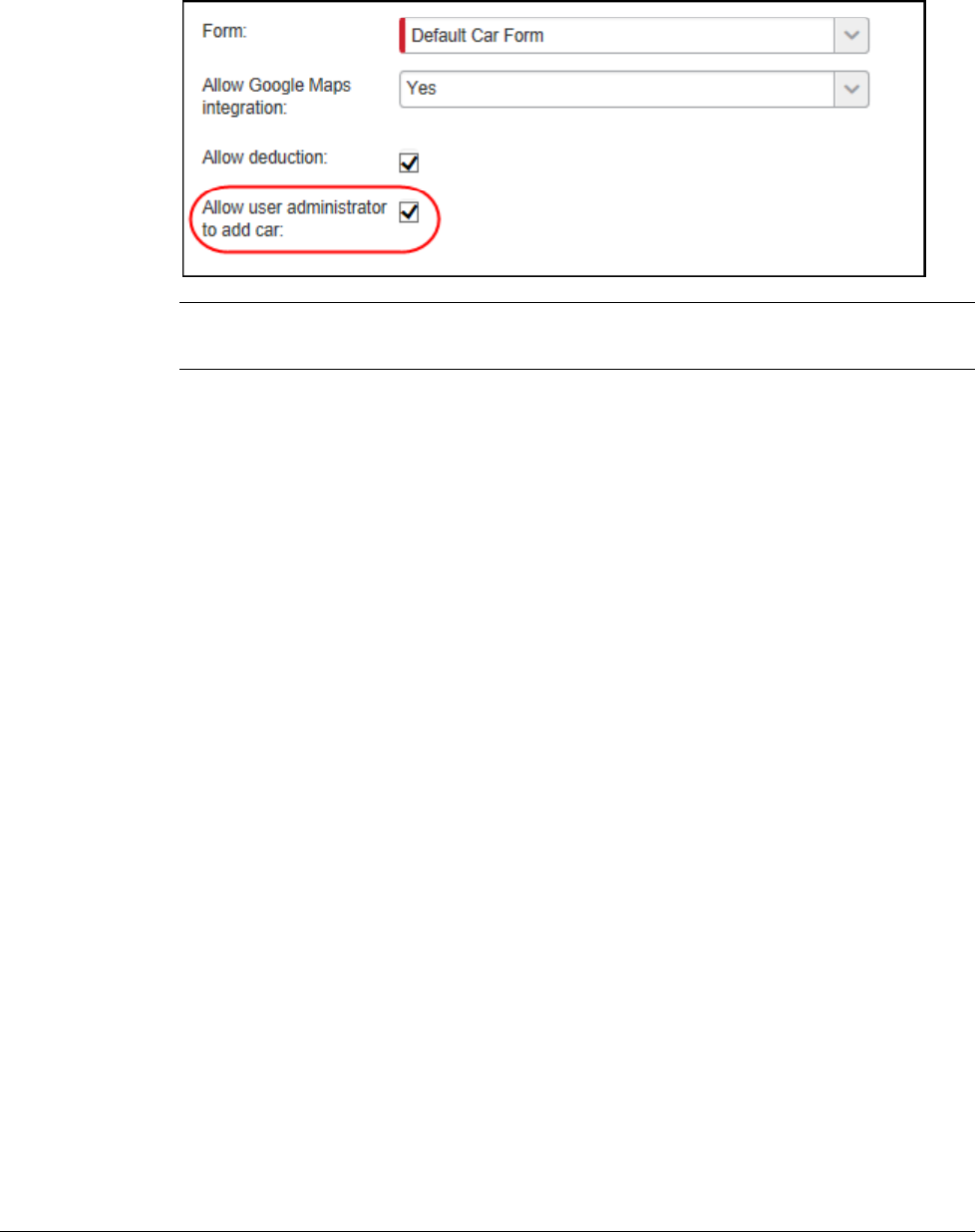

Enabling and Restricting Car Configuration for the User Administrator

A user administrator can be restricted from using selected areas of car registration

options. Permissions are granted as follows:

• Permissions to Register a Car: If the Allow user administrator to add car

setting is selected in Car Configuration, the administrator will see the New

button in the Car Registration page and may use this to add another car on

behalf of the user

Section 3: User Experience

Concur Expense: Car Configuration Setup Guide 19

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

NOTE: This setting can be different for each car configuration, allowing

selective administrator access to cars based on the car configuration.

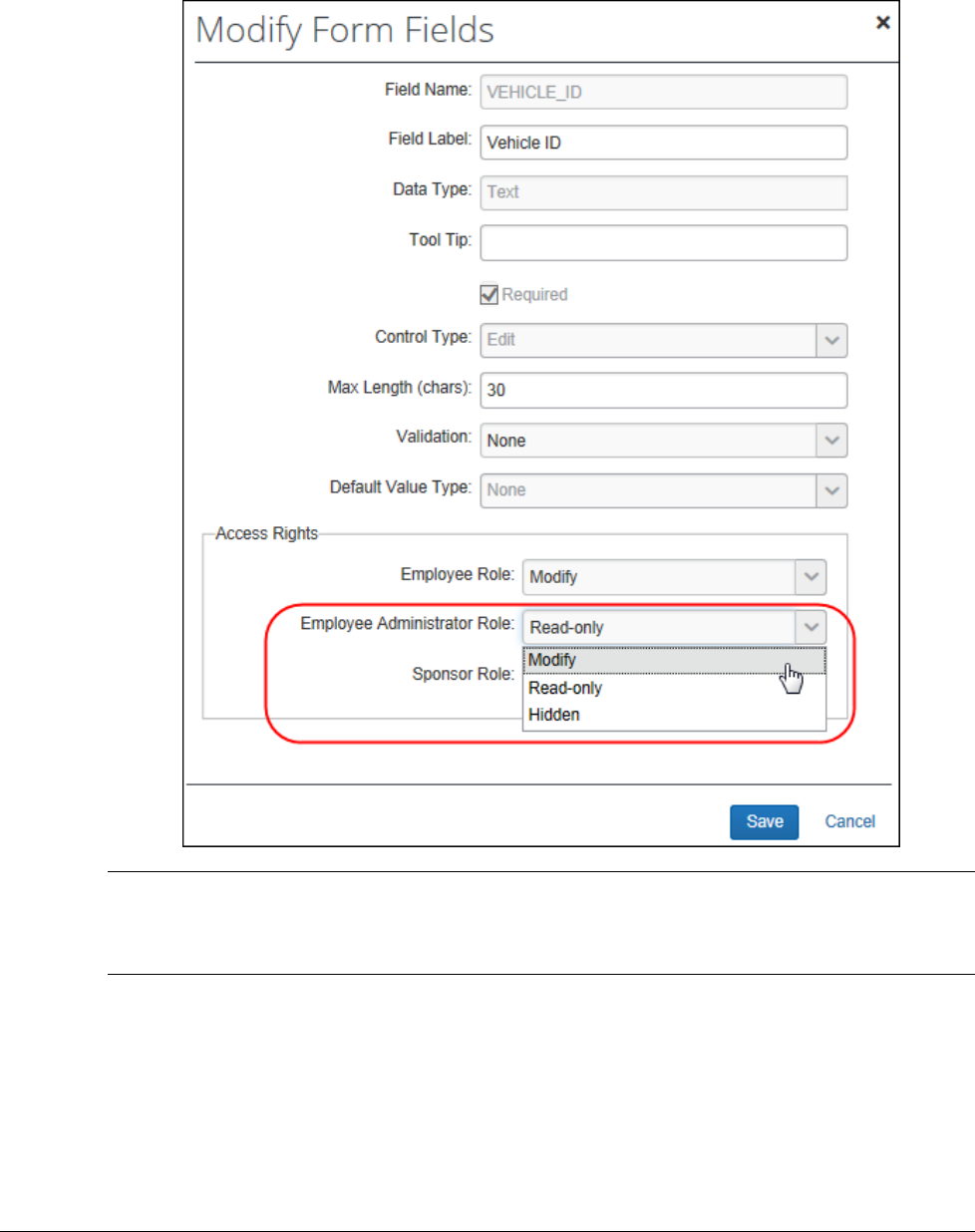

• Permissions to Change Expense Car Form Fields: If a field is set to

Modify for the user administrator they have permissions to change values in

that field, while Read-Only and Hidden restrict the ability to perform changes

Section 3: User Experience

20 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

! IMPORTANT: By default, only the Initial Distance field is set to Modify for the

user administrator - the Expense Configuration admin must change any other Car

form field, such as Vehicle ID, to grant access to the user administrator.

Section 3: User Experience

Concur Expense: Car Configuration Setup Guide 21

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

What the User Administrator Sees

The user administrator selects a user to manage and is given permissions to use the

Personal or Company Car links to view the car configuration for that user. Beyond

this, the overall configuration dictates what they can and cannot do.

The example above hides the New button, and sets all fields excepting Initial

Distance to Read-Only. The administrator is denied the ability to edit any other

fields or register a car for the user they are managing.

In the figures below, full permissions are granted. The New and Remove buttons

are enabled through car configuration:

Section 3: User Experience

22 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

When opening a car for editing, all fields are available to the user administrator:

BEST PRACTICE: EDITING THE INITIAL DISTANCE FIELD

As best practice, the Initial Distance field should be made set to Modify for the

user administrator (this is the default setting for this field). This allows the user

administrator to reset the distance figure should corrections be required without

need to contact SAP. When correcting this field, the system will prompt for the

change - click OK to dismiss the confirmation message.

Section 4: Car Configuration Procedures

Concur Expense: Car Configuration Setup Guide 23

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

NOTE: Resetting the initial distance does not recalculate the mileage within existing

reports, but does provide the correct base mileage for reports created after

the correction.

Section 4: Car Configuration Procedures

The Car Configuration page allows an administrator to specify the company or

personal car reimbursement rate, to indicate whether there is a distance limit at

which the rate changes, and to provide other criteria that set the rate.

Concur Expense provides these options for company car reimbursement:

• Distance/No Reimbursement: The employee is reimbursed for actual

company car expenses, and not for mileage. No rates need to be entered.

• Variable Rates: The employee is reimbursed for company car mileage based

on certain criteria, such as engine size, emissions value, petrol, or diesel.

Concur Expense provides these options for personal car reimbursement:

• One Rate for All Cars: The employee is reimbursed at a single rate for all

car–related expenses regardless of distance or criteria.

• Variable Rates Depending on Car Type: The employee is reimbursed at a

rate based on a car type as defined by various criteria such as engine size,

emissions value, petrol or diesel. The administrator defines the criteria using

the personal car configuration wizard.

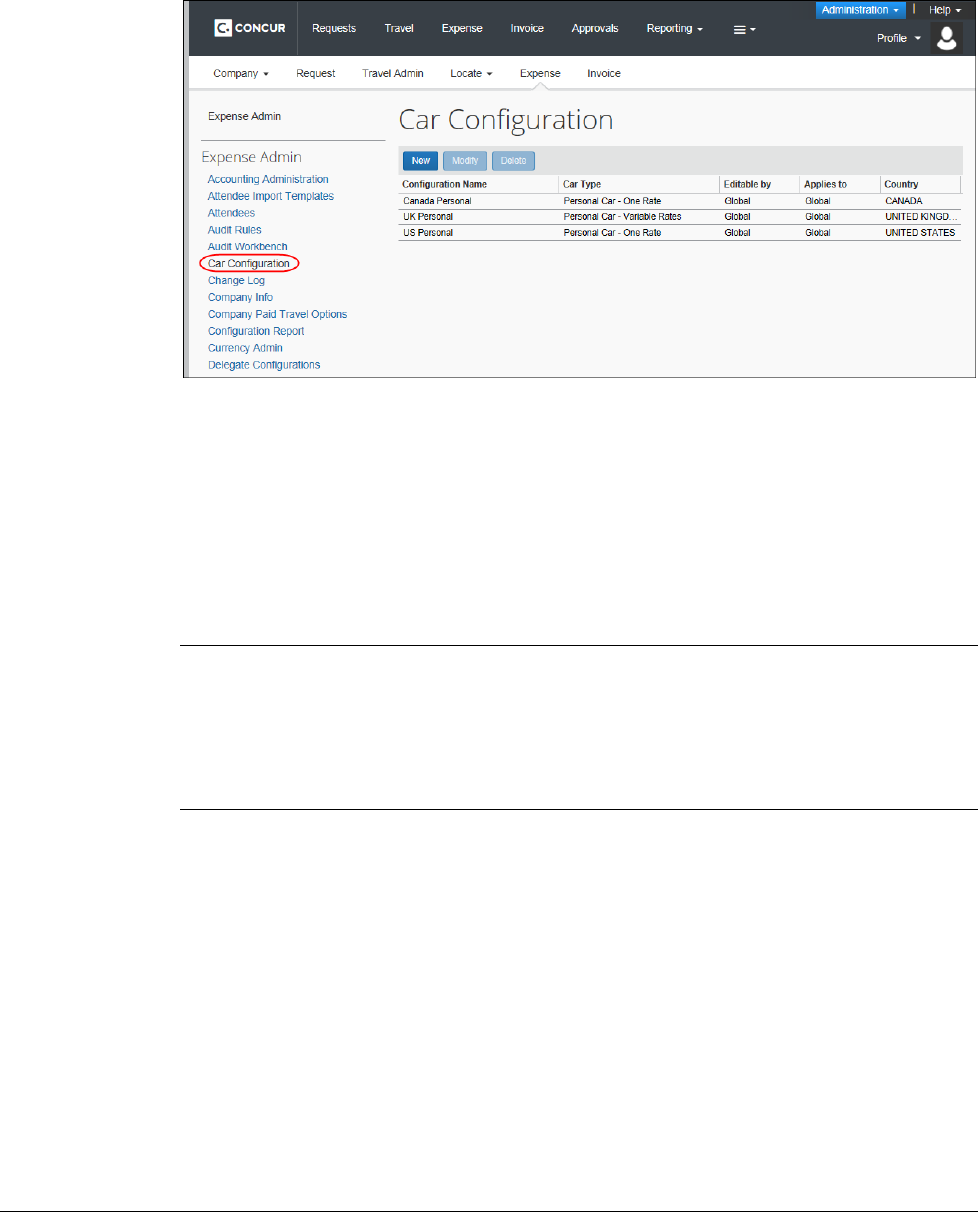

Accessing Car Configurations

Car configurations should be created after the appropriate car registration forms

have been created.

To access Car Configurations:

1. Click Administration > Expense.

Section 4: Car Configuration Procedures

24 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

2. Click Car Configuration (left menu). The Car Configuration page appears.

The Car Configuration page displays all car configurations created on a Global and

Group level. Configurations only appear on the page for the groups that you have

access to administer. Employees assigned the role of Expense Configuration

administrator for the Global group can view, edit and delete all car configurations.

• The Editable By column identifies the administrators who can modify the car

configuration.

• The Applies to column identifies the groups to which the configuration data

applies.

NOTE: If you need greater granularity in your group hierarchy when assigning

mileage reimbursement within a company, you can use the group

hierarchy tree functionality. To do this, clear (disable) the Use Named

Groups for Car Configuration check box on the Site Settings page.

For more information, refer to the section Assigning Different Car

Reimbursements Rates Using UnNamed Groups in this manual.

• The Country column indicates the country to which this configuration applies.

A car configuration is associated with a group and a country, as are employees. The

car configuration options in Concur Expense only appear to the employee if the

criterion set for the car configuration matches the country and group to which the

employee belongs.

Section 4: Car Configuration Procedures

Concur Expense: Car Configuration Setup Guide 25

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

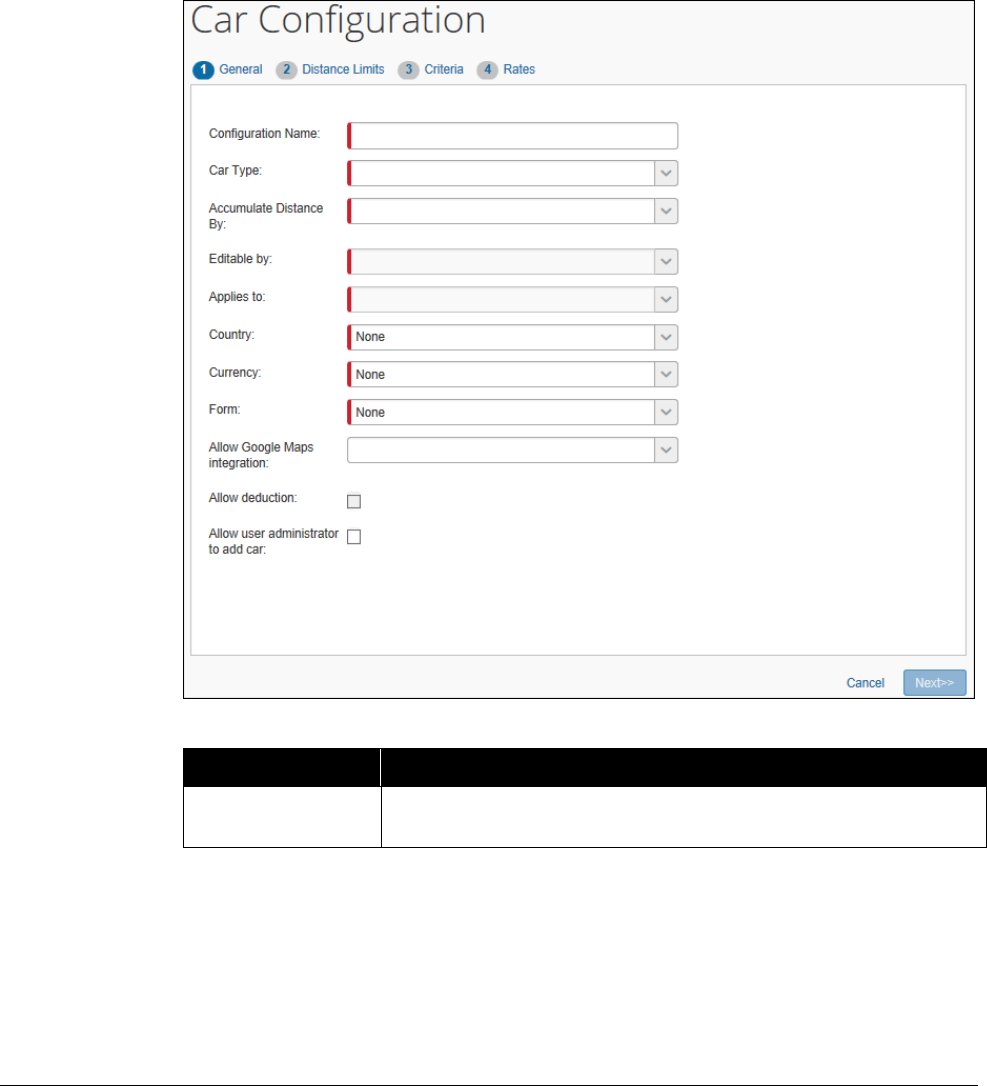

One Rate or No Reimbursement Configuration

To create a One Rate or No Reimbursement configuration:

1. On the Car Configuration page, click New. The General step of the Car

Configuration wizard appears.

2. Complete the required fields.

Field

Description

Configuration

Name

Type a descriptive name for the car configuration. This name

appears on the Car Configuration page.

Section 4: Car Configuration Procedures

26 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

Field

Description

Car Type

Select the desired car type:

• Personal Car - One Rate: The car is employee owned and

maintained. The employee is reimbursed for expenses.

• Company Car - Distance/No Reimbursement: The

employee is reimbursed for actual expenses; company car

distance entries would be created only to track odometer

readings, and so on. The employee would also be expected

to create expenses for gas, maintenance, insurance, and so

on.

Editable By

Select the group rights that an administrator must have in

order to modify the configuration.

Applies to

Select the group(s) to which the car configuration applies.

NOTE: If you need greater granularity in your group hierarchy

when assigning mileage reimbursement within a company, you

can use the group hierarchy tree functionality. To do this, clear

(disable) the Use Named Groups for Car Configuration

check box on the Site Settings page. For more information,

refer to the section Assigning Different Car Reimbursements

Rates Using UnNamed Groups in this manual.

Country

Select a country for this configuration. The country value

indicates which employees use this configuration for car

distance entries.

You can easily access the country name by typing the first

letter of the country, such as U for United States, to go

immediately to all countries that begin with U. Continue typing

until you reach the country you want.

NOTE: In the case where an employee from the United States

travels to Canada, the United States rates would apply. An

employee is also linked to a locale defined in User

Administration; however, locale does not always identify the

country in which the employee is located, although in most

cases it is the same. The locale determines how date and time

are formatted. For example, an employee could be a US citizen

working in Germany, so his locale is US-ENG, but the country in

which the rates for reimbursement apply, is Germany. The

employee can view dates in the US format (mm/dd/yyyy) not

the German format (yyyy/mm/dd), but the German

configuration rates for car mileage will apply.

IMPORTANT: The country selected here for the car

configuration must match the default country of the employee.

This may not be the same as the default locale of the

employee.

Section 4: Car Configuration Procedures

Concur Expense: Car Configuration Setup Guide 27

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

Field

Description

Currency

Select the currency in which the rate is entered (for example,

Euros or US Dollars). The rate is displayed to the employee

using the standard alpha currency code, such as EUR or USD.

The calculation performed and displayed to the employee uses

the currency specified.

IMPORTANT: The currency selected here for the car

configuration must match the default currency of the employee.

Form

Select the car registration form you would like users to see in

Profile.

Allow Google Maps

Integration

Select an option:

• No: The Google Maps Mileage Calculator link is hidden,

and the user enters the To and From location manually

• Yes: The Google Maps Mileage Calculator link is available

and can be used optionally, in place of the To and From

Location options

• Required: The Mileage Calculator window appears

automatically when the user chooses the car mileage

expense types - the To and From Location options are

disabled and automatically populated from the mileage

calculator waypoints

Allow deduction

Select the check box to allow users to deduct commute

distances from their mileage expenses.

NOTE: Only available when using Google Maps Integration.

Allow user

administrator to

add car

Select the check box to allow the user administrator to add a

car on behalf of the employee they are administrating in User

Admin.

NOTE: This privilege is additional to their ability to view and

edit existing car configurations on behalf of an employee.

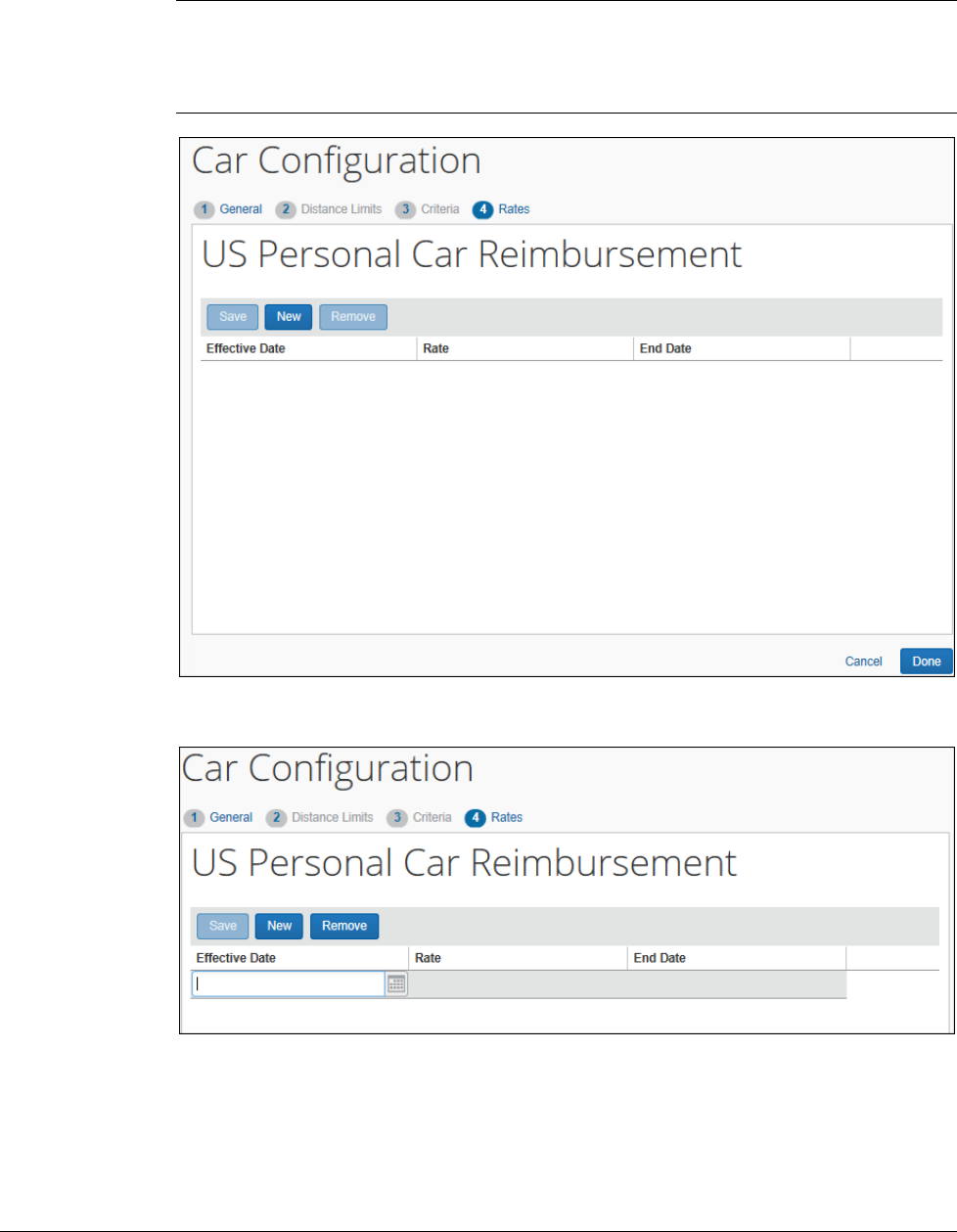

3. Click Next. The Rates step appears.

Section 4: Car Configuration Procedures

28 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

NOTE: If you chose Company Car - Distance/No Reimbursement as the

Car Type in Step 2, the configuration is complete and you are returned

to the Company Car Configuration page. No additional steps are

required.

4. Click New. A new line appears.

5. Complete the fields.

Section 4: Car Configuration Procedures

Concur Expense: Car Configuration Setup Guide 29

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

Field

Description

Effective Date

Select a date from the Date helper pane that you

want this rate to take effect. The rate will be applied

to any personal car mileage expense with a date

greater than or equal to the date you select.

Rate

Type a number using the appropriate decimal places

for a rate per mile or kilometer.

6. Click Save.

7. Click Done.

Variable Rate Configuration (Company or Personal car)

To create a Variable Rates Configuration:

1. On the Car Configuration page, click New. The General step of the Car

Configuration wizard appears.

Section 4: Car Configuration Procedures

30 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

2. Complete the required fields.

Field

Description

Configuration

Name

Type a descriptive name for the car configuration. This name

appears on the Car Configuration page.

Car Type

Select one of the car types to indicate the car owner and how the

reimbursement is being handled:

• Personal Car – Variable Rates: The employee is reimbursed

at a fixed rate for all personal car distance entries, such as .20

USD a mile.

• Company Car - Variable Rates: The employee is reimbursed

at a fixed rate for all company car distance entries, such as .20

USD a mile.

Accumulate

Distance By

Choose the distance accumulation calculation method for the

Variable Rate (only) personal or company car configuration. There

are three options:

• Configuration: Calculate accumulated mileage for one or more

cars according to the overall car configuration

• Car Criteria: Calculate accumulated mileage for one or more

cars according to the specific car criteria under which the car is

registered

• Car: Calculate accumulated mileage for this car only and no

others

Editable By

Select the group rights that an administrator must have in order to

modify the configuration.

Applies to

Select the group(s) to which the car configuration applies.

NOTE: If you need greater granularity in your group hierarchy when

assigning mileage reimbursement within a company, you can use

the group hierarchy tree functionality. To do this, clear (disable) the

Use Named Groups for Car Configuration check box on the Site

Settings page. For more information, refer to the section Assigning

Different Car Reimbursements Rates Using UnNamed Groups

in this manual.

Section 4: Car Configuration Procedures

Concur Expense: Car Configuration Setup Guide 31

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

Field

Description

Country

Select a country for this configuration. The country value indicates

which employees use this configuration for car distance entries.

You can easily access the country name by typing the first letter of

the country, such as U for United States, to go immediately to all

countries that begin with U. Continue typing until you reach the

country you want.

NOTE: In the case where an employee from the United States

travels to Canada, the United States rates would apply. An

employee is also linked to a locale defined in User Administration;

however, locale does not always identify the country in which the

employee is located, although in most cases it is the same. The

locale determines how date and time are formatted. For example, an

employee could be a US citizen working in Germany so his locale is

US-ENG, but the country in which the rates for reimbursement

apply, is Germany. The employee can view dates in the US format

(mm/dd/yyyy) not the German format (yyyy/mm/dd), but the

German configuration rates for car mileage will apply.

IMPORTANT: The country selected here for the car configuration

must match the default country of the employee. This may not be

the same as the default locale of the employee.

Currency

Select the currency in which the rate is entered (for example, Euros

or US Dollars). The rate is displayed to the employee using the

standard alpha currency code, such as EUR or USD. The calculation

performed and displayed to the employee uses the currency

specified.

IMPORTANT: The country selected here for the car configuration

must match the default country of the employee. This may not be

the same as the default locale of the employee.

Form

Select the car registration form you would like users to see in

Profile.

Allow Google

Maps

Integration

Select the check box to allow users to use the Google Maps Mileage

Calculator when creating mileage expenses.

Allow

deduction

Select the check box to allow users to deduct commute distances

from their mileage expenses. Only available when using Google

Maps Integration.

Allow user

administrator

to add car

Select the check box to allow the user administrator to add a car on

behalf of the employee they are administrating in User Admin.

NOTE: This privilege is additional to their ability to view and edit

existing car configurations on behalf of an employee.

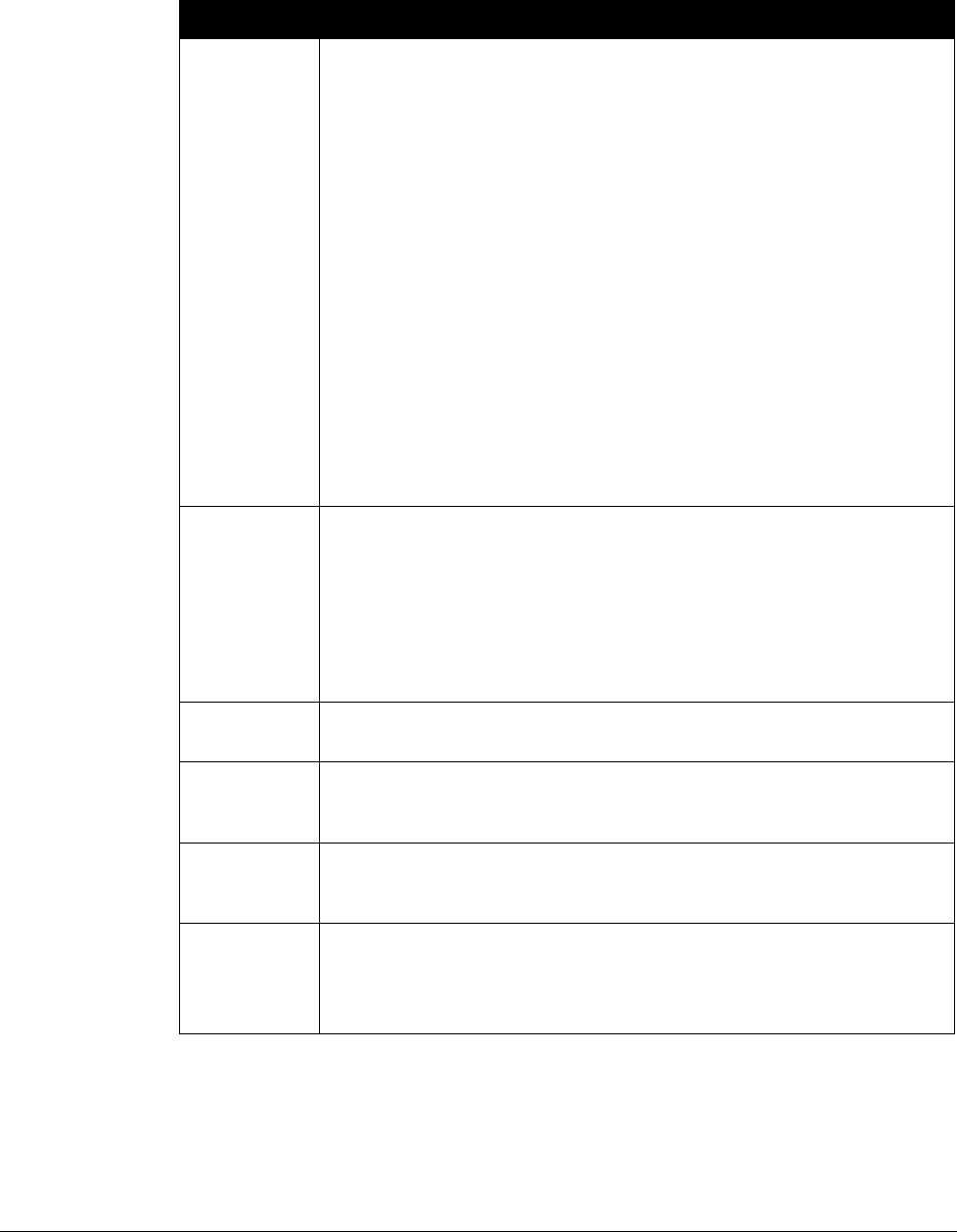

3. Click Next. The Distance Limits step appears.

Section 4: Car Configuration Procedures

32 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

4. Complete the required fields.

Field

Description

Distance Limit1

Enter the limit where the rate changes, such as 1000 miles, if

applicable. Limits are not required. You can set up criteria

without designating limits.

Distance Limit2

Enter the next limit where the rate changes, such as 2000 miles,

if applicable.

Distance Limit3

Enter the next limit where the rate changes, such as 15000

miles, if applicable.

Period for

Distance Limits

Defines the timeframe for which distance limits are reset to zero

and the lowest distance limit rate is applied. For example, if the

period is monthly, then the tracking of miles for an employee is

reset to zero at the beginning of the month. This means that

when the employee submits an expense report at the beginning

of the month, the first rate would apply again, even if the

distance at the end of the previous month exceeded the

beginning distance rate.

Select monthly, quarterly, or annually. This field is required if a

distance limit is entered. If Annually is selected, then Starting

Month and Starting Day fields appear in the helper pane.

These are required fields.

Starting Month

Select the month the year begins. This field only appears if

Period for Distance Limits is set to Annually.

Section 4: Car Configuration Procedures

Concur Expense: Car Configuration Setup Guide 33

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

Field

Description

Starting Day

Select the day of the month the year begins. This field only

appears if Period for Distance Limits is set to Annually.

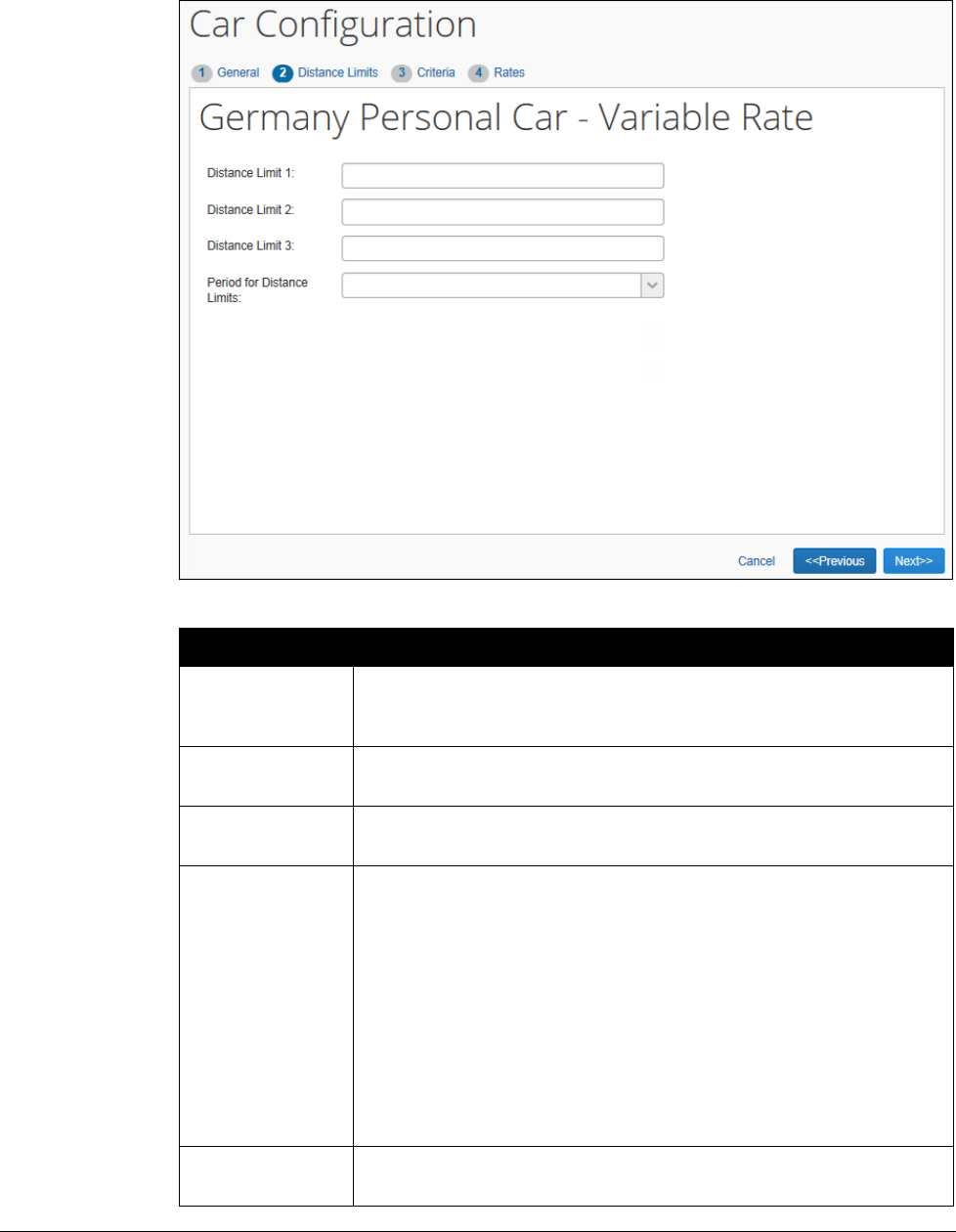

5. Click Next. The Criteria page appears.

6. Click New. The New Car Criteria window appears.

7. Type a criterion, and then click OK. Repeat steps 6-7 until the Criteria list is

completed.

Section 4: Car Configuration Procedures

34 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

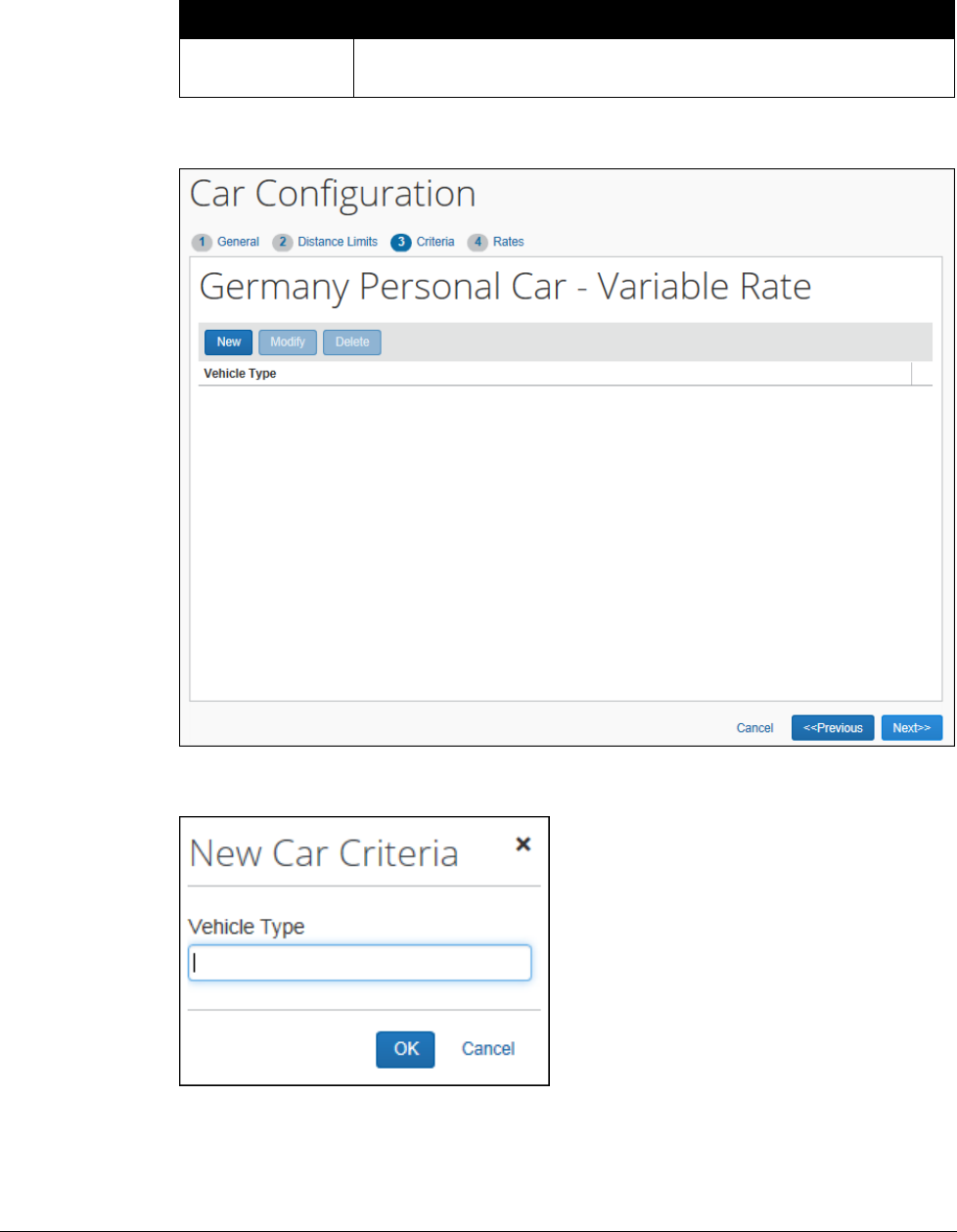

8. Click Next. The Rates step appears.

9. Click New. A new line appears.

10. Complete the required fields.

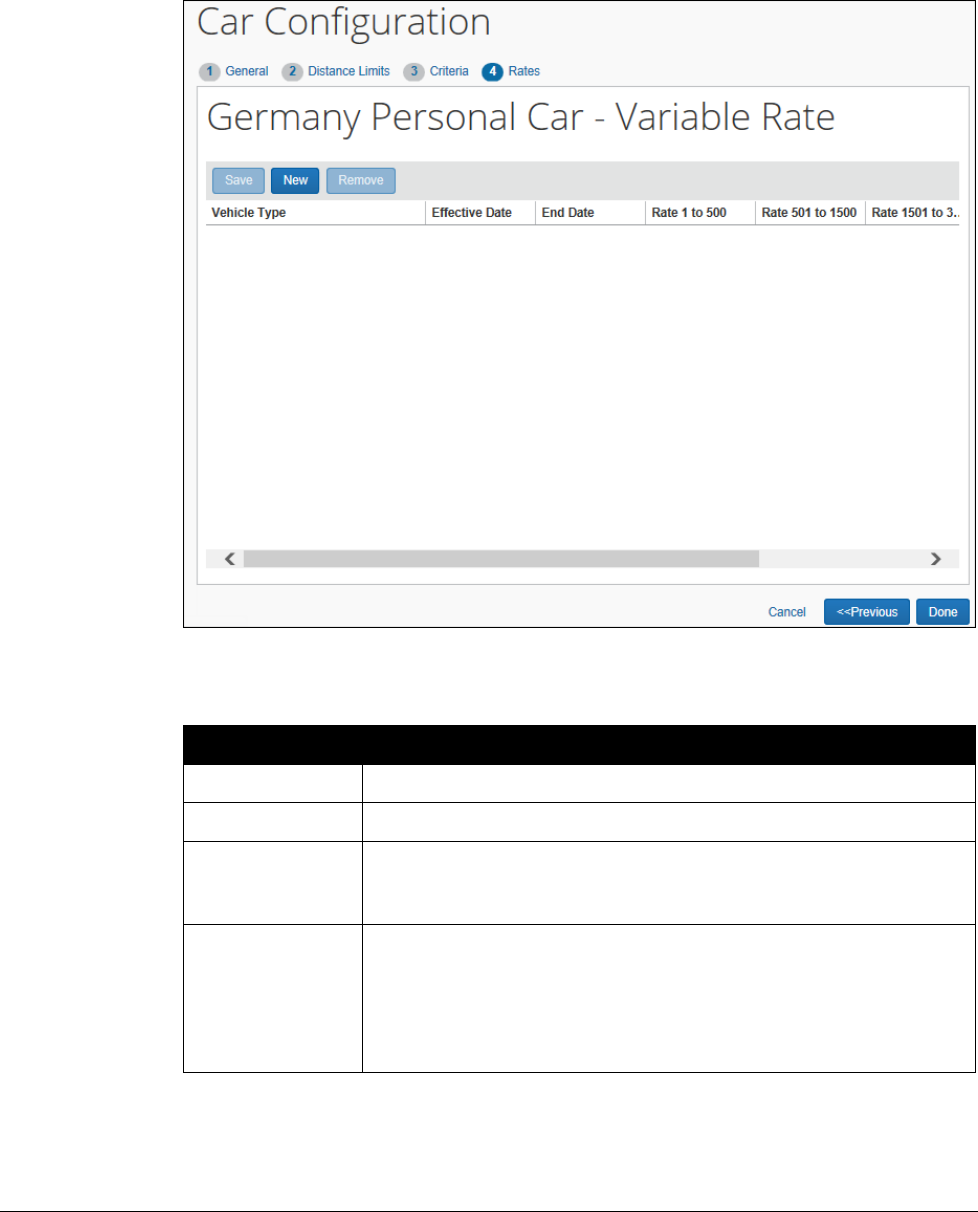

Field

Description

Vehicle Type

Select the type of vehicle the rate applies to.

Effective Date

Select the date the rate should take effect.

Rate 1 to X

Type the rate that applies to this distance. The X value in the

field name reflects the number you entered for Distance Limit

1 in the Distance Limits step.

Rate from X to Y

Type the rate that applies to this distance. The X value in the

field name is the number you entered in the first Distance field

plus 1. The Y field name reflects the number you entered for

Distance Limit 2 in the Distance Limits step. Note that, when

adding the rate, the number of digits to the right of the decimal

is always four, regardless of the chosen currency.

Section 4: Car Configuration Procedures

Concur Expense: Car Configuration Setup Guide 35

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

Field

Description

Rate from Y to Z

Type the rate that applies to this distance. The Y value in the

field name is the number you entered in the first Distance field

plus 1. The Z value in the field name reflects the number you

entered for Distance Limit 3 in the Distance Limits step. Note

that, when adding the rate, the number of digits to the right of

the decimal is always four, regardless of the chosen currency.

Rate Over Z

Type the rate that applies to this distance. The Z value reflects

the number you entered for Distance Limit 3 in the Distance

Limits step.

Personal Rate

(Company car

only)

Type a rate that is used when an employee uses the company

car for personal use, such as .10.

This rate is multiplied by the distance entered by the employee

in the Personal Distance field in the Car Mileage helper pane

and then added to the distance entered in the Business

Distance field multiplied by the rate.

Example: (Personal Rate*personal distance) + (Business

Miles*rate)

Rate per

passenger

If applicable, type a rate for a passenger, such .03. Note that,

when adding the rate, the number of digits to the right of the

decimal is always four, regardless of the chosen currency.

11. Click Done. The Car Configuration page appears.

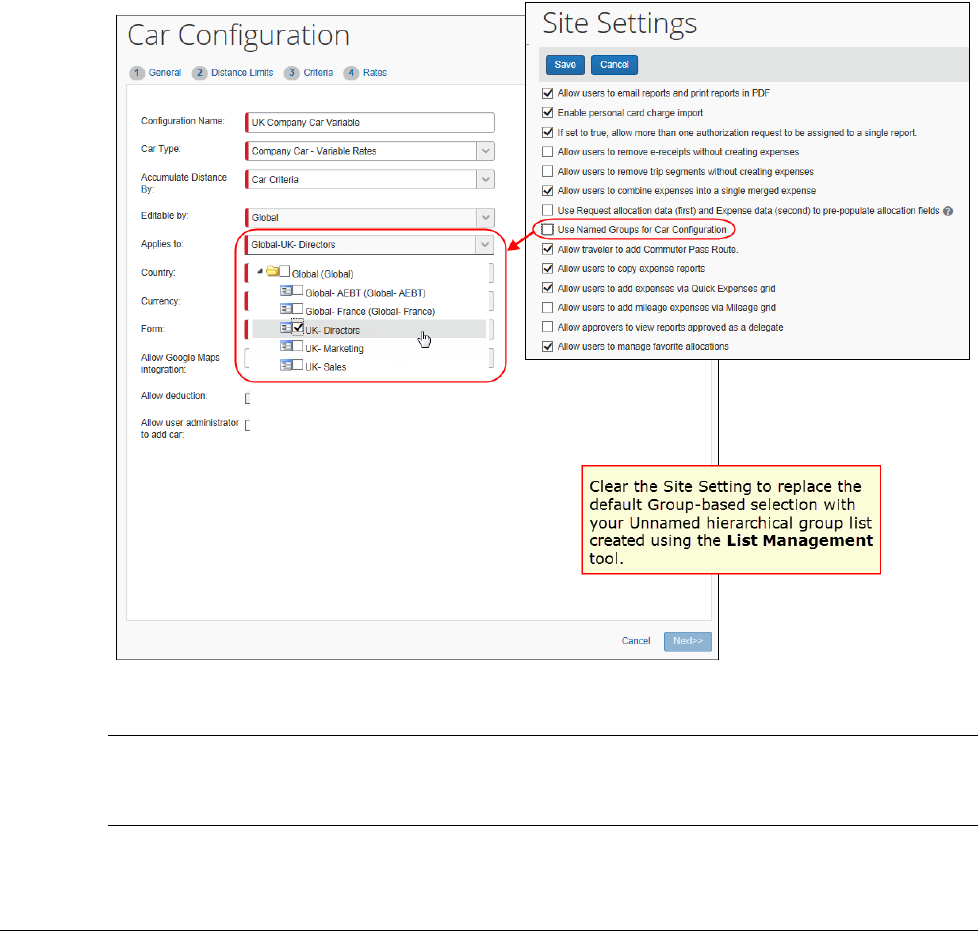

Assigning Different Car Reimbursements Rates Using UnNamed Groups

Depending on a company's policy, an administrator can elect to use an "UnNamed"

group hierarchy tree in order to select and assign different car mileage

reimbursement rates to their car users. This provides greater granularity for the

assignment of mileage rate reimbursements to different users within a company.

Terminology for this feature is used as follows:

• Named Group: A Group that originates from the Group Configurations tool,

and under which is mapped the car configuration attributes (car mileage

reimbursement rate in this discussion) to groups of users in a company.

• UnNamed Group: A group-like list of hierarchical nodes created using the

List Management tool, and configured to mimic a Group structure (Global >

UK > Directors; Global > UK > Marketing as examples in this section) by

allowing association of a node (group) of users to the specified car mileage

reimbursement rates.

Example – Assigning to Different Users

Assume you have different user types, Directors, Marketing, and Sales, that you

want to reimburse at different care mileage rates. If the company's car configuration

business policy is the only difference between these employee types, creating or

modifying Groups for this business purpose adds an additional configuration

Section 4: Car Configuration Procedures

36 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

maintenance burden for a relatively simple need. Instead, you can create named

“groups” using a hierarchical list and expose this list within the Car Configuration tool

for association to these groups of users.

How It Works

The administrator works with several tools within Concur Expense to create and

expose the hierarchical list that mimics the employee group structure they want to

work with (Global > UK > Directors; Global > UK > Marketing as examples). A

setting in Site Settings is used to tell Concur Expense to replace the traditional

Group-based hierarchy in Car Configuration with the list-based hierarchy the

administrator has created.

The general steps required to configure this feature are as follows:

NOTE: Access to one or more tools may be restricted – consult with your Concur

Expense administrator or submit a Service Request to Support to configure

those tools you do not have access to.

• Step 1 - List Management: Create the hierarchical list using the Employee

Groups list type in the List Management tool.

Section 4: Car Configuration Procedures

Concur Expense: Car Configuration Setup Guide 37

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

Refer to Shared: List Management Setup Guide for more information.

• Step 2 - Forms and Fields: Edit the Employee header form to select the list,

add and configure fields, and preview and assign your work to the Default

Employee Information form. Then, do the same for the Employee Entry form,

being sure to apply the Hidden attribute to the fields at this level and assign

the connected list to the Car Mileage form.

Refer to Concur Expense: Forms and Fields Setup Guide for more

information.

• Step 3 - User Administration: Review the fields and access rights you have

added in Step 2 by opening User Administration and noting the field

appearance and behavior.

Refer to Shared: User Administration User Guide for more information.

• Step 4 – Feature Hierarchies: Add the field structure in the desired order

(Level One; Level Two) to the Employee hierarchy feature, and confirm your

changes.

Refer to Shared: Feature Hierarchies Setup Guide for more

information.

• Step 5 – Group Configurations: Match the hierarchical list naming

structure you created using the List Management tool by entering these

names as nodes under the Global group in Group Configurations, repeating

this for the Employee group configuration as well.

Refer to Expense: Group Configurations Setup Guide and Shared:

Group Configurations for Employees Setup Guide for more information.

• Step 6 – Site Settings: Clear (disable) the Use Named Groups for Car

Configuration setting – this replaces the traditional Group-based list with

the list you created using the List Management tool, allowing you to now

select and assign mileage rates to the “group” displayed in list format.

For more information about site settings, refer to Concur Expense: Site

Settings Setup Guide.

Modifying Car Configurations

Both the employee and their user administrator can view and edit the car

configuration. However, only the user administrator may edit the Initial Distance

field.

Please note the following when modifying car configurations:

• Changes to the configuration take effect immediately for all expense reports

not filed.

Section 4: Car Configuration Procedures

38 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

• Expense reports that have already been processed will not be affected by the

change.

• For Company Car Variable Rates and Personal Car Variable Rates, an

administrator can edit the Configuration Name, Applies to, Editable by,

and Allow Google Maps integration fields. All other fields are read-only.

• If rates have been assigned to a Personal Car One Rate configuration, then

the Effective Date for the configuration cannot be changed.

NOTE: A Company Car Distance/No Reimbursement configuration cannot be

edited once an expense report that uses that configuration has been

submitted.

To modify a car configuration:

1. On the Car Configuration page, select the name of the desired car

configuration.

2. Click Modify. The General step of the Car Configuration wizard appears.

3. Make any necessary changes.

NOTE: For complete field definitions, refer to the information in this guide

about adding configurations.

4. Click Done.

Deleting Car Configurations

Note the following:

• If a car rate is used in a submitted expense report, then the car configuration

is removed from view but still exists in Concur Expense.

• If a car rate has not been used, then the car configuration is permanently

deleted from the system.

• If a personal car is available in a user's profile and if you delete the

associated car configuration, the system automatically deletes the personal

car information in the profile.

! IMPORTANT: Consider alerting your users that the personal car

information will be deleted and that they must re-enter the information

when the new configuration is available.

To delete a car configuration:

1. On the Personal and Company Car Configuration page, select the desired

configuration.

Section 5: Fuel for Mileage Configuration Procedures

Concur Expense: Car Configuration Setup Guide 39

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

NOTE: Click Select All to delete all configurations.

2. Click Delete Selected Rows.

Section 5: Fuel for Mileage Configuration Procedures

Overview

The following section explains how to set up the new Fuel for Mileage feature. Use

the Site Settings section of Expense Admin to set up fuel for mileage for your

organization.

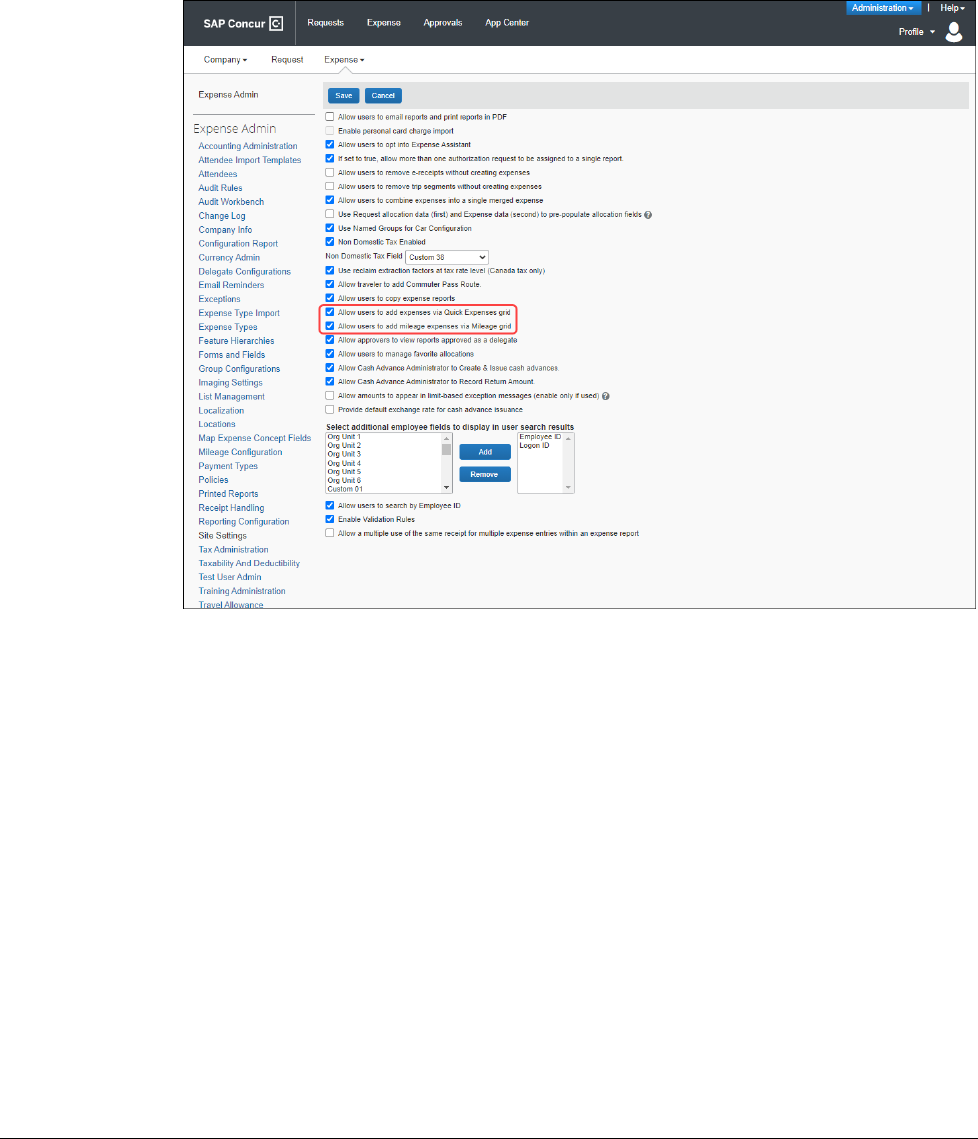

Updating Site Settings

To update the Site Settings:

1. Click Administration > Expense > Expense Admin > Site Settings.

Section 5: Fuel for Mileage Configuration Procedures

40 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

2. Select the following options:

Allow users to add expenses via Quick Expenses grid

Allow users to add mileage expense via Mileage grid

3. Click Save.

Section 5: Fuel for Mileage Configuration Procedures

Concur Expense: Car Configuration Setup Guide 41

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

Creating the Fuel for Mileage Expense Type

To create the Fuel for Mileage Expense Type:

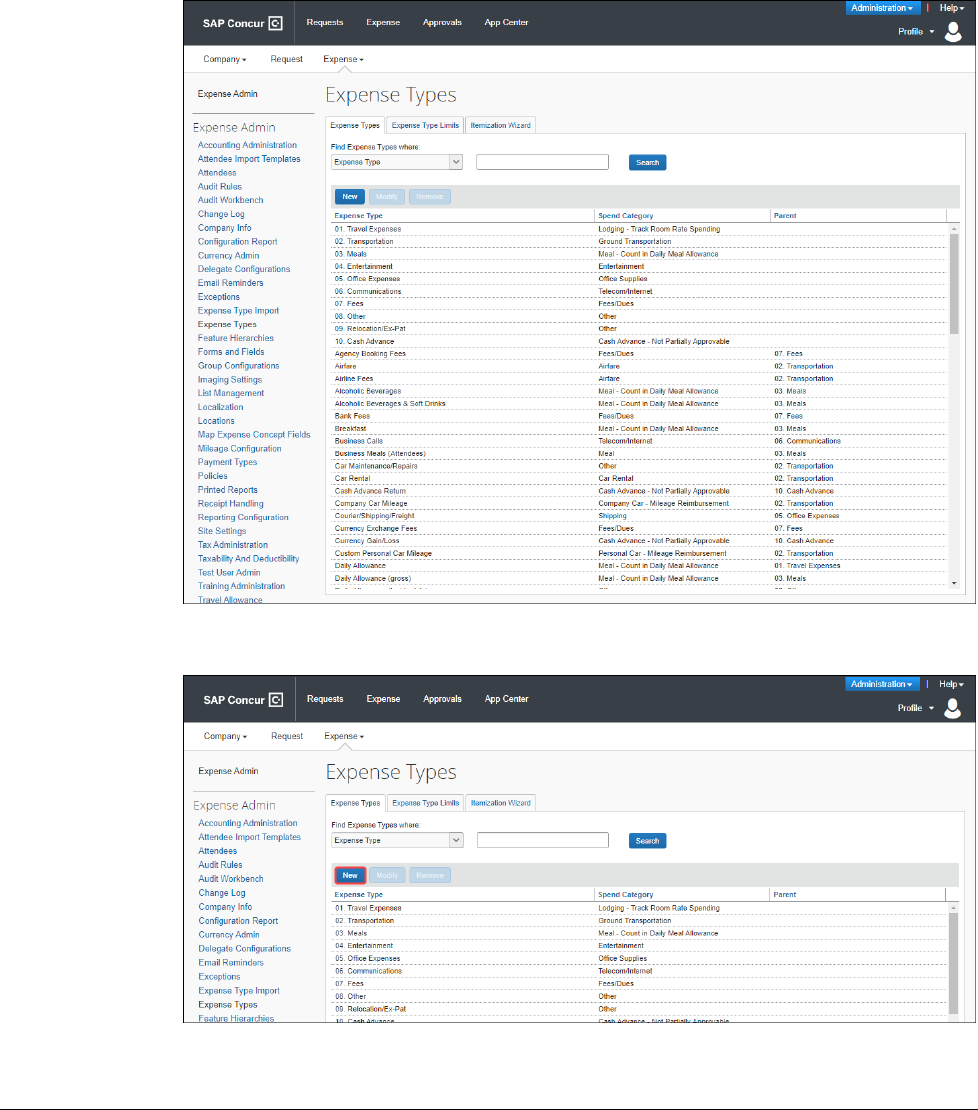

1. Click Administration > Expense > Expense Admin > Expense Types.

2. Click New to add a new expense type.

Section 5: Fuel for Mileage Configuration Procedures

42 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

3. Provide the following values:

Name: Fuel for Mileage

Spend Category: Fuel for Mileage

Available for: Both Entry and Itemization

Has this Parent: 02. Transportation

4. Click Next to complete the remaining tabs in the wizard.

5. Click Done.

Section 5: Fuel for Mileage Configuration Procedures

Concur Expense: Car Configuration Setup Guide 43

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

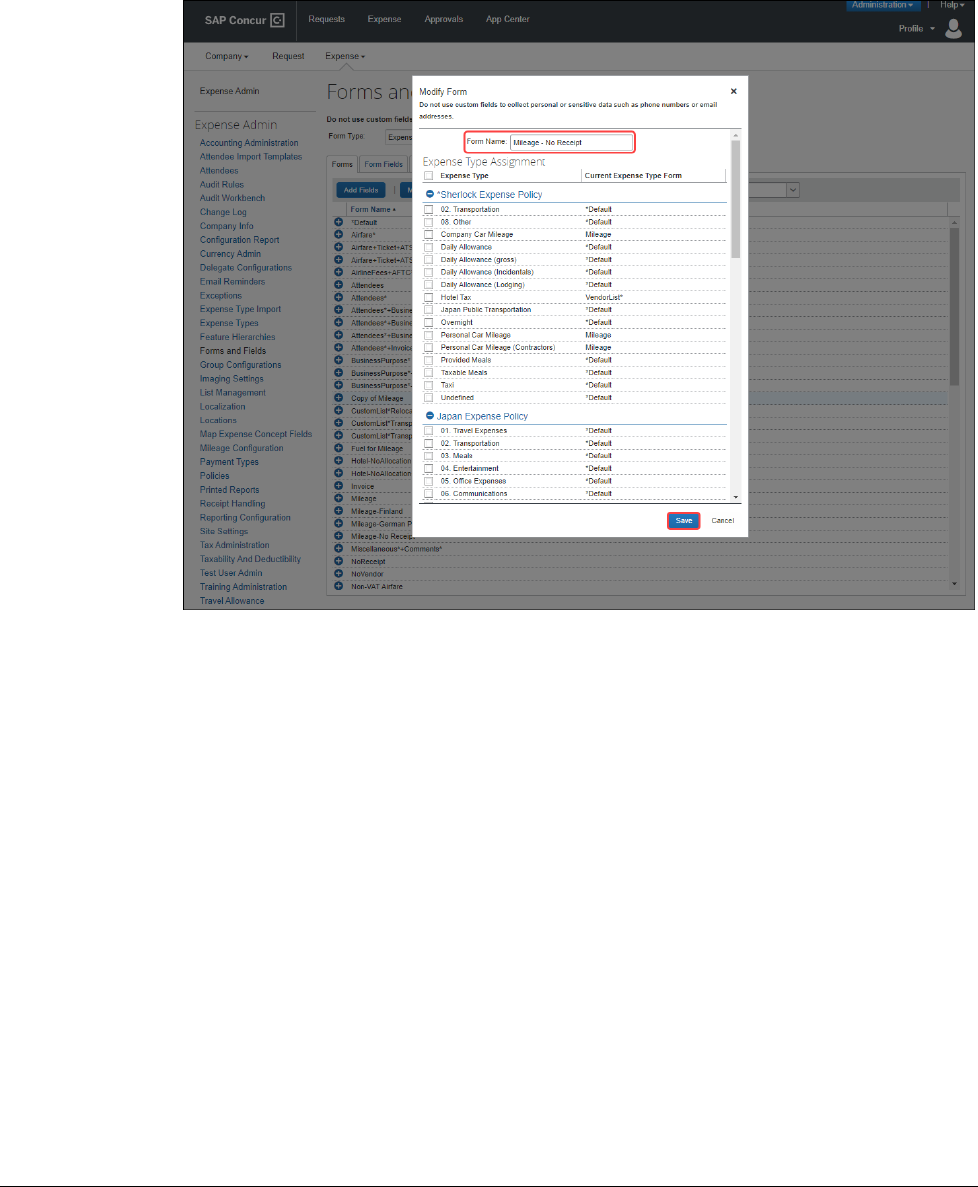

Creating a new Entry Form – Mileage – No Receipt

To create a new Mileage – No Receipt Entry Form:

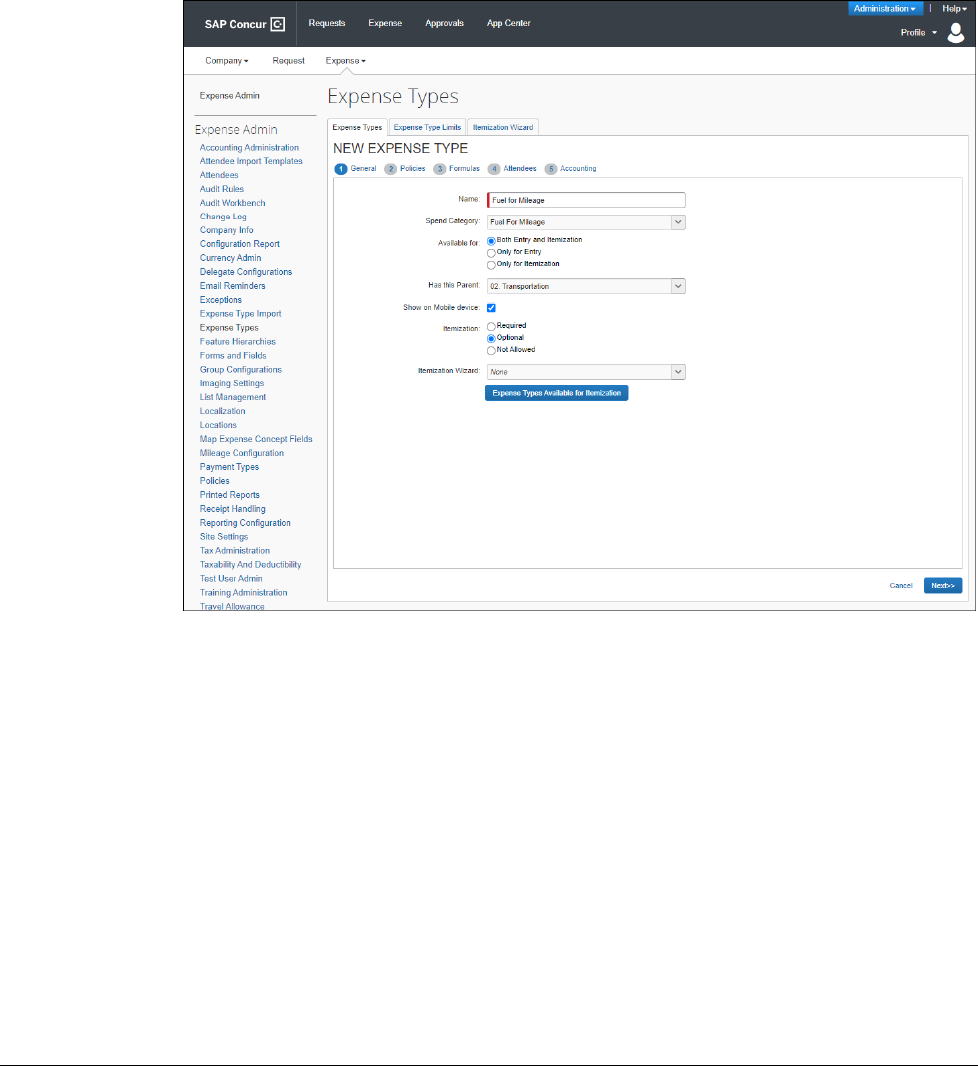

1. Click Administration > Expense > Expense Admin > Forms and Fields.

2. Click the Form Type list and select Expense Entry.

Section 5: Fuel for Mileage Configuration Procedures

44 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

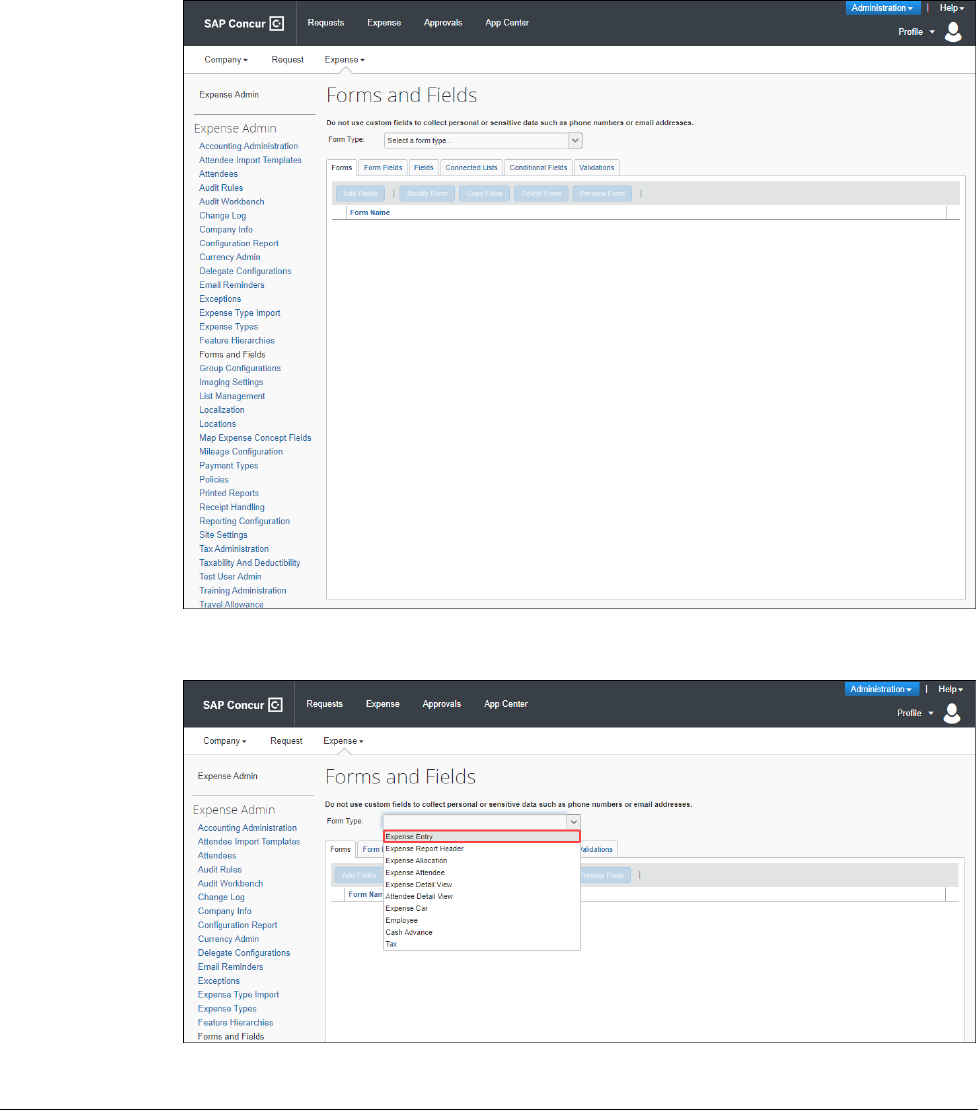

3. Select Mileage and click Copy Form.

4. Double-click Copy of Mileage to modify the form.

(OPTIONAL: To modify a form, you can also select Copy of Mileage and then

click the Modify Form button.)

Section 5: Fuel for Mileage Configuration Procedures

Concur Expense: Car Configuration Setup Guide 45

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

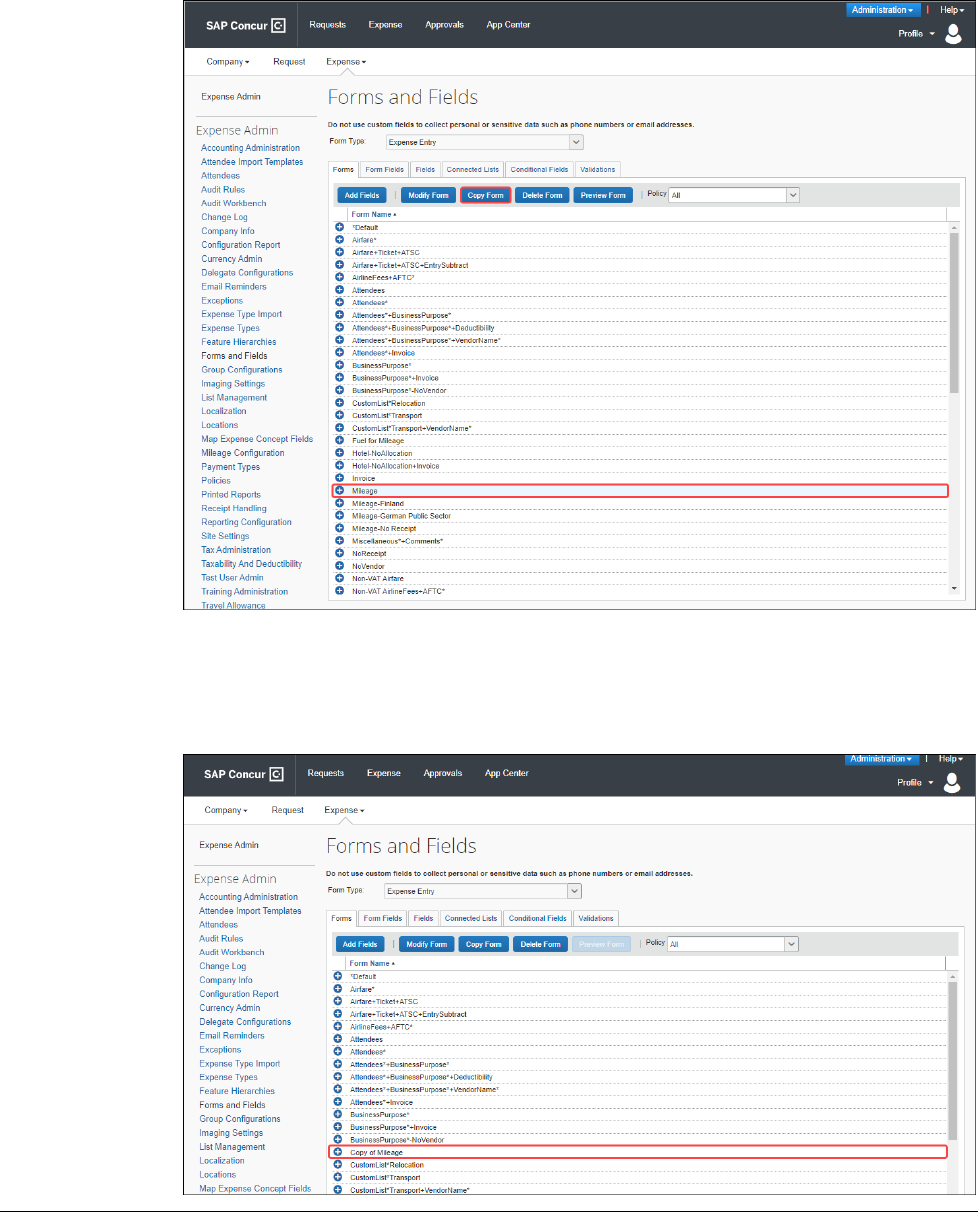

5. In the Form Name field, rename Copy of Mileage to Mileage – No

Receipt and then click Save.

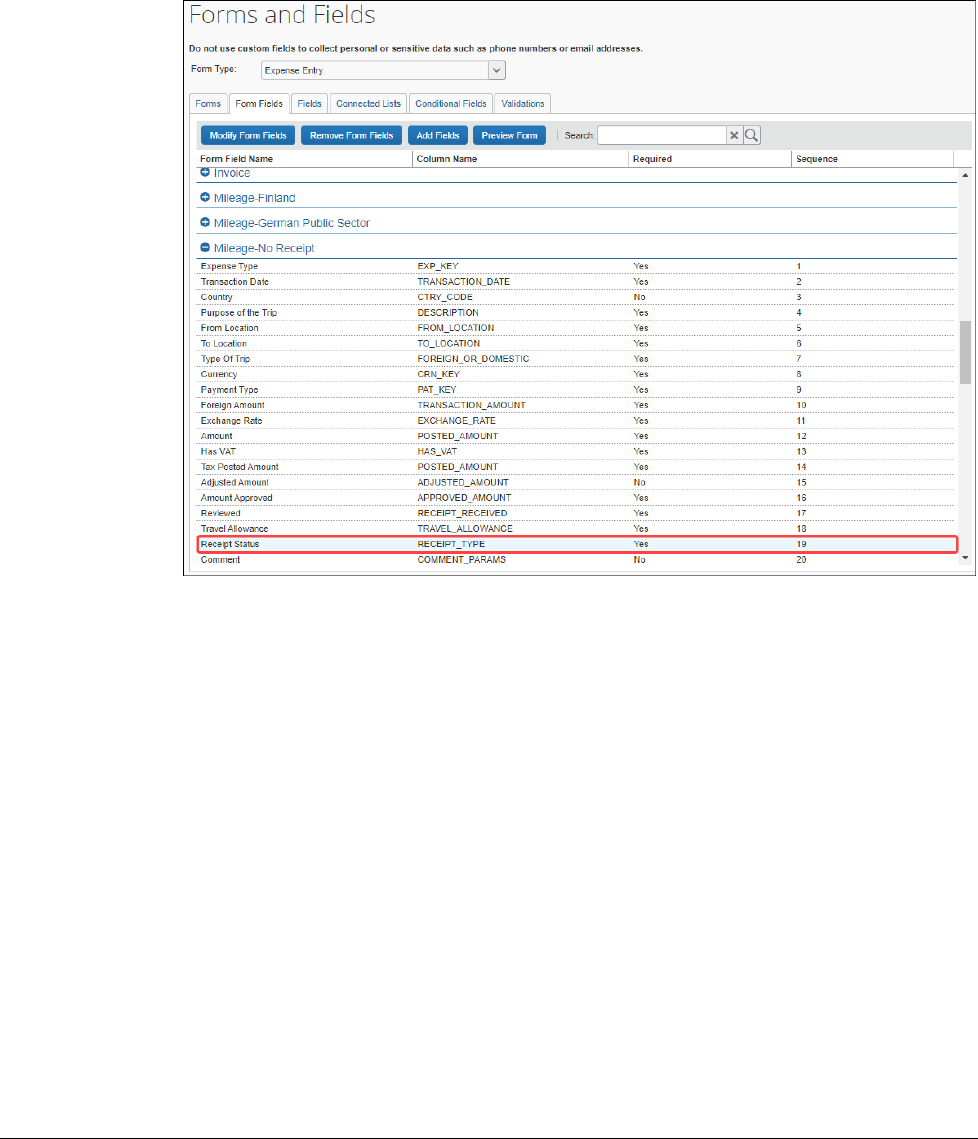

After creating and saving the Mileage – No Receipt entry form, you must

modify the roles associated with Receipt Status for this new entry form.

6. Click the Form Fields tab.

Section 5: Fuel for Mileage Configuration Procedures

46 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

7. Expand Mileage-NoReceipt by clicking the + symbol.

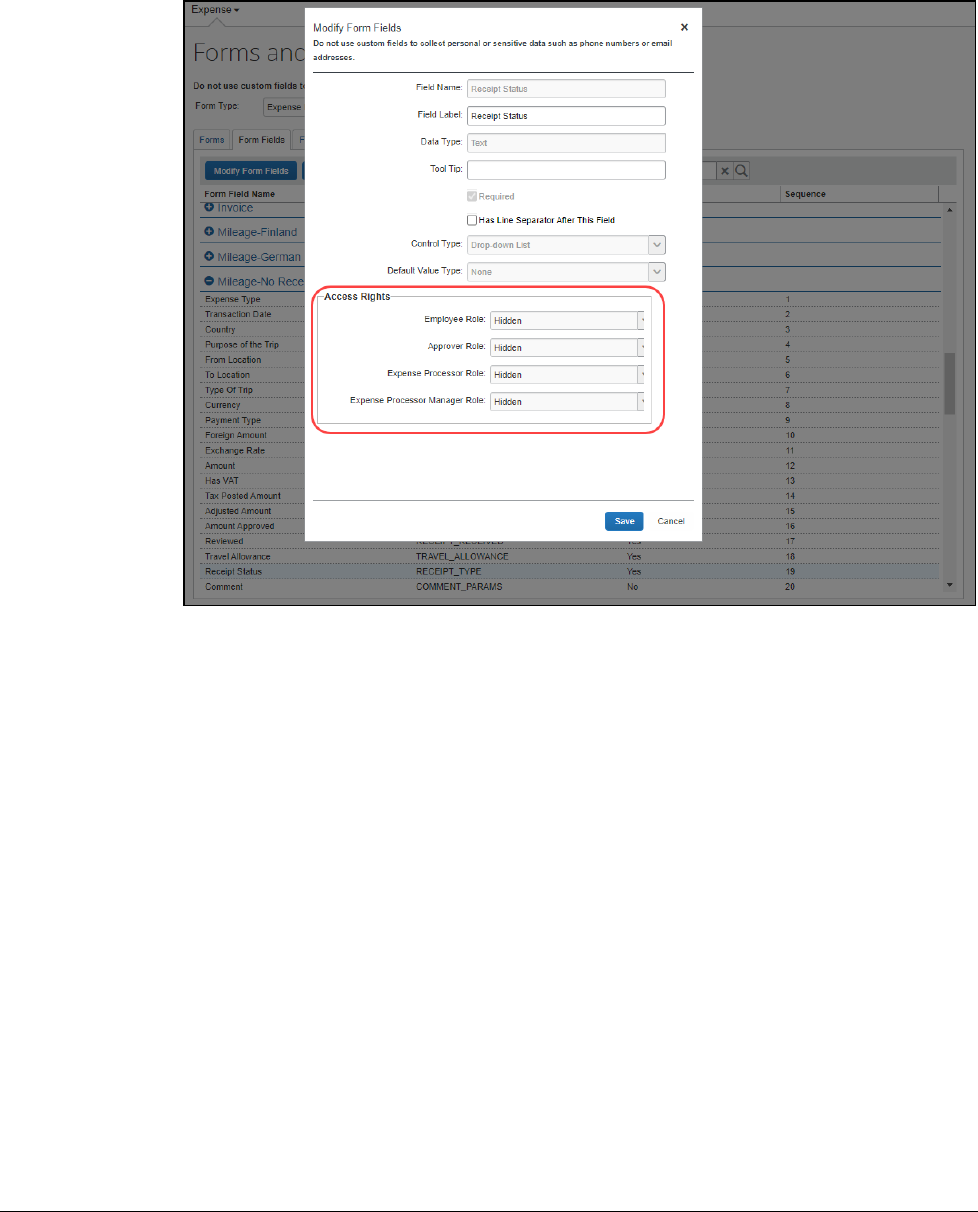

8. Select Receipt Status and click Modify Form Fields – you can also double-

click it.

Section 5: Fuel for Mileage Configuration Procedures

Concur Expense: Car Configuration Setup Guide 47

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

9. In the Access Rights section, ensure all roles have Hidden selected.

10. Click Save.

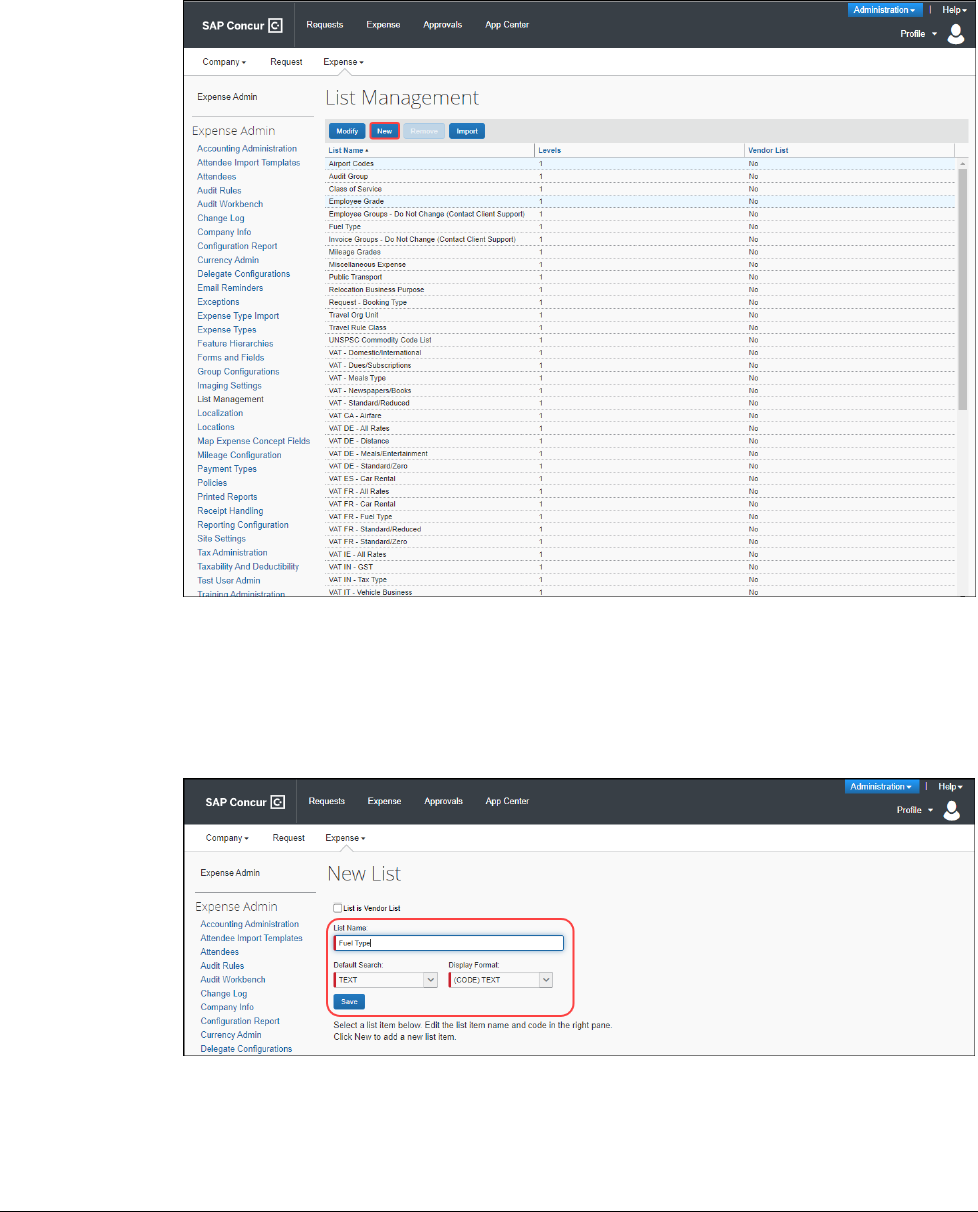

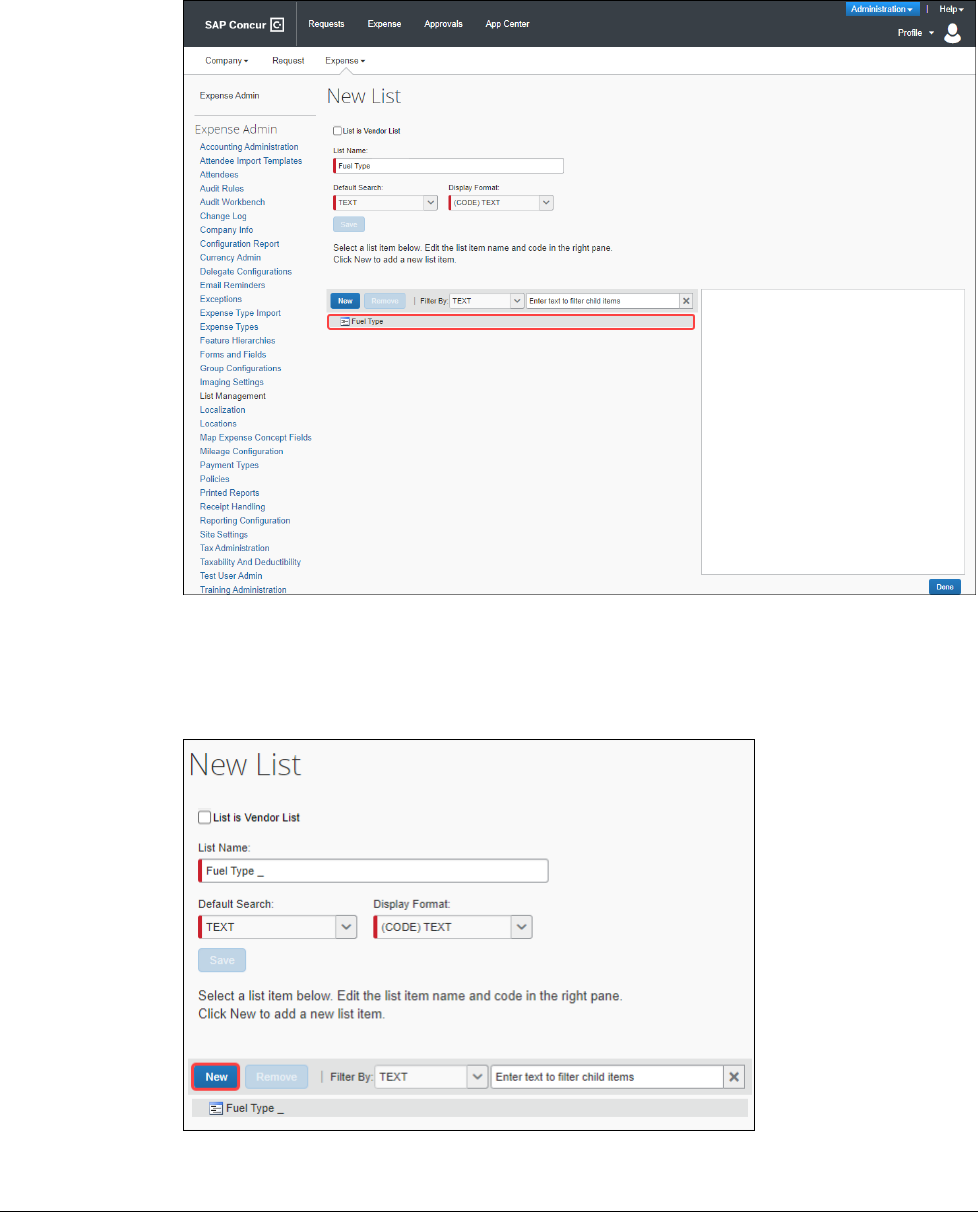

Adding a new simple list (Fuel Type)

To add a new simple list for Fuel Type:

1. Click Administration > Expense > Expense Admin > List Management.

Section 5: Fuel for Mileage Configuration Procedures

48 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

2. Click New.

3. On the New List page, provide the following values:

List Name: Fuel Type

Default Search: Retain default value, TEXT.

Display Format: Retain default value, (CODE) TEXT.

Section 5: Fuel for Mileage Configuration Procedures

Concur Expense: Car Configuration Setup Guide 49

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

4. Click Save. Fuel Type now appears as a new list item.

With the Fuel Type list item created, you now need to add the fuel types

required.

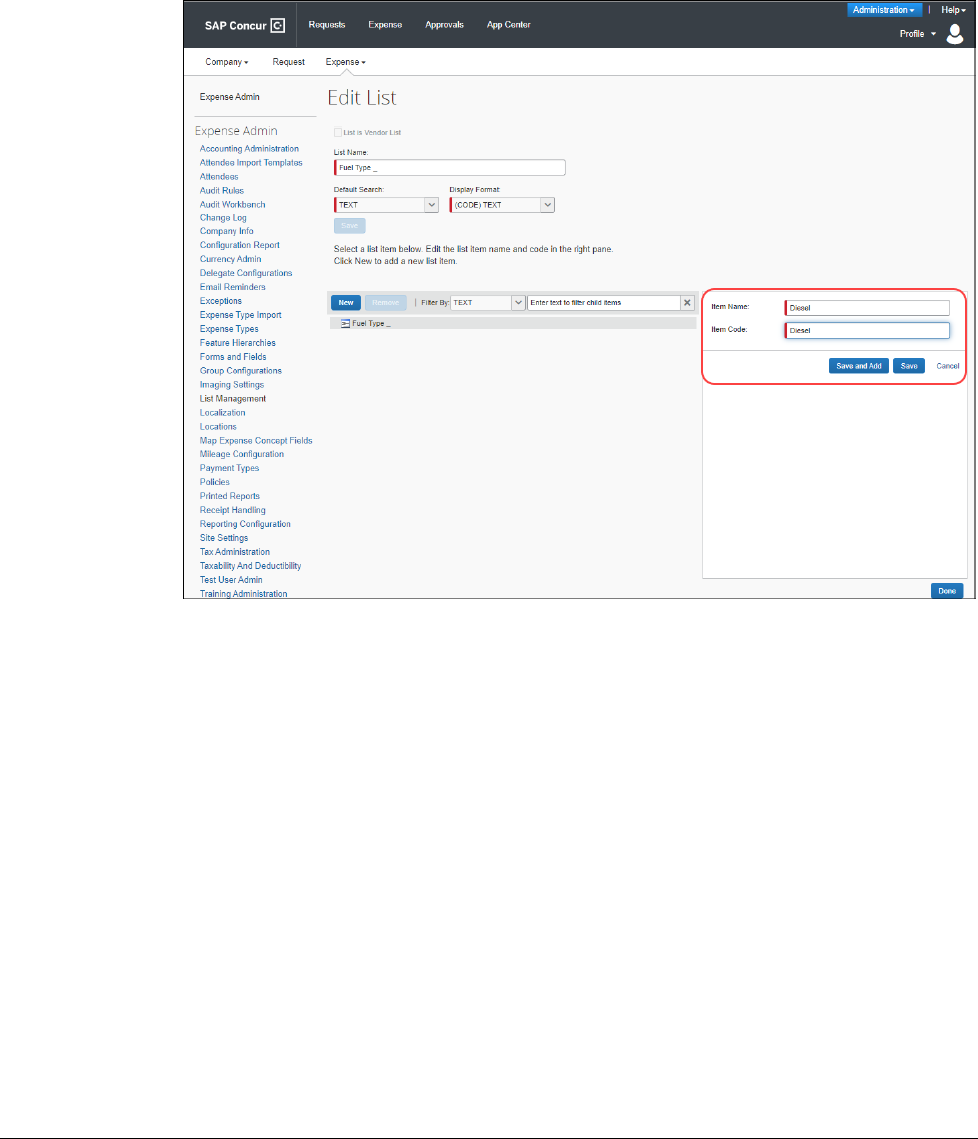

5. Click New.

Section 5: Fuel for Mileage Configuration Procedures

50 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

6. Provide the following values:

Item Name: Diesel

Item Code: Diesel

7. Click Save and Add to add Diesel to the Fuel Type list but also to clear the

Item Name and Item Code fields so you can add another fuel type.

Section 5: Fuel for Mileage Configuration Procedures

Concur Expense: Car Configuration Setup Guide 51

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

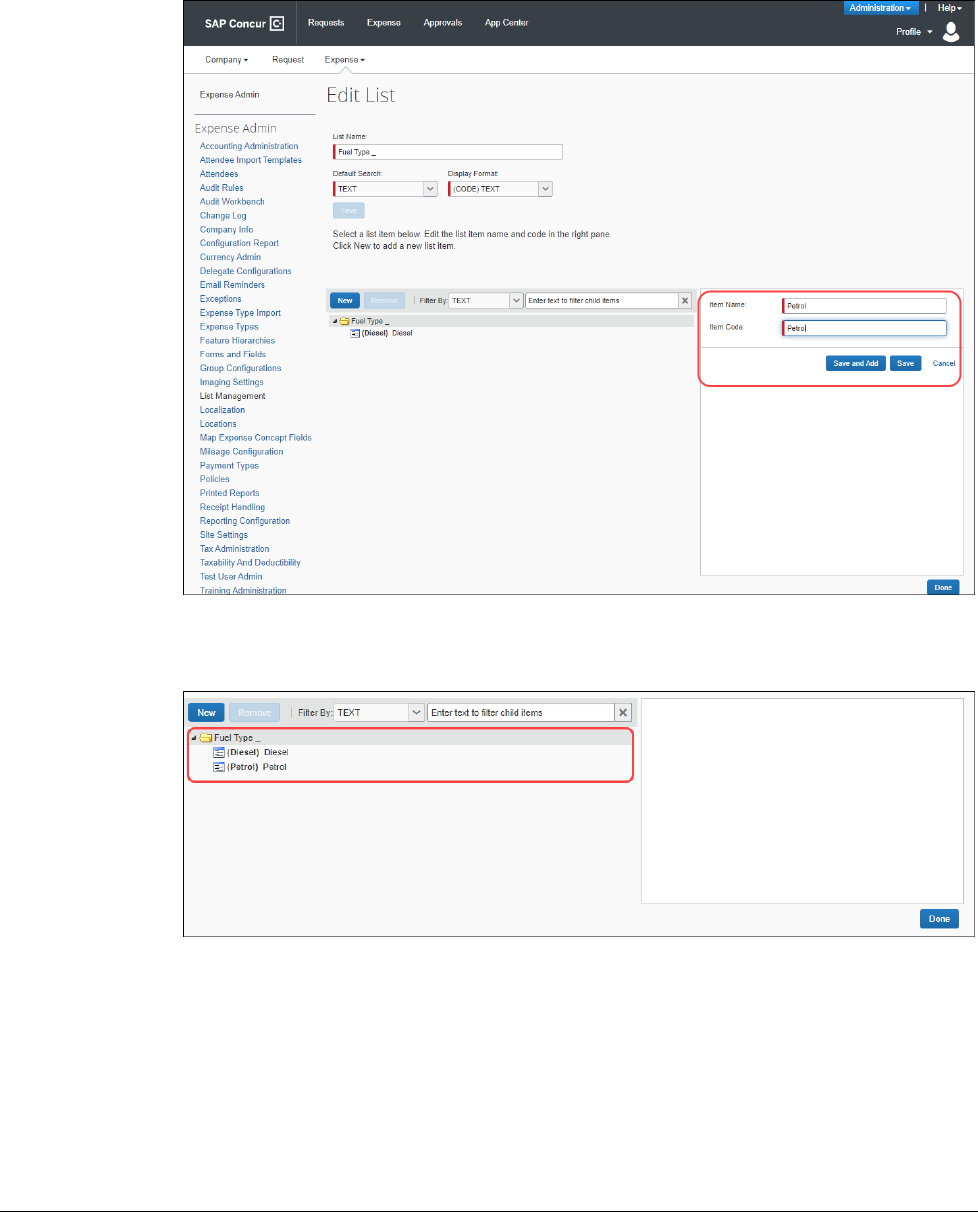

8. Provide the following values for Petrol:

9. Click Save and Add to add Petrol to the Fuel Type list.

10. Click Done.

Section 5: Fuel for Mileage Configuration Procedures

52 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

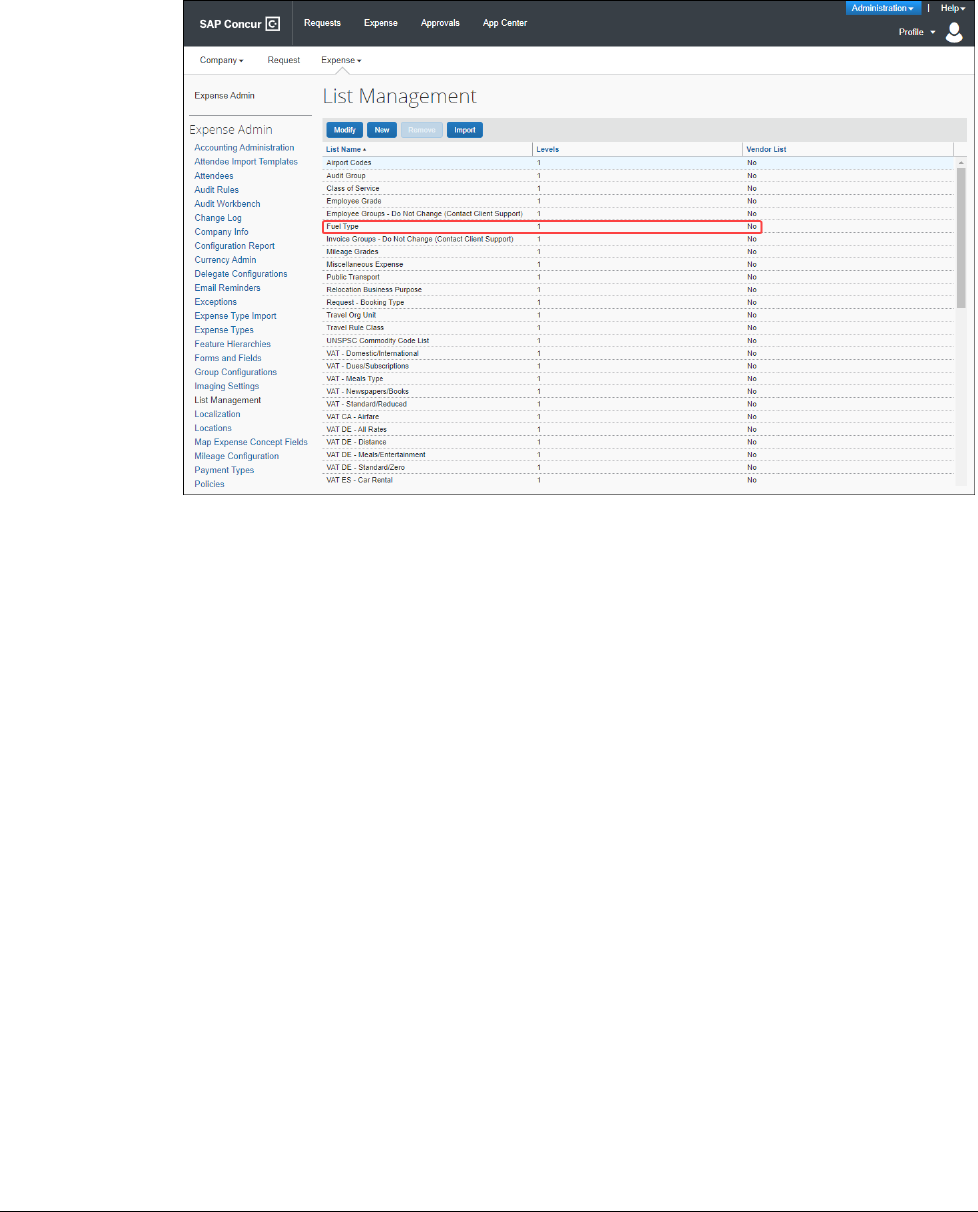

The Fuel Type list is now available on the List Management page.

Copying the Default Entry Form to Create a New Entry Form (Fuel for

Mileage)

To copy the default form to create a new entry form (Fule for Mileage):

1. Click Administration > Expense > Expense Admin > Forms and Fields.

2. Click the Form Type list and select Expense Entry.

3. Select Mileage and click Copy Form.

4. Double-click Copy of Mileage to modify the form.

(OPTIONAL: To modify a form, you can also select Copy of Mileage and then

click the Modify Form button.)

5. In the Form Name field, rename Copy of Mileage to Fuel for Mileage and

then click Save.

Section 5: Fuel for Mileage Configuration Procedures

Concur Expense: Car Configuration Setup Guide 53

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

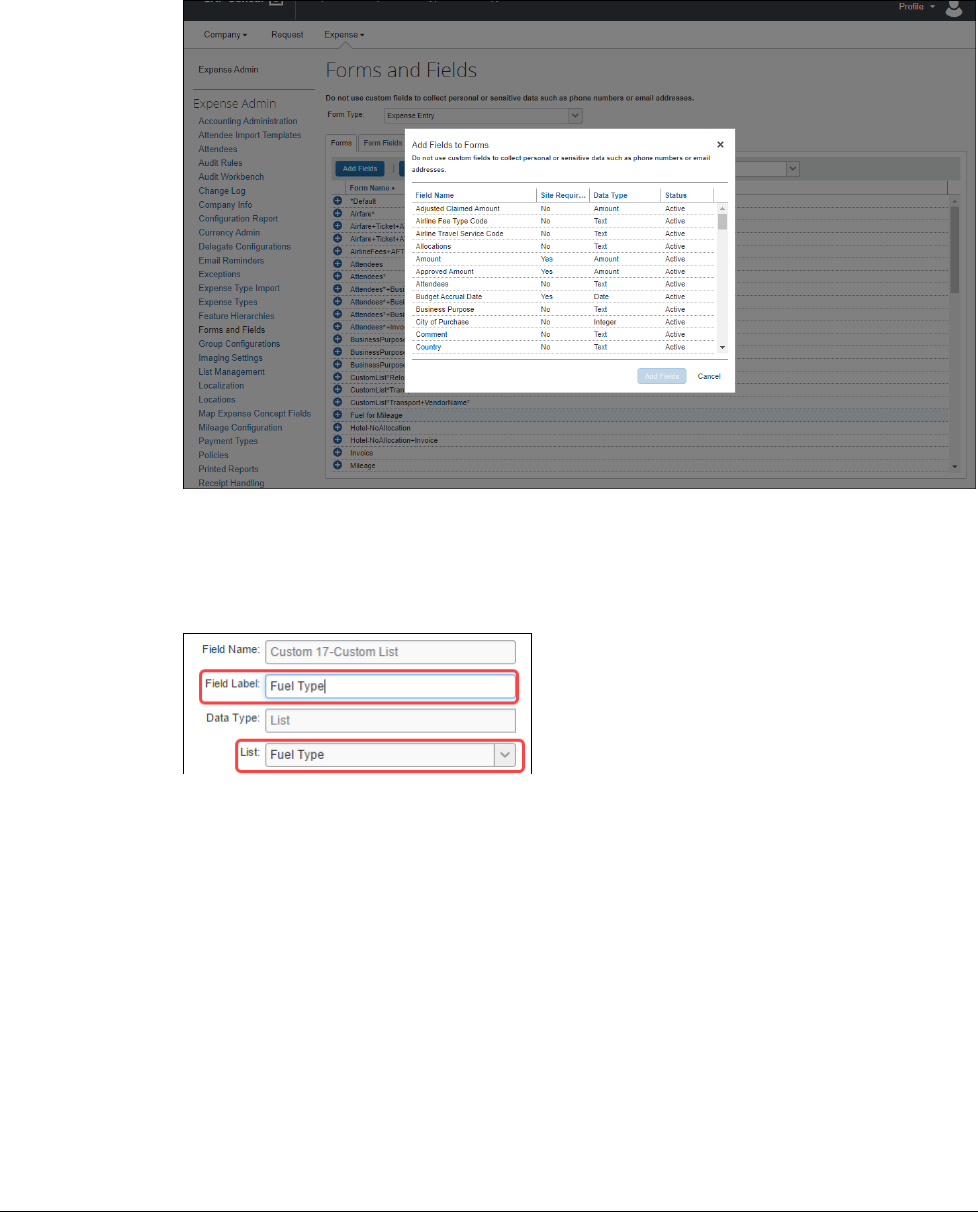

6. Select the Fuel for Mileage form you just created and click Add Fields.

7. Select Custom 17-Custom List and place/order it below Receipt Status.

8. In the Field Label list, specify Fuel Type and map it to the new Fuel Type

list.

9. Select Fuel for Mileage and click Modify Form.

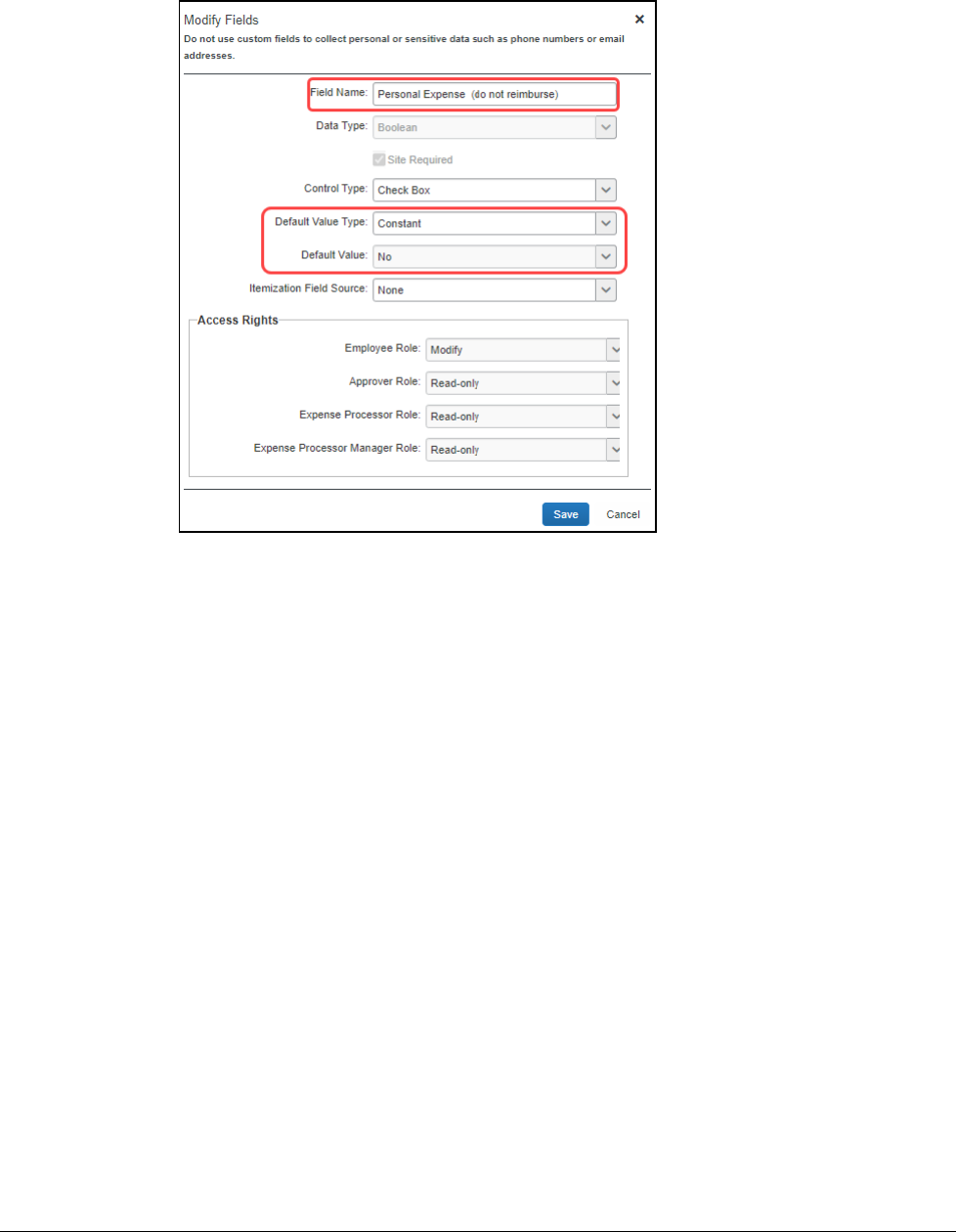

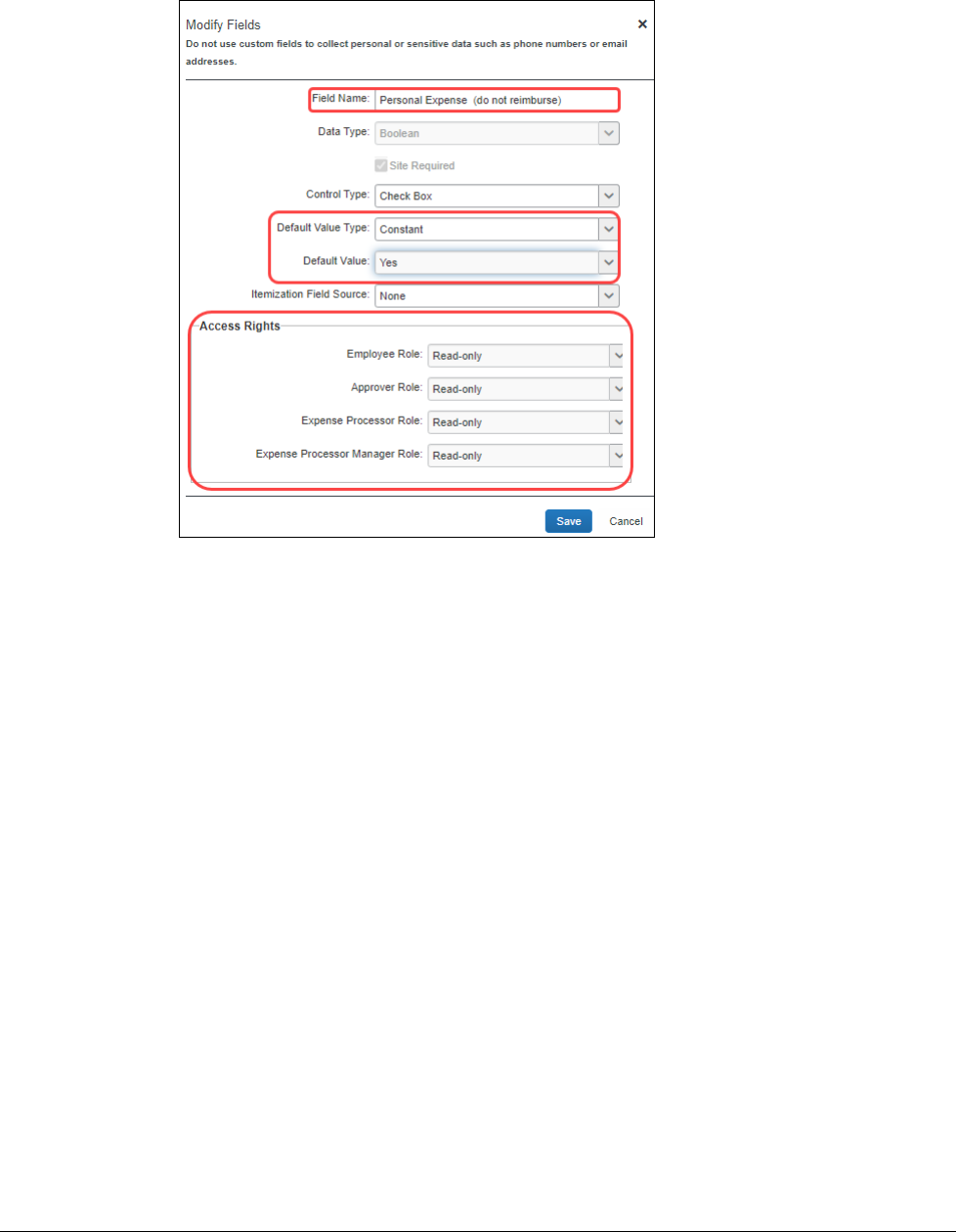

10. On the Fields tab, double-click Personal Expense (do not reimburse).

11. On the Modify Fields window, ensure the Default Value Type of Constant

has a Default Value of No.

Section 5: Fuel for Mileage Configuration Procedures

54 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

12. Click Save.

13. Return to the Fuel for Mileage Entry form and set the default value for

Personal Expense (do not reimburse) to Constant = Yes and specify all

roles as Read-only.

Section 5: Fuel for Mileage Configuration Procedures

Concur Expense: Car Configuration Setup Guide 55

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

14. Click Save.

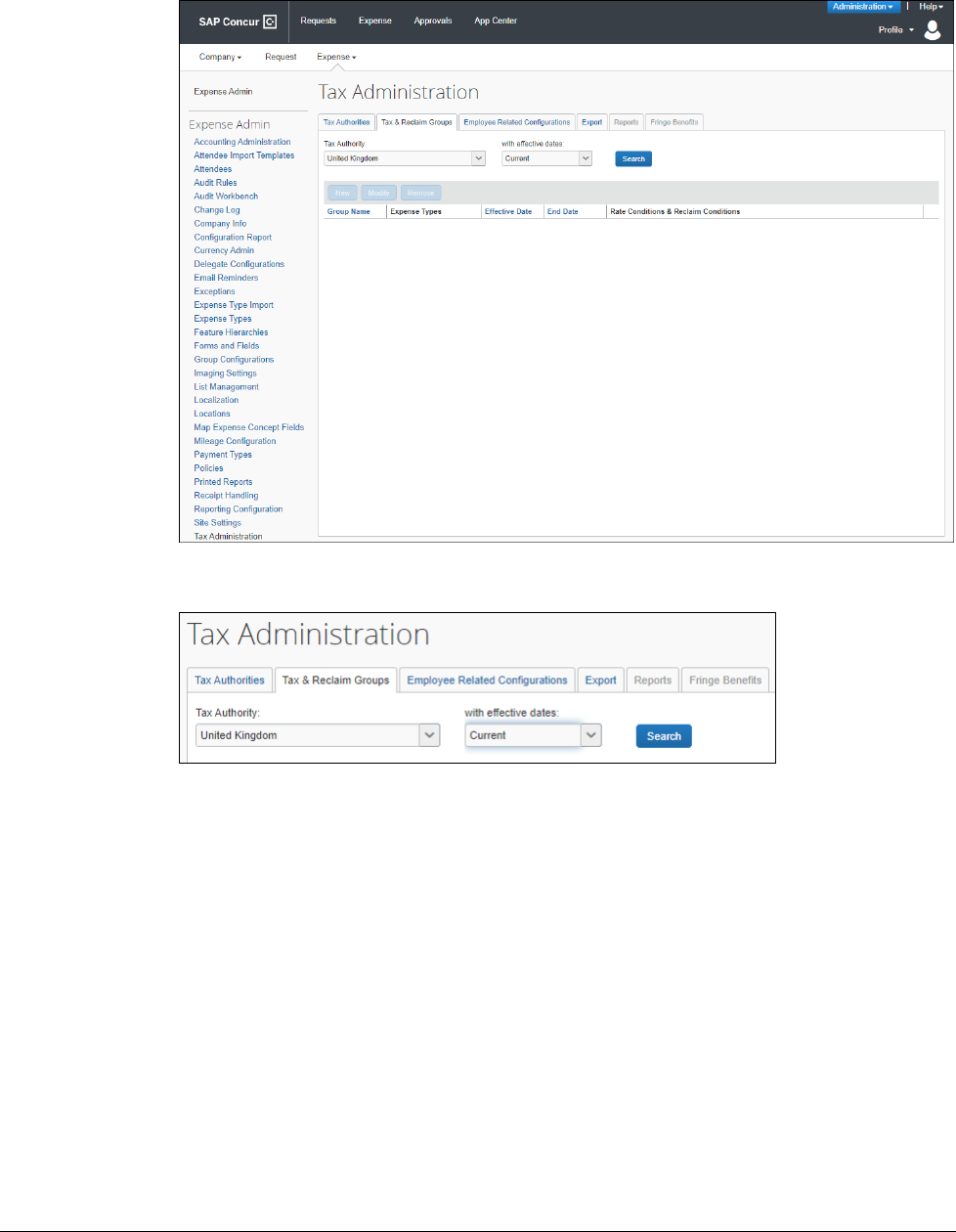

Setting up a New UK Tax Group – Mileage (Placeholder)

To set up a new tax group (UK Tax Group – Mileage):

1. Click Administration > Expense > Expense Admin > Tax

Administration.

Section 5: Fuel for Mileage Configuration Procedures

56 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

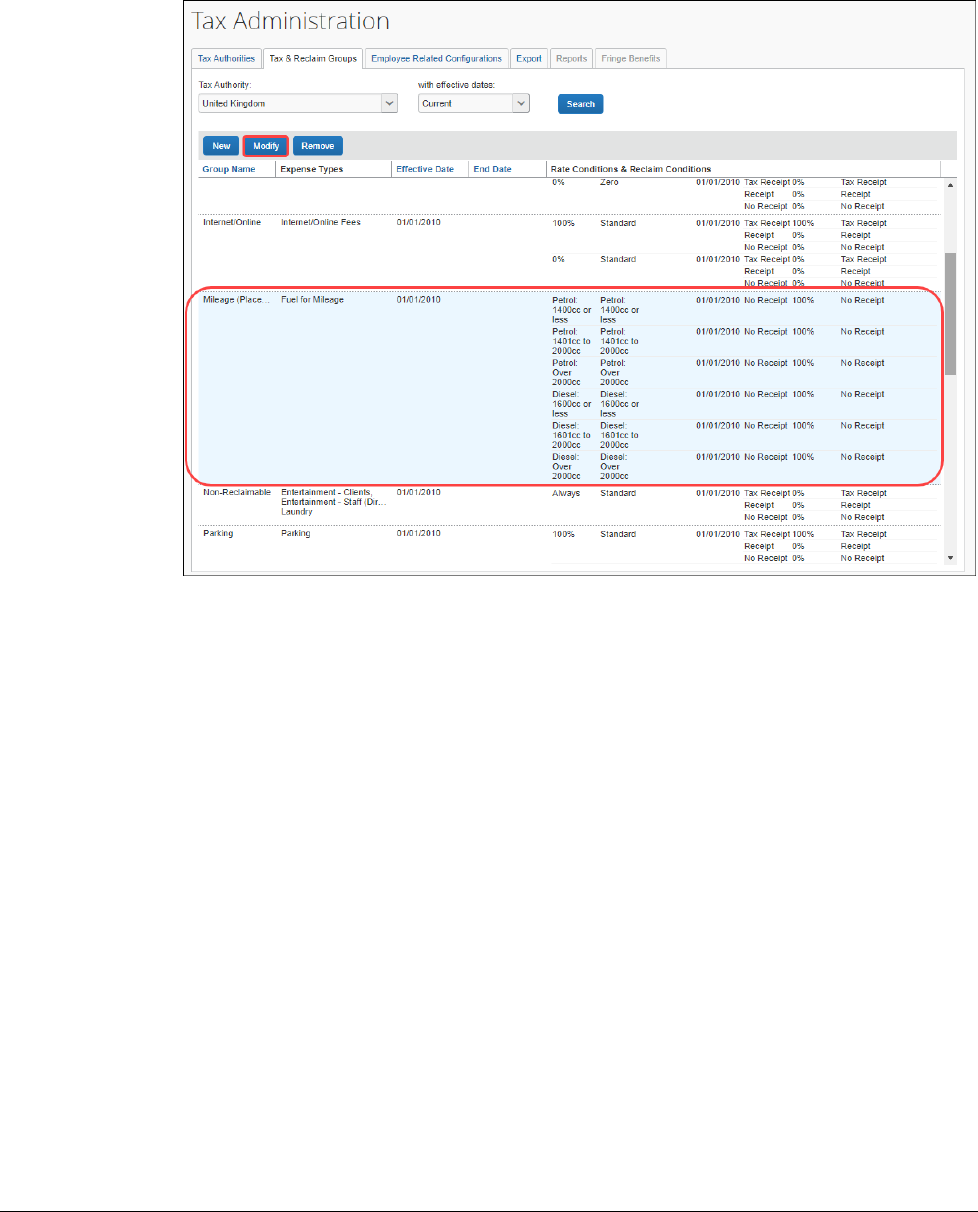

2. From the Tax Authority list, select United Kingdom and click Search.

Section 5: Fuel for Mileage Configuration Procedures

Concur Expense: Car Configuration Setup Guide 57

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

3. Select Mileage (Placeholder) and click Modify.

Section 5: Fuel for Mileage Configuration Procedures

58 Concur Expense: Car Configuration Setup Guide

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

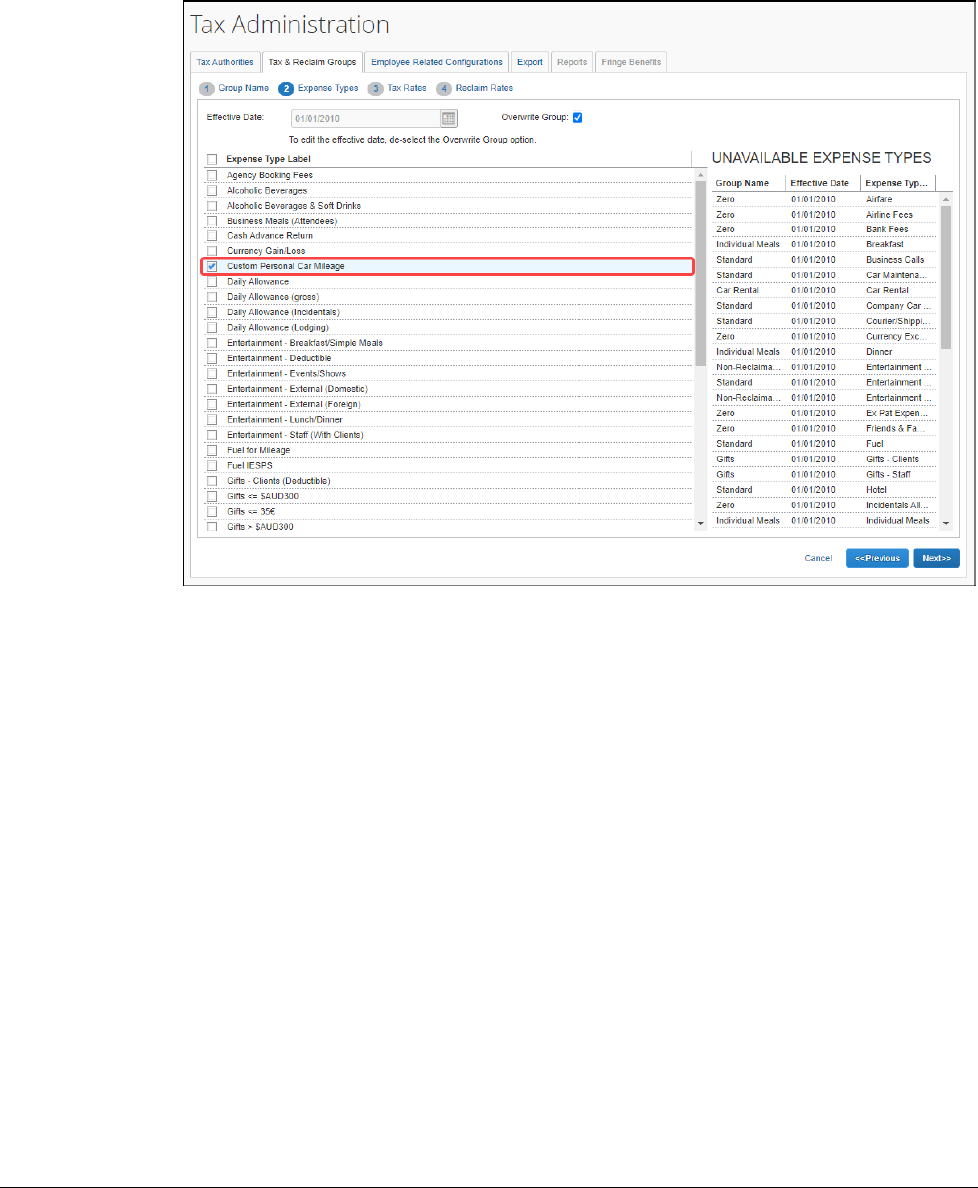

4. Click Next to advance to Expense Types, select Custom Personal Car

Mileage, and click Next.

Section 5: Fuel for Mileage Configuration Procedures

Concur Expense: Car Configuration Setup Guide 59

Last Revised: January 12, 2024

© 2004 - 2024 SAP Concur All rights reserved.

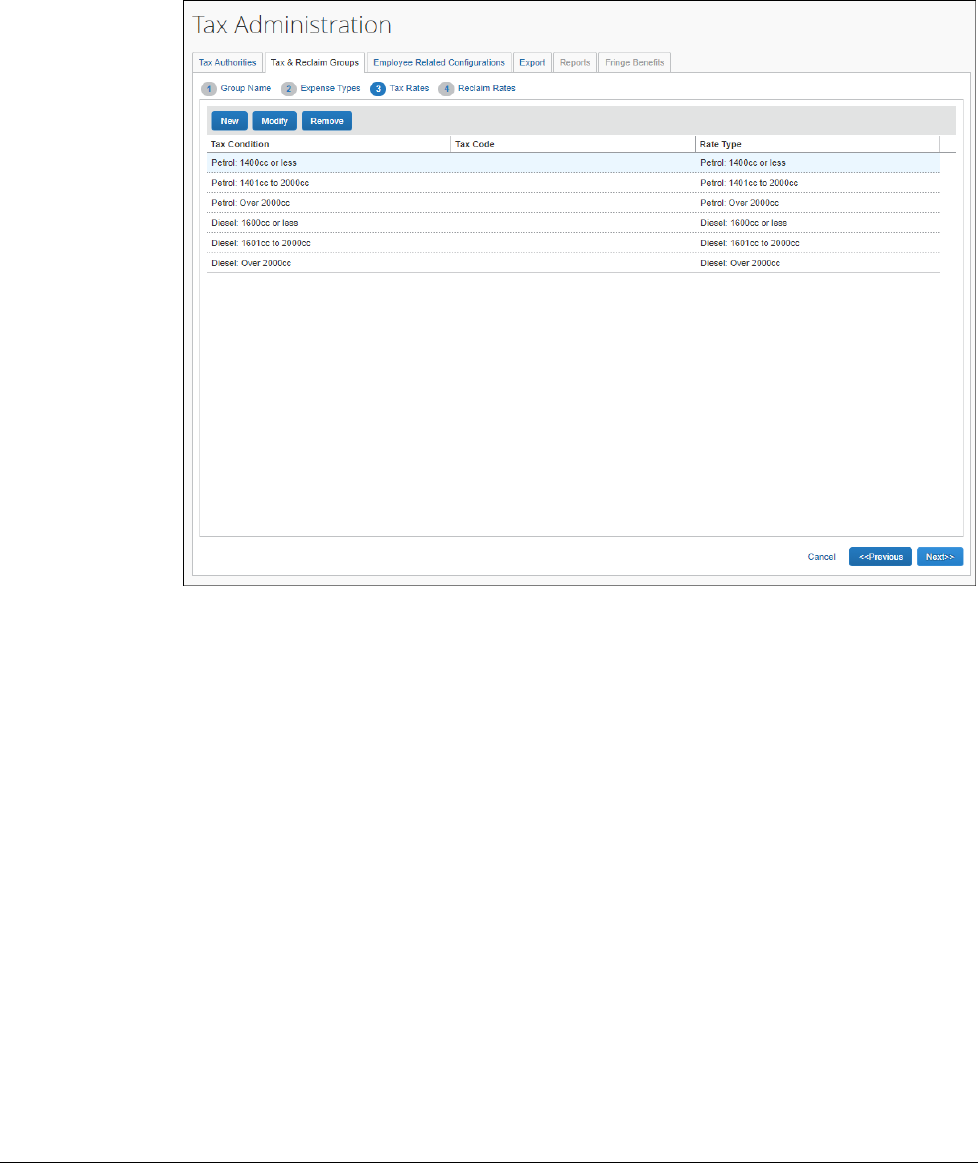

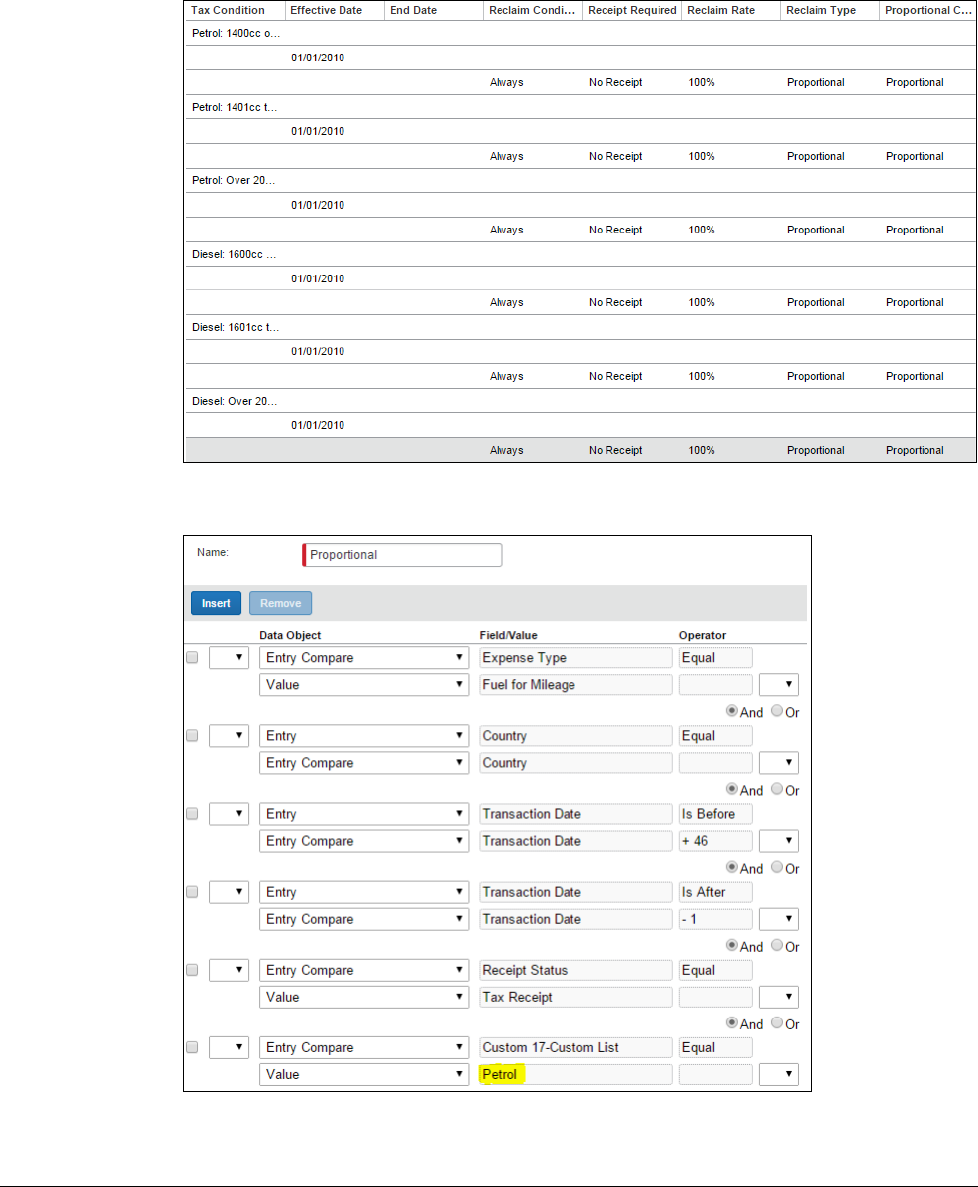

5. Keep the following six tax conditions for Engine Size/Fuel Type to replicate

the exact tax conditions for the default Personal Car Mileage tax group for